How it the powering up HIVE going? Time to look at the recent data and at the historical rates.

@thepeakstudio image

We will be looking at:

- Overall power up VS power down by date

- Recent power up VS power down by date

- Historical rate of the Hive Power share

- Recent rate of the Hive Power share

- Top 20 Accounts that powered up

- Top 20 Accounts that powered down

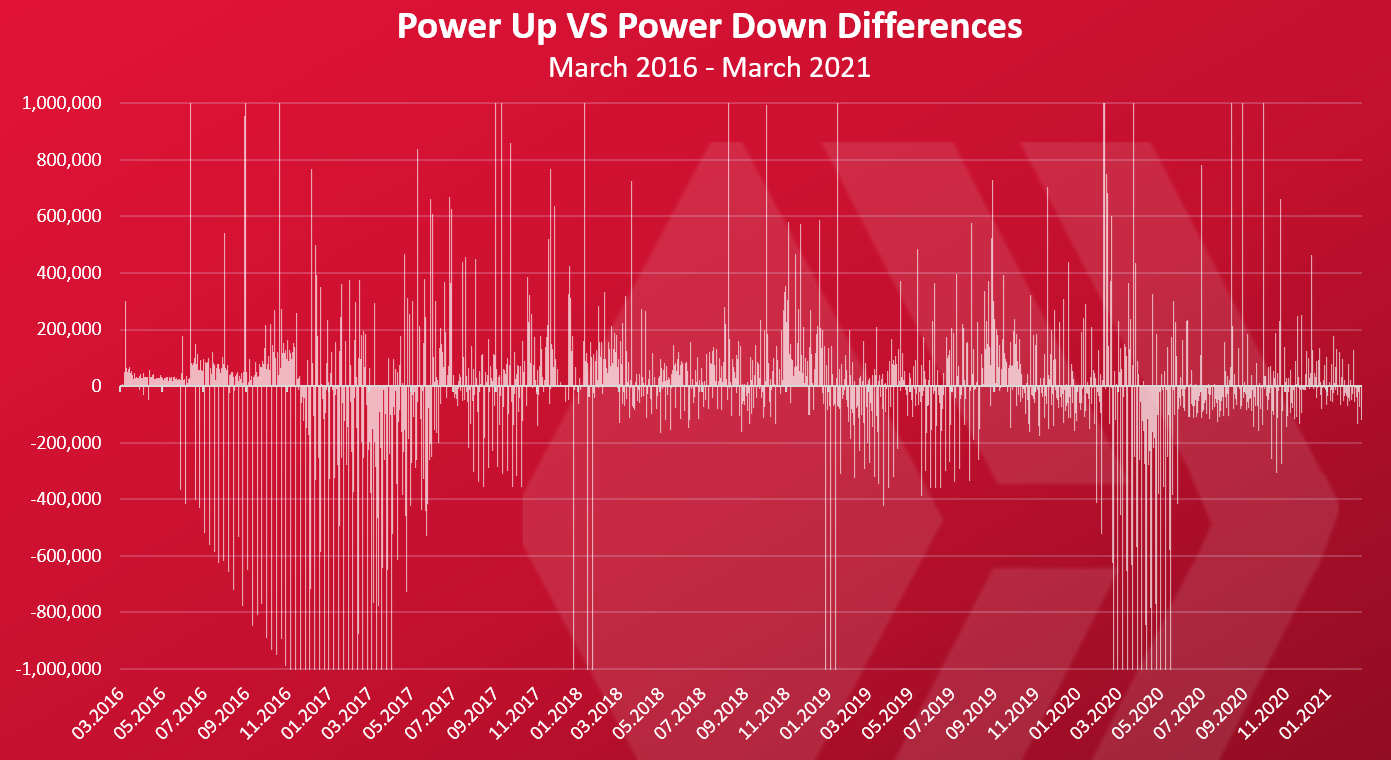

Power UP VS Power Down

Here is the chart with the difference in HIVE power up VS power down, including the daily rewards in Hive Power (author rewards, curation rewards, witnesses’ rewards).

The all time net powered up/down Hive.

Note here is all the data from the old chain as well 😊.

A lot of powering down in the period September 2016 – April 2017, and then also March – May 2020. This period was when the exchanges were powering down.

A lot of powering up, when the fight for governance of the chain was happening, end of February 2020.

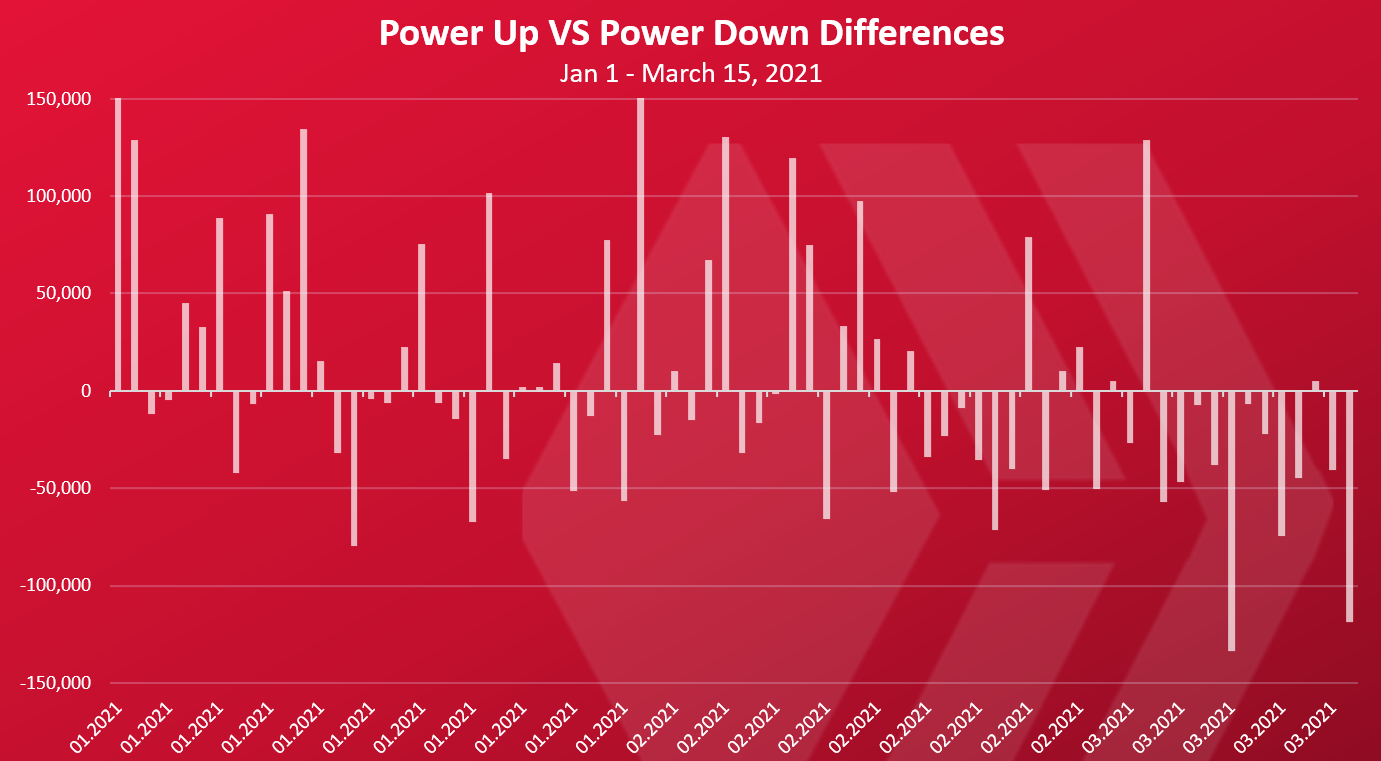

The data on the recent power up vs power down chart looks like this.

When taken into account the rewards in form of a Hive Power (around 50k per day), the overall chart in the last period is in favor for the power up. A net of 500k more HIVE powered up then powered down. Almost a draw 😊.

Depends on the day the numbers usually go in the range from -150k to 150k HP.

