Stablecoins, or a dollar-pegged coins have been growing in market cap. The prices of Bitcoin and other cryptocurrencies have increased so the increase in the market cap of stablecoins is to be expected. But not all of them are growing and not at the same rate.

It’s been a fun ride for stablecoins in the last years. Let’s take a look!

The TerraUST fiasco back in May 2022 has left a mark on the stablecoins industry. It took a while for the market to recover. Meanwhile other coins like BUSD, TUSD have been facing regulatory challenges and have been closed operations.

Apart from the fiat backed stablecoins (USDT, USDC, BUSD….) that are keeping dollars in the banks or equivalent like T-bills, there are tokens like DAI, HBD that are backed by other crypto as collateral, and/or using conversion on chain operations to maintain the peg.

Here we will be looking at:

- Tether [USDT]

- USD Coin [USDC]

- Dai [DAI]

- Binance USD [BUSD]

- TrueUSD [TUSD]

There are a few more out there like FDUSD, FRAX, PaxosUSD, USDP, etc, but we will focus on the above as the biggest ones in market cap.

Tether [USDT]

Tether is the oldest stablecoin in crypto. It has been around since 2015. Allegedly it is founded by the Bitfinex exchange. A lot of controversy around this coin in the past, including court cases. The main issue that has been raised has been is each coin backed by one dollar in the bank. Tether is an offshore company with a location outside of the US jurisdiction.

But Tether has survived multiple crashes and run on the banks in the last years, and it has proven itself to work as intended in the mist of the biggest chaos in the crypto industry.

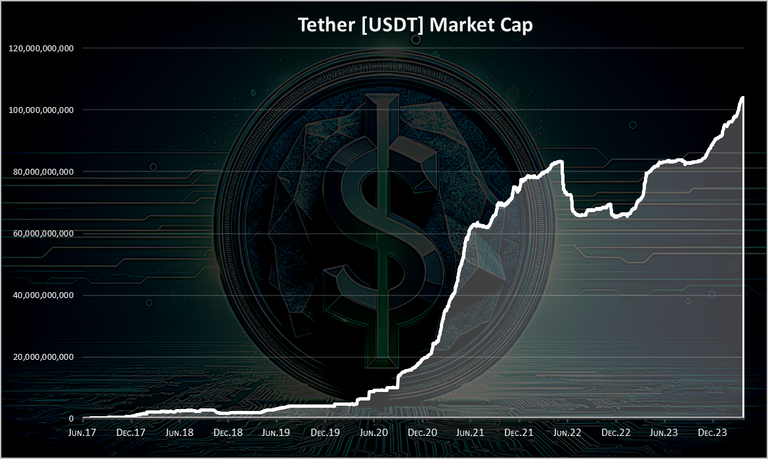

Here is the market cap for Tether .

As mentioned, Tether started operating back in 2015, but it gained some significant market cap for the first time in 2017. A real bull run and a massive increase in the market cap happened in 2021 when its market cap went from under 10B to more than 83B.

Then in 2022 there was the crypto crash and the Tether market cap contracted from 83B to 65B. In the first half of 2023 it started growing again reaching 91B at the end of the year. In 2024 this growth continued and has reached 104B now, for the first breaking above 100B.

USD Coin [USDC]

USDC is a common project between Circle and Coinbase. It is a US based company.

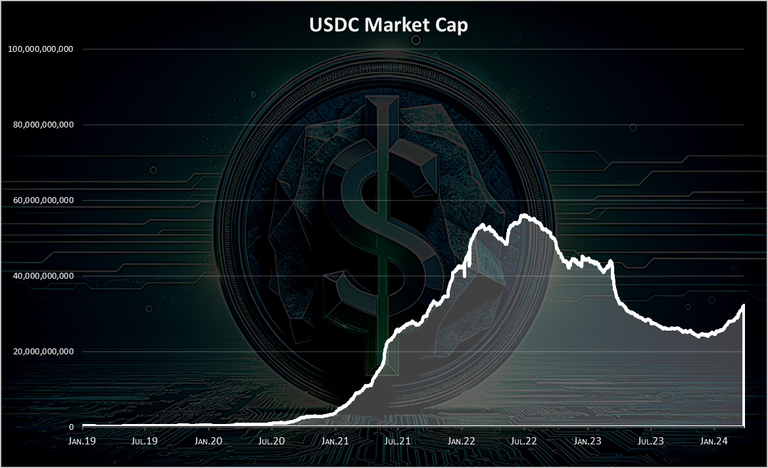

Here is the chart.

