We are very close to Bitcoin's latest all-time high, and there are many reasons to be optimistic!

REASONS TO BE BULLISH ABOUT BITCOIN

Chart Analysis and the Future of Bitcoin

Bitcoin has just broken out of a bullish flag on the monthly chart, with each candle representing an entire month of trading. This is a classic sign of buying strength!

Going back a little further on the chart, we find the famous cup and handle pattern, one of the most bullish setups that exists and which points to possible price spikes.

The 200-Day Moving Average and the Next Boom

Breaking the 200-day moving average is a rare feat, and Bitcoin has already done it twice this year, most recently on October 14. Each break of this resistance resulted in strong rallies, and now, with BTC above the 200-day moving average, buying pressure is in place, projecting more gains ahead.

Halving Year and US Elections

Since the 2008 crash that gave rise to Bitcoin, governments have been expanding their debts and stimulating the economy with money emissions that end up devaluing the purchasing power of the entire world (since the dollar is the international currency of exchange) and pushing BTC to new highs every 4-year cycle. And guess what? We are right at that tipping point again.

Furthermore, American elections have historically played an important role in the price of the asset and for the first time in history we have a candidate who publicly positions himself in favor of the cryptocurrency market and the development of innovation.

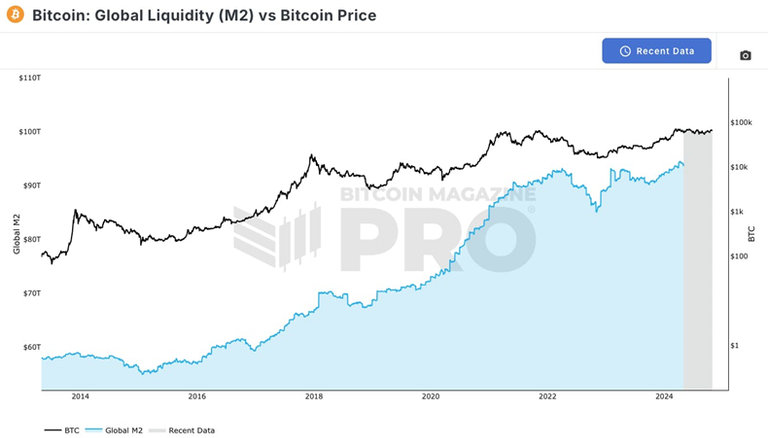

Global Liquidity and the M2 Cycle

For those who don't know, the M2 monetary aggregate is made up of the monetary base - the sum of all paper money in the economy and bank deposits on demand - and also term deposits in the banking market, such as the famous CDBs.

Global liquidity is already at its peak and tends to grow even more to cover public debt and economic stimulus, creating a scenario of strong pressure for the appreciation of scarce assets. BTC, of course, should react in tune with this movement.

The M2 expansion also follows 4-year cycles, closely following BTC, as you can see in the chart above, where the Bitcoin price is represented by the black line and the Global M2 by the blue area.

Gold on the Rise and Its Influence on Markets

With global liquidity rising, gold, another store of value asset, has already risen about 33% from its previous high. Gold is currently trading at $2,700, indicating that investors are eyeing the safety it offers in times of economic uncertainty.

In the last market cycle, the gold boom also preceded the Bitcoin boom and we see no reason to believe that this time will be any different.

S&P 500, the Relationship with M2, Gold and Bitcoin

The largest US companies directly reflect the impact of M2 and gold appreciation. This “ripple effect” shows that the interactions between traditional and digital assets can offer unique opportunities for those who know how to observe them.

And guess what? The rise of the S&P500 also preceded the rise of Bitcoin in past cycles.

In 2020, gold, S&P and Bitcoin rose in that order, all driven by M2 liquidity. Today, we are just 3.5% away from BTC's all-time high. What to expect with M2 on the rise? History tells us that for BTC comes volatility and possibly yet another opportunity for new highs.

