Busy options expiry time with a series of LEAPS coming to expiry - sold puts to the rescue for many. Some key adds in uranium and alternate energy especially

Portfolio News

In a week where S&P 500 rose 0.95% and Europe rose 2.55%, my pension portfolio rose 1.52% somewhat in the middle. Doing the heavy lifting was de Grey Mining (DEG.AX) up 3.8%, ASX uranium (only 2 down), a surprising mix of US stock (Bitcoin mining, uranium enrichment, Internet services, uranium, semiconductors and and makeup) .

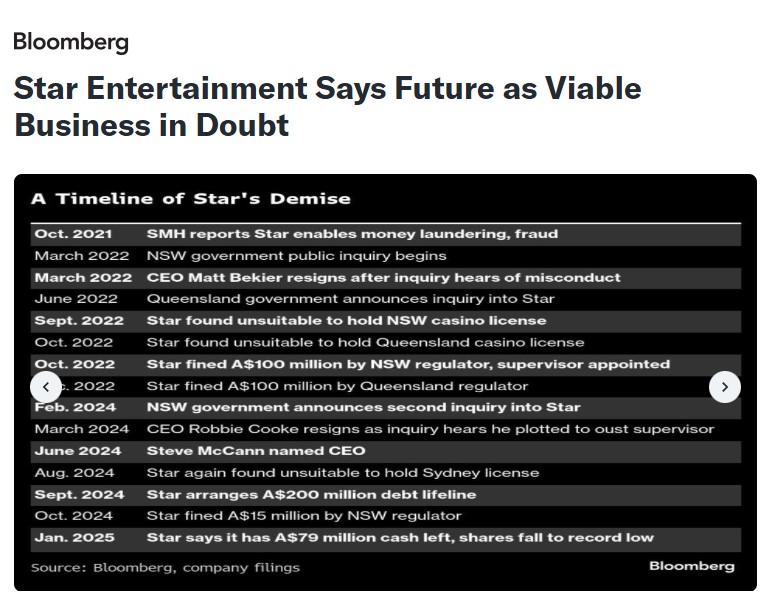

Big movers of the week were Condor Energy (CND.AX) (60%), Stroud Resources (SDR.V) (57.1%), Lanthanein Resources (LNR.AX) (50%), Heavy Minerals (HVY.AX) (29.6%), The Star Entertainment Group (SGR.AX) (27.3%), Arafura Rare Earths (ARU.AX) (26.1%), ASP Isotopes (ASPI) (25.9%), CleanSpark (CLSK) (17.6%), Duratec (DUR.AX) (15.5%), Lightning Minerals (L1M.AX) (13.5%), AdAlta (1AD.AX) (13.3%), Pantera Lithium (PFE.AX) (13.3%), Koonenberry Gold (KNB.AX) (13.3%), Tabcorp Holdings (TAH.AX) (13.3%), Terra Uranium (T92.AX) (13.2%), Paladin Energy (PDN.TO) (12.7%), Mount Gibson Iron (MGX.AX) (11.9%), Boss Energy (BOE.AX) (10.4%), St George Mining (SGQ.AX) (10.4%), GR Engineering Services (GNG.AX) (10.3%), PayPal Holdings (PYPL) (10.1%), Seven West Media (SWM.AX) (10%)

A more respectable list of 21 big movers with a bunch coming from one portfolio. What stands out is 17 of the stocks are listed on the ASX - maybe a sign of things to come. Normally the ASX only picks up after Australia signals back to work time after Australia Day (Jan 26). A few big themes represented - from the top - gold/silver mining (2 stocks), alternate energy materials (4 stocks), rare earths (2 stocks), uranium/nuclear (4 stocks). Top of the is a Peru based gas explorer on the back of drill results.

One surprise in the list of big movers given this headline - someone bought a tranche to try to prop the dying beast up. My holding is small

US markets wanted to go higher - good bank earnings to start earnings season did help - and higher oil prices.

