Let’s take a look how is the @hbdstabilizer doing!

For those who don’t know the @hbdstabilizer account is trying to maintain the peg of the HBD to the dollar. It receives HBD from the DAO/DHF and trade it on the internal market and then sent funds back to the @hive.fund.

Since the last Hardfork and the ability to convert HBD to HIVE, the @hbdstabilizer works in both directions and it is buying or selling HBD on the internal market depending on the HBD peg at the moment. The bot is runed and operated by @smooth.

We have two scenarios/modes of the stabilizer operation.

- Selling HBD

- Buying HBD

HBD is paired on the internal market with HIVE so the trading is in the two native Hive currencies.

Selling HBD

If the price of HBD is above the dollar then the stabilizer is selling HBD to bring it back to $1.

When the stabilizer is selling HBD, it receives HBD from the DHF (DHF payments are in HBD only), sells it on the internal market for HIVE and sends back the HIVE to the DHF, where it is being instantly converted to HBD so it can be used from the DHF.

These instant conversions from HIVE to HBD in the DHF are a bit tricky since there is no virtual or any operation showing them, hence the exact price of conversions. I have used the feed price in this analysis. @howo has already stated that he will be developing an operation that will show these conversions in the future.

Buying HBD

When HBD is bellow the peg then the stabilizer is buying HBD to bring the HBD value to $1. Since it receives HBD from the DHF, fist it is converting that HBD to HIVE, and then uses HIVE on the internal market to buy HBD. Buying HBD means selling HIVE.

From the description above we can conclude that the @hbdstabulizer is receiving funds in HBD only but it is returning funds in HBD and HIVE. When it sells HBD it is returning funds to the DHF in form of HIVE, and when it is buying HBD it is returning funds in form of HBD. To be able to compare the received vs returned funds we will need to convert the HIVE sent to the DHF in HBD.

The @hbdstabilizser started operating at the end of February 2021, and we will be looking at the data since then.

