Stayed out of markets through the holidays apart from a little tinkering to raise capital and chase an alternate energy idea

Portfolio News

In a week where S&P 500 dropped 0.51% and Europe dropped 0.67%, my pension portfolio rose a whopping 2.85%.

Big movers of the week were Stem (STEM) (105.2%), Stroud Resources (SDR.V) (66.7%), Standard Uranium (STND.V) (36.4%), Gevo (GEVO) (35.7%), GoviEx Uranium (GXU.V) (33.3%), Koonenberry Gold (KNB.AX) (30.8%), WhiteHawk (WHK.AX) (30%), Forsys Metals (FSY.TO) (27.6%), Lightbridge Corporation (LTBR) (24.2%), Lotus Resources (LOT.AX) (23.7%), Elevate Uranium (EL8.AX) (22.4%), Baselode Energy (FIND.V) (22.2%), Alligator Energy (AGE.AX) (21.9%), Northern Dynasty Minerals (NAK) (20.8%), AdAlta (1AD.AX) (20%), Oklo (OKLO) (19.6%), Bannerman Energy (BMN.AX) (19.3%), IsoEnergy (ISO.TO) (18%), Skyharbour Resources (SYH.V) (17.6%), Global Atomic Corporation (GLO.TO) (17.5%), Kairos Minerals (KAI.AX) (16.7%), Atha Energy (SASK.V) (16.1%), Aura Energy (AEE.AX) (15.4%), Cauldron Energy (CXU.AX) (15.4%), Elixir Energy (EXR.AX) (15.2%), F3 Uranium (FUU.V) (14.6%), Centrus Energy (LEU) (14.3%), Premier American Uranium (PUR.V) (13.8%), Mithril Silver and Gold (MTH.AX) (13.2%), Lithium Universe (LU7.AX) (12.5%), Deep Yellow (DYL.AX) (12.3%), Denison Mines (DNN) (12.3%), ASP Isotopes (ASPI) (11.4%), Lifeist Wellness (LFST.V) (11.1%), Cettire (CTT.AX) (10.7%), Sprott Junior Uranium Miners ETF (URNJ) (10.6%), CleanSpark (CLSK) (10.4%), Energy Fuels (UUUU) (10.4%), Karoon Energy (KAR.AX) (10.4%), Paladin Energy (PDN.TO) (10.3%), Silex Systems (SLX.AX) (10.2%), Boss Energy (BOE.AX) (10.1%), Earths Energy (EE1.AX) (10%), Zinc of Ireland (ZMI.AX) (10%)

A whopping 44 stocks in the big movers list with 4 themes represented. From the top alternate energy (4 stocks), gold/silver mining (4 stocks) uranium/nuclear technology (27 stocks), cannabis (1 stock).

Stem, Inc (STEM) leading the charge on an upgrade to Buy by Zacks who seem to like the unfolding earning story better than other analysts. Pretty chuffed with the doubling up position made on Dec 17 - now up 239%

https://finance.yahoo.com/news/stem-stem-upgraded-buy-does-170011407.html

US markets went into drift mode for the holiday week with only one day up - the last day of the week breaking a 5 day losing streak.

Crypto Rebounds

Bitcoin price tracked lower a bit and then pushed higher ending the week 5.9% higher with a trough to peak range of 8.7% testing up to $100k again

Ethereum chart looks much the same ending the week 6.7% higher with a trough to peak range of 11.1% - some way to go to the $4k mark.

Cardano (ADA) popped 34% from the get go and then held that level.

Stellar (XLM) reversed its decline on the 4 hour chart and popped 50% holding onto 80% of that

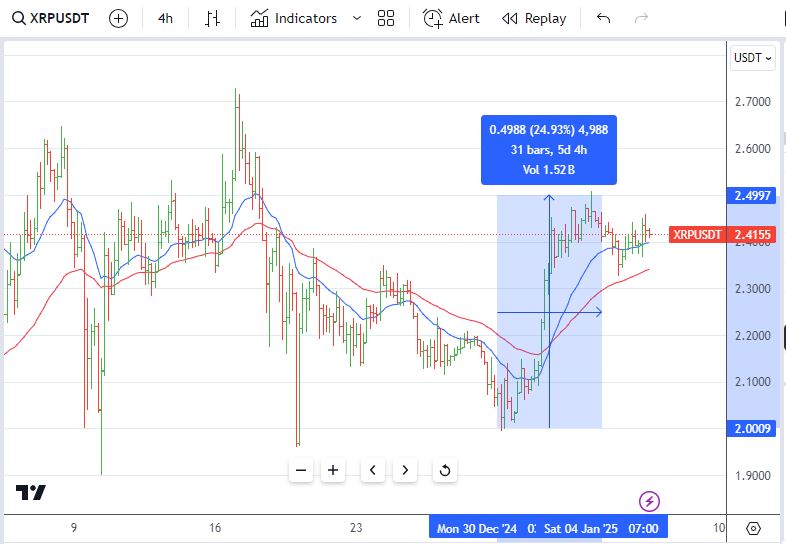

Many altcoins followed the same sort of pattern - Ripple (XRP) getting a bit of news flow too

Nuclear Energy Holdings

The in-situ recovery JV, in which Cameco holds a 40% stake and state-owned Kazatomprom (LSE: KAP) holds 60%, didn’t get an extension to submit its project paperwork because of a delayed submission to Kazakhstan’s energy ministry.

Still, Kazatomprom doesn’t expect any significant impact on its production forecast this year of 65-68.9 million tonnes of uranium oxide (U3O8), Pearce said. BMO puts the same forecast at 65.6 million tonnes of U3O8.

https://www.mining.com/cameco-surprised-by-kazakh-foulup-suspending-inkai-jv-output/

Despite what Kazatomprom said, that news put a fire under uranium stocks including a modest uplift in spot prices

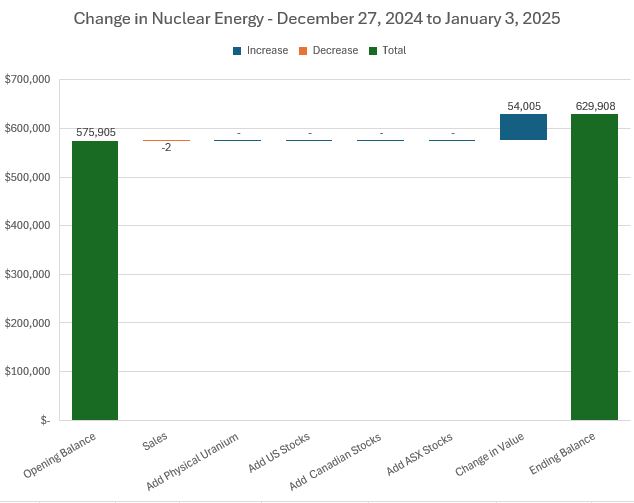

One small change in sale of fractional share of Paladin Energy (PDN.TO) but a whopping 9.8% increase in valuation.

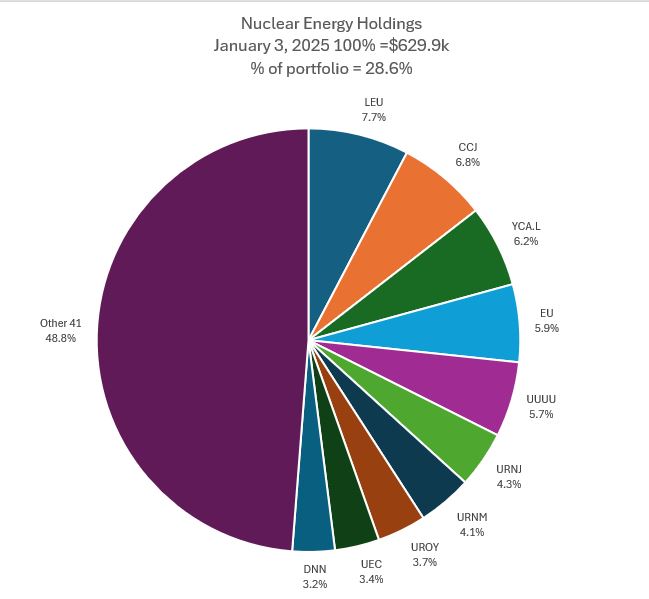

One change in mix of holdings with Denison Mines Corp coming into slot 10 displacing BHP Group (BHP.AX). No surprise there as uranium is a tiny part of BHP operations even though it is the 3rd largest producer worldwide. Overall share of portfolio jumps 1.6 percentage points to 28.6%

The changes in holdings by stage are not quite what I would expect starting with the merger of Paladin Energy (PDN.AX) pulling Fission Uranium (FCU.TO) out of explorers into producing. The Kazatomprom news should have pushed anyone producing up more than the others. The winners with increased shares are near producing (up 0.8 points), 2027 on (up 0.2 points), enrichment (up 0.4 points), technology (up 0.2 points). The losers are physical (down 0.4 points), producing (down 1.1 points). Fully understand the drop in physical as spot price lags the market on events like this.

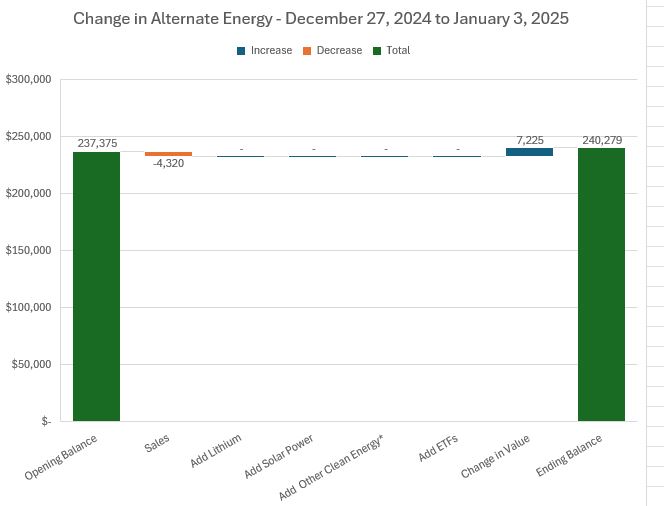

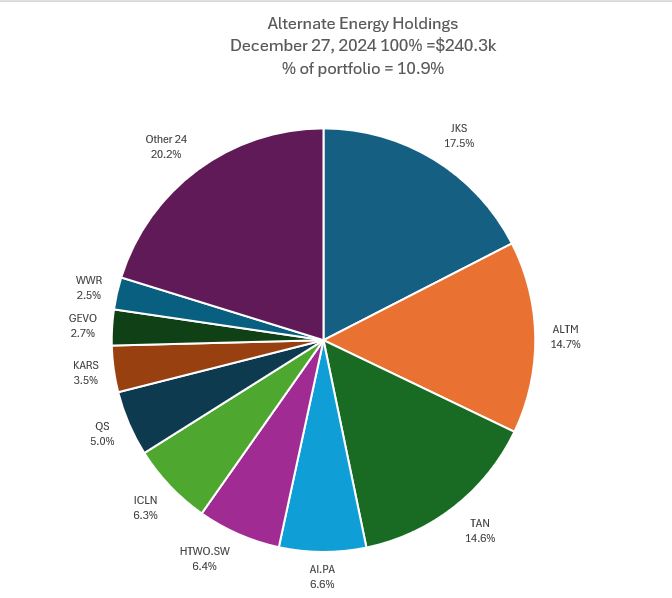

Alternate Energy Holdings

One sale in the changes and a 3% rise in valuation - no new additions

One change in the mix of holdings with Gevo Inc (GEVO) coming into slot 8 and Vulcan Resources (VUL.AX) dropping out of the Top 10. Share of portfolios drops 0.2 points to 10.9% as alternate energy rise was smaller than nuclear rise.

Bought

Gevo, Inc (GEVO): Specialty Chemicals. With price opening at $2.18 (Dec 31) set up a 2.5/2 January expiry risk reversal. Trade is cash positive with $2.47 breakeven on the bought call and 1.5% return on sold put with 9% price coverage

Gevo has a reasonably liquid options market with strikes close together. Have been kick around ways to leverage returns using options in addition to holding stock. The chart shows the action

- First stock purchase assigned on covered call in that first race up.

- Two more stock purchases at lower entries than the first. Covered calls expired on those

- Assigned on naked put well above market.

- Latest options trade looking for open ended upside funded by sold put (right hand two rays)

- Breakeven for the completed options trades plus the stock holdings at $1.64 - the green ray.

Looking good so far with price currently above the breakeven and the bought call (2.5).

Why the interest in this stock? Gevo focuses on transforming renewable energy into energy-dense liquid hydrocarbons that can be used as renewable fuels.

88 Energy Limited (88E.AX): Alaska Oil. Price has been popping between $0.001 and $0.002 for weeks on end. My pending order at $0.001 was one of 1.5 billion shares on order. Have seen trades settle at $0.0015 - though that is not a price one can set. Upped my bid to $0.002 (at half size) to test if I could get a split price - no luck on that. The investment thesis is there is a lot of oil in Alaska but Joe Biden has blocked access to DoD lands up there - maybe a change of regime will ease that restriction. The new guy loves oil and gas. Biden just invoked more restrictions on offshore oil and gas - does not affect this stock as it is onshore. Exit plan - exit entire holding at $0.004 - maybe even $0.003 (profitably)

How did we land up here? Stock was formerly Tangiers Petroleum exploring for oil in offshore Morocco.

Sold

Unicredito Italiano (UCG.MI): Italian Bank. Needed to raise some short term capital - picked this as the holding is too small to write covered calls. Locks in 6.8% profit since November 2024 - 6 weeks work is more than the covered calls would have raised.

Latin Resources (LRS.AX): Lithium. Closed out holding to raise capital in pension portfolio for 1507% blended profit since January 2020/December 2022. Started out as Next Investors copper idea. Chose to sell as Pilbara Minerals (PLS.AX) have finalised a stock for stock acquisition and I already hold that stock. Time to get the profits to work somewhere else rather than waiting for a hostile bid.

Paladin Energy Ltd (PDN.TO): Uranium. Sale of fractional share after merger with Fission Uranium (FCU.TO) in small managed portfolio for small loss

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

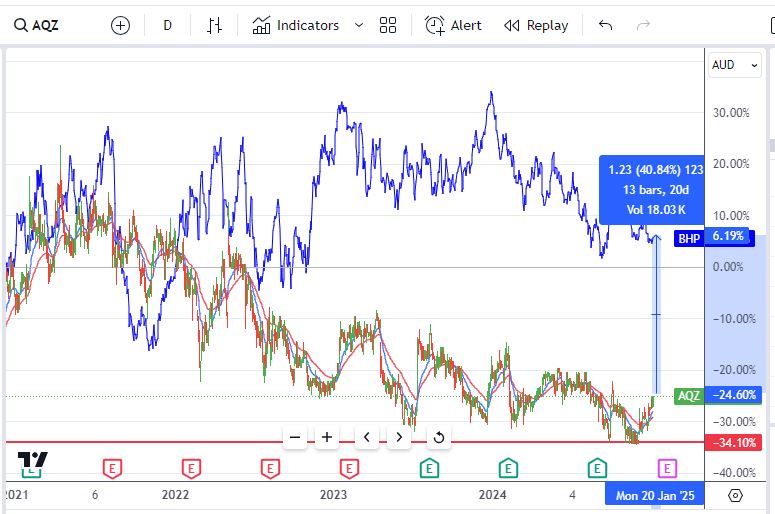

Alliance Aviation Services Limited (AQZ.AX): Aviation Services. Have ignored the signals to date - waiting for a bit of a bounce in commodity markets as the company operates mostly fly in-fly out services to the mining industry.

Chart shows price has bounced off a base level 5 times since the start of 2023 and failed to break up - maybe this time. There is headroom for 40% profit target around the 2022 highs. Have overlaid chart of largest Australian mining business (BHP.AX - the blue line). There is a 30 percentage point gap to that. With 52 week high target of 25% this should be a solid trade.

Top Ups

Next two stocks are essentially New Zealand businesses - a few weeks ago chose to bend the rules about Australian stocks only in this portfolio as both do operate in the Australian market place as well. Chose then to do half size - both appeared on top up screens at the same time - topped up again in halves (a bit less $100 vs $125).

Helloworld Travel Ltd (HLO.AX): Travel Services. Dividend yield 5.26%

The chart shows price having a second shot at breaking up from the reversal forming something of an inverted head and shoulders.

Tourism Holdings Limited (THL.AX): Travel Services. Dividend yield 4.84%

Rather than do a separate chart for this stock, have put it on the chart above - the blue line. Price is also showing signs of breaking up the 2024 lows (a few times). The key for me is the 95 percentage points difference between the two.

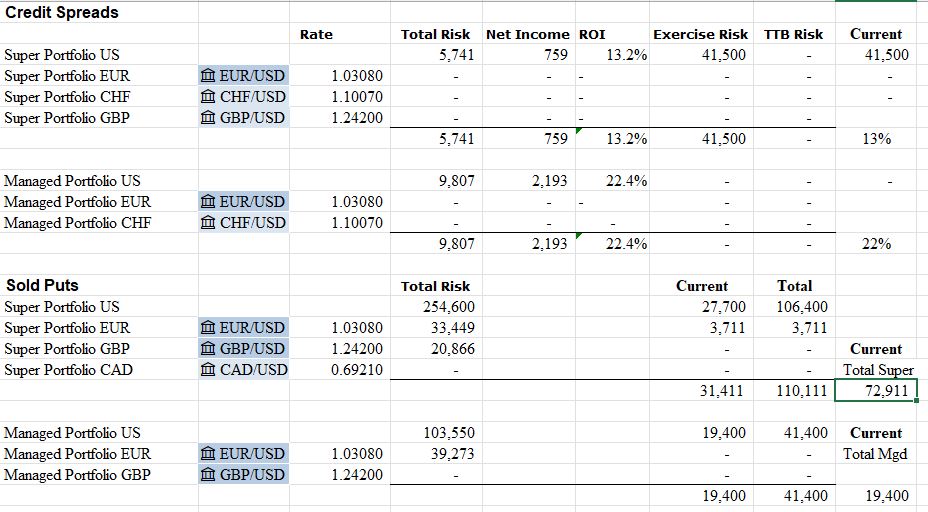

Income Trades

15 covered calls written in the week (Europe 1 US 12 Canada 2). Widened the margins a bit and cut the scale of uranium calls to part holdings only - this sector is going to move and do not want to be called away.

Naked Puts

A few naked puts written on stocks happy to hold at lower entry prices:

- Cameco Corporation (CCJ): Uranium. Return 1.46% Coverage 7.5%

- KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. Return 3.2% Coverage -1.0% - gives breakeven 25% below current price. Looking for bounce in EV's.

- Westwater Resources (WWR) Return 35% Coverage -19.0% - gives breakeven 19% below current price.

Credit Spreads

Builders FirstSource (BLDR): Building Materials. Closed out the bought leg of 180/170 credit spread for 597% profit since start of December 2024. With breakeven at $151.67 there is some way to go to recover the 5.7% premium to $143.47 close (Dec 30). TSP idea to hold. Wrote covered call for 0.36% premium with 5.5% coverage is the start.

Exercise risk in the pension portfolio is a bit high - one credit spread traded into the middle of the spread and a call spread risk reversal on gold trading below the sold put level. To be fixed next week as the portfolio is a bit tight on capital.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

December 30-January 3,2024