Crypto booms

Bitcoin price continued the drift lower and then found momentum of buying ending he week 14.2% higher with a trough to peak range of 22.5%

Ethereum price dropped hard to start the week before buyers emerged ending flat on the week but with a trough to peak range of 20.3%

A few top ten coins got the bug too - Cardano (ADA) up 32% but giving two thirds away

Litecoin (LTC) popped 52% before giving half away but broken above last weeks highs

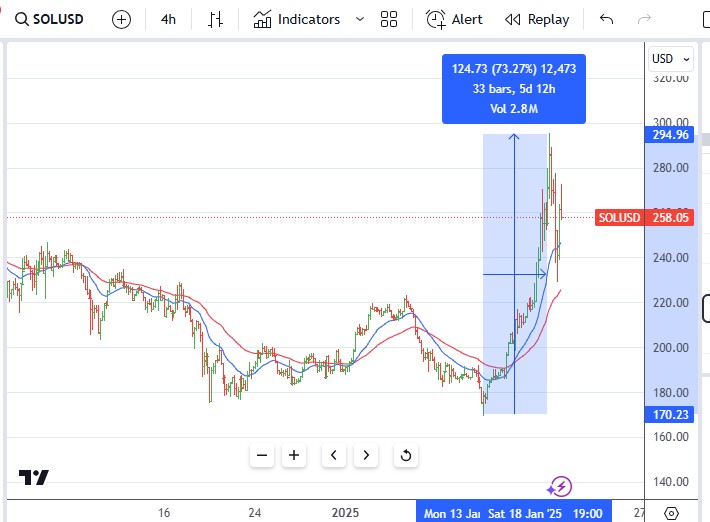

Solana (SOL) popped 73% caught in the hype of the Trump coin - then gave 40% away

Ripple (XRP) also popping 45% but recovering to hold those leve at the end of the week

Chainlink (LINK) alos popping 50% and keeping momentum. sadly none of the moves was enough to trigger exits.

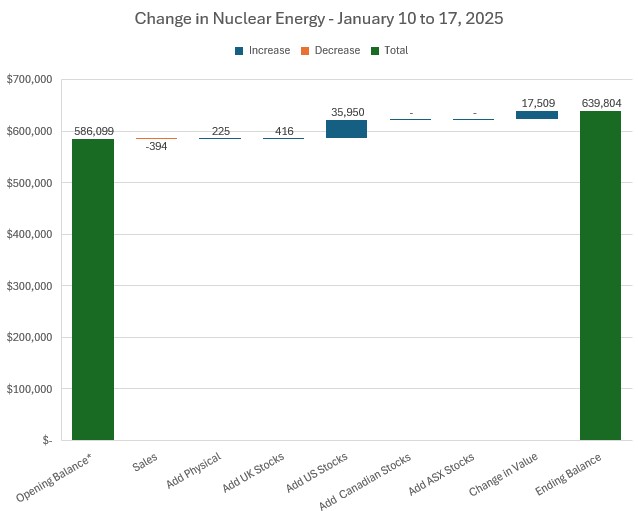

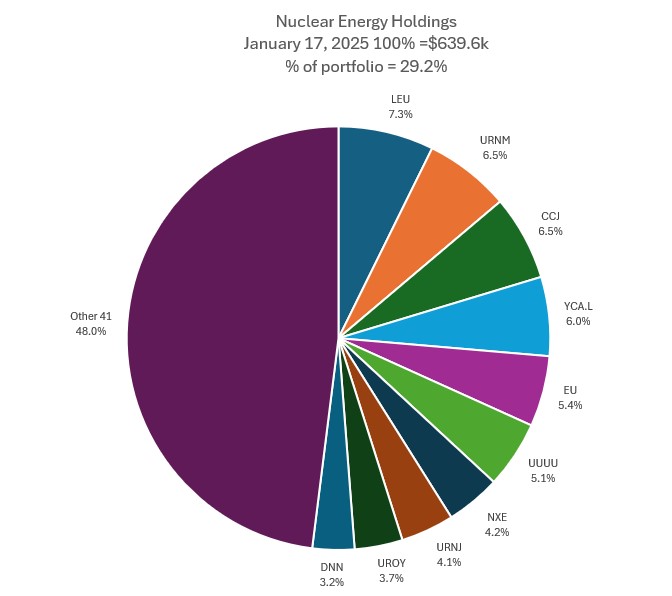

Nuclear Energy Holdings

A busy options expiry and a few small holding changes sees big jump in US stocks (mostly ETFs) and a 3% rise in share of portfolios. Opening Balance has been adjusted down - found an error in the spreadsheet.