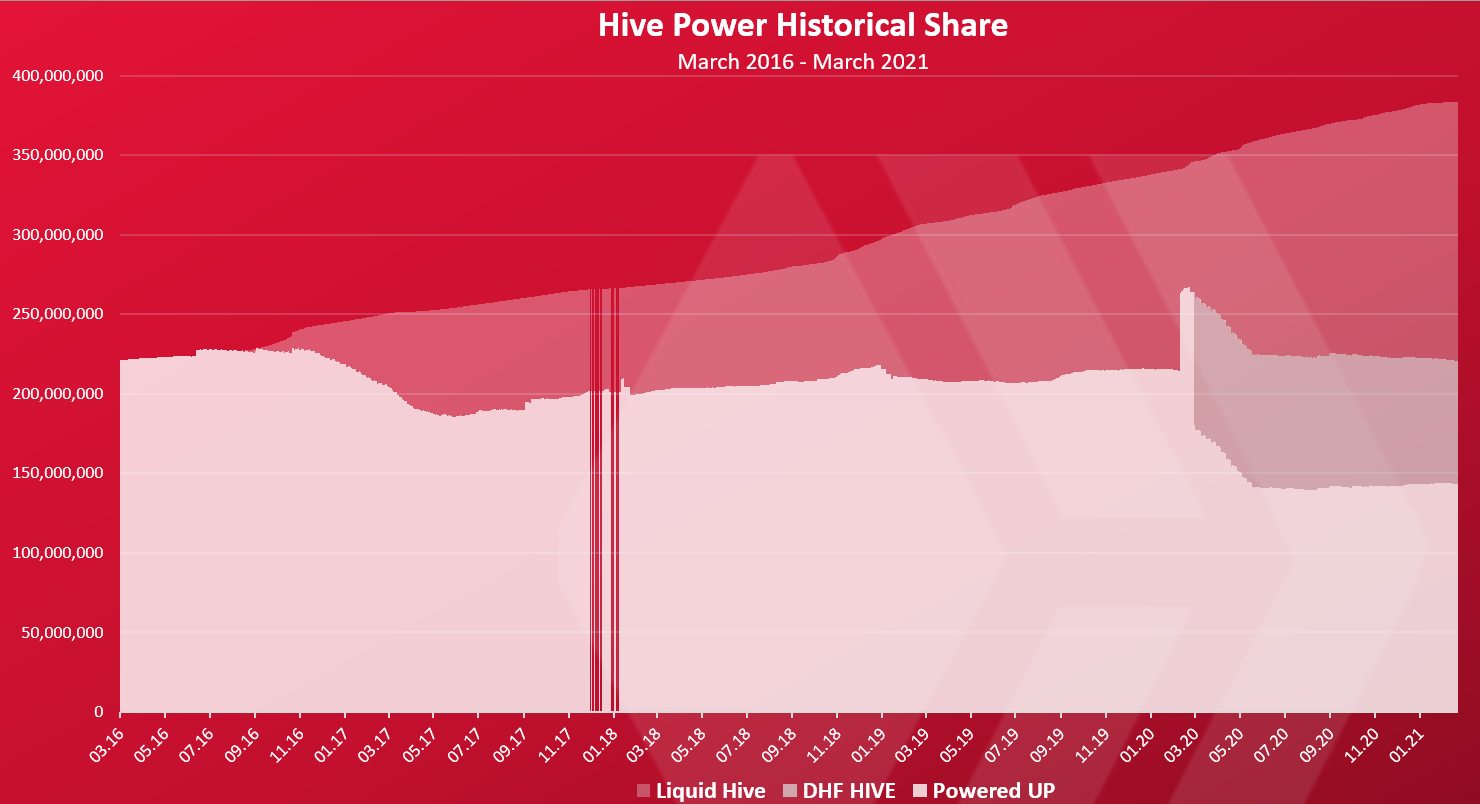

Historical Rate Of The Powered Up Hive

Here is the chart for the all time rate of powered up Hive/Steem.

The last grey area are funds held in the @hive.fund. Around 83M were transferred from the Steemit Inc accounts and a few others to the fund after the Hardfork in March. These funds are now slowly being converted to HBD over a course of five years period.

Overall, the amount of Hive powered up has been just above 200M historically. There is some drop in 2016, and then a steady increase. In 2019 the amount of Hive Powered Up was almost constant around 200M to 210M.

When the fight for the governance started, we can see a sharp increase in the HP, as exchanges powered up more than 40M HIVE. At that point the amount of HP was highest reaching almost 270M.

Later the exchanges powered down over the course of 13 weeks period.

Also the funds from Steemit Inc were powered down instantly in the Hardfork.

