If you are new to Hive or crypto and blockchains, then welcome! Even if you have spent a great deal of time investing in traditional markets and securities, you may find this new world pretty overwhelming or intimidating. I know that I did and sometimes still do.

Below are a couple of ideas for you based on my non-extensive history in investing in the Hive universe and other crypto assets. Also, you will see this phrase a lot in your reading: DYOR - it means that you should do you own research.

Boy oh Boy are we Havin' Fun Now!

My first suggestion is one that dramatically accelerated my understanding about blockchains in general. You might be surprised to read that I did this by starting to play Splinterlands, a Hive blockchain based game. Here's why it helped me. When I found Splinterlands, my full involvement in crypto was that I had a Coinbase account that my younger brother had helped me to set up.

Playing Splinterlands motivated me to learn how to transfer assets from an exchange (first Coinbase and then Gate.io) into a wallet. I did this so that I could start to acquire some of the in-game currency, Dark Energy Crystals (DEC) and the Splinterlands token Splintershards (SPS). DEC can be used to purchase cards, or if you hold it, will allow you to receive daily airdrops of SPS. Oh yeah, so I guess I learned about airdrops too!

My point about all of this is that because I was interested in the game, I was a little more willing to spend some time learning about what I needed to do to accomplish some of the tasks that I made for myself in moving forward. If you would like to try the game out, you can do so by clicking my referral link at the bottom of the page.

Silent Liquidity

Liquidity Pools are used in decentralized exchanges to create liquidity between trading pairs of currencies. Offering this liquidity allows other investors to trade one of the currencies to acquire some of the other. This helps to facilitate trading between the assets. So, liquidity providers (LPs) offer a service to the investors. Depending upon the trading pairs, the liquidity pool can offer low or high rates of potential return. They can also offer differing levels of risk.

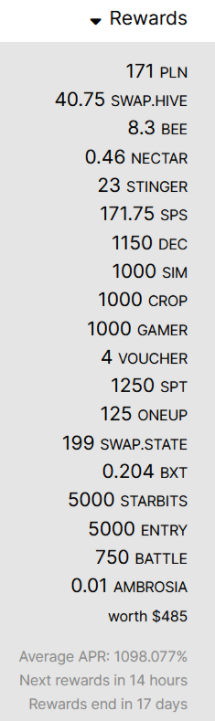

Liquidity pools frequently compensate the LPs by paying them in one of the trading pairs. They also will sometimes pay them using other currencies. And, this was how I tricked myself! I recently invested in the SWAP.HIVE:PLN liquidity pool. PLN was created by @megalithic, who has been ranked as high as number one in Splinterlands in the Gold League. I came across the white paper last week and was interested so I bought a few shares of PLN and started adding a small amount of liquidity over the course of the week. (I've copied a link to the white paper below, if you are interested)

The white paper showed that there were a lot of tokens backing up the liquidity pool. Here's a screen grab from the white paper.

So many different tokens! Due to my provision of liquidity, a little bit of these assets shows up in my wallet and I can stake some of them in the hopes that those will grow. These new assets have some different affiliations and offer great starting points for more investigation. Since the founder has so much history with Splinterlands, some of them are Splinterlands assets. However, one of them, BEE, is the native token of the Hive ecosystem. A couple others, like Starbits and Entry are associated with other games on the Hive blockchain that I have not played yet. As a result, I have been motivated to learn a little more about those other endeavors, and have developed some exposure to assets that I may not have otherwise found.

One nice feature about doing this through BeeSwap, on the Hive blockchain, is that you can provide liquidity to a pool without having to meet an onerous minimum. I participated in a couple liquidity pools through the Gate.io exchange and there were $100 minimums for each side of the trading pair. I was fine with that but if you are just getting your feet wet, you may want to test the waters with a smaller investment. That's possible on BeeSwap. I actually had a small amount of PLN remaining after adding liquidity one time, and was able to add that fractional share and its value-equivalent Hive token into the pool, without having to increase the provision up to any preset minimums.

I hope this is helpful to some of you - I wish you happy gaming and investing!

Splinterlands Referral Link:

https://splinterlands.com?ref=dangerbald

PLN links

https://peakd.com/pln/@nectar-queen/nectar-queen-v1-white-paper

https://beeswap.dcity.io/swap?pools&search=pln