A few key changes in the mix of holdings. Sprott Uranium Miners ETF (URNM) moves up 5 places into slot 2. NexGen Energy Ltd (NXE) comes into Top 10 in slot 5 displacing Uranium Energy Corp (UEC) from the Top 10. Others drops to 41 stocks with one sale and drops below 50%. Overall share of portfolios rises nearly 2 points to 29.2%

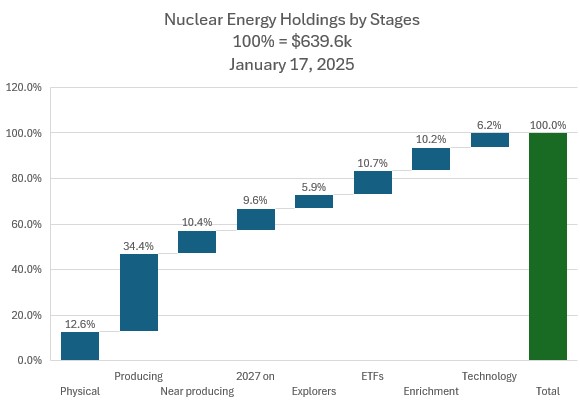

Biggest change in the holdings by stage is the pop in ETF's with the adds there and 0.7 points step up in technology with the adds there and the pops in valuations.

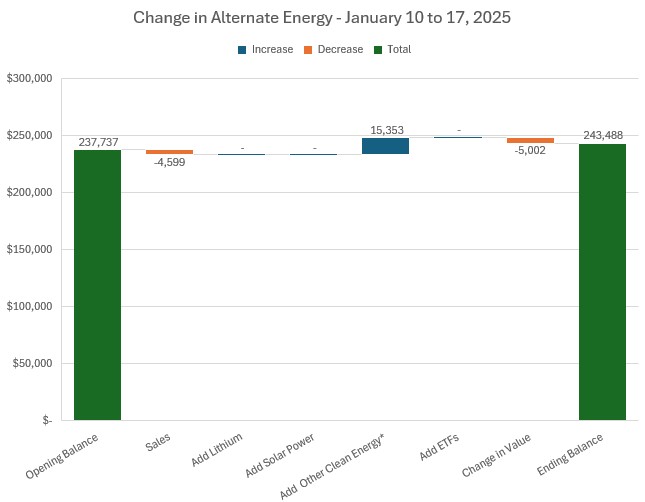

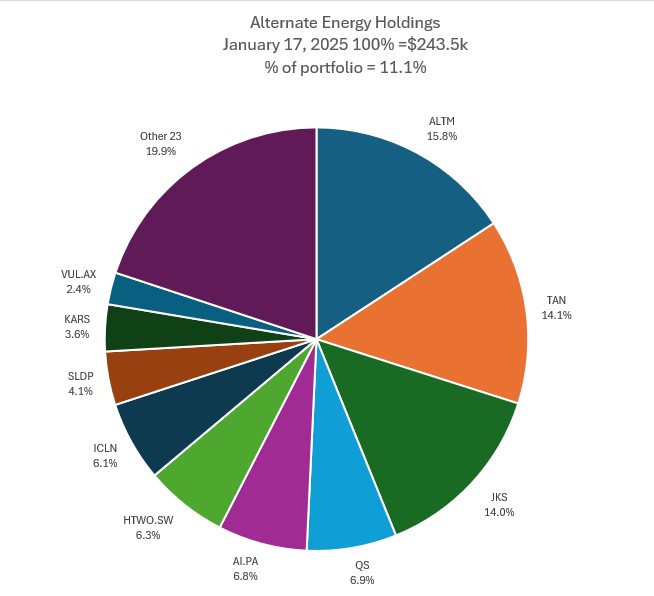

Alternate Energy Holdings

A few additions in other alternate energy category and one sale has portfolio increase in total size even after 2.1% drop in value.

JinkoSolar (JKS) drops two places and gives up slot 1 to Arcadium Lithium (ALTM). QuantumScape (QS) rurises 3 places on the additions there into slot 4. SolidPower (SLDP) rises one place on additions there in slot 8. Vulcan Energy (VUL.AX) displaced WestWater Resources (WWR) in slot 10. Share of portfolio remains the same at 11.1%

Bought

Aurora Cannabis (ACB.TO): Canadian Marijuana. Assigned on sold puts in two portfolios - chose to let these run to average down entry prices. A long way to go to recover.

