A down week for markets especially uranium is time to back up the truck and load up. Options assignments added even more uranium plus a few other solid targets

Portfolio News

In a week where S&P 500 dropped 2.16% and Europe dropped 4.58%, my pension portfolio dropped 2.99% - somewhere in the middle but not because it is weighted more to Europe. More to do with uranium. Only one market in the green - Canada - thanks to two of the stocks in the big movers list. Biggest drags were De Grey Mining (DEG.AX) down 8% and uranium pretty well across the board.

Big movers of the week were 88 Energy (88E.AX) (100%), Bayhorse Silver (BHS.V) (45.4%), Premier American Uranium (PUR.V) (40.8%), Solid Power (SLDP) (19.3%), Cettire (CTT.AX) (19.2%), Oklo (OKLO) (16.1%), Direxion Daily Real Estate Bear 3X Shares (DRV) (14.4%), Aura Energy (AEE.AX) (12%), GoviEx Uranium (GXU.V) (10%), WhiteHawk (WHK.AX) (10%)

A short list of only 10 big movers. Three themes represented with uranium (3 stocks), nuclear technology (1 stock), alternate energy (1 stock) and silver mining (1 stock).

Drilling results from Bayhorse Silver (BHS.V) look encouraging though final assays have not been completed.

Cannot find any news for the Premier American Uranium move - last news is resignation of a president effective December 1. Something is afoot. What I do know is Premier has past producing tenements in Wyoming, Colorado and New Mexico.

Maybe the announcement from Peninsula Energy (PEN.AX) of restarting production at their Lance project in Wyoming reopens mill possibilities.

With Canada approving Paladin Energy’s takeover of Fission Uranium (FCU.TO) eyes will turn to Athabasca Basin possibilities.

Markets headed down for 8th, 9th and 10th day helped along by a more dovish Federal Reserve than analysts expected - back to 1974 since the Dow dropped that many days in a streak. Better than expected inflation data bought some life back on the last day of the week.

Crypto Sags

Bitcoin kept going higher to all time high and then fell over with all the markets ending the week 8.6% lower with a peak to trough range of 14.9%

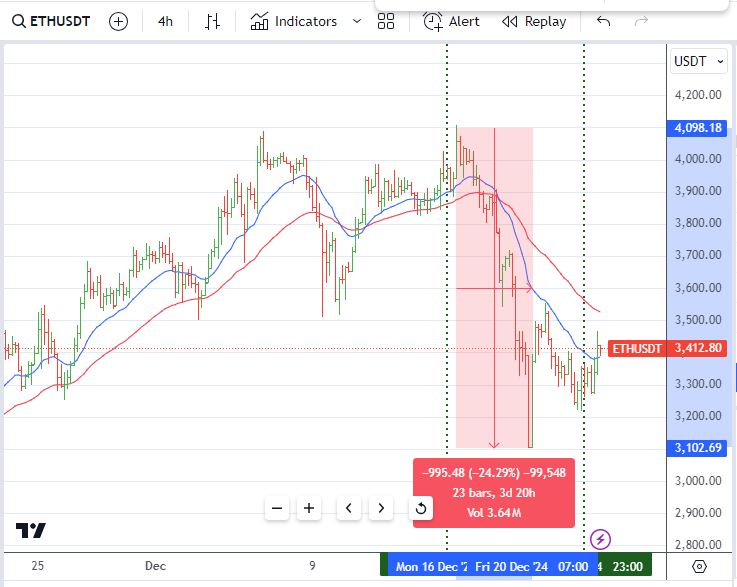

Ethereum price squeaked out a higher high and also fell over ending the week 15.7% lower with a peak to trough range of 24.5%

Most of the charts look the same - here is one that is a little different. Aave (AAVE) dropping 32% and then recovering all of that.

Too bad my exit was last week, though I do still have a holding.

