"Bitcoin is not a store of value because it can drop 20% within a day."

You have heard this argument so many times.

It's bitcoin denier's last resort, it's his/her last line of defence... 😀

That's true, bitcoin's daily volatility is high compared to gold's.

However, the denier "forgets" to mention that a few days (or even a day) after the -20% dip, bitcoin pumps by +30%...

My point is, bitcoin's daily volatility is irrelevant, let me repeat this:

Bitcoin's daily volatility is irrelevant.

The reason is very simple:

you don't want to preserve your money's value for a single day, but in the long run...

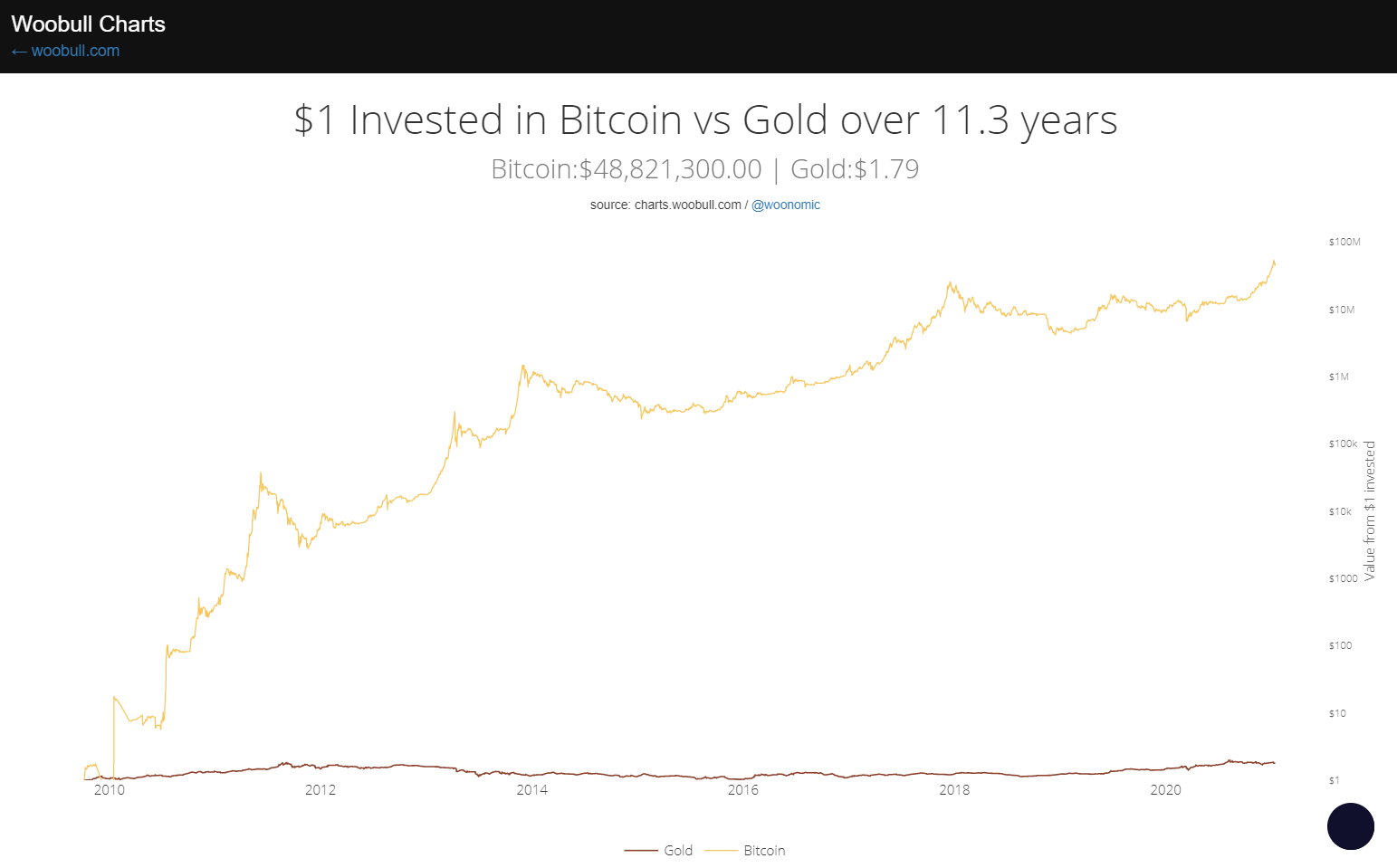

So, let's look at the following chart, how well a US dollar's value has been preserved so far by bitcoin and gold since bitcoin's inception in 2009.

1$ value of 2010 was preserved by bitcoin with $48,821,300 in 2021.

While, 1$ value of 2010 was preserved by gold with $1.79 in 2021...

And they still tell you bitcoin is not a store of value, because of its high daily volatility...

What's the problem with deniers?

But, why deniers carry on repeating this ridiculous argument?

They certainly are not stupid.

I strongly believe the explanation is psychological.

They need an excuse to justify themselves for not buying bitcoin at an earlier stage.

This excuse gives them a false feeling of mental stability.

Especially those deniers who have an educational background in economics exhibit this condition in a more severe way than others.

I seriously consider this behaviour as a soft mental illeness...

Sharing is caring

I am not writing this article to mock these people.

Mental conditions (however soft) deserve to be treated with respect.

So, if you have friends in this category, you can do something to cure them.

Try gifting them bitcoin on their next birthday.

Buy a hardware wallet, it won't cost you more than $50, buy bitcoin of (let's say) $50 worth, store it in the wallet and hand it over to them.

That's the best you can do for your friends mental stability!

PS. If you would like to, you can follow me on:

🚩 twitter: https://twitter.com/cryptovios1

🚩 youtube: https://www.youtube.com/channel/UC4t1o-i3DUieL5erhYYFYTQ

🚩 3Speak: https://3speak.co/user/cryptovios

🚩 Torum: https://torum.com/u/cryptovios

🚩 Publish0x: https://www.publish0x.com/cryptovios

Posted Using LeoFinance Beta

Im not sure I agree with the store of value definition. It is more like an investment in the future of storing value.

I would even go so far as say that the gold price stability over thousands of years is more like a lucky accident than a god-given thing.

Posted Using LeoFinance Beta

I would rephrase your point as follows.

Bitcoin is a store of value, but people have just started to realise it.

Its value will hugely appreciate over time, as more and more people realise it's a store of value.

Regarding gold, it's more of a social consensus, leaving aside gold's characteristics that make it fit the money definition.

The diamond history is even more interesting.

It was a useless thing until about 1-2 centuries ago.

Brain washing (a.k.a. marketing) transformed it in what it is today.

Posted Using LeoFinance Beta

I mean sure Gold has the scarcity and all that, but there is no assurance gold will always be appreciated the same. Even if it's 6000 years and maybe more of human history, I would still call it a history bias that makes you believe people might not just find a much better store of value.

I'm not bearish on gold, but I have concerns and am far less bullish than I was 8 months ago.

I hate diamonds, you could literally take poo and press it hard enough (not quite sure if poo has enough carbon, but still)

Posted Using LeoFinance Beta

Word up! You've said it all. I've got people in my family environment with degrees in finance and economics exhibiting this sort of behaviour whenever we discuss anything BTC-related.

Good job!

Posted Using LeoFinance Beta