Uranium Royalty Corp (UROY): Uranium. Bought a parcel for small managed portfolio as stock offers exposure to a wider range of projects, some producing, than CanAlaska (CVV.V) just sold. Ran comparisons with other US listed stocks with low ticker prices - this is the laggard - fits the contrarian theme. Wrote covered call for 4% premium with 11.6% price coverage.

ING Groep N.V (INGA.AS): Dutch Bank. Replaced stock likely to be assigned plus one extra share as changed multiplier would result in a short position.

Advanced Micro Devices (AMD): US Semiconductors. Added parcel to pension portfolio to average down entry cost and apply proceeds of sale of Applied Materials (AMAT) which will be assigned.

Largo Inc (LGO): Vanadium. Added a parcel to average down entry price in pension portfolio. Switching to stock trades away from options trades (see below)

Sprott Uranium Miners ETF (URNM): Uranium. Assigned on two different call spread risk reversals. Breakeven spelled out below is below current price.

Neo Energy Metals Plc (NEO.L): Uranium. Scaled into holding in personal portfolio to average down entry price. Neo is a new listing planning to reopen Beatrix gold and uranium mine in South Africa.

NexGen Energy Ltd(NXE): Uranium. Assigned on sold put in two portfolios. $6.83 is breakeven vs $6.87 close (Jan 17)

Denison Mines Corp (DNN): Uranium. Assigned on sold put in personal portfolio

Sold

Ingenia Communities Group (INA.AX): Australian Property. Ingenia sold the lifestyle village we have a house in. Had bought the stock to get access to shareholder meetings and financial data. Not needed now. Sold for 10% profit since May 2024 plus the last dividend

CanAlaska Uranium (CVV.V): Uranium. Closed at 52 week high for 31.2% blended profit since June/July/September 2024 in small managed portfolio and 12.3% profit since September 2024 in pension portfolio. One less uranium stock in the holdings.

Alerian MLP ETF (AMLP): US Oil. Assigned on covered call in pension portfolio for 4.9% profit since October 2024. Will use sold puts to drive income from the possibility from rising oil prices and the Trump trade - he wants more drilling and fracking.

Commerzbank AG (CBK.DE): German Bank. Assigned on covered call in personal portfolio for 9.6% profit since November 2024 and 5.9% blended profit since November/December 2024 in managed portfolio. Using sold puts to keep in touch with a rising stock price.

Centrica plc (CNA.L): UK Utility. Assigned on covered call for 10.7% blended loss since November/December 2023/January/February 2024 in personal portfolio. 1.1% blended loss in managed portfolio since May/December 2024. Averaging down helped

Glencore plc (GLEN.L): Base Metals. Assigned on covered call for 8.2% blended loss since July 2023/March/October 2024 in personal portfolio. 17.1% blended loss in managed portfolio since April/May/June/July 2024 - Rio Tinto talks arrived a bit late

CVS Health Corporation (CVS): US Healthcare. Assigned on covered call for 17.4% blended loss since May/November 2024 - got undone by attack on prescribed medicine fees and tailing off of Covid vaccinations

Halliburton Company (HAL): Oil Services. Assigned on covered call for 13.5% loss since November 2024 - stock screen idea squeezed by sliding oil prices. Same trade in two portfolios. Watch it recover - hence the sold puts - see below

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Assigned on covered call for 1.1% blended loss since August/November 2024. Income trades covered that loss well.

ENGIE SA (ENGI.PA): French Utility. Assigned on covered call for 2.5% blended loss since September/December 2024. Engie has been more of an income trade than a stock trade.

ING Groep N.V (INGA.AS): Dutch Bank. Assigned on covered call for 4.7% blended profit since December 2024/January 2025

RTL Group S.A. (RRTL.DE): Satellite Broadcasting. Assigned on covered call for 15.5% blended loss since December 2023/July 2024 - stock screen idea which did not take off with Paris Olympics as one had hoped.

Applied Materials, Inc (AMAT): US Semiconductors. Assigned on covered call for 2.8% profit since December 2024 in pension portfolio but $500 is $500. TSP idea.

Builders FirstSource (BLDR): Building Material. Assigned on covered call for 11.1% loss since December 2024. Credit spread that was assigned not long after TSP sold out.