USDC was founded back in 2018 and it gained real momentum in 2021, when it reached 58B. A drop followed afterwards in 2022, and even bigger drop in the first half of 2023 due to a bank crisis in the US. In March 2023, one of the banks where USDC had a share of its reserves in USD, collapsed, causing the market to panic and pushing down the peg of USDC as low as 88 cents. This was short lived and the USDC peg recovered in a day or two, and later it even managed to get access to its funds in the collapsed bank. But the damage was done and a lot of funds exited from USDC.

At the end of 2023 the market cap of USDC started growing again and has increased from 24B to 32B now. It still far bellow its ATH of almost 60B.

USDT vs USDC

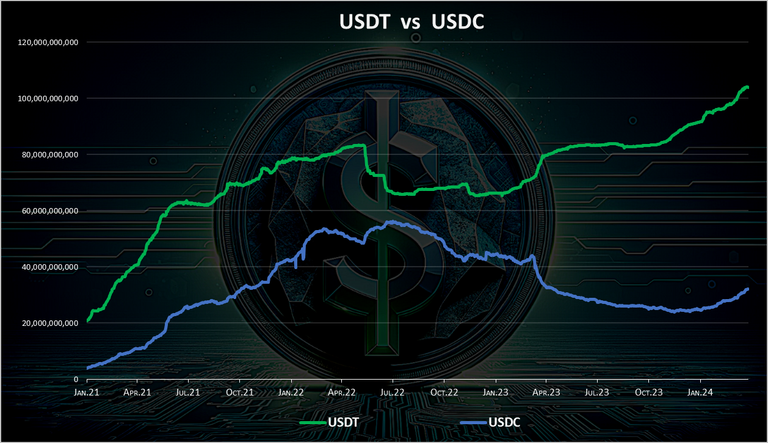

When we plot the market cap of the two biggest stablecoins we get this.

An almost ideal inverse pattern!

After the growth of both of these coins back in 2021, since 2022 the market cap of these two has been inversely correlated. Whenever Tether lost market cap, USDC gained.

In the last months, for the first time in a while both of the coins started growing again, although we can notice that Tether is growing faster than USDC.

Dai [DAI]

DAI is the decentralized version for stablecoin. It runs as a smart contract on Ethereum. Everyone can use the MakerDAO protocol, deposit collateral and generate DAI as a loan.

DAI works as overcollateralized stablecoin, where users put in crypto assets to mint DAI.

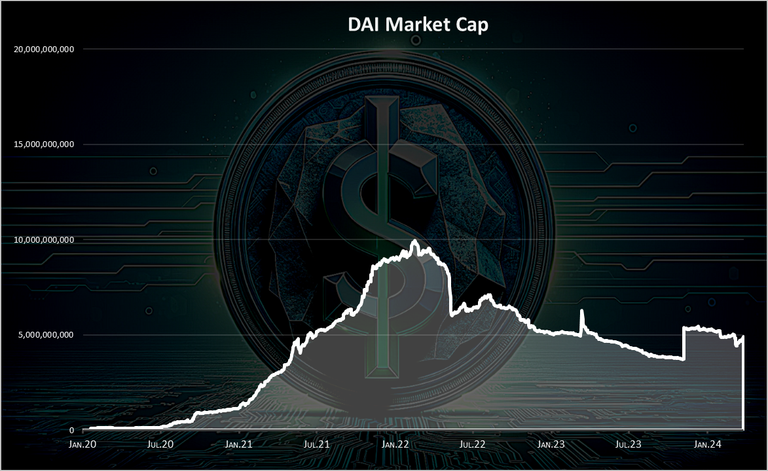

DAI was established back in 2019, it grew through 2021 a lot reaching 10B market cap, and it has been in decline since then up November 2023.