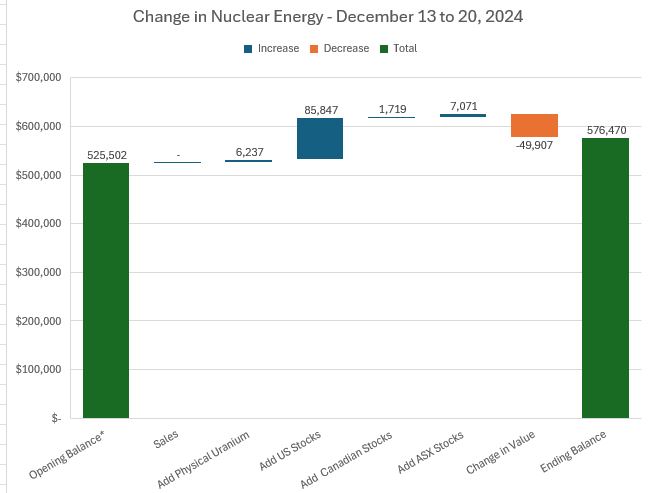

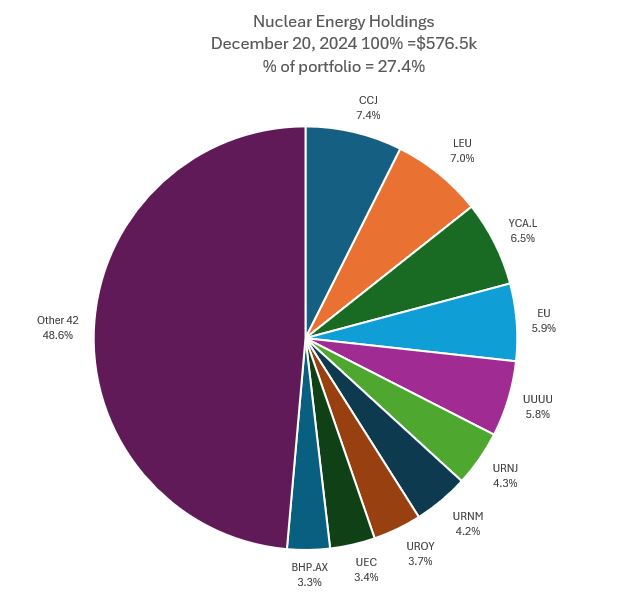

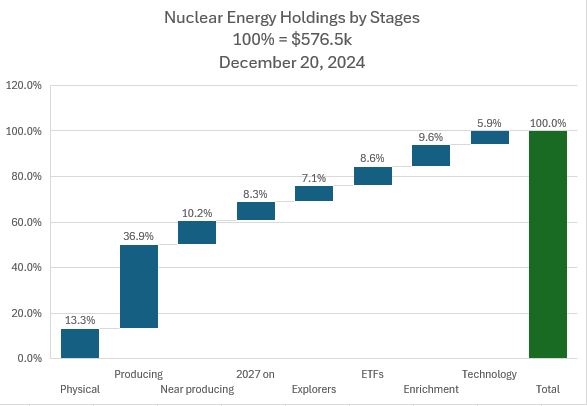

Nuclear Energy Holdings

This week felt like the week to back up the truck - and load up - and then along came options expiry time which added a whole lot more additions. Sure hope this is right as the portfolio value went down 9.5% - a fair bit of that will be from stock assigned on sold put strikes and marked to market (even after accounting for the sold put premium)

Note: Opening balance has been changed to add in a holding not previously reported

A lot of change in the mix of holdings with the purchases and options assignments. Cameco Corp (CCJ) moves up 5 places into slot 1. Centrus Energy (LEU) moves up two into slot 2. Sprott Junior Uranium Miners ETF (URNJ) moves up two places and switches ranking with Sprott Uranium Miners ETF (URNM). Uranium Royalty Corp (UROY) comes into Top 10 in slot 8 based on additions. Uranium Energy Corp (UEC) comes into slot 9 based on valuation increase. Dropping out of Top 10 are NexGen (NXE) and Sprott Physical Uranium Trust (U-UN.TO). The big move is the share of portfolios rising well over 5 points to 27.4% - feels like conviction trade time.

