Hey Jessinvestors

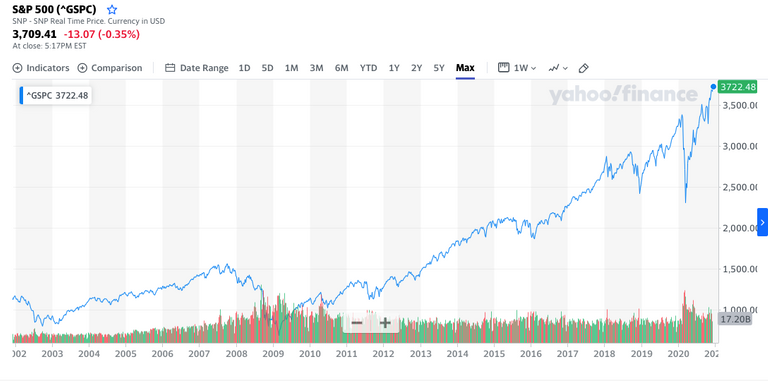

The stock market is at all-time high record valuations, and it seems to continue on a rampage, with Tesla now joining the S&P500 on Monday. There have been so many so-called winners in the last few years it just seems like investing in the stock market is a no brainer.

Looking at the data

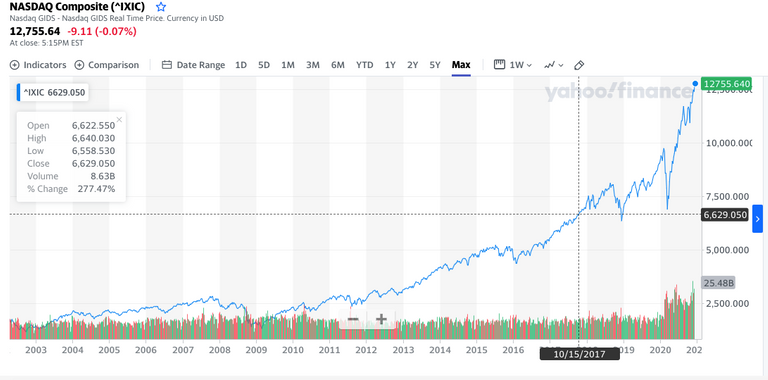

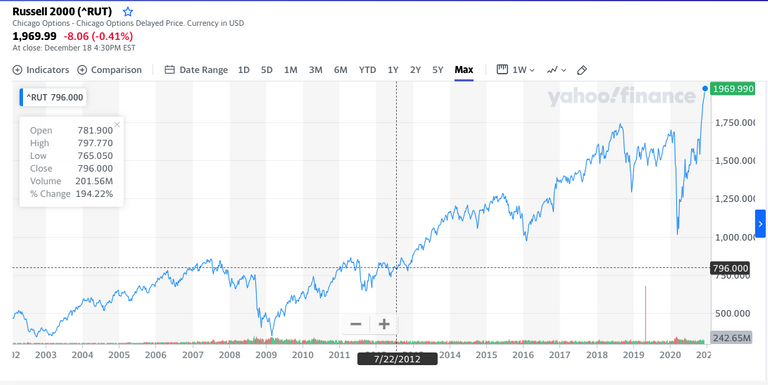

If we pull the data for markets like the S&P500, Dow Jones, Russell 2000 and the Nasdaq if all you did was put your money in either 20 years ago, or dollar cost averaged into the market over the last 20 years you would have made a killing.

All these markets have been on one trend since the early 2000s, a 45-degree angle to the right. I know it's impossible to have predicted what markets would do and it's easy to look in hindsight and make assumptions, but this has to be one of the longest bull markets in stock market history.

Dow Jones

Nasdaq

Russell 2000

S&P 500

Buy the dip

As markets are at all-time highs and have continued to surge over the last 20 years, the strategy of buying the dip has been insanely profitable for anyone who was consistent and spent time in the market. If you can't lose, and when others take profits, you can buy the dip only to have it turn into profit, the bullish sentiment tends to become overwhelming.

