I did a small buy last week adding 25k WINR to my portfolio and having it staked for 180 days.

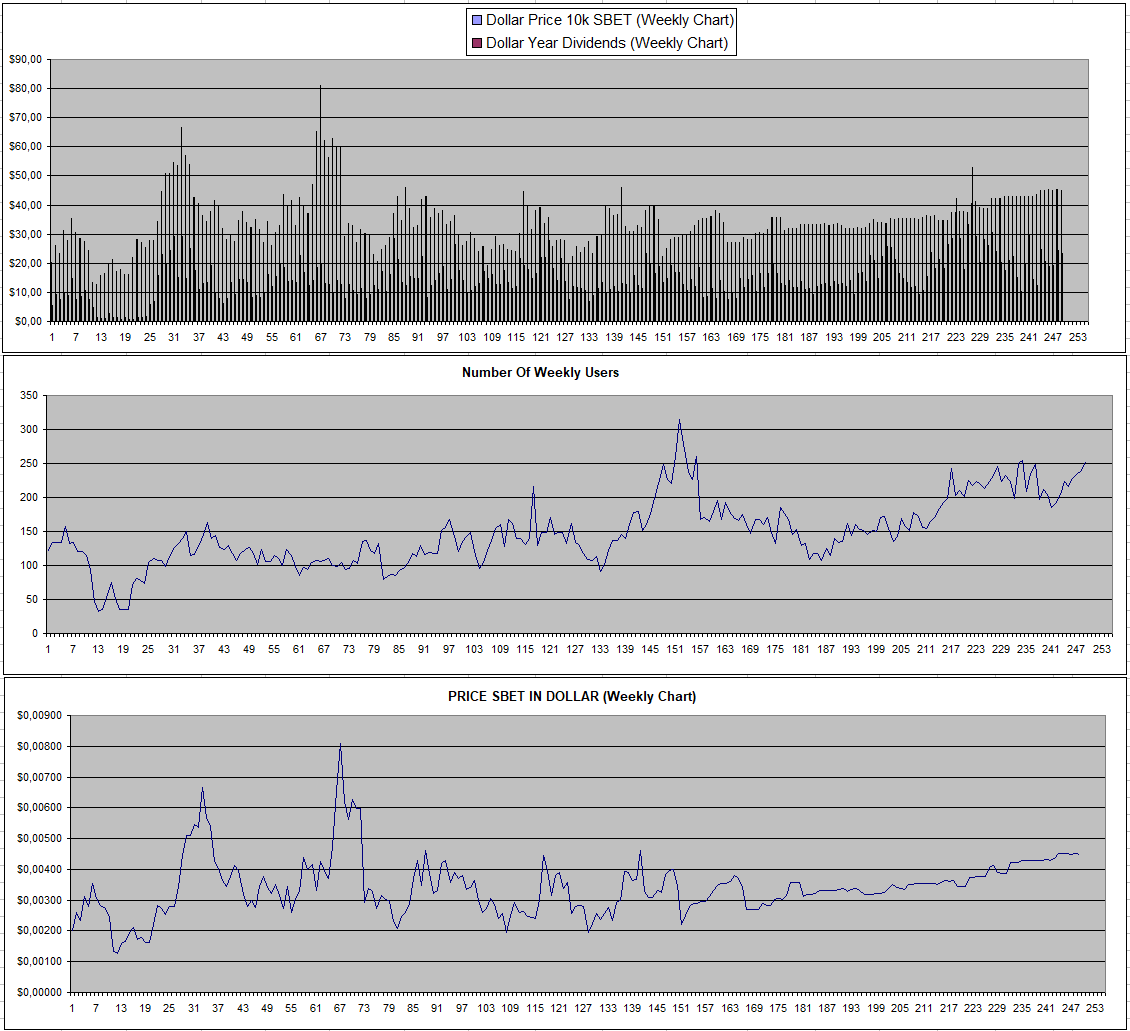

Sportbet.one (SBET)

It was another ok week for SBET with a slightly lower payout compared to last week but still above 50% APY which really adds up. If I would just compound everything each month or so it would be something that goes quite exponential but I'm invested enough to just always use the money I earn either to do some everyday expenses or diversify into other crypto.