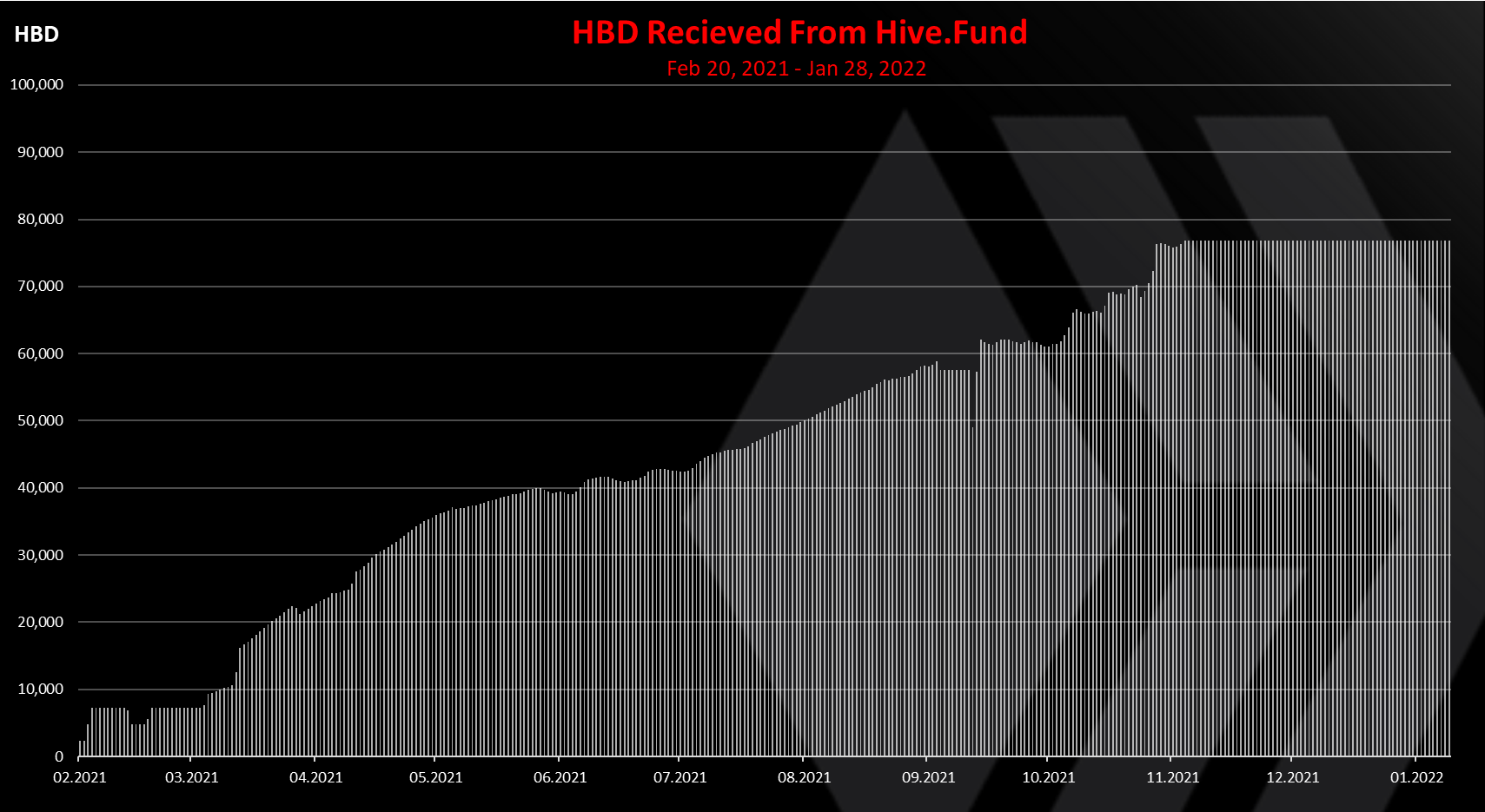

Funds Received

As already mentioned the DHF is paying funds only in HDB. Here is the chart for the HBD transferred to the stabilizers.

As mentioned, the @hbdstabilizer started receiving funds for the first time on February 20, 2021. At first it was only 2.3k per day. The thing is the DHF had a small amount of HBD in February 2021 and could not transfer more funds. As the time progressed the funds in the DHF grew from 1M to more then 11M HBD now and the daily payouts increased.

In the last period the stabilizer receives 76.8k HBD daily. This sum was reached at the end of November 2021 and it has stayed at that level. I guess this amount is enough for now to keep the peg.

A total of 16.3M HBD was sent to the @hbdstabilizer in the period.

