Hello my fellow bloggers! Today I want to about the blood of current bull market – stable coins. We all know there is a correlation between stable coin volume and price moves. Let’s dive in and investigate.

Source

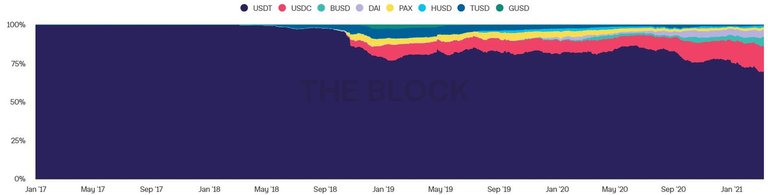

Stable coins play a very important role in crypto market dynamics since the beginning of 2018. In 2018-2019 the volume of stable coins (mostly represented by USDT at this time) was pretty “stable”. Everything changed in March 2020. This was the time when all major economic powers started money printing for various COVID stimulus with volumes unseen before. Crypto market always moves in the same direction as world economy. See the chart below:

Source

I bet you can point the place where the money printer was turned on. Tether started printing enormous amounts of USDT, raising more concerns if it is still backed 1:1 with USD. At the time even with all printing USDT started to loose its dominance:

Source

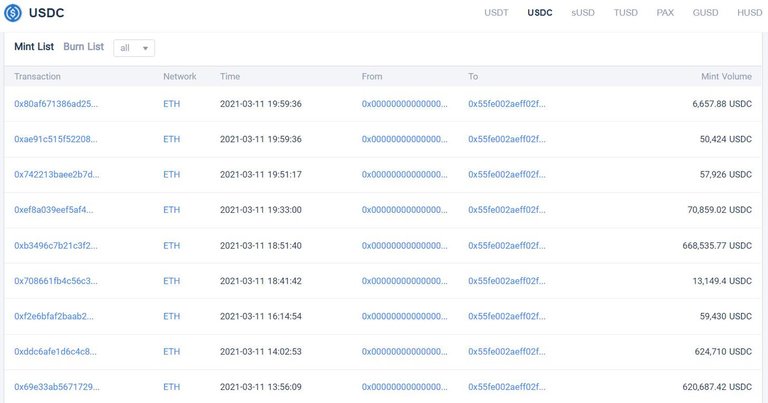

I find the way Tether mints USDT suspicious to say the least. Let me explain why. See how USDC is minted:

Source

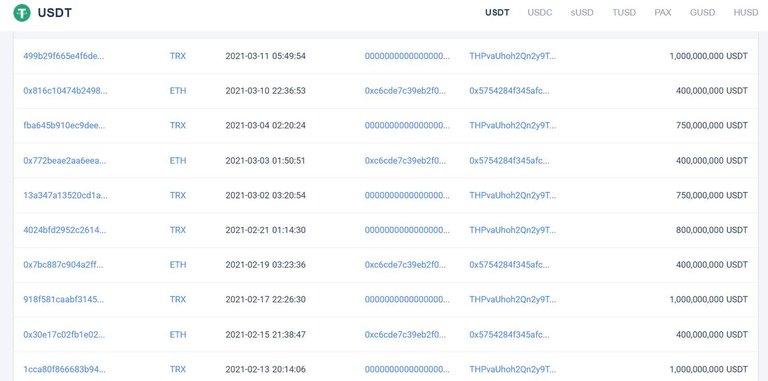

As you can see, USDC is minted in relatively small amount. This is a clean and transparent way to mint more stable coins. People invest more fiat money in crypto and get USDC coins. Now this is how USDT is minted:

Source

In past month (since Feb 11) we see at least 3 days when 1 billion USDT was printed in a single day. It is hard to imagine someone comes to tether and buys 1 billion USDT in a single day. Overall in past month 8 billion USDT were minted. We see the result of this on BTC and alts charts. This looks like money printing we see in fiat world. Many retail investors and companies turn to crypto market to hide from inflation caused by money printing. And here we are. Event today another billion USDT were printed.

I like the effect it has on market dynamics. Yet I really have trust issues with USDT. What do you think about stable coins printing? Is it healthy for the market or will it result in a massive drop in the future? Let me know in the comments below!

Other articles you might enjoy

Can hedge and mutual funds take over crypto market?

Will NFT hype beat DeFI one? Let’s check some numbers!

Do oil wars stop Bitcoin from pumping on stimulus news?

BTC correction: Small investors panic, smart money buying

Disclaimer

I’m not a financial of any kind. I encourage you to check all information yourself and make decision only based on your own opinion. All articles are created for solely entertainment purpose.

If you like this post please vote for it and follow my blog. Feel free to share your thoughts in comment section.

Posted Using LeoFinance Beta

Congratulations @cryptohumster! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 90 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPA good call-out on the stable coins. A major failure in the market would be absolutely devastating to corporate and small investors. USDC, run by Coinbase and Circle, is gaining ground but is expensive to move in small amounts. To a corporation may not be such a big deal, but moms and pops will almost always go the cheaper route.

Then there is the proliferation of USDT on other chains. I'm not sure how that is being tracked.

Thank you @cryptohumster! Good to keep this top of mind.

Posted Using LeoFinance Beta