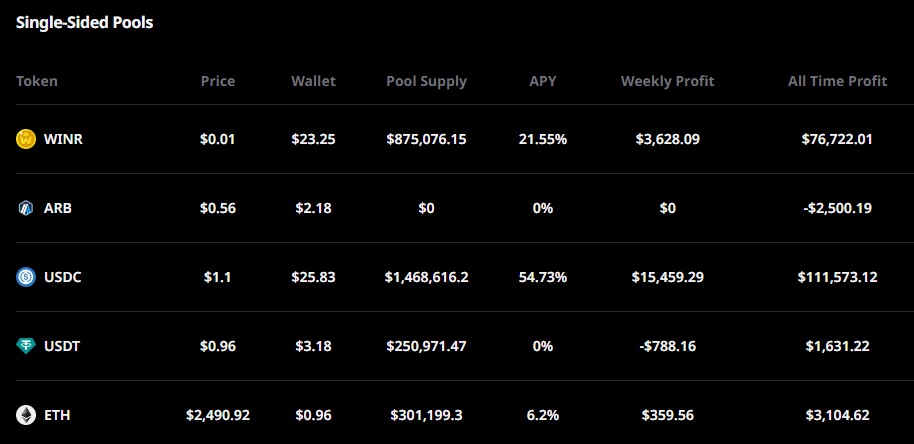

I pulled the trigger on completing a 100K WINR stake buying 25k extra paying 671$ for that which mainly came from other dividends. I kind of like the WINR chain and how dividends can be claimed there while the APY looks ok even though a lot more WINR is about to get staked so current numbers are no reference. I am thinking of possibly buying some more but will need to dig a bit deeper before that an I also haven't yet found the time to fully put all the data in my excel tracking sheet as it's a lot and WINR remains a very confusing and complicated platform.

So far for having 25k WINR staked for 3 weeks, these have been the dividends which added up to 55,4$ but I do anticipate it only getting to a fraction of this in the coming months as more of the WINr and vWINR from arbitrum gets briged over.

As for how far the activity goes on WINR, right now it looks like mainly some bots are running 0.01$ bets just to show some activity. In total on the WINR chain there was 733k volume in bets.

I do ain or next week to get the tracking set up properly to give me more info on if it's worth investing more. Last week I received 13.67$ in earnings from the 25k and next week I should have double the stake. I do aim to sell the earnings and buy more WINR with it to play the compounding interest game.

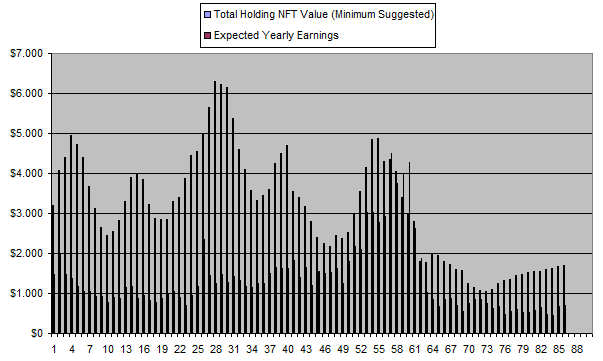

Defibookie (NFTs)

I assumed there would have been a revenue announcement by now but it hasn't come yet. So I'm still playing the waiting game for DefiBookie.