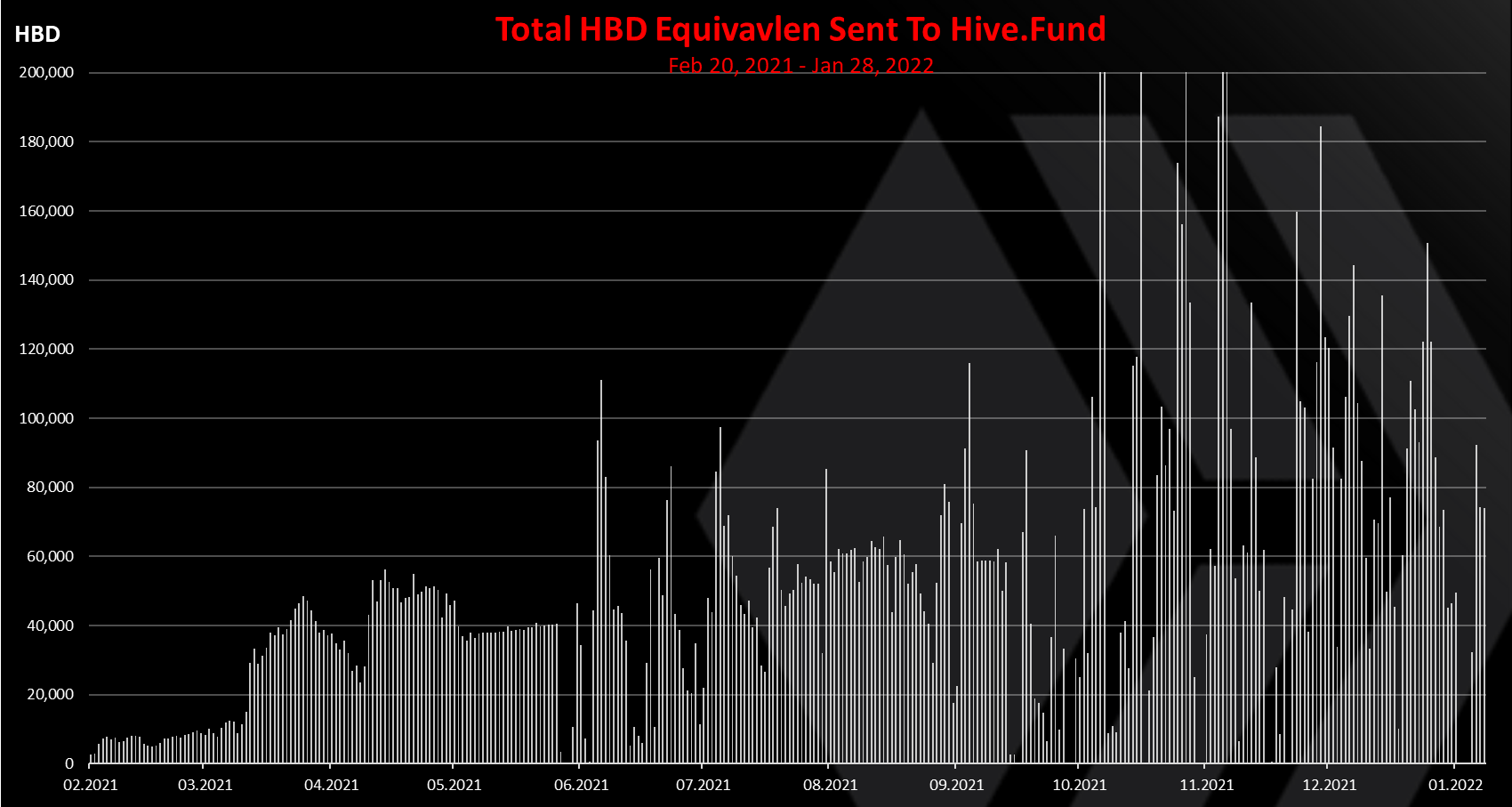

Funds Sent To The Hive.Fund

We have seen the funding of the @hbdstabilizer now let’s take a look at the funds that it has sent back to the fund.

Note that funds sent to the @hive.fund are in form of HIVE and HBD. I have converted the HIVE rewards to HBD, for easy representation and comparison. The numbers are approximate because of the conversions.

As mentioned the @hbdstabilizer sells HBD for HIVE on the internal market and then sent the HIVE to the @hive.fund where it is instantly converted to back to HBD. It is also buying HBD with HIVE when the price of HBD is bellow one dollar and sends that back the HBD as well.

On occasions there was more then 200k HBD sent to the DHF on a daily basis.

Overall, in the period above a total of 17.3M HBD equivalent was sent to the DHF fund. If we compare this to the 16.3M received it is a profit of around 1M HBD.

