I skipped last weeks report as I both lacked the time and not too much news happened.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

When logging into my rollbit account on Monday while doing my weekly roundup of all projects that I'm invested it, I noticed that my Rollbot NFTs got unstaked and I just assume it's just the next measure in the KYC requirements. A while back I was unable to stake my Sportsbot without doing the KYC so I had to sell it as I'm using a VPN to access the site. The 2 Rollbot NFTs I had were staked and just stayed staked generating earnings until now it seems. I'l not trying to sell them at a reasonable price. I once paid 1364$ for them before Rollbit and RLB really took off and not put them for sale for 843$ & 1260$ which ranks them 6th and 8th on the site for NFTs for sale that offer the best deal. I might lower the price a bit more just to have a bigger chance to get them sold.

So from here on on, I will no longer be able to give updates on the actual returns they offer which is something which nowhere really can be found on the internet for as far as I know similar to most of the other projects. However, I will continue tracking the RLB coin and the actual burn. I also might convert part of the money from the NFTs sales (If I can get them sold) to buy RLB at current prices. It's one of those coins that simply offers a good risk-reward given the tokenomics where a ton of coins get burned weekly.

The main risk is that rollbit is just straight making up numbers and are just selling part of their own coins to buy them back and burn. However, the fact that they are now sponsoring multiple big teams while the KYC requirements also indicate regulatory comply.

The price of RLB has been in a long downtrend after the explosion up. At the same time since I first invested in this project around 90 weeks ago, the supply went from 3,3 Billion to now 2,4 billion meaning that 27% of it got burned! The holdings in the biggest wallet have gone from 1.87 Billion to 1.15 Billion so I assume that rollbit themselves are selling some possibly to fund the sponsorships and such. It all remains a project where a lot of questions arise which is likely the reason that holds many to invest heavily into it.

The price of WINR over the past 9 days went up from 0.022$ to 0.035$ now seeing a big +60% increase. It now also is well above my average accumulation price of 0.028$. I'm glad I managed to get 100k but at the same time I feel I'm still underexposed to it (which is always the case after something went up).

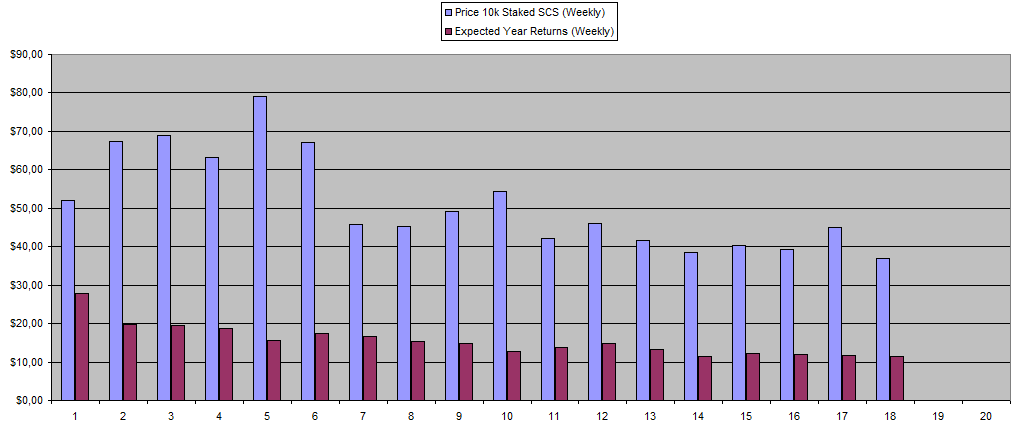

I guess the main reason why the price went up is because the overall betting volume on the winr chain has increased and it looks to continue this trend. From what I have seen now, dividends are released weekly on Thursday so it will be interesting to see if they actually increased tomorrow. In Week 41 on the WINR Chain having 50k staked , they equaled 20.08$ while week 42 only showed 11,08$.

It also looked like the BASE chain is being integrated and BRETT can now be used to gamble on just.bet and it also means that brett can be deposited and staked in a single sided liquidity pool to earn some real yield on it which is pretty big. I actually will try out putting some brett in the liquidity pool to potentially ramp up my earnings.