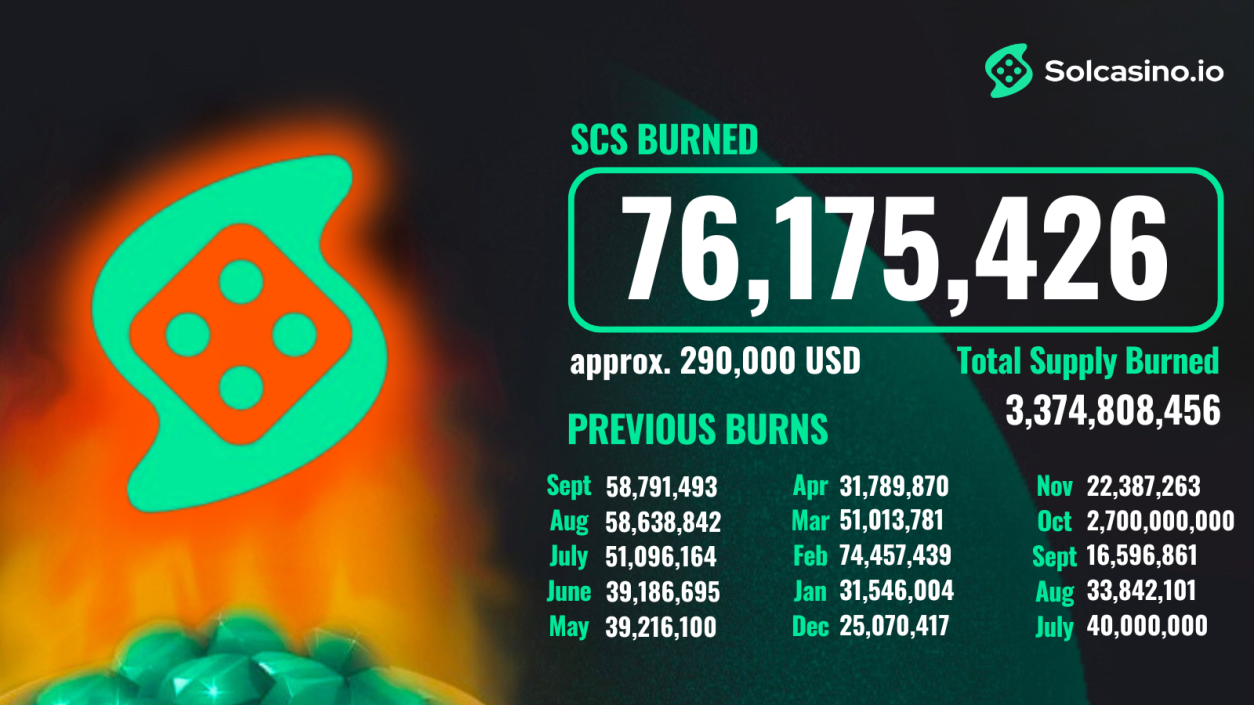

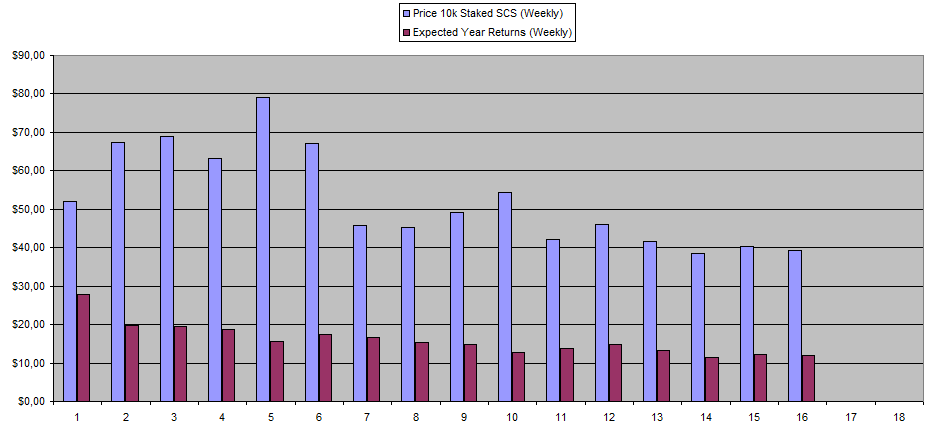

Solcasino.io (SCS)

There was another SCS burn with 290k which was increased compared to last month from 58M SCS to 76M SCS. However, the dividends haven't gone up while more SCS is released to NFT holders and staked. It would be nice if they also kept stats on the USDC Pool which is what matters most.

I'm not really tempted to buy more now even though I also don't see it as a bad deal.