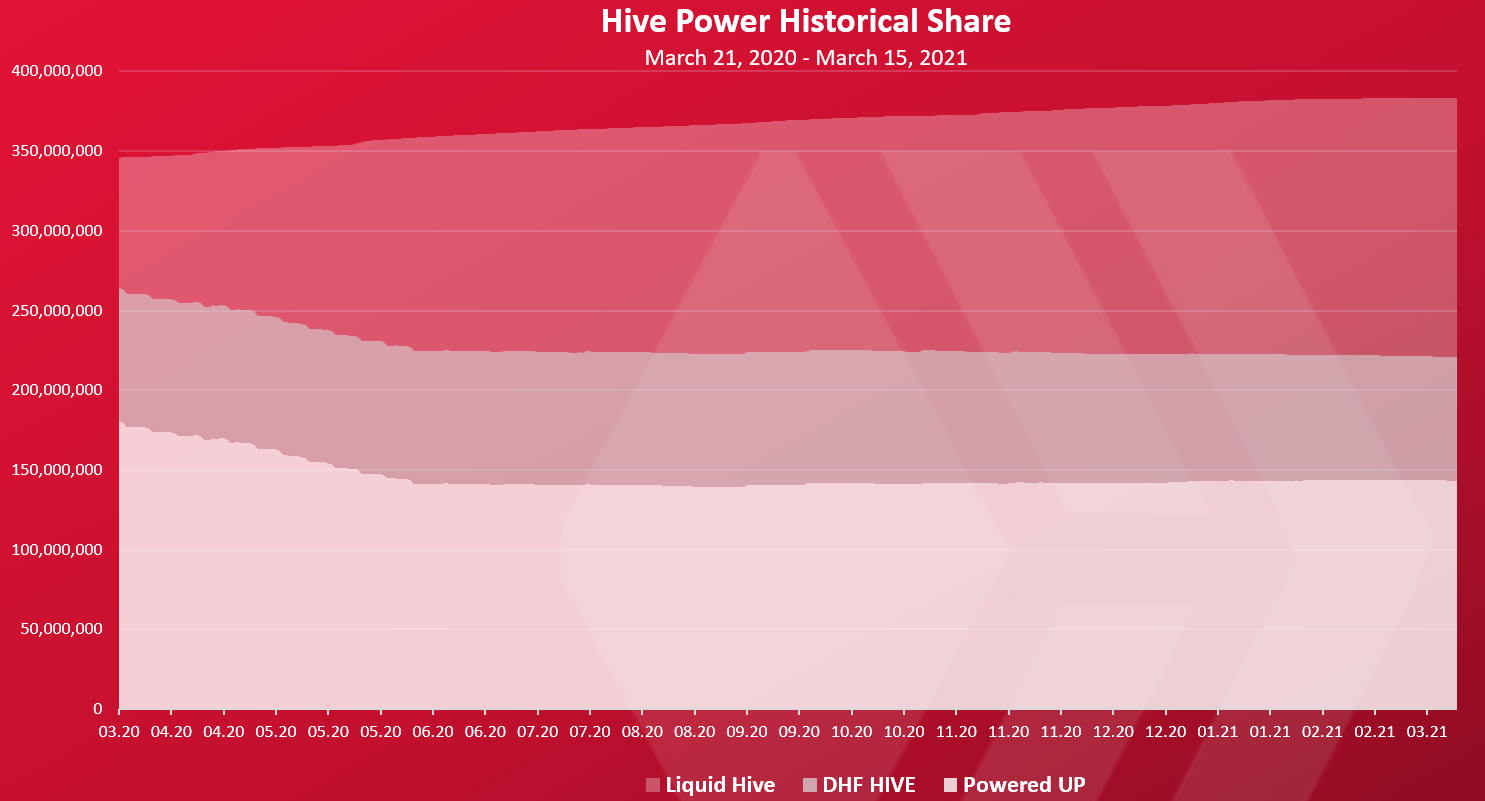

When zoom into Hive only we have this.

Here as well the funds in the @hive.fund are represented separately. I’m putting them here because they are basically not accessible and locked.

We can see the trend of exchanges powering down here as well. From June 2020 the amount of HP is has grown a bit from 136M to 143M at the moment. But in the same time the amount of liquid Hive has also increased and the Hive on exchanges.

