Curve has been going through a lot of challenges in the last period. Starting from 2023 there was a hack on the protocol that was not as scary, but it revealed the massive loan of the founder of the Curve that couldn’t be liquidated, basically putting the protocol in bad debt.

Afterwards there were some OTC deals, and the loan value was reduced. But then in 2024 there was another drop in the price of the CRV token and what left of the loan got liquidated leaving the protocol with some bad debt position. The founder has stated that he will repay all the bad debt. Not sure what is the current status of it at the moment.

Curve is a stablecoin DEX. It provides swaps of big amounts of stablecoins with the lowest slippage.

At one point Curve had the largest TVL of all the defi apps. The now fallen TerraUST project had its biggest liquidity pool on Curve. Apart from stablecoins it is also used for other derivatives that have a counter partner of 1 to 1 ratio. This has come in handy for liquid staking projects like staked ETH and ETH pools.

Here we will be looking at:

- Total value locked

- Trading Volume

- Number of users DAUs MAUs

- Top Pairs

- Price

The data here is compiled from different sources like DefiLama and Dune Analytics.

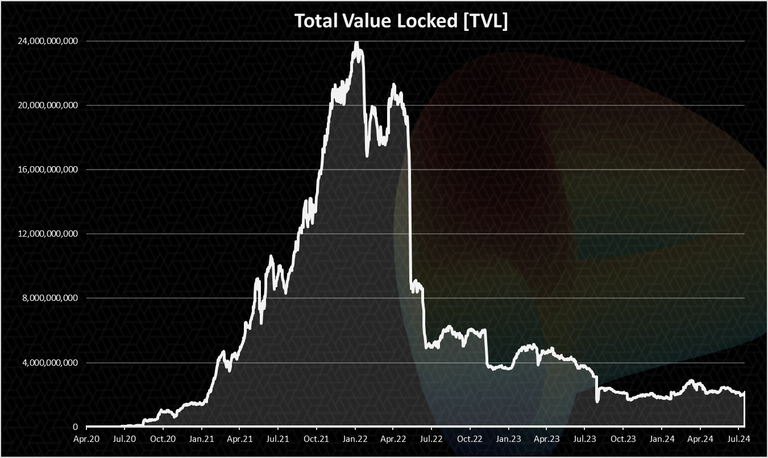

Total Value Locked

Here is the chart for the TVL on Curve.

We can see the heights in TVL on Curve were reached back in January 2022 with 24B in deposits. Shortly after, in May 2022, there was a massive drop in TVL from more than 20B to 5B. This was due to the collapse of UST. A total of 15B TVL was removed from Curve in a period of a month.

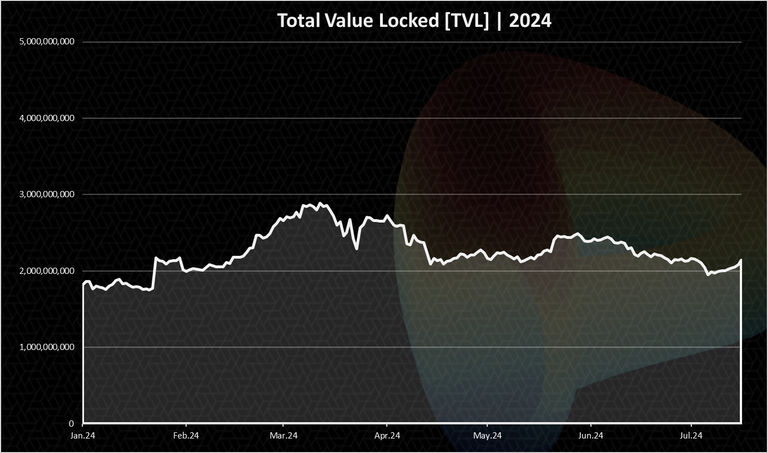

When we zoom in 2024 we have this:

In 2024 the protocol is hovering in the range between 2B to 3B. Far from the ATH of more than 20B.

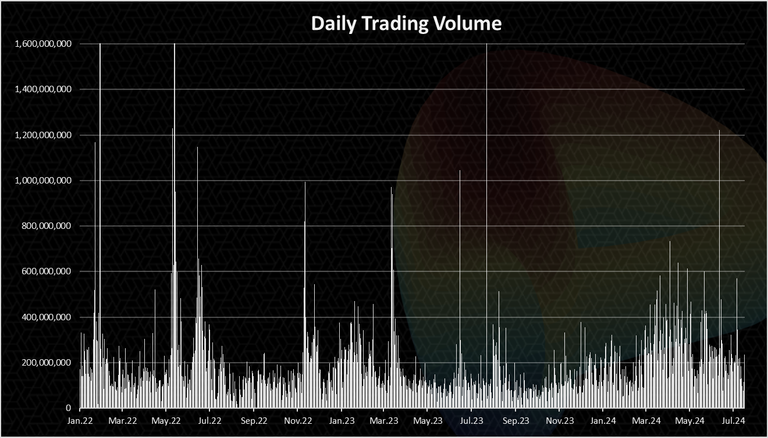

Trading Volume

Trading volume is extremely important. That is where the fees come from and the APR for liquidity providers. No trading volume means no fees and no capital in the protocol.