So overall, there is good progression for WINR and I'm glad that I started to keep track of this project in February overpaying for 10k WINR afterward increasing it to 100k near the bottom as things looked to head in the right direction. I'll see if I can find more time to actually test things out more and properly move my tracking from abritrum to the winr chain.

These are the earnings for having a 50k WINR stakd for 180 days last week spread over 4 different takes. I still have 50k vWINR on the arbitrum chain which was supposed to be migrated automatically but there seems to be a big delay on that.

Sportbet.one (SBET)

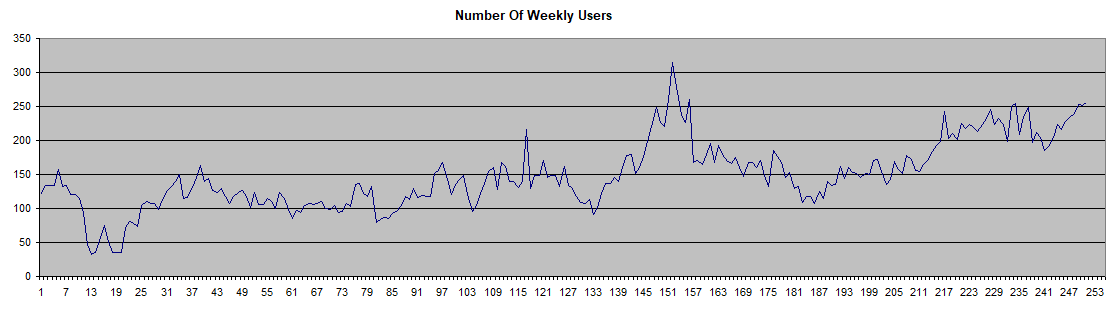

more of the same for Sportbet which continues to generate very solid earnings week after week

The numbers of weekly users also continues to be in an uptrend hopefully toward a new high.

vBookie (NFTs)

Froim what I can see there haven't been any earling yet for the vbookie / Defibookie NFTs but they continue to trade for an ok price.

Solcasino.io (SCS)

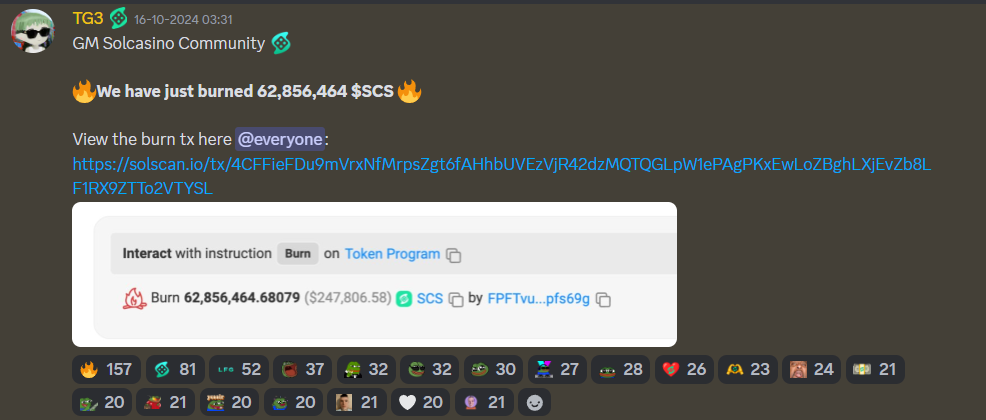

SCS is starting to get into a price range around 0.003$ where I'm tempted to pick some up as it does look like they want to support the price.

There was a buyback and burn recently after they made money with WIF which added up to 62.8 Million SCS burned good for 250k Dollars. This was around 2% of the total supply. At the same time, more SCS is being earned by NFT stakers and more SCS is staked in the USDC Pool to the point where that saw and increase of +18%. This while the total SCS staked to get part of the dividends now is only around 8%. So the only real way for SCS to go up in my view is for the USDC pool to increase a lot while that is the thing that is never mentioned anywhere.

Some more good news as they now also listed $FWOG, $GIGA, $GOAT, $MUMU, $SCF and $CHONKY as coins that people can leverage trade bet at least that is what they claim as I don't see them on the website yet.

It's a tricky thing as I could make a case for both buying or selling SCS at current price range

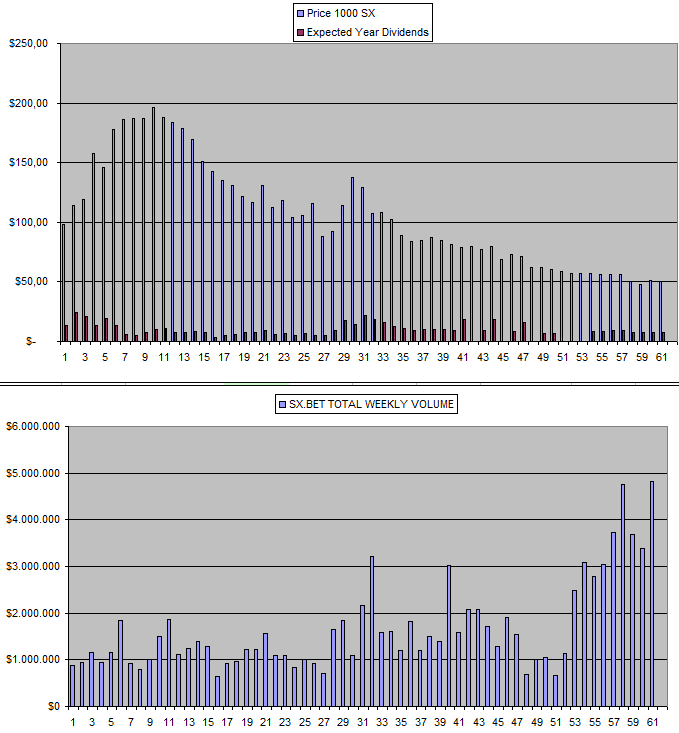

Sx.Bet (SX)

Volume was up again for sx but that doesn't really mean a lot for the token since it has no use case aside from earning more sx which comes from inflation right now. I guess patience is key and as long as more people start using the platform it's a good thing. The difficulty with kick-starting an exchange even at 0% fees is that there needs to be volume to attract users but at the same time users are needed to bring that volume.

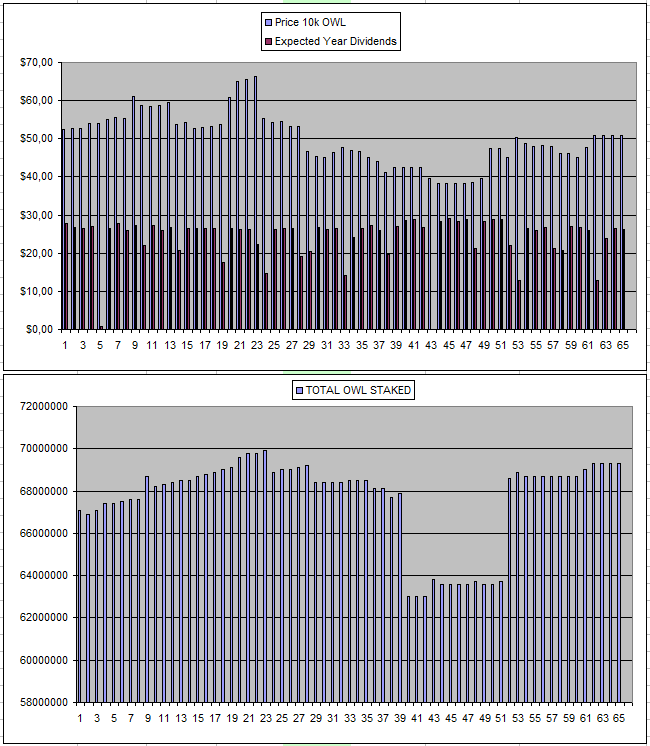

Owl.Games (OWL)

I thought the liquidity pool for OWL was down but it's actually still there I think under a new contract so all is good even though I keep getting way too many signs that the devs behind this project are not to be trusted. At the same time, dividends keep coming weekly and I never had an issue withdrawing funds. So I continue to just earn back what I put in week after week as a good pace.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

| 30/07/2024 | 600k | 3179$ | 2673$ | 14.85$ | 1367.84$ | 43.03% | +861$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 13/08/2024 | 600k | 3179$ | 2544$ | 29.92$ | 1428.42$ | 44.93% | +793$ |

| 20/08/2024 | 600k | 3179$ | 2551$ | 30.78$ | 1459.20$ | 45.9% | +831$ |

| 27/08/2024 | 600k | 3179$ | 2546$ | 24.58$ | 1483.78$ | 46.7% | +850$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 10/09/2024 | 600k | 3179$ | 2451$ | 31.28$ | 1538.99$ | 48.41% | +811$ |

| 16/09/2024 | 600k | 3179$ | 2388$ | 30.83$ | 1569.82$ | 49.38% | +778$ |

| 24/09/2024 | 600k | 3179$ | 2531$ | 30.00$ | 1599.82$ | 50.32% | +952$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 08/10/2024 | 600k | 3179$ | 2696$ | 27.38$ | 1641.97$ | 51.65% | +1159$ |

| 15/10/2024 | 600k | 3179$ | 2696$ | 30.54$ | 1672.51$ | 52.60% | +1189$ |

| 22/10/2024 | 600k | 3179$ | 2696$ | 30.13$ | 1702.64$ | 53.55% | +1219$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

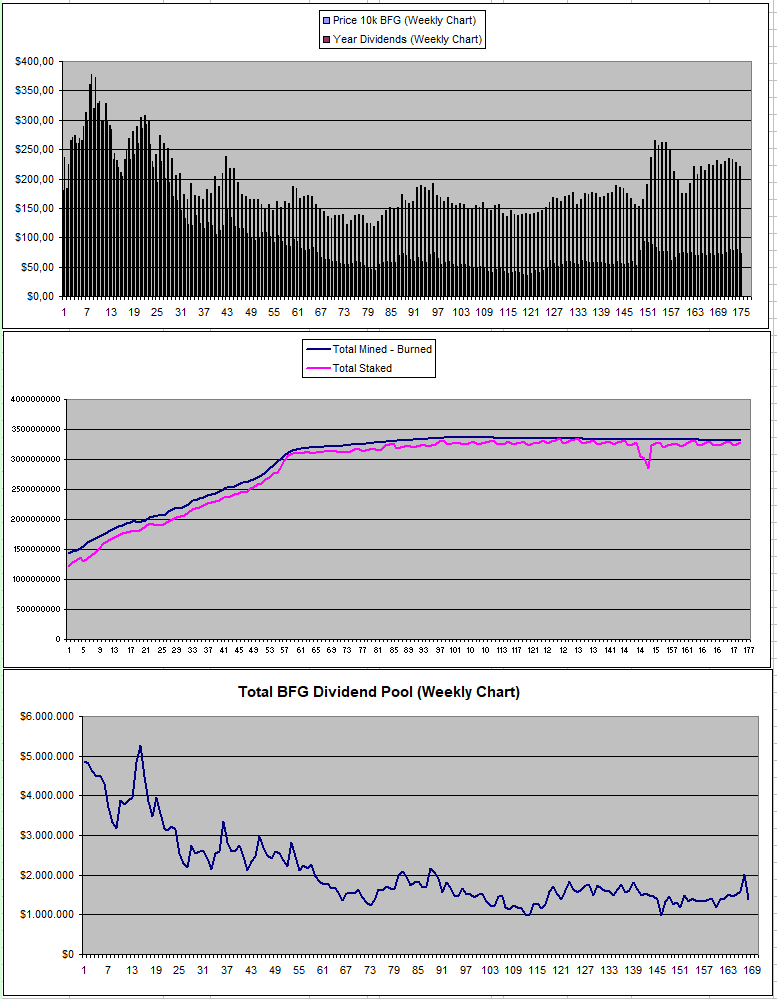

Betfury.io (BFG)

There was a sharp decline in the dividend pool at BFG from 2Million to just 1.4 Million so I expect a drop in earnings for next week.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +41% APY |

| Betfury.io (BFG) | +33% APY |

| Owl.Games (OWL) | +51% APY |

| Sx.Bet (SX) | +15% APY |

| WINR Protocol (WINR) | +36% APY |

| Solcasino (SCS) | +31% APY |

| VBookieSports (NFTs) | Soon |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

The last 2 weeks were good for 364$ and 309$ in passive earnings for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 26 Defibookie NFTs | 600k OWL | 26.4k SX | 75k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using InLeo Alpha