(Image modified from HBO’s Game of Thrones: “Winter is Coming” – House Stark)

Unlike the title chosen for this article, we are not convinced that structural inflation is returning. On the contrary, we are of the opinion that the COVID-19 pandemic is an exogenous event that momentarily created a rise in prices, similar to what happened in the 1970s with the oil crisis. But let's take a closer look at the data that will show us what will happen between now and the end of the year in the markets.

We have reached a point where developments in the economy and markets between now and the end of the year have become more predictable.

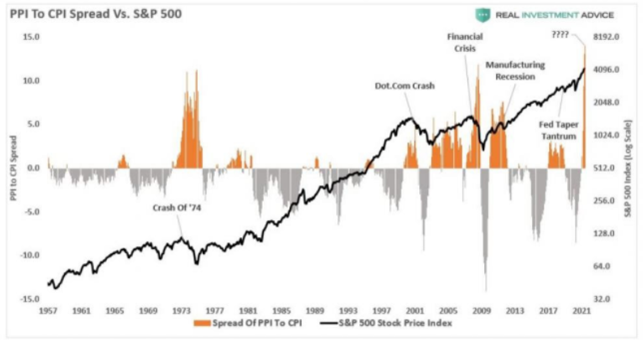

The first chart shows the difference (spread) between producer prices (PPI) and consumer prices (CPI):

The higher producer prices are relative to consumer prices, the more difficult it is for producers to pass on the burden of these increases to consumers overnight, as this would undermine the resilience of the consumer market, making purchases to consumers nearly impossible.

The chart shows that currently the difference between producer prices and consumer prices is at an all-time high, indicating that producers will only be able to pass on a limited portion of these increases to consumers.

As a result, increases in production costs, since they cannot be passed on externally, will begin to erode companies' profits and margins over the long term.

The following graph instead shows the increase of the prices to the export and the import.

While the increases of the export prices favor the exporting companies, the increases of the imported goods penalize the companies that use them, beyond eroding the purchasing power of the consumers. So usually this situation leads to a slowdown in economic growth.

Meanwhile, as the same chart shows, wages continue to weaken (purple curve), contradicting the media narrative about a supposed recovery of the economy.

With such a steady decline in wages, an increase in production costs, and a future reduction in corporate profits and consumer spending power, it is also difficult to sustain the narrative about possible inflation as a product of a recovery in consumption and production.

On the contrary, the scenario is still the pre-Covid one: low growth and monetary inflation. Nothing has changed since 2019, as the chart below shows:

The extraordinary amount of liquidity injected into the financial system as usual has not and will not be transferred to the real economy. This is evidenced by the fact that the lending and leasing capacity of banks (orange line) is always at historic lows, as is the "monetary velocity" (black line), i.e., the circulation of money in the economy.

Media talk of a hypothetical recovery of the economy and a structural inflation of goods and consumption is completely unfounded. There is no evidence in the data.

On the contrary, any school textbook of economics would conclude, based on this data, that:

- we are still in low growth, as we have always been in the last decade, and that

- a transitory inflation, due to the temporary interruption of production and consumption due to covid, has momentarily interfered with monetary inflation (inflation due to increased liquidity flowing to financial markets and not to the real economy) that has dominated the last 10 years.

But as this temporary inflation dissipates, the effects of the excess liquidity that still has to flow into the markets will be felt again, with increases in the prices of investment assets of all kinds.

In the real economy, on the other hand, the increase in the cost of imported goods, driven by the continuing weakness of the dollar, will cause temporary inflation to turn into deflation by the end of the year.

And finally, the markets have figured it out. In fact, we can already observe: - the rise in the price of high-risk corporate bonds (despite the fact that the Fed has long since halted purchases in the sector - purchases, moreover, that have never been large compared to spontaneous market purchases),

- the decrease in interest rates on US government bonds from 10 years upwards,

- the return of investors' preference for high-growth securities...

All these signals show that the markets already perceive the impending deflationary phase by the end of the year, which will take investment assets to new highs, just as happened several times in the ten years before the covid.

Why, however, should the growth of the markets move into its final phase this time? Because in the meantime the Federal Reserve, running after the insistence of the media, might reduce QE, no one knows when. The "tapering" would therefore take place right in the middle of this delicate process and would bring distortions that are difficult to predict.

The fact is that, as this chart shows, there has not been a single time when the Fed has done a tapering without serious consequences in the economy and in the stock markets:

Conclusions

No one can dispute any longer that we are heading for a fairly usual scenario of the stock markets having their usual merry little parties while the economy resumes stagnating as it always has for the past decade.

The hope is that the signs of low growth in the real economy will become apparent before the Fed does the tapering promised to our noisy media circus. In that case, there is a chance that the Fed will backtrack from that intention, letting markets go upward for another couple of years.

If, on the other hand, there is tapering, then it will be best to enjoy the last yields of this long ten-year bubble by the end of 2021 and prepare for an entirely different scenario for the following years.

Written by Macron

DISCLAIMER

We are not giving any financial advice regarding cryptocurrencies, but rather giving applicable advice for new, intermediate and experienced people who are currently into cryptocurrencies or someone who is just now realizing what it is. Before you read this I must say that this blog will be based on the assumption that you have already done some research on cryptocurrencies and the Blockchain ecosystem. We will continue to provide explanations and details to the best of our ability, however we encourage you to do your OWN research because only YOU will know how this second financial revolution will best fit into your life. Thank you for reading our contents.

Posted Using LeoFinance Beta

Congratulations @cryptosniperz! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!