The additions have bolstered the share of producing and near producing and enrichment. Strategy from here ion in is to weed out the smaller holdings in explorers and focus on the first 3 columns using the ETF's to hold the minors.

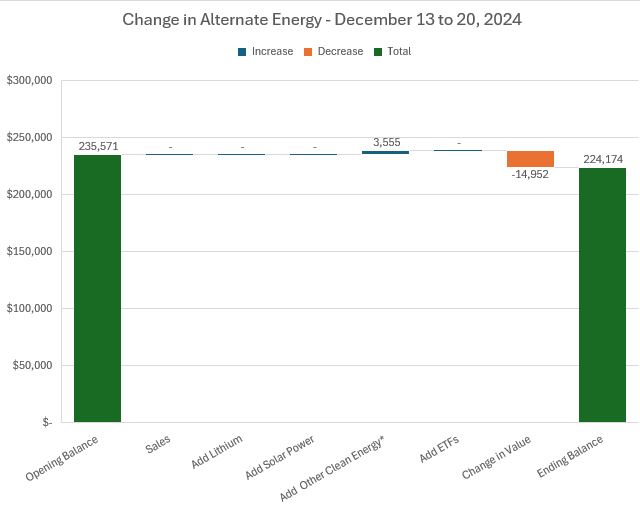

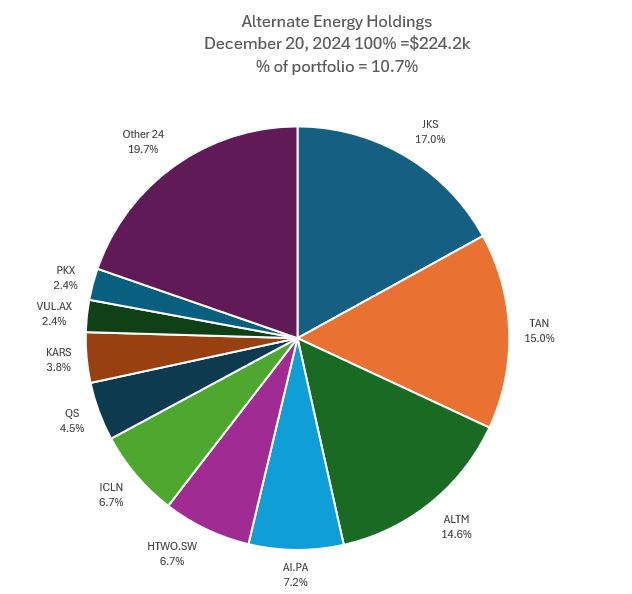

Alternate Energy Holdings

A few additions in the Other category and a 6.3% drop in overall value. Share of portfolio remains at 10.7%.

One small change in the mix of holdings with iShares Global Clean Energy ETF (ICLN) swapping places with L&G Hydrogen Economy UCITS ETF (HTWO.SW) in the middle of the pack again.

Bought

ASX uranium stocks started to take it on the nose again after a bit of resurgence the week before - averaged down entry prices in managed portfolio and scaled position size to $5k per holding.

Boss Energy Limited (BOE.AX): Uranium. Producing at Honeymoon, South Australia

Paladin Resources (PDN.AX): Uranium. Producing at Langer Heinrich in Namibia scaling back to full production

Peninsula Energy Limited (PEN.AX): Uranium. Near to producing in Lance, Wyoming. A few more months to go.

Silex Systems Limited (SLX.AX): Uranium Enrichment. Won a share of the DoE Enrichment contracts the week before via GLE.

Started to see some green shoots in the uranium sector following the Paladin news on the Fission Uranium (FCU.TO) news. That got me adding to US and Athabasca holdings in pension portfolio.