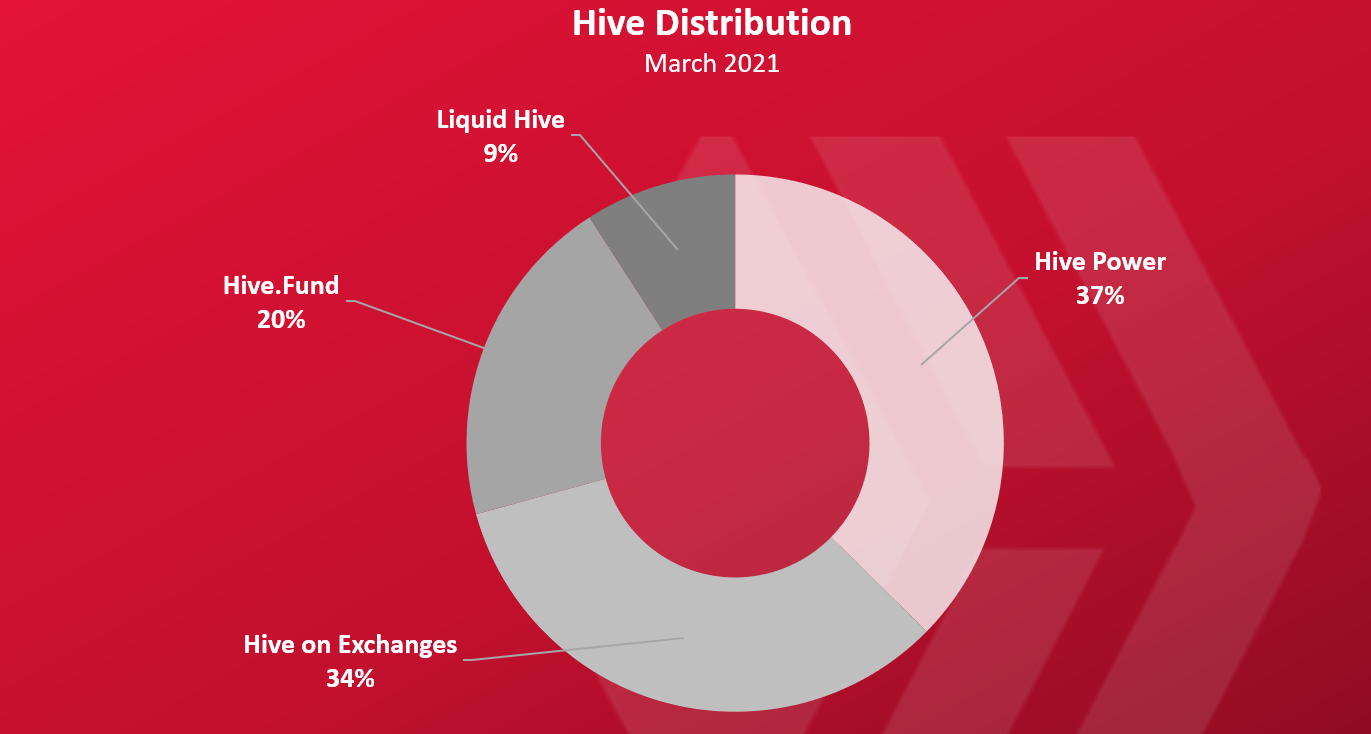

At the moment the share of liquid, powered up and hive in the dev fund looks like this.

The Hive distribution goes like this:

- 37% Hive Power

- 34% Hive on exchanges

- 20% Hive in the DHF/DAO

- 9% liquid Hive on users wallets

- 5.2M HBD

The share of powered up hive of 36%, that gives a nice APR of 3.2% plus a nice curation rewards.