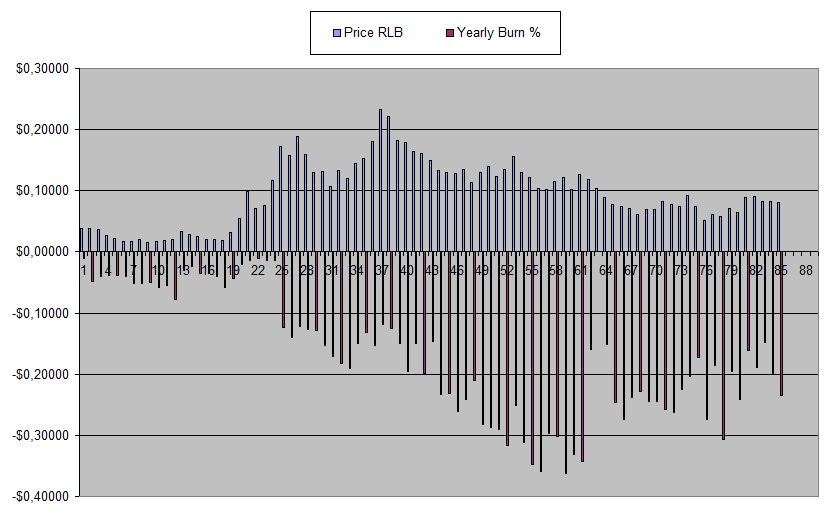

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

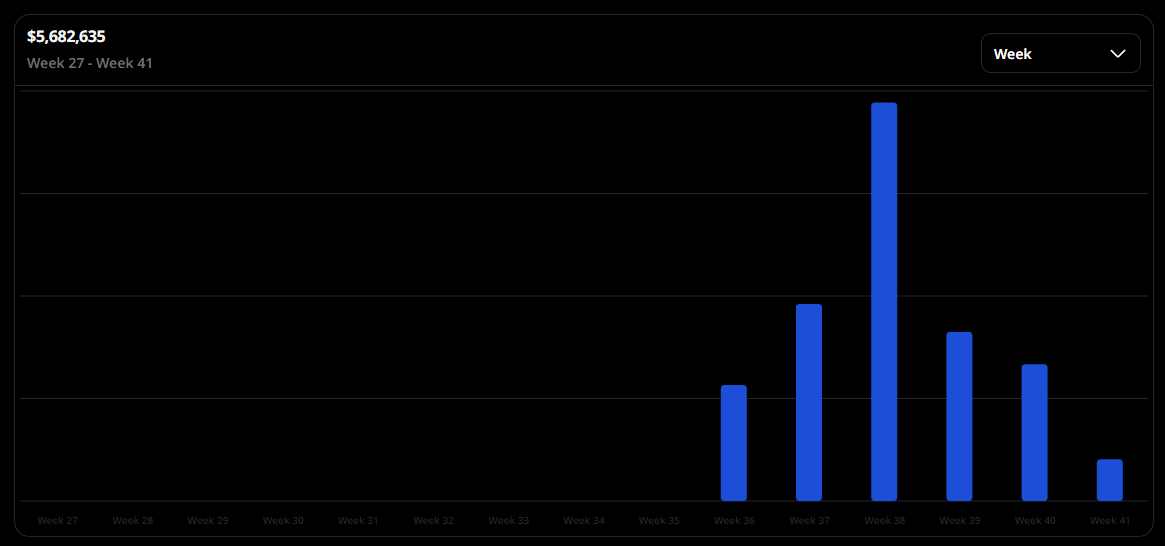

There was increased revenue again for Rollbit which was nice to see. From what I hears however, there is 1 big seller who isn't done selling yet which suppresses the price.

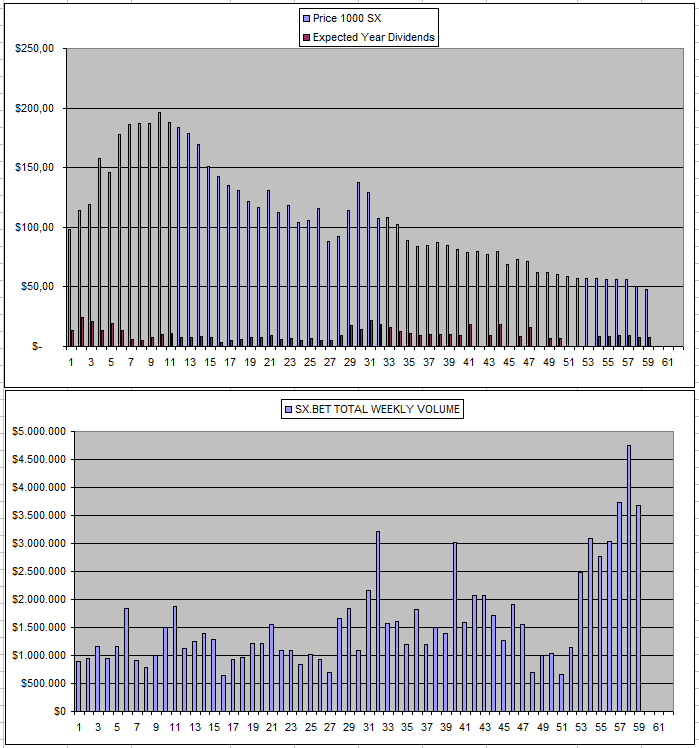

Sx.Bet (SX)

It also looks like the statistics were changed from 'winnings' to 'Volume' as that gives a more brighter view. The price continues to go down however as fees are turned off in boost adoption while SX is getting inflated.