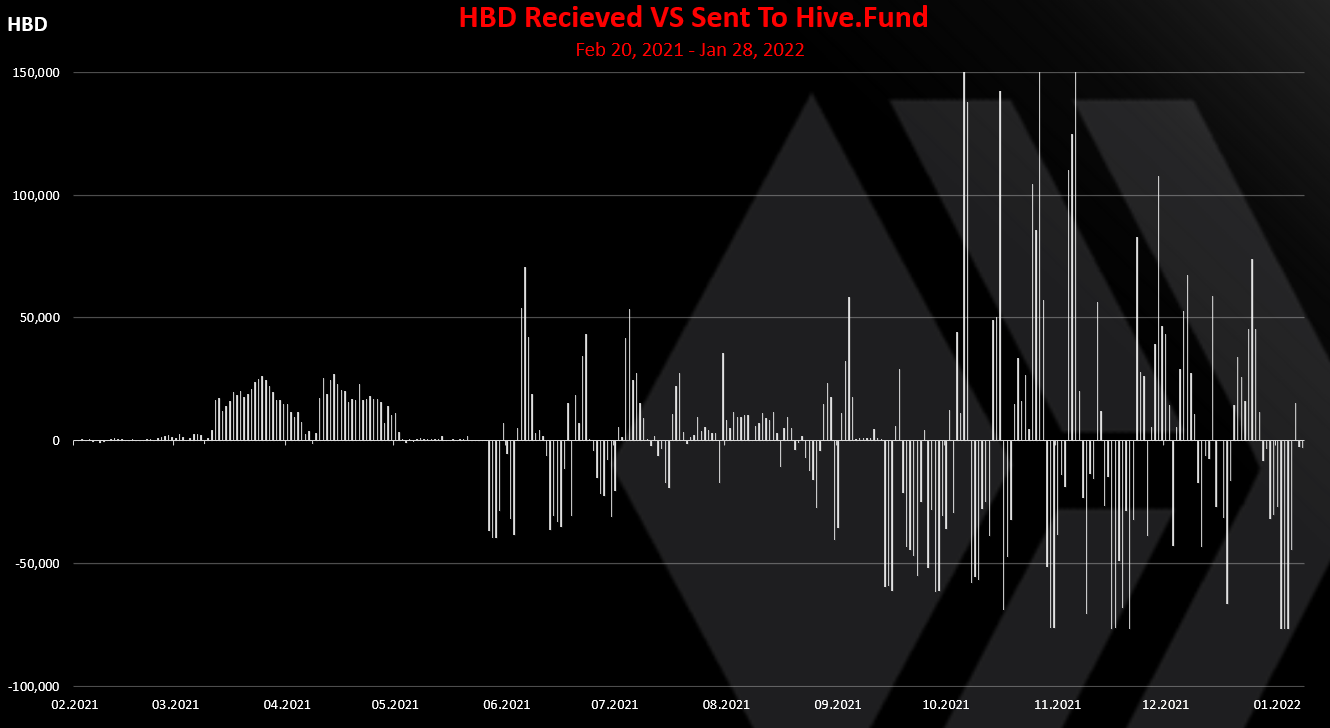

HBD Received VS Sent

If we plot the amount of HBD received VS sent to the @hive.fund from the @hbdstabilizers we get this.

*A positive bar means that the stabilizer has sent more funds to the DHF then received, a net profit, while a negative bar means that the stabilizer has received more funds then sent back, or a net loss.