We can see the big spike at the end of the chart. That is an increase in the market cap of DAI from 3.5B to 5B in just a few days. The biggest increase was on November 8, when there was 1.5B DAI minted in a day. Since then the market cap of DAI has been almost stable, although has declined just a bit.

In the previous bull run there was a tendency to use USDC to mint DAI, but in the last period this has changed and most of the collateral to mint DAI now is ETH, with more than 70% share.

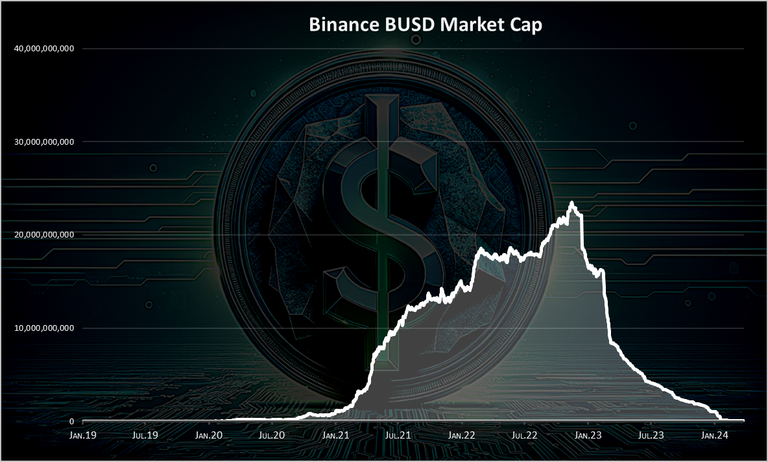

Binance USD [BUSD]

The Binance exchange stablecoin. It is issued by Paxos with the Binance branding. But this token has received a ban from the US authorities, and it is now in a closing down phase. No new tokens will be minted, and the exiting one will be slowly put out of circulation.

This coin has been doing great in 2022 up until the regulators stepped in and sued Paxos in December 2022, for issuing the coin. Since then, there is no more minting of the token and it is slowly being decommissioned as fuds exit the project. Since January 2024 the funds have totally exited the project.

FDUSD, USDE and TUSD

These are three of the next biggest stablecoins. The FDUSD has grown especially in the last period and has reached more than 3B since August 2023 till now. USDE (Ethena USD) is also above 1B in market cap, while TUSD is now at 700M and has declined since its peak of 3B.

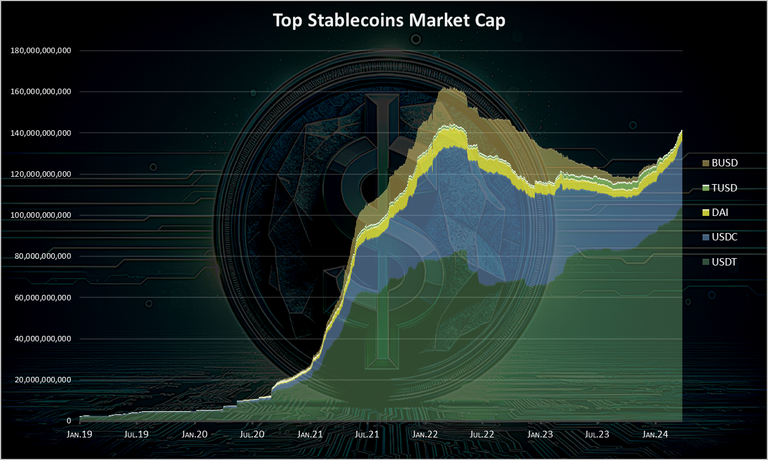

Cumulative Stablecoins Market Cap

Here is the chart for the total stablecoins market cap.