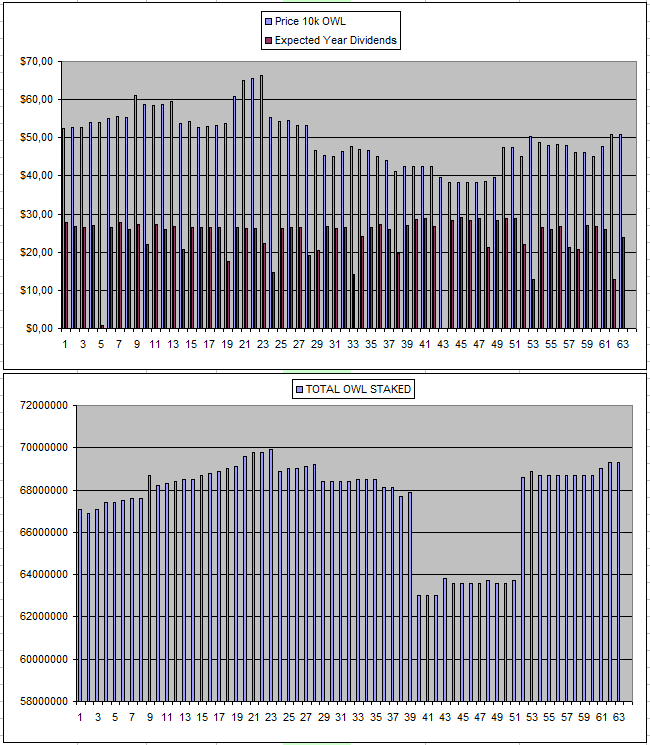

Owl.Games (OWL)

I was unable to get the price of OWL as the liquidity pool seemed to be offline. I however did manage to do another withdraw even though it sucked to have to pay 5$ fees for it. I will see if I can ask about the liquidity pool without getting banned from the telegram as I did get banned in discord after asking why MEXC got delisted. All these things continue to make me very distrustful about Owldao even though the dividends are nice and continue to come in reliably.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

| 30/07/2024 | 600k | 3179$ | 2673$ | 14.85$ | 1367.84$ | 43.03% | +861$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 13/08/2024 | 600k | 3179$ | 2544$ | 29.92$ | 1428.42$ | 44.93% | +793$ |

| 20/08/2024 | 600k | 3179$ | 2551$ | 30.78$ | 1459.20$ | 45.9% | +831$ |

| 27/08/2024 | 600k | 3179$ | 2546$ | 24.58$ | 1483.78$ | 46.7% | +850$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 10/09/2024 | 600k | 3179$ | 2451$ | 31.28$ | 1538.99$ | 48.41% | +811$ |

| 16/09/2024 | 600k | 3179$ | 2388$ | 30.83$ | 1569.82$ | 49.38% | +778$ |

| 24/09/2024 | 600k | 3179$ | 2531$ | 30.00$ | 1599.82$ | 50.32% | +952$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 08/10/2024 | 600k | 3179$ | 2696$ | 27.38$ | 1641.97$ | 51.65% | +1159$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