The chart for the trading volume looks like this.

There are a few spikes in the trading volume up to 2B daily on occasions. This usually happens when there are some market volatilities.

On regular days the trading volume is around 200M per day.

Some uptrend is noticeable in the last period with the daily trading volume in the range of 400M on some occasions.

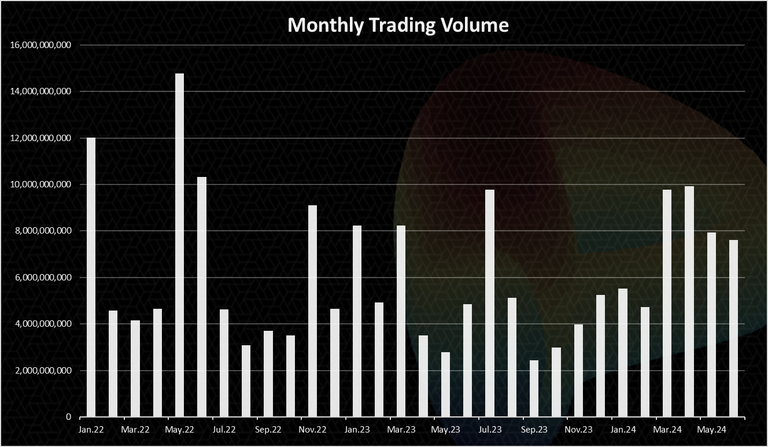

The chart for the monthly trading volume looks like this:

We can notice that in 2024 the volume has been growing in the first months reaching 10B in April 2024 and has dropped a bit in the last two months to around 8B. Still a higher volume when compared with 2023.

DEX VS CEX Volume

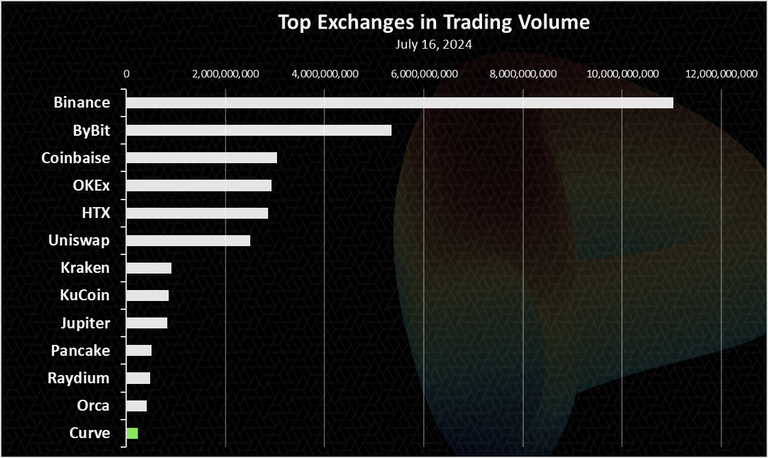

If we take a look at the data for the trading volume on the other exchanges provided by some of the aggregators like coingecko the numbers looks like this.

An example for January 15, 2024:

We can notice Curve is barley managing to enter the top exchanges from the both categories, DEXs and CEXs.

As mentioned it has a volume around 200M daily, while the to first on the list Binance is above 10B. The number one DEX, Uniswap is having volumes in the billions as well. The Solana exchanges, like Jupiter are also close to billion now.

Active Users

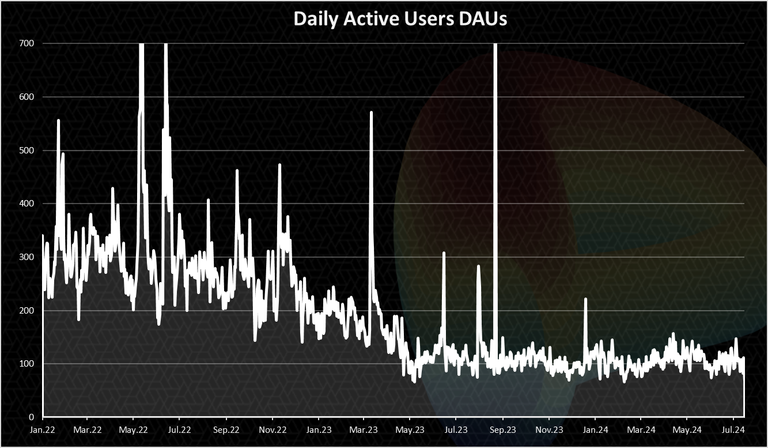

How many users does Curve has? Here is the chart.