Gevo, Inc (GEVO): Alternate Energy. Assigned on covered call for 14.6% blended profit since November/December 2024 and 22.8% above breakeven after all the options trades - see more discussion below

The Mosaic Company (MOS): Fertiliser. Assigned on covered call for 45% blended loss since August 2022/December 2023. Not even the outbreak of Ukraine-Russia war could drive potash prices high enough. Ukraine is a major producer.

Nokia Oyj (NOK): Network Equipment. Assigned part of portfolio holding for trading costs. Weird - price closed at $4.51 = the whole holding should have been assigned but only part was.

Oklo Inc (OKLO): Nuclear Technology. Exercised as part of 22.5/30/17.5 call spread risk reversal. Had good success levering up with sold puts bringing breakeven to $18.93 vs $26.05 close (Jan 17)

Chart shows price did trade over the top of the spread recently and a few days below the sold put (17.5). As price was in the middle of the spread coming into the week of expiry decided to go to exercise. Scales into an existing small position.

QuantumScape Corporation (QS): Battery Technology. Assigned on sold put. While the chart looks very rocky have had good success selling nake puts and have brought breakeven down to $4.60 which is a 13.2% discount to $5.22 close (Jan 17)

Solid Power (SLDP): Battery Technology. Assigned on sold put. Breakeven after one put sold in-the-money is $1.75 vs $1.66. This was a deliberate trade to get a chance of hitting another spike like the last one on the chart. It also averages down entry cost for a long held position - long term view is battery power will be very important.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Ampol Ltd (ALD.AX): Petrol Marketing. Dividend yield 5.40%

2nd time investing in this stock. Chart shows the classic shape for the strategy. Price made a big run - exit in their - then collapses and tests support from the last run up and show signs of breaking higher. Be wary of earnings coming up - the E box below the chart.

Top Ups

Santos Ltd (STO.AX): Oil. Dividend yield 5.70%

Chart shows two versions of what happens with the signals. Left hand blue ray signalled at the top of a ranging cycle = this had run for quite a few months. This one ran one more cycle before falling over. New entry is more in keeping with the strategy. Price has broken the steep downtrend and reversing. The signal is a bit late - when the 20 day moving average (blue line) crosses the 50 day from underneath (red line). Price reversed above support - the green line from a weekly chart going back a long way. The notes in the boxes talk about rising oil prices.

Viva Energy Group Ltd (VEA.AX): Petrol Supplier. Dividend yield 4.2%

Chart shows the two entry possibilities for the strategy even more clearly. First entry (left hand blue ray) is on a rising trend after breaking out of a channel. The next two are at the tops of cycles. The latest entry is after breaking the downtrend and revering off a support level (the horizontal red line)

Managed to put order in twice. Sold the surplus the week after for 1 cents more a share to recover the error at no loss.

Expiring Options

A busy options expiry time with January expiries on LEAPS - long terms options. A few lessons.

ASP Isotopes Inc (ASPI): Nuclear Technology. With price closing at $4.95 am exposed to sold puts at 3 strikes - 5, 6 and 7. Decided to let the 5 strikes go to assignment (if price wants to stay below $5) and kick the can down the road for the other strikes. These trades are part of bullish trades which will expire worthless. Will be down to assigned puts to make the profits if and when they get assigned. As it happened price moved above $5 - no assignment on the 5 strike sol puts. Status to date is 25% loss - waiting for February expiry to see if it improves

Chart shows two of the bullish trades - 9/12/6 call spread risk reversal and 10/7 risk reversal. The idea is to use the sold put premium to fund the call premium. The entries (the starts of the rays) look like FOMO trades. At the time it felt like entering at $6 or $7 would be an effective entry if price fell over. As it happens price never crossed the bought call levels (9 and 10) and soon plumbed below the sold put levels (6 and 7). The blue arrow shows the kick the can down the road trades.

GE Vernova Inc (GEV): Alternate Energy. With price closing at $401.41 (Jan 17), 230/250/195 call spread risk reversal expired in-the-money. This kind of feels like the one that got away with the sold leg (250) 60% below the close. In the managed portfolio, two cycles produced a profit over $5k fully funded by sold put premium.

The chart shows the runaway story. The ideal trade would have been to keep something open-ended - a small parcel of stock. In the otehr portfolios, I did run a series of sold puts behind the move up to grab premium, along the way

ChargePoint Holdings (CHPT): Electric Vehicles. With price closing at $1.08 (Jan 17) 10/15/7 call spread risk reversal from May 2023 expired out-the-money. Trade set up was a little different with the sold put (7) at a shorter expiry (Nov 23) than the call spread (Jan 25). Was assigned on the sold put (7) at the November expiry and still holding the stock (ouch). After that kept writing sold puts to claw back premium and look for lower entry points. Net-net of the trade was the call spread started out fully funded and ended up being funded 6 times over. Makes up for the investment in the stock itself

Chart shows the decline. TSP idea - they had confidence the business would not go bankrupt and EV charging was a good business to be in. Not bankrupt yet

VanEck Gold Miners ETF (GDX): Gold Mining. With price closing at $36.75 (Jan 17) 41/38 risk reversal from October 2024 expired out-the-money. Still testing out the use of risk reversals. The call option (41) was only partly funded by the sold puts (36 and 38).

Chart shows price was heading in the right direction and then got the wobbles dropping below the sold put strike. That sold put has since been pushed out to February expiry. Lesson learned - sell the call when it passes the strike and hold onto the sold put. My coach always used to say "hold to expiry"

Gevo, Inc (GEVO): Specialty Chemicals. With price closing at $2.20 (Jan 17) 2.5/2 risk reversal from December 2024 expired out-the-money. This has been an experimental area of options and stock trades as ticker price is low and strikes are close together and liquidity good.

Chart shows the expiring trades with price ending between the sold put (2) and the bought call (2.5). The sold put fully funded the bought call. Options trades have added another 33% to the stock profits.

Largo Inc (LGO): Vanadium. With price closing at $1.73 2.5/5 call spread from July 2024 expired out-the-money.

Chart shows price never getting near the bought call (2.5). The challenge of the trade is the strikes are too far part and there is no put option market below the current price. It is better to just buy the stock - hence the stock purchase this last week. If price follows the blue arrow price scenario stock will double. .

Global X Lithium & Battery Tech ETF (LIT): Lithium. With price closing at $42.28 46/52/43 call spread risk reversal from October 2024 expired out-the-money.

Chart shows price only touched above the bought call (46) a few times and dropped below the sold put (43) in the weeks before expiry - that is why the sold put was pushed out to February (the blue arrow). The call spread remains fully funded even after the latest adjustment. Price remains below the sold put level (43)

Pan American Silver (PAAS): Silver Mining. With price closing at $21.43 22/26/19 call spread risk reversal from September 2024 expired out-the-money.

Chart shows price touched the sold call (26) and then traded below the bought call (22) but never got as low as the sold put (19). The call spread was fully funded by the sold put and the additional puts sold before expiry. Again might have been good to ignore the "hold to expiry" mantra and close the call side when price was close to $26. Theta value is high and one does the reap the full potential.

NuScale Power Corporation (SMR): Nuclear Technology. With price opening at $21.00 17.5/22.5 call spread will expire in-the-money. As the account is tight on capital, chose to close out the call spread rather than just sell the bought call (17.5) - could not afford for price to go over sold call (22.5) before expiry.

Chart shows the initial trade set up with expiry on the sold put (13) shorter than the call spread. Rolled that first put out before expiry removed the funding of the call spread. Subsequent rolling of the sold puts recovered that fully. Profit on call spread was 45% and that was scaled up by another 1.6 times with sold puts. Charts like this tempt one to keep selling puts. Did explore closing out the call spread when price traded over the top (22.5) but the theta lost was not pretty. As it happens with price ending close to the sold call level the profit was solid.

Global X Uranium ETF (URA): Uranium. With price closing at $28.03 30/33/26 and 30/35/26 call spread risk reversals from September 2024 expired out-the-money.

Chart shows one of the trades with the call spread partly funded by the first sold put (28) - subsequent sold puts funded the spread fully leaving a small profit at the end of the trade. Price did cross the bought call (30) and stayed above for a large slice of the time. Another example of theta going against closing the call spread early. Maybe it was a belief that price could well follow the Elliott wave drawn in at the start and end in-the-money.

Sprott Uranium Miners ETF (URNM) With price closing at $41.83, 54/60/47 call spread risk reversal from April 2024 expired out-the-money. The call spread was fully funded. As price closed below sold put (47) stock was assigned.