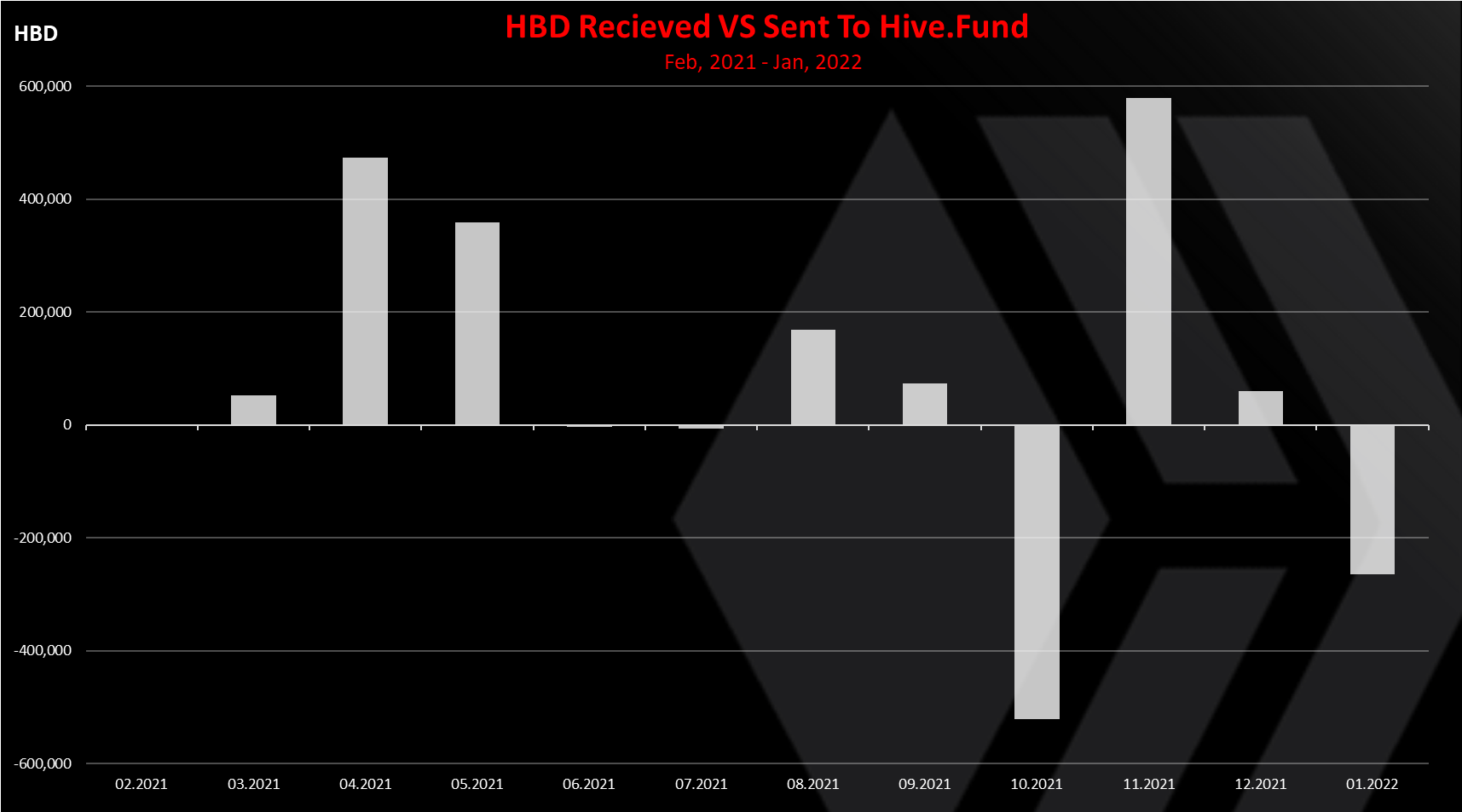

For better visibility lets see the monthly chart.

We can see that in the first months of operation the stabilizer was almost in constant profit, sending more funds back, although the amounts were not as big. Then in the summer the stabilizer worked with small loses. The overall crypto market was down in the period. August and September 2021 were positive for the stabilizer, but then October had a major loss. A big spike in November in the positive, a lower profit in December and now a loss in January.

As mentioned, overall, the stabilizer is in profit with 0.97M HBD equivalent more sent then received from the DHF.

I find the November 2021 bar a bit odd since the price of HBD was not up in the period. But the price of HIVE was up then with ATH of $3 per HIVE. I guess the profit in November is coming from conversions.