Curve does not have that many users, and the numbers have steadily gone down in the period. Throughout all the year there have been between 100 to 200 DAUs, with occasional spikes to 500 or more. This again shows the protocol is used on an industrial level, from other apps and not by individual users. It makes sense since its primary use is for large stablecoins swaps. Not a lot of users have a large amounts stablecoins to swap around.

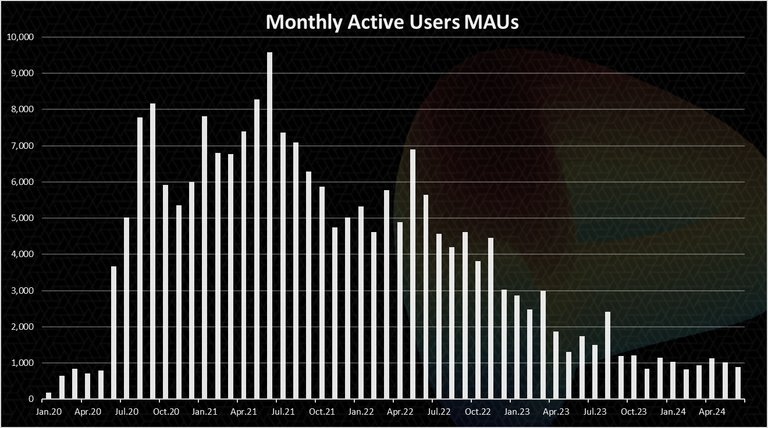

On a monthly basis the chart looks like this:

The number of monthly users is a bit higher than the daily ones and it is around 1k. In the last two years it has dropped from a record high of 10k to 1k now.

Top Liquidity Pools on Curve

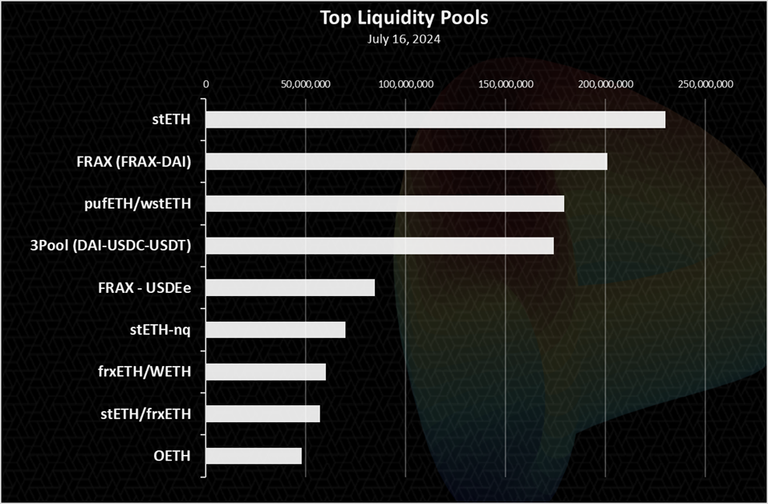

Here is the chart for the top pools ranked by liquidity.

The stETH pool is in the first spot with 235M. Not a stablecoin pool but an ETH derivative from liquid staking. Next is the FRAX-DAI pool, a stablecoin pair, followed by another staked ETH pool. Basically stablecoins and staked Ethereum pools.

Price

The all-time chart for the CRV price looks like this.

Quite the downtrend for the token. The bear market has been especially rough for defi coins and CRV is not an exception. At the top the CRV token was worth more than $6. Now it stands at around 0.5. On a few occasions it dipped to bellow 0.3. More than a 90% drop in the price. It has dropped even more in the recent period.

It remains to be seen how things will evolve on Curve now that the founder has been liquidated and the risk is fully taken off.

The staked ETH pools were a major new development for Curve, with a lot of liquidity locking in those pools, because the ETH to stETH acts like a stablecoin pools. But we have seen that even this liquidity has been exiting the protocol. Overall, not the best position for the protocol to be in.

All the best

@dalz

Posted Using InLeo Alpha

Bybit is gaining more recognition on trading these days and we Nigerians are even using it more because we can no longer make use of Binance

Your detailed breakdown of Curve’s situation really clarifies the current DeFi landscape. Great work brother as always !HUG

I sent 1.0 HUG on behalf of @theringmaster.

(3/3)

I’m shocked to see Bybit come above Coinbase

Well, a lot of people are now making use of Bybit now

But I’m not sure it can surpass Binance soon

The price has gradually come down, very informative post

They are really performing quite well in the stablecoins

It actually looks like due to the strong volatility happening in the crypto space, people have been storing in stablecoins

I'm not familiar with Curve, but that is a massive decrease in overall data. From TVL, to active users, and token price, they are really taking a beating. It will be interesting to see if they can recover.

I just wanted to know who came up with the idea for the CURVE token's main artwork. It's like looking at a randomly drawn dot with the BRUSH tool LOL.

Yea the overall platform look is old school :)