Retail continues to get sucked in

We've even seen the influx of retail flowing in as the stock market seems like it simply cannot fail. Even now during the pandemic, when people were stuck at home, those who used to bet on sports, those with stimulus cheques, those with extra cash, those looking to earn additional streams of income have all begun to play in the stock market.

Apps like Robinhood, eToro, Plus500 or more have made to easy for people to download an app on their phones and then load up some cash and begin to play in the stock market.

This extra cash, incentives and lower barrier to entry along with a trend that hasn't changed in years have all mixed nicely to suck everyone with a few bucks to spare into the stock market.

I am no stock trader; I don't own any momentum stocks, I own local value stocks and have held them for years for their dividends, this isn't really my game. So when I see people who have no business being active investors, come to me and ask about stocks, I tend to get a little worried.

Suprsessd volatility always returns

As money printing continues to suppress volatility and push markets higher, all it does is suck more investors into the stock market, thinking they can buy and sell higher. While others are thinking they're not ready to sell as they keep making money by staying in the market.

The more buyers become holders, that means the pool of sellers becomes less and less. So when the market becomes a net seller to take profits, there won't be enough buying demand to take it over driving prices lower.

If central banks don't step in with freshly printed money and devalue the dollar to be the buyer of last resort a generation of active investors and to an extent, passive investors will be hurt.

Saving one by sacrificing another

If active investors are to be saved, it will come at the cost of those who are currency holders, and wage earners. Inflation will remove purchasing power from the currency and migrate it to the stock market as it has done for aggressively since 2008 until now.

We're now in a position where we either allow the stock market to correct, companies to shut down, jobs to be lost, and investors to be cleaned out or let the currency take the burnt of it, so investors holding cash gets hurt.

The irony of it all is that even if you are rich in nominal terms from stock market gains, it's still measured and paid out in a devalued/devaluing currency.

Either way, something has got to give!

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, comment "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

Posted Using LeoFinance Beta

I literally cashed out 15K EU of shares on Thursday last week, my main fund is up 500% since its inception in 2010 - I've sold quite a lot on the way up, and with hindsight I'd have been better of waiting and selling the whole lot now, but hey, I took some profits at 300% up, then 400% up, I mean it seemed silly not too.

But now I think we're really in government subsidised fantasy valuation land for those stocks. Ultimately it's demand that drives value, and that's going to dry up at some point very soon.

I needed that money for a land purchase anyway, TBH that's why I invested in stocks anyway 10 years ago, I've always had this money earmarked for land, but I feel I've got pretty lucky needing to sell right now.

It looks set to burst, massively. I mean let's face it, this is a pandemic related financial crisis, but stocks haven't been affected yet, that's got to give at some point!

Posted Using LeoFinance Beta

I think you made a good call especially taking a phased exit in these crazy markets, 10 years in this stock market even with a little capital would have done really well

I agree with you regarding it being government subsidies valuations lol but we got to keep the party going, if we take away the punch bowl now we might start to sober up and see the truth, gotta keep us all drunk a while longer

I can say with conviction it will burst, just how it will burst and when I have no clue. I hope your land investment also works out, I am sure it will

Posted Using LeoFinance Beta

I love to invest in SIP (systematic Investment plans). Preffer to invet in mutual funds instead of single stock.

SIP gives a good returen over long term.

I've also have a few index funds, as a millennial we like to invest in passive funds, but I don't like to make it too much of my overall portfolio

Retirees and pension funds are being sacrificed as savings earn no interest. So they have to rely on the Equity markets and riskier instruments to make up the shortfall. A lot of Pensions are not adequately funded, my Municipal pension recently announced major changes to their entire financial model last year. I'm not retiring for a while but I'd be worried if I am pensioner these days.

Posted Using LeoFinance Beta

State pensions surly they are not going to be saved, either they're getting cut or some nice financial trickery will be done to give you the promised figures without the promised purchasing power.

I have a private pension and its performed shockingly bad, I still obviously have to contribute to it, but I doubt it will be worth anything when it comes time for me retire so I have to figure something else out

Posted Using LeoFinance Beta

Be liquid my friends ! Stock market will eventually get corrected. That day you want to emerge from the blood bath with your cash to buy solid companies stock at a discount.