This is the long term chart for the stablecoins. We can see the overall trend here that most of the stablecoins capitalization came in 2021, with Tether emerging as the first, followed by USDC and DAI. We can see the decline and fall of BYSD and the TUSD (green).

At this moment Tether and USDC have more than 90% share of the market cap.

While Tether has reached its ATH market cap, the overall stablecoin have not yet reached its previous market cap of 160B.

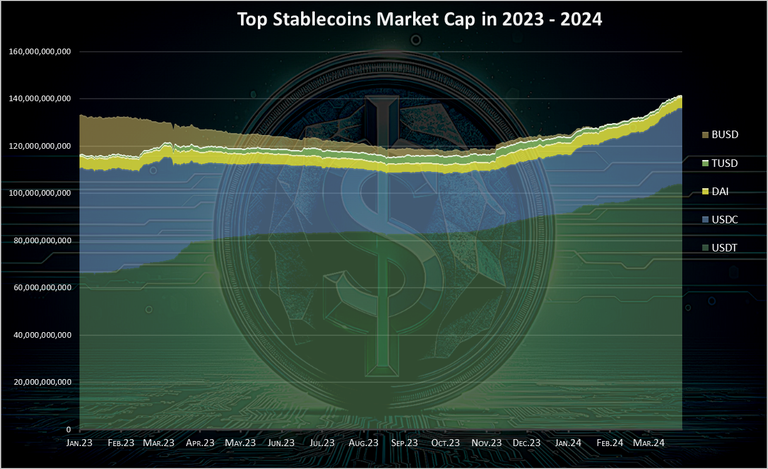

When we zoom in 2023-2024 we have this:

Here we can notice the reverse trend in the market cap in 2023, and also the increase in the share of Tether. As mentioned Tether and USDC are now dominating, then DAI with a small share and the other tokens are almost negligible.

The overall market cap of the stablecoins is now at 150B.

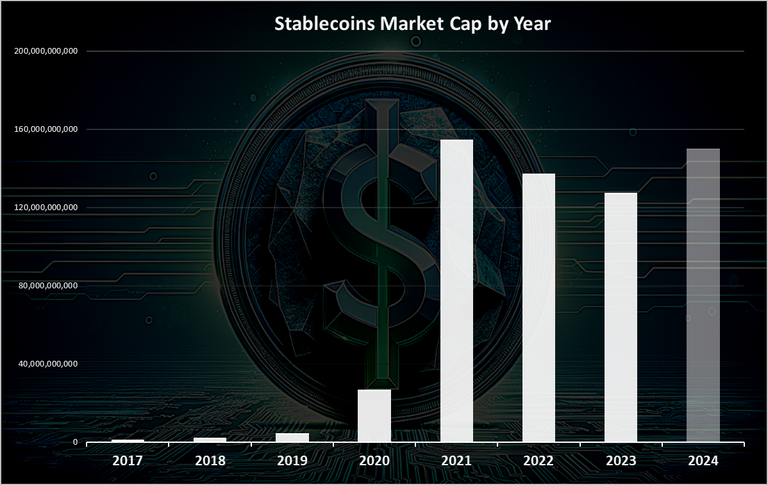

For context on a longer timeframe, on a yearly basis the market cap for stablecoins looks like this.

After an explosive growth in 2021, the stablecoins market cap has been dropping in 2022 and 2023 and now has been growing again in 2024.

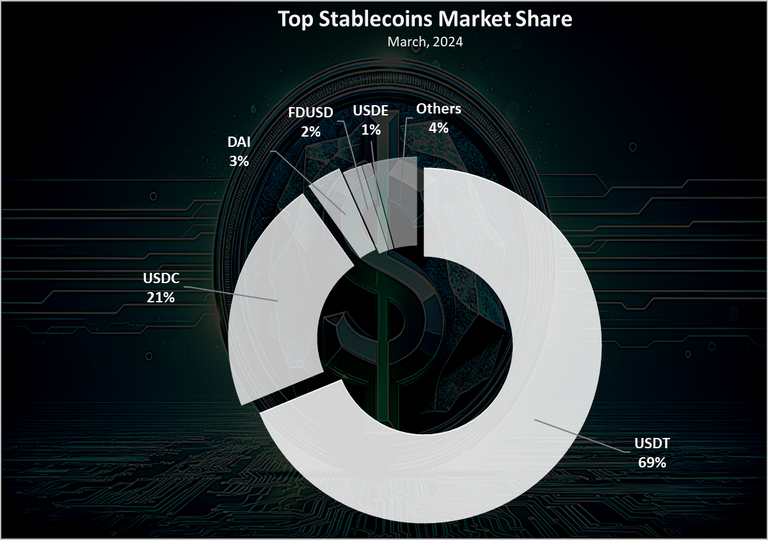

Top Stablecoins Market Share

Here is the chart for the market share of the top stablecoins.

Tether USDT is absolutely dominant now, and this is probably its biggest market share in the stablecoins industry since 2021. The harsh regulation in the US on stablecoins has probably contributed to this. Things might change if/when there is more clarity about stablecoins issuers in the US.

Tether USDT now holds close to 70% share in the stablecoins industry. USDC is in the second spot with 21% share followed by DAI with 3% share.

All the best

@dalz

USDT and USDC is all that survived lol pretty wild when you think about just how many stablecoins there were of which many ended up not being so "stable"

It would have been interesting to see how the HBD is doing in comparison to the big ones. Would the slice in the pie chart be even 1 pixel wide?

No :)

😩

Impressive, Stablecoin economy need to be more stronger in the coming days.

The way tether is still undisputed after all the fuds and all.. still standing on top.

I believe Next competition will be with tradfi backed Stablecoin more like backed by stocks treasury by some bankers..

Thanks for the report tho!

!PIZZA !LUV

a correction is incoming - so some position to be held in stables is a MUST!

I like USDT but their domain is too big. It would be better if DAI grew in capitalization. Although the stablecoin I like the most is HBD

Stability is a fluid concept when it comes to all of these tokens.

So $HBD is included in that 4%. Interesting to see how the market cap of stablecoins grew through the years.

Good to see that the overall market cap of stablecoins is increasing, I think they've become a key part of the crypto ecosystem. It will be great if USDT's dominance doesn't increase over the years and there are more decentralized stablecoins with respectable market caps.

I hope HBD will have its place among stablecoins soon.

The dai coin really looks to be performing and will still do so much more in the future I am strong of that

That’s fantastic

I feel there should be a form of price correction to come though and I’m 70% sure about that

Can you explain me simple why market cap is important?

Great insight on the stablecoins and if I can make a suggestion is to add stablecoins from the Cardano blockchain as well. It is growing heavily lately and some new stables backed through USD are providing crazy returns topping 100% and more.

Thank you for sharing these data as always. I mostly used USDT myself, but it would be great if HBD will be able to get up there sometime soon. There are smart contracts and DEX/bridges on the way to make accessing Hive tokens easier, so I hope that helps.

!ALIVE

!PGM

!DHEDGE

!LOLZ

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-0.1 THGAMING-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

@dalz! You Are Alive so I just staked 0.1 $ALIVE to your account on behalf of @ tuisada. (9/10)

The tip has been paid for by the We Are Alive Tribe through the earnings on @alive.chat, feel free to swing by our daily chat any time you want, plus you can win Hive Power (2x 50 HP) and Alive Power (2x 500 AP) delegations (4 weeks), and Ecency Points (4x 50 EP), in our chat every day.

lolztoken.com

Earthquacks

Credit: reddit

@dalz, I sent you an $LOLZ on behalf of tuisada

(5/6)

Just like stablecoin is not easy to take care of demand supply has to be taken care of a lot and we are seeing that HBD is still giving and has performed very well in bear market as well we pray. Let it continue to perform like this.

Stability all the way

Yep. USDT, still the dominant one.