Uniswap is that the most generally used localised exchange on Ethereum, and it's shown explosive growth throughout the second quarter.

In fact, but a month past, Uniswap's mercantilism volume surpassed Coinbase professional, and Uniswap exchange processed $426 million price of transactions at intervals twenty four hours.

Throughout 2019, the localised finance (DeFi) market was comparatively stagnant till the thought of liquid mining and governance tokens became additional standard.

Liquidity mining may be a method during which investors use varied DeFi protocols to supply liquidity to come up with high returns.

In most cases, the benefits come from the value of governance tokens. In addition to locking DeFi tokens, users can also lock cryptocurrencies such as Ethereum (ETH).

For example, unlike many DeFi-related tokens, Yearn.finance (YFI) is issued without any pre-mining. On the contrary, users mortgaged their encrypted assets to mine YFI in the early stage, thus realizing the decentralized distribution of YFI.

When Compound and its governance token COMP were launched, the model became well-known and more attractive. After the successful launch of COMP, there has been a surge in governance tokens in the DeFi market.

Therefore, many users want to earn up to 35000% of the revenue or buy the "next" YFI tokens, starting to buy and sell governance tokens from decentralized exchanges.

Will DeFi trading volume exceed that of centralized exchanges?

The advantage of Uniswap over major centralized exchanges is that users do not have to wait for tokens to be listed.

On Uniswap, users can increase liquidity and create their own token pairs, which allows DeFi users to trade new tokens.

The huge demand for buying and selling DeFi governance tokens makes Uniswap more popular than centralized exchanges.

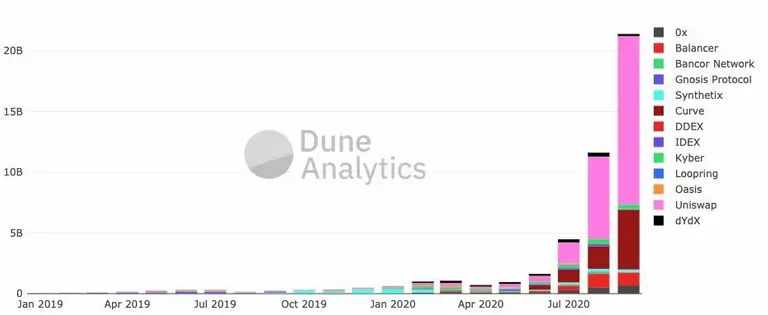

Therefore, compared with other decentralized exchanges, Uniswap showed a parabolic growth from July to September. At present, the decentralized cryptocurrency trading market processes approximately US$20 billion in transactions per month, and most of the monthly transaction volume comes from Uniswap.

In the past 12 months, the transaction volume of decentralized exchanges reached 44.617 billion U.S. dollars. With the arrival of October, the market is expected to process half of the transaction volume, which indicates the rapid growth of the DeFi field.

Uniswap's governance token may achieve long-term growth

As Cointelegraph reported, Uniswap launched its own governance token (called UNI), and Uniswap exchange adopted a very unique method to distribute tokens. Uniswap did not adopt a mortgage model, but airdropped 400 UNI to all users. At the peak of the UNI price, these tokens were worth about $3,200.

The distribution of governance tokens is critical to Uniswap's sustainable development. The official document allocates 17.6% of the total tokens to the team, but the distribution period is four years.

This distribution model ensures the stable development and maintenance of the Uniswap protocol, while also allowing the governance of the community-led protocol. The file says:

"The vault managed by the community opens up a world of unlimited possibilities. We hope to see a variety of experiments, including ecosystem donations and public product funding, both of which can promote the further growth of the Uniswap ecosystem."