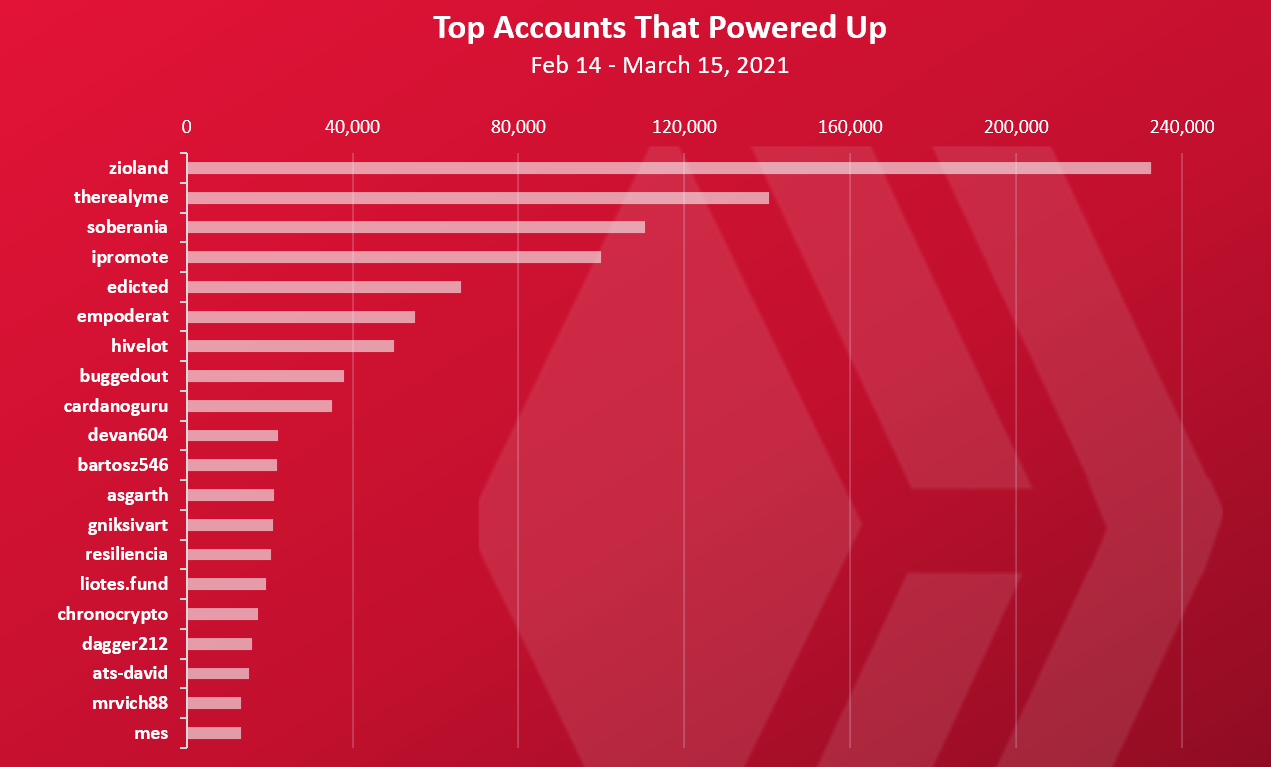

Top 20 Accounts That Powered Up

Who is powering up the most?

Here is the chart for the period between February 14 – March 15, 2021.

The @zioland account is on the top with around 230k HP, followed by @therealyme and @soberania.

@edicted and @empoderat on the list as well 😊.

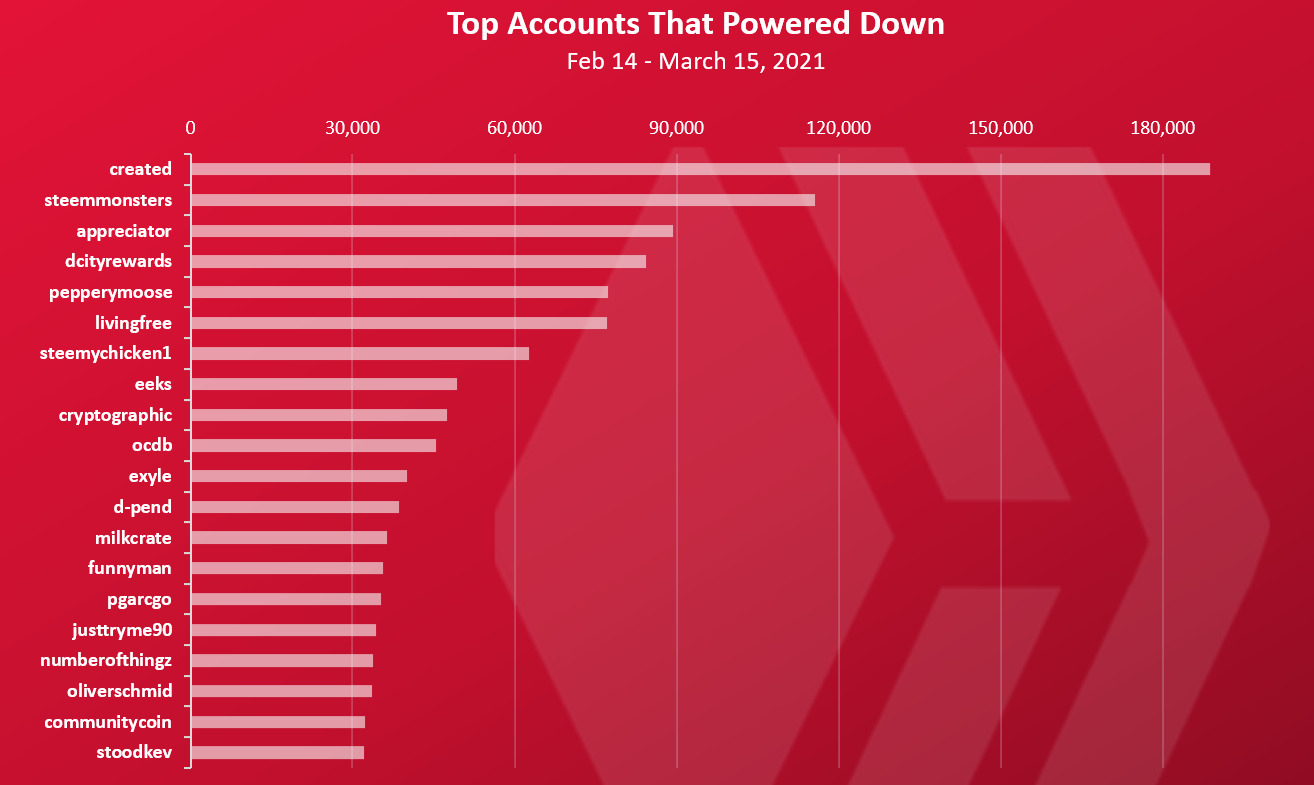

Top 20 Accounts That Powered Down

Who is powering down the most?

Note this are finished power downs, not started.

The @created account is on the top with 190k HP powered down, followed by @steemmonsters and @appreciator.

Overall, the staking numbers are almost constant on Hive in the last period, with just a bit more Hive being powered up the powered down, when we include the HP received as rewards as well.

All the best

@dalz

Posted Using LeoFinance Beta

Nice information as always @dalz !

Posted Using LeoFinance Beta

Thank you!

Posted Using LeoFinance Beta

Some number to look for.

@exyle is still around even

in graph. These graphs are

what we can see in bulk.

I am pretty sure most hivers

are on the hold spot now.

Posted Using LeoFinance Beta

You've got to wonder about all that Hive on the exchanges - why is there so much there? Is that just traders?

Posted Using LeoFinance Beta

Yea its amazing .... those are the ones who control the price :)

How many people do you reckon control 90% of it? About 10 or so maybe?

Posted Using LeoFinance Beta

Cant really tell .... but if you look at the number of top HIVE holders, that hold HIVE on their wallets, cant be a lot :)

Somewhere between 10 to 100.

Posted Using LeoFinance Beta

Wow, this is all very interesting. It is surprising to see some of the accounts who are powering down. I am sure they have their reasons I guess, but it is still a bit of a shock. I am trying to work some things out to get my hands on some more Hive right now. I really wish I had the funds available when the price was really low.

Posted Using LeoFinance Beta

Thank you for the breakdown. I am curious though. I wonder how much of the liquidation of HIVE native coin are being used to invest in tokens of the HIVE Blockchain Network? Now that would be neat to know.

With all of the action going on with @leofinance projects I wonder if some of the liquidation of $HIVE is being done to concentrate on second-layer projects (e.g., Cub Finance). Just musing.

Posted Using LeoFinance Beta

Nice Post also!

!SEOcheck

Title is too long- Try to keep it under 60 characters

Your permlink is too long-Try to keep under 60 characters

Header 1 found but Header 2 not found- Add H2

Image available-Perfect

Title keywords are used in header-Perfect

No links in the body-Add internal and external links

Congratulations @dalz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 75000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPI think your content brings value to the ecosystem.

My support.

Posted Using LeoFinance Beta