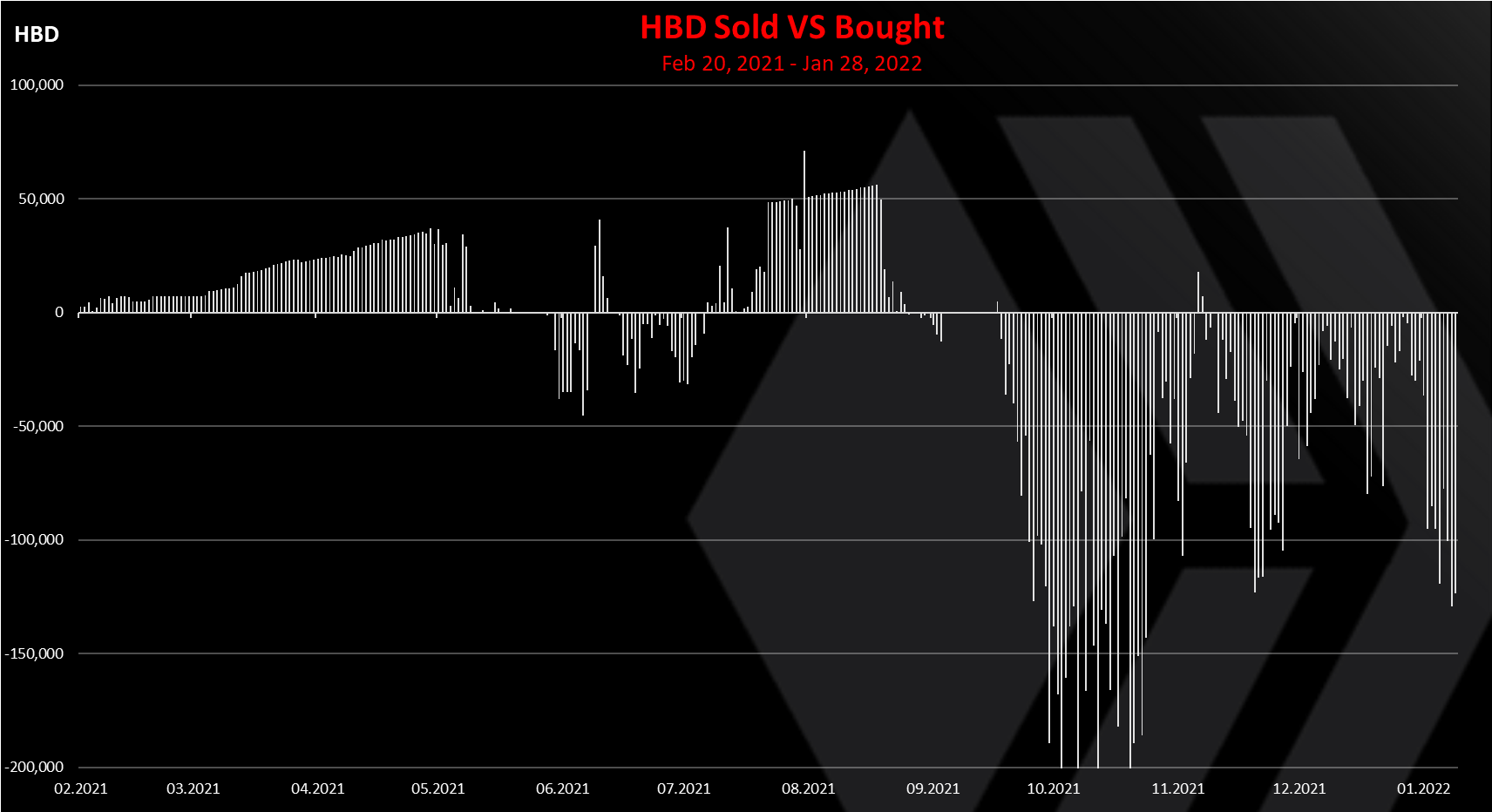

HBD Sold VS Bought

Now let’s take a look at the market activities and how much selling and buying the stabilizers has been doing.

Note that when the stabilizer is selling HBD it means HBD is above the peg, and when it is buying HBD is bellow the peg.

We can see that until May 2021 the numbers for the HBD sold kept going up and reached 35k per day. In this period HBD was trading above $1.

Then the peg was reached the selling stopped and there was some buying in the summer 2021. Then another wave of selling HBD (high HBD price) at the end of August and the begging of September 2021. Since then the stabilizer has mostly been buying HBD, meaning that the HBD peg was bellow the dollar.

Here is the monthly chart.

We can see the trend from above here as well. Selling HBD at first, some buying in the summer 2021, then selling again in August and September, and constant buying HBD in the last four months.

A total of 3.6M HBD was sold and 9M HBD was bought. Note that a lot of these amount are circulated.

HBD Price

At the end the chart for the HBD price in the period.

We can see that HBD was quite unstable in the first half of 2021 reaching price more then 2$. At that time the HIVE to HBD conversions were not possible, and the DHF fund had less funds. Since June 2021 the HBD has been more stable, with a spike up at the end of August to 1.2$, but the conversions were live then and the DHF had more funds so the peg was brough back quite fast.

Since September HBD is trading mostly in the range of 0.95 to $1, with a rare occasions when price broke this range. The last weeks has been a another test for the HBD as we have seen the price going down to 0.92, but it has recovered fast and now is around 0.98.

There are much more funds in the DHF now for the stabilizer, it has even put a cap, and the option to convert HIVE in both direction gives more stability to HBD.

The net effect from the @hbdstabilizer still remains positive even with the funds spent to maintain the peg in the last four months. This is most likely because the stabilizer has made profit from conversions as well, especially in November 2021, when the price of HIVE went up.

The final goal is for the HBD to have a stable price, and that has been achieved with relative success in the last period.

The HBD concept is solid. It has a lot of elements now for it to work. It has an incentivized internal market where DHF funds are used through the @hbdstabilizer to maintain the peg. Any external markets and exchanges can use the internal market and arbitrage the price of HBD. The two way conversions are also doing there job. HBD has a 12% interest now for the savings account, that is a competitive APR.

What HBD needs at this point is more liquidity, more market and defi pools and faster conversions so the peg is kept in even more tight range.

One of the major risks for HBD is if the debt limit is broken and the blockchain no longer price HBD at $1 when conversions are done. This limit is now 10%, while we are under 5% debt atm. In a future hardfork it is planned for the debt limit to be increased to 2% to 30% that will give a bit more room and a guarantee that the blockchain will do the conversions at $1.

All the best

@dalz

Posted Using LeoFinance Beta

Re. October vs November

What happens is that when HBD is persistently less than $1, the stabilizer does HBD->HIVE conversions which lock up a lot of HBD in the 3.5 day timer. Once HBD starts to go above $1, the HBD or HIVE is just sent back. The former happened more in October and the latter happened more in November.

Recently we've seen HBD more below $1 so the balance locked in 3.5 day conversions has been increasing again.

