This is the third part of my current market analyses. In the first part, I did a technical analysis on the equities market and in my second part, a fundamental analysis. I like to bring some attention to cryptocurrencies and gold in this part as we are seeing some interesting developments in the 2 markets.

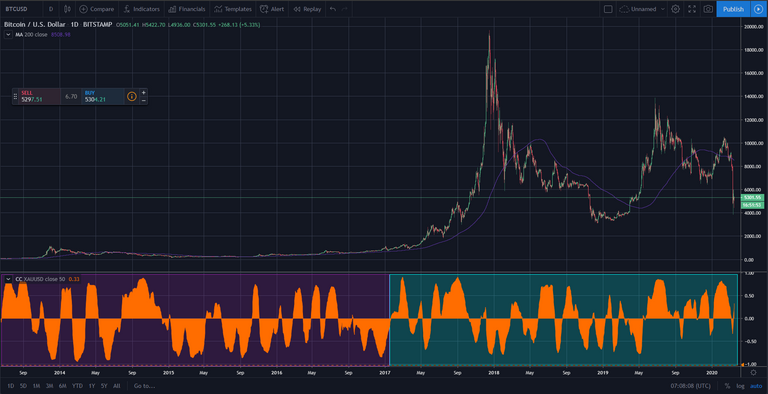

In this analysis, I am going to use Bitcoin to represent the crypto market. Since most other coins are still correlated to Bitcoin, I think it is a fair representation. Besides, Bitcoin also has the longest trading history that we can draw references from.

Bitcoin

Since the recent peak in mid-February, Bitcoin had seen a major drawdown of over 60% from $10,400 to $3,800. This caught many people by surprise as there has been a narrative on how Bitcoin is uncorrelated to the traditional financial market and how Bitcoin is a hedge for the failure of it.

Allow me to weigh in on this narrative. Bitcoin was found to be relatively uncorrelated to many other asset classes according to a research done by Binance. However, that does not mean that it is a good hedge against the stock market. Having multiple assets that are of low correlation helps to diversify the risk of your portfolio. However, if you need something that is a hedge against the stock market specifically, then you need something which is negatively correlated to it. No correlation is not equal to negative correlation.

So why did Bitcoin tanked when the traditional financial market is in turmoil? Before I jump into answering that question. Let's also have a look at the gold market. Gold is widely believed to be a "safe haven" asset. So it should be going up when the financial market is in turmoil right? The fact is quite the opposite. It has seen an over 14% drawdown since it reached its recent peak last week.

Mad rush for liquidity

Let's switch back to the Bitcoin chart again. Gold started its fall from 9th March, and it is not a coincidence that Bitcoin also started its major decline on 7th March.

Why these 2 markets crashed in the past week? The answer is simple, a desperate rush to liquidity. In a highly leveraged world of traditional finance, many market participants have leveraged positions that will be margin called during times of high volatility. What will you do when your positions in equities are margin called? You look at your portfolio and "balance it" by taking profit on those assets that are in the money.

Since the beginning of 2020, to the point prior to the crash last week, Bitcoin had a return of 34%. Gold had an almost 10% return in the same period. Stocks, using $SPY as a reference, had about an 11% loss in the same period. When the equities market suddenly tanked, market participants panicked and begin by selling stocks. However, it quickly reached a point (last week) where they will have to realize paper losses on their stocks if they continue to sell them. As a result, many chose to sell gold and Bitcoin that are still in the green.

So what is next for crypto and gold?

There is no telling how the crypto and gold market is going to move. There are a few possible scenarios. Scenario 1, the leveraged market participants had sold all their crypto and gold to top up their margins. If that is the case, then there should be no further sell-off in gold and crypto even if the financial market sells off further. However, if the the massive liquidity injection from the central bankers manage to calm the financial market (i.e. VIX level starts to drop), gold and crypto should be bouncing up very quickly.

Scenario 2, the leveraged market participants had sold all their crypto and gold. In this case, if the financial market continue to sell-off, there will still be some selling pressure on crypto and gold. However, the effect will be lesser than before. Reason is that Bitcoin and gold are not so deep in the money anymore. On the other hand, if the financial market stabilizes, gold and crypto should be bouncing up fairly quickly as well.

The 2 scenarios both assume that market participants sold Bitcoin and gold due to desperation. They do not want to part with these 2 assets but were forced to do so. Hence, they will likely to re-enter when the opportunity arises.

In a nutshell, I do not see a reason for people to give up on gold and Bitcoin at a time when so much fiat money is pumped into the system. Hence, it is likely the sell-off is due to a liquidity crunch on market participants. There can be further downside on crypto but I doubt it will be go below the price range ($3,200 - $4,000 per BTC) during the accumulation phase between Dec 2018 to Mar 2019. Similarly for gold, I do not think it will go below the price range ($1,450 - $1,480) during the accumulation phase between Nov 2019 and Dec 2019.

In addition, I am of the belief that there will be a relief rally in the equities market. What is likely going to happen during the relief rally is that experienced investors will re-position their portfolio for the longer term. Many will sell away growth stocks that are unlikely to do well during a recession and buy consumer staples and "recession-friendly" stocks. Some will also re-enter into gold and Bitcoin to protect against risk of high inflation.

On correlation

On Twitter, I have seen debates on whether Bitcoin is correlated to the equities market. Using $SPY as a reference and the built-in "correlation coefficient" feature in TradingView, this is how it looks like.

As you can see, the correlation coefficient oscillates. This indicates that there isn't a very clear correlation and depending on the situation Bitcoin can be positively or negatively correlated with $SPY. However, it does seem like Bitcoin is positively correlated with $SPY more often than not.

Next, let's take a look at Bitcoin correlation with gold.

This is an interesting picture as we can see that prior to 2017, Bitcoin is more negatively correlated with gold than positively correlated. However, since the beginning of 2017, we are seeing Bitcoin more positively correlated with gold than not. Perhaps this is also testament to the narrative of Bitcoin slowly becoming a store of value/safe haven asset class?

Summing it up

It is tough to tell how crypto and gold will respond if there is further turmoil in the financial market. However, in my opinion, the downside of both asset classes are limited while the upside is tremendous. I also think that the equities market is overdue for a rebound. As the reality of the COVID-19 virus started to sink in, there will first be panic, like what happened in China and some parts of Asia at first. However, with the right measures, humanity typically has the resilience to overcome the panic and gradually adapt to a new norm.

Cities are locking down now, which is the right measure as what we saw China did. As an optimistic person, I believe that things will get better sooner rather than later. I will cover more on the COVID-19 situation in my next post.

Again this article is not financial advice. Please do your own due diligence and research for your own investments.

20% of post rewards goes to @ph-fund, 5% goes to @steemworld.org and 5% goes to @leo.voter to support these amazing projects.

Join the Steem ENS Discord server to interact with the community!

This article is created on the Steem blockchain. Check this series of posts to learn more about writing on an immutable and censorship-resistant content platform:

- What is Steem? - My Interpretation

- Steem Thoughts - Traditional Apps vs Steem Apps

- Steem Thoughts - A Fat or Thin Protocol?

- Steem Thoughts - There is Inequitable Value Between Users and Apps

- Make my votes count! Use Dustsweeper!

- What caused STEEM to get dumped? Why I think the worst might be over

- Steem 2020 is about having a "SMART U"

price instability is mind boggling. I hope that we will get out of all these crises soon, the world needs solutions, liquidity and balance.

Indeed. I hope that it will be over soon

That oscillating correlation is crazy!

It does suggest that all of that BTC will be bought back at some point not so far away.

Yea, I hope so too 🙏

Wow this crazy seeing bitcoin and gold going down because of the covid-19

Hmm, such a long read but worth it.

We hope for stability and balance soon before things get out of hand.