Holding crypto being ready to move back to stock might be an idea. Good luck to all !

I wonder how long it will take to get back to levels where growth stocks are actually the main factor running the stock market and we've weeded out all the fraud and zombie companies.

I have some cash and I would happily sell some crypto once the markets correct and crypto returns have been taken down and the market matures

Posted Using LeoFinance Beta

Bookmark to read again, theres much to "unpack here".

Thanks

Lol looking forward to your response when you eventually have the time, feel free to shoot holes in my arguments :)

Posted Using LeoFinance Beta

Investing is something that I still want to do (in a broader way), but living here in Brazil this is getting more and more difficult.

Posted Using LeoFinance Beta

I was actually looking at some Brazilian lumber company stocks, they look good, PE ratios are solid and I think they will continue to do well, not sure how that works with the chopping of trees and the environmental side but from cash flow side they are run pretty well

Everything is overheated...

Because money is made by air - and invested all over every market. House, stocks, bonds and some crypto too.

Lol 😂 i literally don’t know how to price anything anymore all I know is I can’t afford anything! At this rate air won’t be free anymore

Posted Using LeoFinance Beta

My main issue with buying the dip is determining what or when the dip actually happens.

Anyways, people are becoming a bit more financially conscious and trying to multiply their money. Judging by how everything is fucked, I really can't blame them for feeling that way. We're slowly realising that we can't depend on the government and assets like these that give one some control of the value of their lives makes life easier.

I think you're still thinking of it as if these markets run on fundamentals, the last 10 years or more have proved there is no reason to worry why or how deep the dip, just buy the dip and you'll be rewarded.

I do think people are waking up to something is wrong but most people haven't and those that are starting to wake up can't exactly explain what they are seeing and feeling, they just know something is off here.

That's why I like crypto it got a lot of smart mother fuckers together and said let's try and do something about it, and try just about any and everything to come up with solutions. Bitcoin and crypto aren't the enemies, it's just the market solution for the issues we face, if we didn't have these issues there'd be no need for BTC

I can't see things changing so I can only see a bigger reason for crypto

Posted Using LeoFinance Beta

Your enthusiasm is contagious. I'm considering selling my balls and buying Bitcoin

LOL yeah I tend to get like that I have very little optimism for other things so I guess I am putting too much of it in one basket, but the more I learn about people who make big fortunes more often than not it was 1 big trade that took ages

Definitely something has to give and probably sooner the better.

I'm with you on that, delaying the pain doesn't help the situation, the pain is coming like it or not, i'd rather take it and start to rebuild then keep the fantasy going and hurting more people

Posted Using LeoFinance Beta

I think the writing is on the wall even for the Hedge Funds and large asset managers that the market can not continue to grow at such an astronomical rate. When interest rates finally fell to zero (below zero in some areas), that forced a lot of money into equities, suddenly a huge demand drove the prices of everything to the moon. It's conceivable that there is still further to climb given our current monetary policies, but there is no doubt that as the equities market continues to balloon, so too will the likelihood that a massive correction could decimate the market. I believe that the institutional shift to Cryptocurrency has been driven by this fact. They can't park all of their gains into the market, and there aren't many other areas for them to go. The good news is, they are recognizing Cryptocurrencies as a store of value, which is exactly what we believers have been preaching for years.

Posted Using LeoFinance Beta

I think the writing is on the wall even for the Hedge Funds and large asset managers that the market can not continue to grow at such an astronomical rate. When interest rates finally fell to zero (below zero in some areas), that forced a lot of money into equities, suddenly a huge demand drove the prices of everything to the moon. It's conceivable that there is still further to climb given our current monetary policies, but there is no doubt that as the equities market continues to balloon, so too will the likelihood that a massive correction could decimate the market. I believe that the institutional shift to Cryptocurrency has been driven by this fact. They can't park all of their gains into the market, and there aren't many other areas for them to go. The good news is, they are recognizing Cryptocurrencies as a store of value, which is exactly what we believers have been preaching for years.

Posted Using LeoFinance Beta