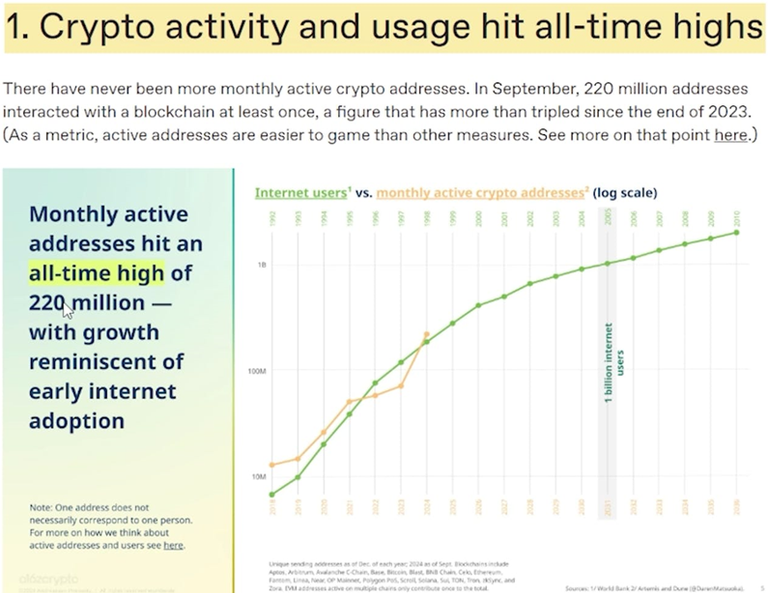

BTC Addresses at All-Time Highs

The number of active addresses has reached 220 million, tripling since the end of 2023. With more people on the network, BTC is gaining strength, indicating that demand is on the rise and that the price could follow suit.

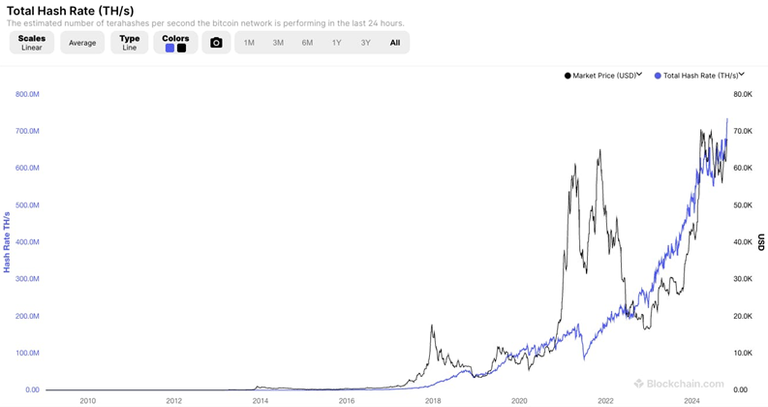

Hashrate at an All-Time High

The hashrate, a measure of the security and health of the Bitcoin network, is at an all-time high. This shows that miners are betting on higher prices and investing in mining capacity, a clear bet that the bull market will continue.

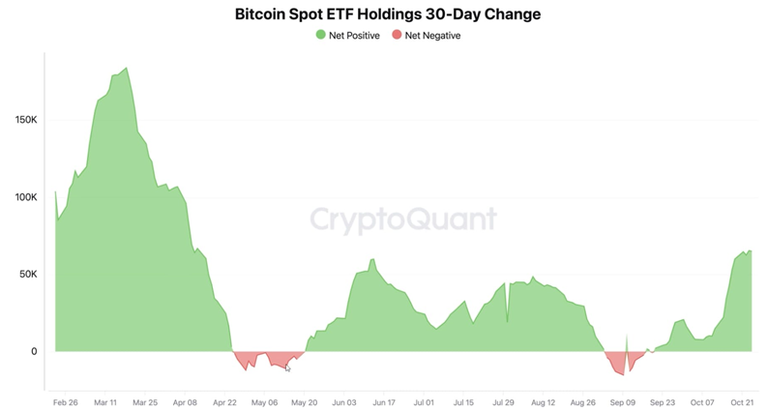

Bitcoin ETFs: Accumulation Expectations and the Sideways Cycle

ETFs have started accumulating BTC again, which represents a movement that has everything to push the price up. After a few months with more outflows than inflows, it seems that we are seeing a reversal in this process, represented by the last green area.

We are in an 8-month sideways market, and when BTC spends a long time like this, it usually breaks out strongly. At this time of market, the trend is upwards.

Posted Using InLeo Alpha

Congratulations @cryptosimplify! You received a personal badge!

Wait until the end of Power Up Day to find out the size of your Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts:

Congratulations @cryptosimplify! You received a personal badge!

Participate in the next Power Up Day and try to power-up more HIVE to get a bigger Power-Bee.

May the Hive Power be with you!

You can view your badges on your board and compare yourself to others in the Ranking

Check out our last posts: