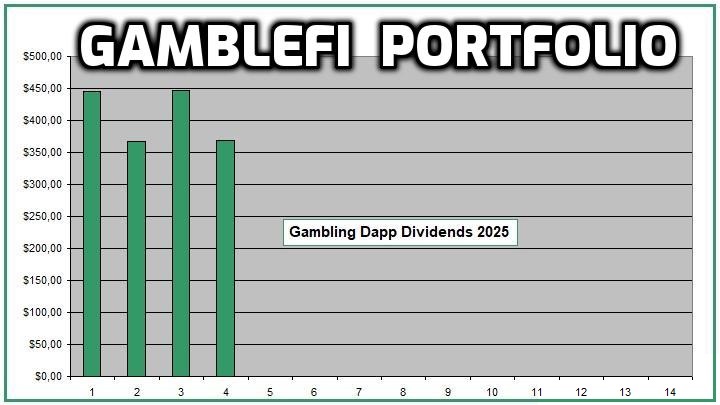

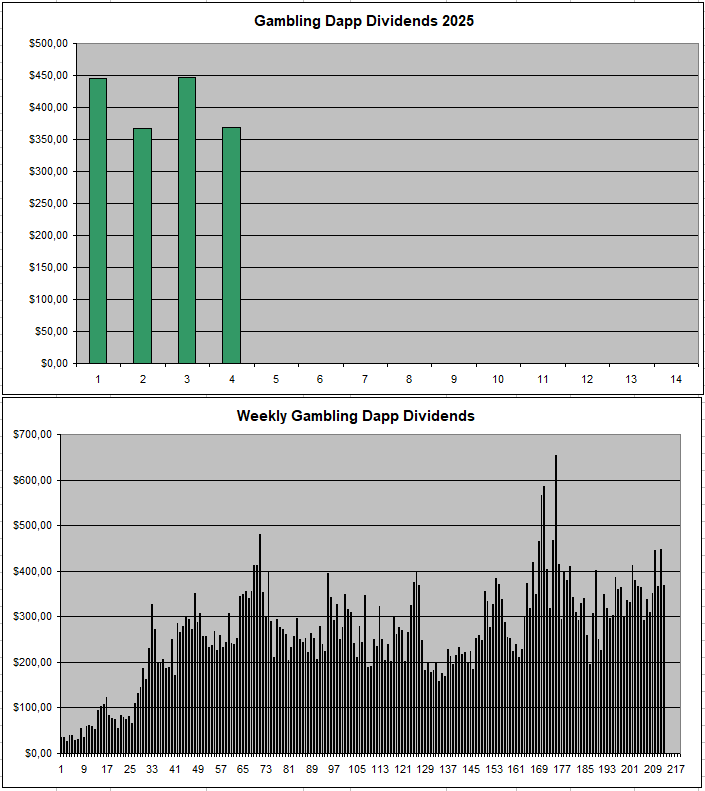

While the crypto market continues to be crazy volatile with a setup where you more or less need to get lucky to pick the right coin, GambleFi coins for me remain a real money-generating force that has been reliable for years now. It was another week where I managed to claim 350$+ in passive earnings just for holding and staking coins that on top come from actual revenue generated by real customers that keep coming back for more. So I'm very pleased with my bags and I continue to keep an eye out to possibly reinvest a bit more. So far this portfolio which is worth in around 50k, has generated 1629$+ in passive returns already in 2025

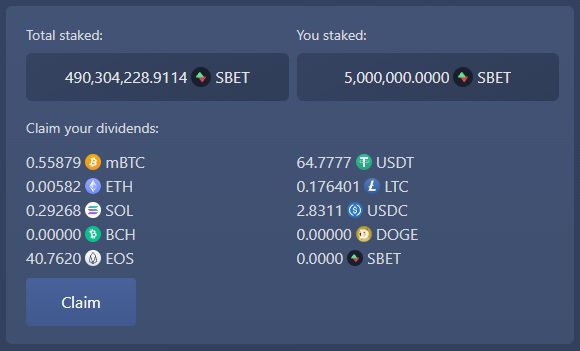

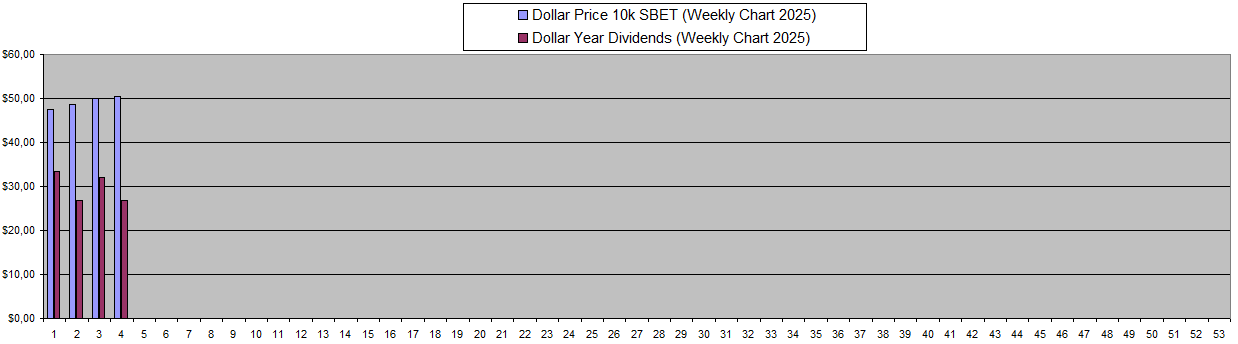

Sportbet.one (SBET)

Sportbet seems to have added some extra currencies to their list with Doge & Bitcoin Cash. Especially SOL which was added a while ago really was a nice addition bringing in quite some extra dividends. The APY still is above 50% for staking SBET

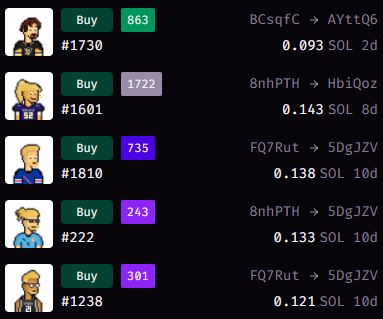

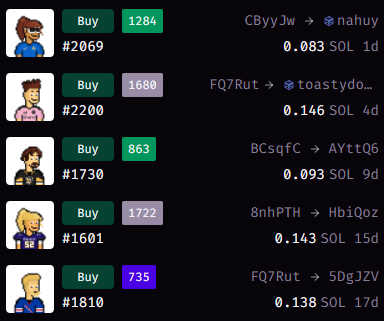

This is what having 5M SBET staked generated last week!

The number of weekly users also continue to trend above 300 and things generally look to be on track in the first 4 weeks of 2025

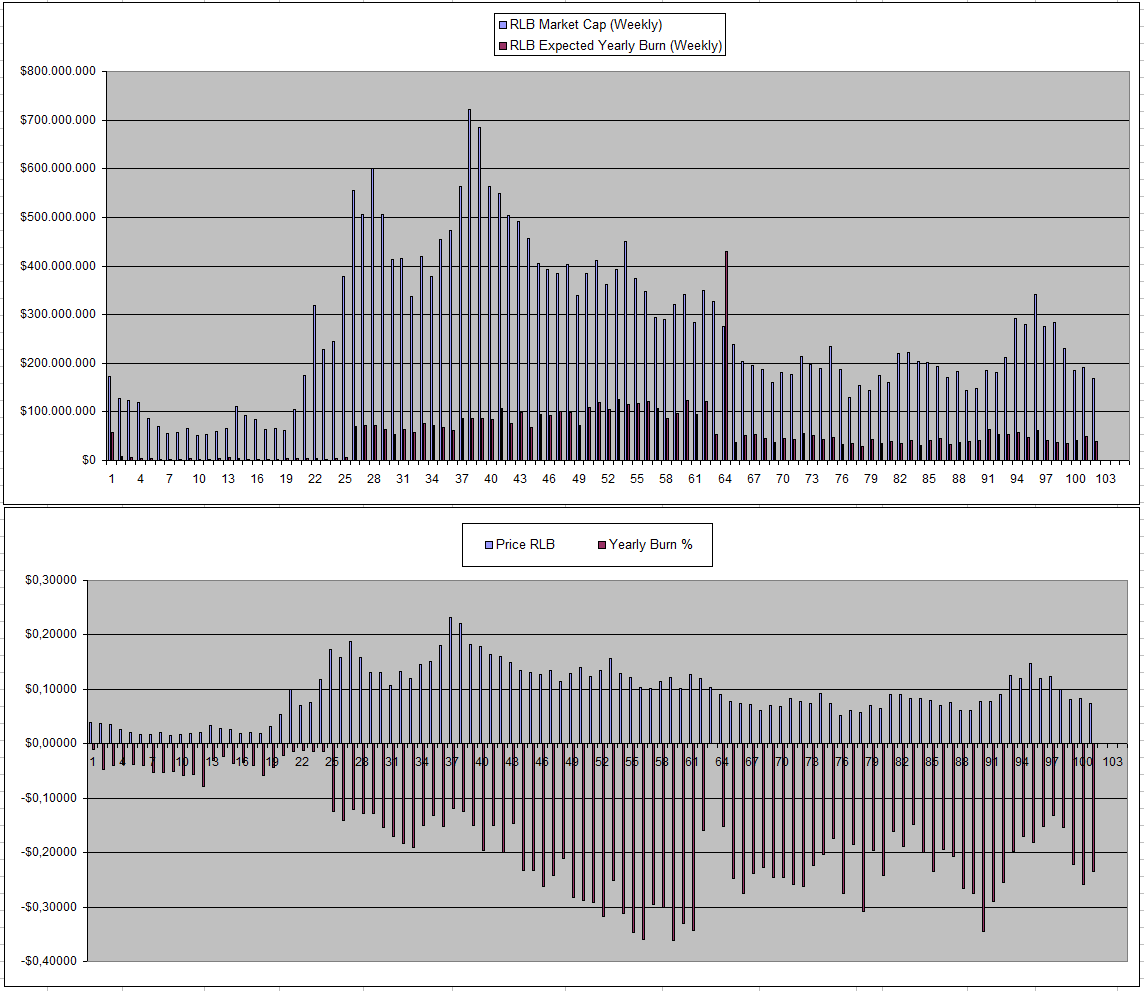

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The price of RLB very much is linked with the crypto market so it continued to fall along with it. However, the buy back and burns provide a mechanic that it only can go so low. At the current price below 0.08$ I'm tempted to buy more as the yearly expected burn is well above 20% but at the same time I don't have the needed funds readily available. So I just continue to keep my bag and enter it in the lottery to possibly earn some extra that way.

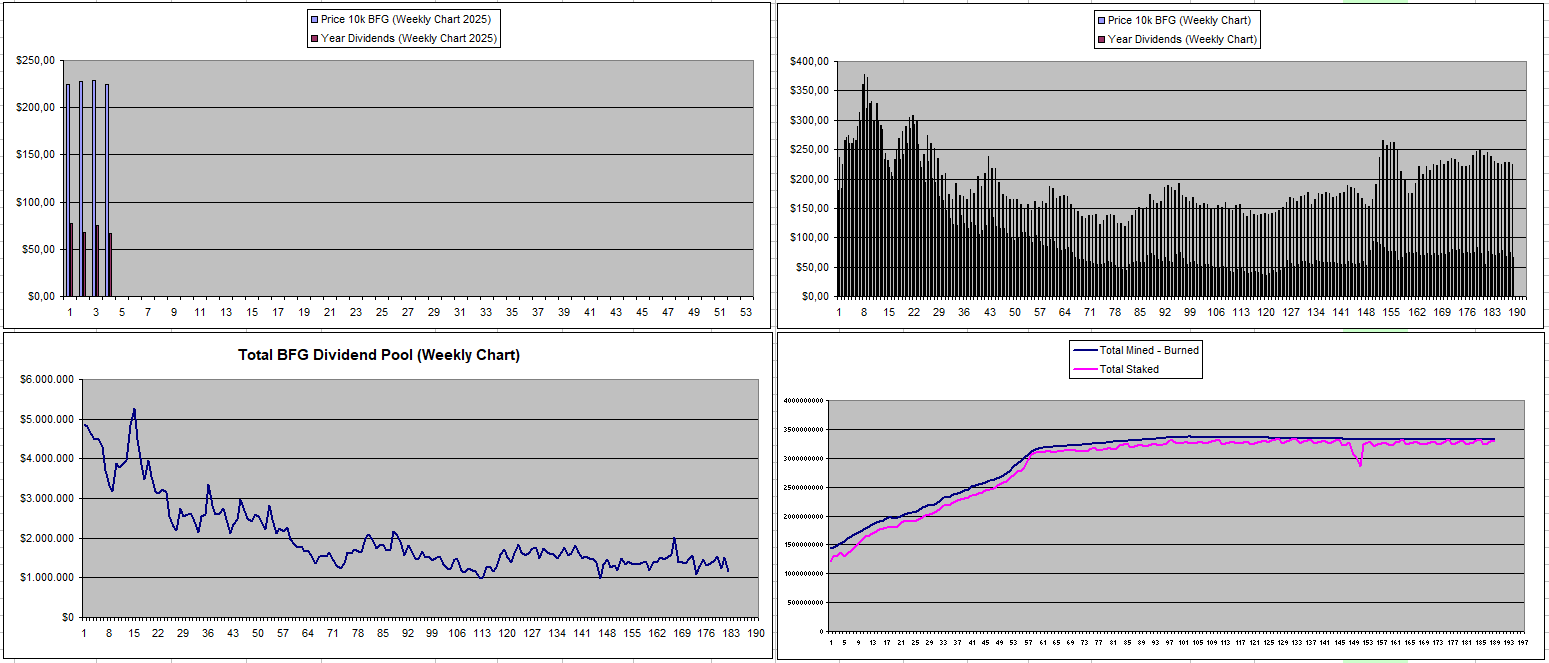

Betfury.io (BFG)

Each time things look good when it comes down to the dividend pool, it always tends to fall back again. Last week there were only ~64$ in dividends for staking 500k BFG which was a bit lower than the usual 70$+. You won't hear me complaign though as the dividends still equal around 30% APY and they are very reliable.

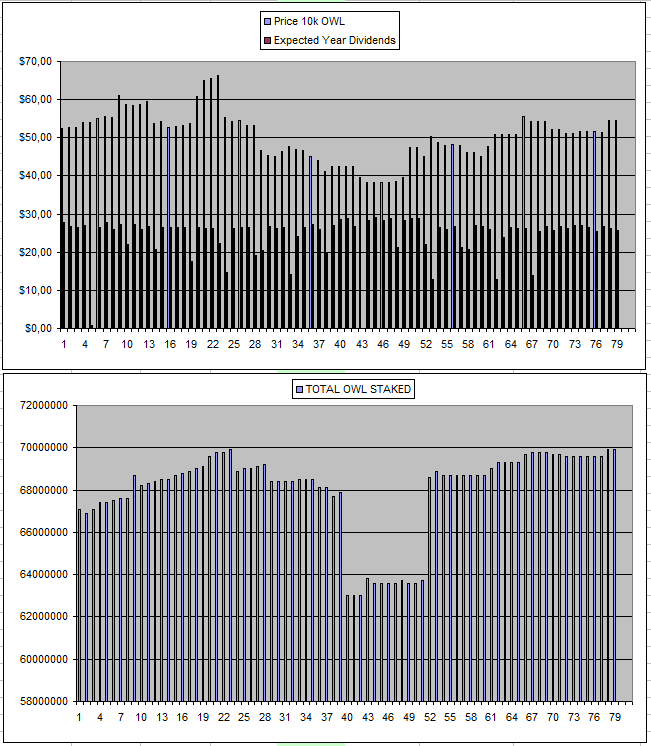

Owl.Games (OWL)

More reliability also from OWL where I managed to earn back over 2/3 of my initial investment which I'm still able to sell if I wanted to for not much less than I paid for it. Owl really has just been a long-game where you slowly but surely get good value for the risk.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

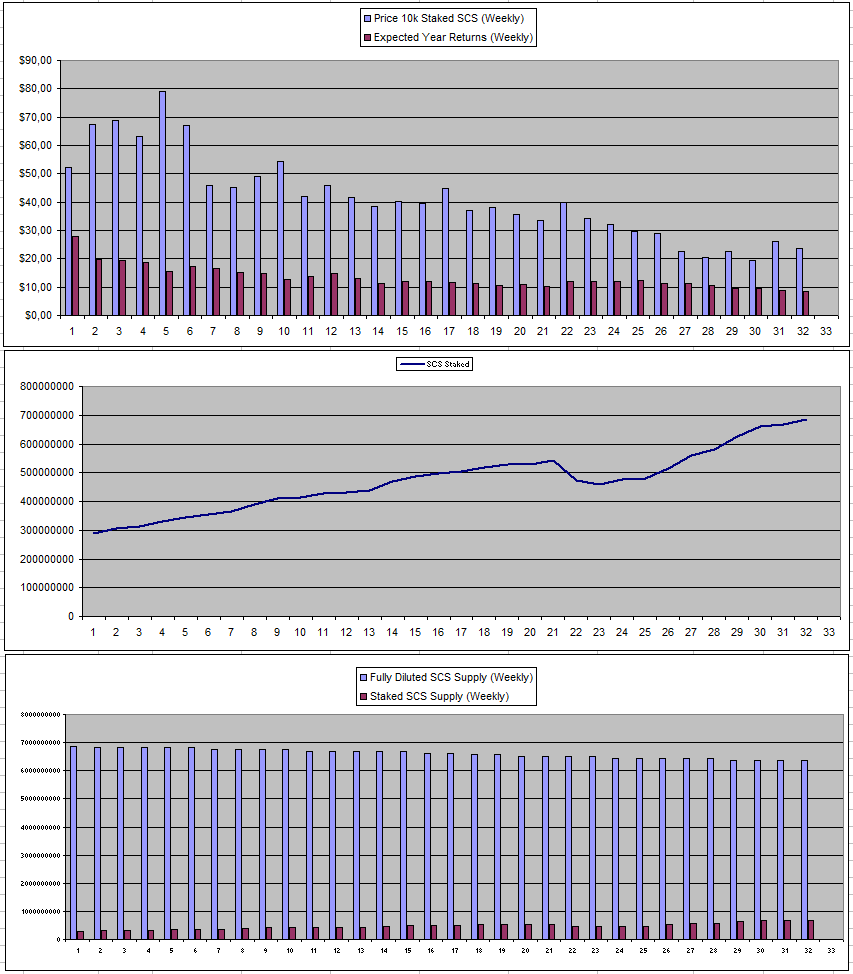

Solcasino.io (SCS)

The absolute dividends continue to go down from 10$ in the last week of 2024 to 9$ in the first 2 weeks, 8.62$ in week 3 and niw 8.1$ in week 4. This is mainly because more SCS is released to NFT stakers of which a part gets staked increasing the pressure. In the last 5 weeks the staked SCS went from 5.6 Billion to 6.8 Billion which is a 21% increase. This also directly correlates to the dividend decrease. So I'm expecting SCS to drop in value in the coming weeks again especially knowing that right now only 10.78% of the total supply is staked. If anything, more focus needs to be on theUSDC pool and making that go up if they want the price of SCS to keep it's value.

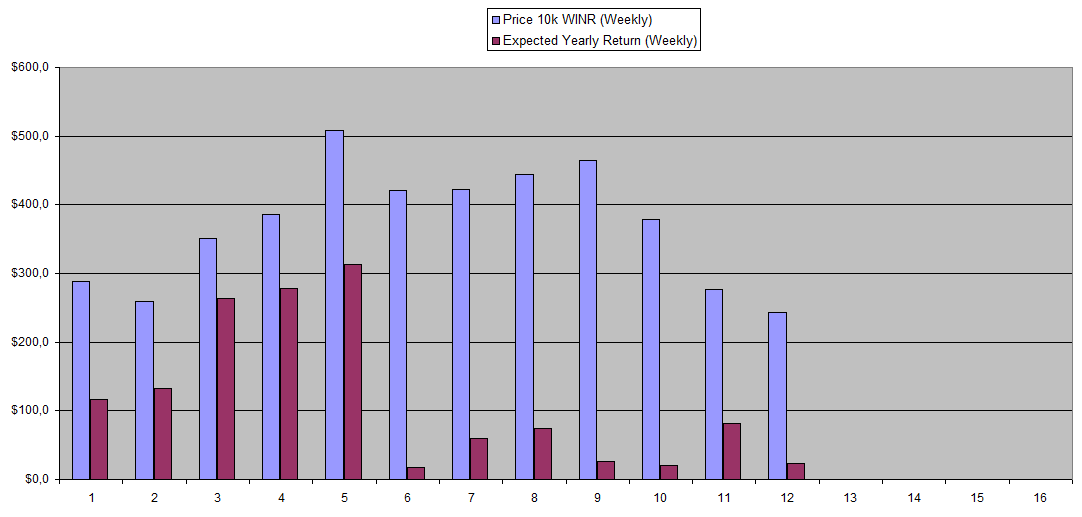

Overall volume has been down a bit for WINR and the dividends have been nowhere near what they were 8 weeks ago. At the same time, I continue to keep an eye out to possibly add 50k WINR to my bags as I do see the project having a good chance to succeed over time.

vBookie (NFTs)

Little to no activity for vbookie and in the coming weeks there will be a next revenue report which hopefully will be favorable.

| Last Week | This Week |

|---|---|

|  |

Sx.Bet (SX)

There was a dip in volume but another reliable payout of SX inflation. It's still a waiting game now for actual use-case for the token as it's not really generating real revenue with the fees turned off.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +53% APY |

| Betfury.io (BFG) | +29% APY |

| Owl.Games (OWL) | +47% APY |

| Sx.Bet (SX) | +14% APY |

| WINR Protocol (WINR) | +10% APY |

| Solcasino (SCS) | +35% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

I received a solid 369$ in passive GambleFi Earnings last week for holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28k SX | 150k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

Play2Earn Games that I am Playing...

Posted Using INLEO

No Gamer token here on Hive? https://kryptogamers.com/?ref=bitcoinflood

That never really was on my radar and at first sight, it's also not really something I instantly like.

Any chance you have accurate numbers on the actual dividends?

!BEER