So less conversion in November, but still a high profit for the stabilizer

We've gotta keep this conversation front and centre!

This is extremely important aspect of HBD that people need to understand.

While our LeoFinance guide content had a go, I'd love to hear a simple explanation from you in the replies to this comment if you're down?

Posted Using LeoFinance Beta

Thanks!

About the HBD debt limit and the haircut.

When the debt is higher then the limit (10%, now, 20% to 30% in the future), the blockchain will no longer give a 1$ rate for a HBD to HIVE conversions.

The rate that the blockchain will apply for HBD depends on the debt level.

For example for a limit of 10% debt, if the debt level is 11%, the blockchain will give around 0.91$ HBD to HIVE, and if the debt is 20%, (double then the 10% limit) then the blockchain will value HBD to HIVE conversions for 0.5$, basically giving a 0.5$ price for HBD.

Good rundown, I appreciate seeing these kinds of statistics. I have a question that’s a little off topic, my apologies, but it’s actually somewhat rare that I get a HBD headscratcher and I can’t quite figure this out. Hoping yourself or others with more knowledge might see something I’m missing. I had a post just payout 25% HBD/liquid rewards. At first I thought maybe HBD wasn’t printing fully right now, but if that was the case it should’ve resulted in a HBD/HIVE/HP split I thought. And seeing in your post that we’re solidly under the debt limit scratches that.

Is liquid % of payout actually a more configurable operation than just 50/50? I’d always thought the blockchain was rigid on that.

This post was through the new @liketu interface and my guess right now is that their 50/50 post option is somehow stacking on top of a default 50/50 to create a 75/25 split…, which would simply be a glitch for their attention, but I was just surprised to see it allowable on chain!

The hbd part is a percentage in comment operations, with 100% actually meaning 50/50. So if they chose the option as 50%, it would be 75/25.

I'm sure that percentage setting was just amiss on Liketu and they're fixing it up! It was just surprising because I didn't know this operation had other potential configurations. So hypothetically a front end like PeakD could actually have a slider to tune in different liquid payouts between 0-50%?

Thanks for bringing this to our attention, will look into it as a matter of priority.

No problem, I just wanted to get some eyes on it to see if I was missing something obvious! My biggest concern is if this is something that technically shouldn't be allowed at the blockchain level, then I'd want to tag in some core developers... but I'm unsure if it's a glitch there too, or just a configuration I haven't personally seen used before.

Work on that is close to done :)

Great one!

Wow the summition is awesome and ambery happy to learn from it that, also hbd can be sell or buy whojc is never occured to me. Wow

I wonder how much of that is also Beneficiary rewards from posts.

As an example: I set @hbdstabilizer as a Beneficiary for some of my posts just to help 'feed' it and often wonder how many others do the same.

I think HBD should be a focal point of concentration, it's been tested recently and even if it's not done too bad, it's not gotten to where we might deem it to be good.

Excellent reports !PGM

Tnx!

100 PGM token to send 0.1 PGM three times per day

500 to send and receive 0.1 PGM five times per day

1000 to send and receive 0.1 PGM ten times per day

Discord

Support the curation account with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

I think people will use HBD a lot when more attractive defi pools will be available. 12% interest in the saving account is nice tho 😄

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Thanks for this excellent breakdown of data for HBD! I love gettin' a closer look at the inner workings of Hive. Definitely looking forward to seeing HBD get closer and closer to a hard $1 pricepoint!

!1UP

!lolz

lolztoken.com

A depression.

Credit: theabsolute

@dalz, I sent you an $LOLZ on behalf of @akumagai

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (1/1)

You have received a 1UP from @entrepidus!

@leo-curator, @ctp-curator, @neoxag-curator, @pob-curator, @vyb-curatorAnd look, they brought !PIZZA 🍕

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

It looks like it's doing it job to stabilize HBD prices.

Posted Using LeoFinance Beta

@dalz Thanks for the info, I think the stability in HBD will attracts more investors over time

I really did not know much about the HBD stabilizer but after reading a thing or two, I understand it a little better than before.

Would like to see this in the nearest future.

Posted using LeoFinance Mobile

thanks for the update!

Thanks for the information. The price of HBD is adding. Because of downtrend in the market.please what's the name of stabilize that bring hbd back when's selling.

.

Posted Using LeoFinance Beta

$WINE

Fascinating, and thank you!