Chart shows price reaching up to the sold call (60) early in the trade life and then falling back below the sold put (47) and ending below that. Did improve the funding of the trade along the way selling puts bringing breakeven to $39.56

Energy Fuels (UUUU): Uranium/Vanadium. With price closing at $5.21 10/15/7 call spread risk reversal from January 2024 expired out-the-money. The call spread was partly funded at the start and fully funded with subsequent sold puts

Chart looks like a blue sky dream with price nowhere near the bought call (10). What was in my mind: From TIB691, the rationale ended with this viewpoint. That 95% target would have taken the trade into the upper reaches of the call spread.

Now go back to the comparative chart discussion above - if price can close half the gap, it will be close to doubling = 95% is possible.

So ends an interesting journey through LEAPS investing - and the value and risk of using call spread risk reversals - someone else pays unless stock closes below sold put levels.

Income Trades

Covered Calls

69 covered calls went to expiry with 18 assignment (in brackets) UK 5 (4) Europe 10 (6) US 52 (8) Canada 2. A few new ones written - really waiting for market open after the inauguration to decide the shape for the next month. Have a feeling the market will pop.

Naked Puts

Puts sold on stocks likely to be assigned on covered calls:

- The Mosaic Company (MOS): Fertilizer. Return 1.76% Coverage 8.6%

- Commerzbank AG (CBK.DE): German Bank. Return 2.13% Coverage 3.5%

- CVS Health Corporation (CVS): US Healthchare. Return 4.3% Coverage 3.9%

- Halliburton Company (HAL): Oil Services. Return 1.75% Coverage 4.5% - two portfolios

- Aurora Cannabis Inc. (ACB.TO): Canadian Marijuana. Return 5.7% Coverage 9.3%

- Glencore plc (GLEN.L): Base Metals. Return 4.1% Coverage 0.4%

- Centrica plc (CNA.L): UK Utility. Return 2.8% Coverage 0.3% - two portfolios

- Glencore plc (GLEN.L): Base Metals. Return 2.2% Coverage 5.9% - different strike

- Alerian MLP ETF (AMLP): US Oil. Return 1.1% Coverage 2.8%

Sold puts on stocks happy yo hold at lower entry price:

- Energy Fuels Inc. (UUUU): Uranium. Return 5% Coverage 3.1%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 2% Coverage 9.6% - two days only

Kicked the can down the road to push out the risk of assignment:

- Elastic N.V. (ESTC): AI Software. 44.1% Loss on buy back. 8.5% cash positive - down a strike

- Honeywell International Inc. (HON): US Industrials 38.8% Loss on buy back. 29.9% cash positive - down a strike

- iShares 7-10 Year Treasury Bond ETF (IEF): US Treasuries. 145% Loss on buy back. 56% cash positive

- Centrus Energy Corp. (LEU): Uranium Enrichment. 140% Loss on buy back. 42% cash positive - down a strike

- ASP Isotopes Inc (ASPI): Nuclear Technology. 14.4% Profit on buy back. 26% cash positive

- ASP Isotopes Inc (ASPI): Nuclear Technology. 24% Loss on buy back. 12.6% cash positive

- Honeywell International Inc. (HON): US Industrials 19% Profit on buy back. 97% cash positive - down a strike - what a difference one day makes

- Wynn Resorts, Limited (WYNN): Gaming. 5% Loss on buy back. 171% cash positive - down a strike

- VanEck Gold Miners ETF (GDX): Gold Mining. 3.2% Profit on buy back. 46% cash positive

Credit Spreads

Honeywell International (HON): US Industrials. With price closing at $219.10 (Jan 13) decided to kick the can down the road on the sold put (220) rather than run the risk of going to assignment. Got first leg of trade wrong - sold another of the sold legs (220). Was able to buy back at a small profit. Did get the trade right rolling out and down the 220 sold put to 210 strike sold put and selling the 210 bought put. To date credit spread trades are 6.5% profitable with a naked put outstanding. Idea is a long term hold to capture profit potential from Converdyn uranium enrichment arm

Elastic N.V. (ESTC): With price opening at $96.02 decided to kick the can down the road on the sold put - one contract only (100) to 95 strike. Plan will be to allow the other contract to go to assignment (if price chooses to stay below $100) and sell the bought put before expiry. TSP idea to hold the stock.

All other credit spreads expired

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

January 13-17,2025

Edits: fixed dates to 2025.

#hive #posh