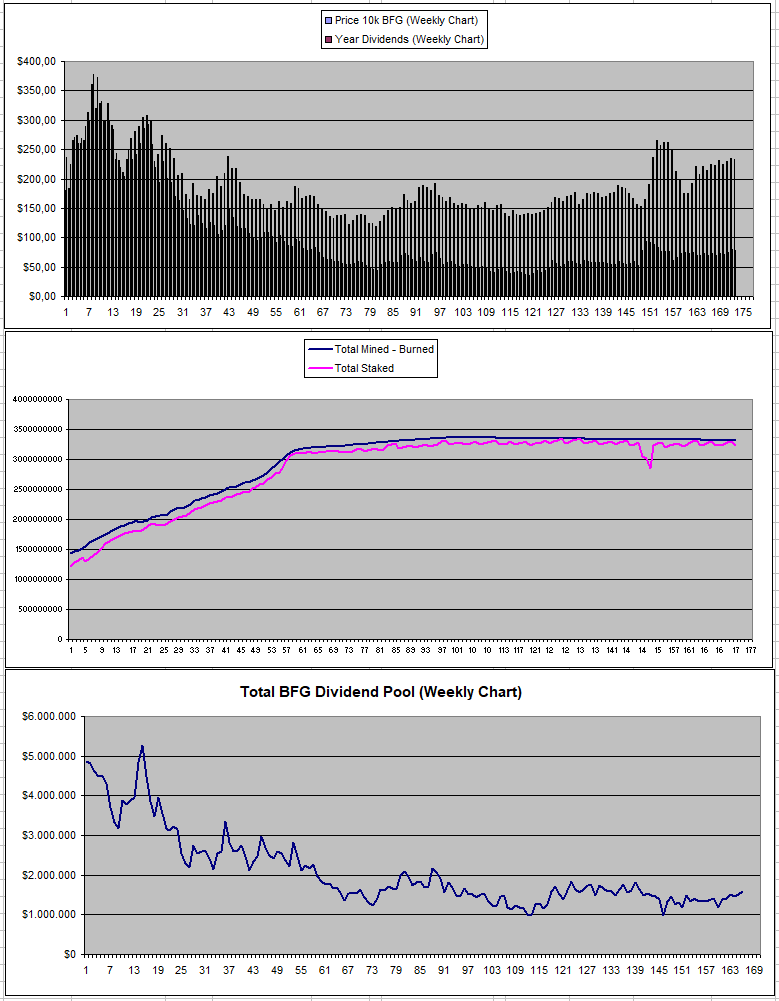

Betfury.io (BFG)

It looks like the dividends pool is slightly going up while the staked BFG which takes from the dividends went down by 1.86%.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +52% APY |

| Betfury.io (BFG) | +33% APY |

| Rollbit.com (NFTs) | +41% APY* |

| Owl.Games (OWL) | +47% APY |

| Sx.Bet (SX) | +15% APY |

| WINR Protocol (WINR) | +109% APY |

| Solcasino (SCS) | +30% APY |

| VBookieSports (NFTs) | Soon |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

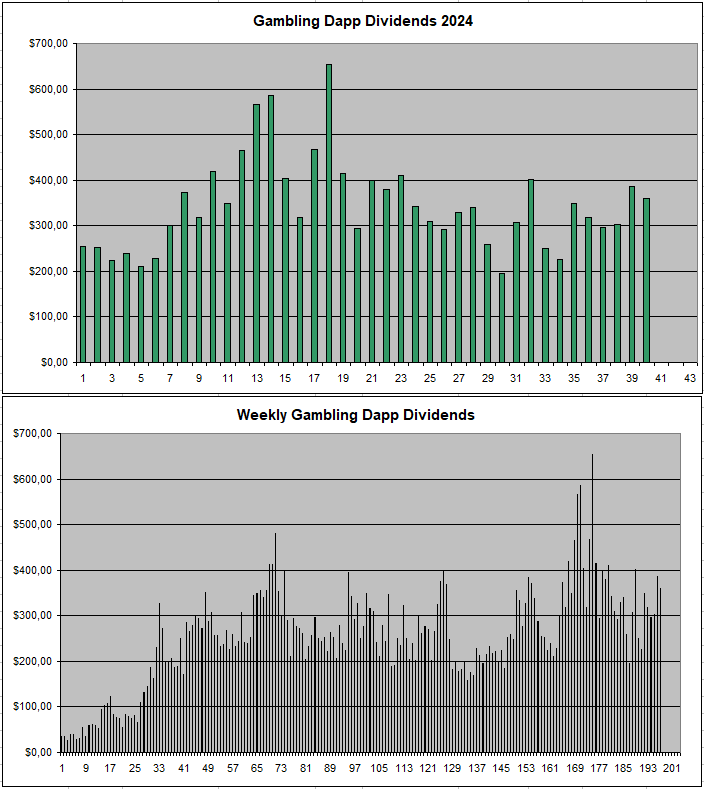

Personal Gambling Dapp Portfolio

It were 360$ of passive dividend earnings that I could claim last week for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 26 Defibookie NFTs | 600k OWL | 26.4k SX | 75k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha

Congratulations @costanza! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 9750 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: