The new year has arrived and with it great expectations to form.

We still don't see clear signs that the Bear Market is dying, but many new, disruptive and interesting things are being developed using blockchain technology. This makes us excited and full of hope that the next Bull Run will be even more important than the ones we've seen so far.

While the time for enjoyment has not arrived, there is much work to be done. We need to keep researching, learning and monitoring the most promising assets and organizations in the market. In addition, we will keep an eye out for trends and innovative use cases that could be big crypto opportunities.

The current period, with the market down, has been extremely significant for the development of projects and new models for using blockchain. It's this, in addition to our conviction in the market, that inspires us to think that a huge increase in adoption may be just around the corner. And in the year that begins, we believe that some trends may consolidate.

In addition, 2023 precedes a cut in the issuance of Bitcoins, the famous Halving. This historic moment tends to be an important trigger for the next bull cycle, driving growth and appreciation of the entire market. Check out what to expect this year and what trends we're keeping an eye on so you don't miss out!

A more digital life

The digitization of our daily lives is inevitable. In recent years, we have seen incredible innovations that have made people's lives easier and solved problems in a simpler and more practical way, offering savings and convenience.

Mobile apps

Something we can all agree on is that the user experience still leaves a lot to be desired in almost everything involving blockchain. The applications and platforms are quite complicated, making it difficult for the standard user to come and, in many cases, offering risks to the most unwary. Therefore, many projects and initiatives are already being developed to make the use more fluid, intuitive and safe.

We hope that in 2023 there will be a robust implementation in the quality of interaction between tools and users, with a leading role for projects and platforms that manage to come out ahead and offer a friendlier environment, mainly to facilitate the on-boarding of new users — which is critical to market growth.

We'll keep an eye on projects like Chainge Finance, which focus on practicality and convenience for users, particularly on mobile apps. Smartphones have played a key role in the mass adoption of the internet. Therefore, it is to be expected that they will also play a leading role in people's access and interest in the blockchain.

Tokenization of real assets

Imagine, then, the immense potential for using blockchain in trading real assets. The English term for this trend is Real World Assets, or just RWA. It consists of tokenizing assets that exist in the real world so that they can be traded on-chain.

In Brazil, there are already some ongoing initiatives. The CVM even took the first steps towards regulation last year, by establishing in its sandbox (test environment) an environment for trading real assets in partnership with Tokenizadora, a joint venture that tokenizes debentures and fund shares investment funds, in addition to bills and/or certificates backed by securities.

This is a robust example of how blockchain can be used to facilitate and support the digitization of trading. In addition to it, we can also mention the experience of Dillianz, a Brazilian company that tokenizes agricultural assets in a private network, offering more transparency to consumers and investors.

Real Yield

With the market going sideways for so long, we've seen a growing interest from users in DeFi. After all, having the opportunity to profit from the tokens that are stopped in the wallet is a great way to not fail to profit in bear markets. However, the latest boom in DEXes has left many people in disbelief and frightened by scams, fraud and hacker attacks.

The alternative that gained a lot of momentum last year — and should be a trend in 2023 — is Real Yield. It offers a much lower return than what you found on platforms in the last DeFi summer. But in return, users are not constantly threatened by reward token inflation. In addition, there are fewer loopholes when the reward is not paid in tokens native to the platforms.

When you invest in Real Yield, the income comes from fees collected for using the network, and not from the unrestrained issuance of tokens. It is worth paying close attention to platforms that offer this type of income and those that migrate to this model, such as Curve and Chainlink.

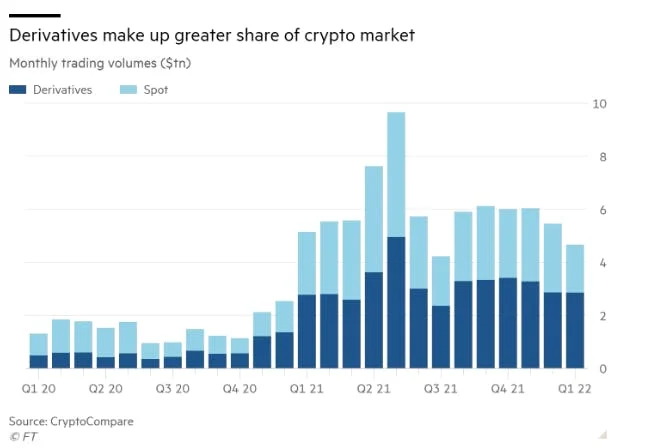

Derivatives market

Speaking of investments, derivatives are on the rise. The bear market and roller coaster of 2022 has made a lot of people rich. This is because the volume traded on the derivatives market is much greater than that recorded on the spot market, as is the case with shares and their derivatives on the conventional market.

The moment with many doubts and uncertainties is ideal for the most attentive, prepared and courageous investors, and can offer substantial rewards. So, be aware of the protocols they already offer and those that will offer derivatives trading in 2023. They could see good growth, and their tokens could also be an opportunity for more conservative investors. But remember, this is an extremely new market, and it comes with risks.

DEXes - Decentralized Exchanges

And speaking of brokerages, the year 2022 opened the eyes of many people to the risks that keeping their funds in them can pose. Centralized exchanges have seen many of their users withdraw their tokens and self-custody should be an even bigger trend in 2023, thank goodness!

With this, the importance of decentralized brokerages grows. They offer an alternative for trading tokens, without the need for their custody by a centralized entity. So you can trade without having to deposit funds. We hope that this year DEXes will once again be at the forefront and that their tokens will become investment options.

The tip is to be aware and use only decentralized brokerages that are safe. To learn how to find options to study, start with the most well-known and traditional ones, such as: Pancake Swap, Uniswap, Thor and Curve. If you want to invest, check first if the founders are real people and if the DEX in question had its contract audited. Don't take unnecessary risks!

Bitcoin Halving in 2024

You may already know, but it doesn't hurt to remind you. The Bitcoin halving is an event programmed into the blockchain code that determines a halving of the reward received by miners every 4 years. As a result, there is a reduction in the number of tokens offered for sale by them and, consequently, greater buying pressure.

2023 is not the year when the next halving will take place, but investors are already anticipating it.

Historically, whenever the halving happens, there is a huge appreciation of Bitcoin. The difference is that, over time, investors are anticipating and increasing their positions earlier and earlier, when there is a rise in price.

Therefore, it is expected that throughout 2023 there will be relatively greater buying pressure for Bitcoin than that observed in 2022. Of course, this is just speculation and everything will depend on what happens throughout the year (especially if we continue with an unfavorable macro scenario and breaches of major protocols).

But don't lose sight of the halving and take advantage of every opportunity to buy BTC at a good price. As we always say around here, don't try to nail the bottom, DCA is still the best strategy.

One year of preparation

2023 should be, above all, a year of preparation. There is a certain congruence in the discourse of most well-known and respected analysts in the sense that the next bull run should only take place in 2024. The path until then is long, and we know that anything can happen, but it is likely that it really will be so.

This means that this year is extremely important. The expectation is that it is preceding a Bull Market that may be the biggest yet, which could project cryptocurrencies to an entirely different level. It could be the last great opportunity to buy cryptocurrencies at relatively low prices and to prepare for the turning point — that point in history where things definitely change.

So get ready! Study hard, strengthen your positions and don't miss any opportunity to multiply the tokens in your wallet.

Posted Using LeoFinance Beta

I think your analysis is perfect.

I agree with everything and especially with the conclusions, now is the time to accumulate and strengthen your positions 💪💪💪

The important is continuing to accumulate and continue to be present.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @cryptosimplify ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

My feeling is that it will be flatline for most of the year. With a possibility of a long pump and back to the same values again.