.

Uranium Energy Corp (UEC): Uranium. Producing in Wyoming and scaling up in 20265 and 2026.

Atha Energy Corp (SASK.V): Uranium. Large tenement holder in Athabasca Basin - exploring.

Aura Energy Limited (AEE.AX): Uranium. Added to holding in pension portfolio at price lower than recent placement - does irk me when existing shareholders get diluted.

Deep Yellow Ltd (DYL.AX): Uranium. Deep Yellow announced a delay in the final investment decision and an increase in reserves. Their CEO, John Borshoff is a shrewd operator - going to guess he is playing the delaying game because spot price is currently poor. Their Tumas project in Namibia is possibly the next greenfield to open - starting in 2026.

Denison Mines Corp (DNN): Uranium. Added to managed portfolio. Good reserves upgrade after this purchase was made.

Stem Inc (STEM): Battery Technology. Price has been a on the big movers list a few times - averaged down holding by doubling position size. Time to work towards the exit on a disappointing investment. Seems that the SPAC sellers took the money and ran. Since April 2021, income trades have recovered 32% of the capital losses to date - and still carrying at a loss.

Westwater Resources (WWR): Graphite Mining. Average down entry price in personal portfolio.

Gevo, Inc (GEVO): Specialty Chemicals. Assigned on sold put in pension portfolio. Trying a few different things on Gevo options as strikes are close together - buying calls, selling puts, selling covered calls. The trades to date and existing holding give a breakeven of $1.70 vs $1.52 close. Some way to go to get to profit.

Options expiry turned into a very busy assignment slate with stock prices selling of in the last two weeks - especially uranium. Have taken a more holistic approach to the sold put analysis - taking in the sold puts for the last 12 months and computing the breakeven (sold put strike less average blended put premium) and comparing that to closing price. This gives me benchmarks for writing covered calls. Have converted into a table - and can slot in new prices to decide covered call strikes.

Note: Accounting in personal portfolio is behind and just takes in the last put trade

Sold

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Assigned on covered call for 3.2% blended profit since October/November 2024.

Fiverr International Ltd. (FVRR): Internet Services. Partial holding assigned - been a long journey struggling to claw capital back - the range of losses that could be booked range for 6% to 93% before counting income trades. Going to book at LIFO loss of 11% as this has been the strategy - wrote naked puts - go to assignment and reduce average cost - claw back accounting to follow.

Pfizer (PFE): US Pharmaceuticals. With price closing at $26.36, assigned on 26.5 strike bought put. This was part of the adjustments made to recover from the trading error which resulted in a long position at $28. Triggers loss of 5.3% on the direct trade - adjustments bought the loss down to 2.3%. Time to saddle up again and aim to go short again - Joe Biden might have extended the no liability window but the Kansas Courts may not.

RTL Group S.A. (RRTL.DE): Satellite Broadcasting. 20.5% blended loss since December 2023/July 2024 in personal portfolio. One covered call written a little tight and a stock screen idea that was not saved by Paris Olympics broadcasting.

American Airlines Group (AAL): US Airline. Assigned on covered call for 1.3% loss since June 2023 - income trades recovered that easily.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

Top Ups

Beach Energy (BPT.AX): Oil. Dividend yield 2.96%.

Sold

Perenti Ltd (PRN.AX): Mining Services. Closed at 52 week high target for 25% blended profit since October/December 2023/May/July 2024. Averaging down helped.

Chart disguises some of the story as the holding came about from a merger which resulted in some high average costs for the first two entries. One would not have invested in this business at that time based on the shape of the charts to there. The move after is more convincing with price reversing on earnings and making a few cycles higher before hitting an escape point.

Expiring Options

GE Vernova (GEV): Alternate Energy. Assigned early on sold leg of 230/250 bull call spread. No worry as bought leg will go to exercise a few hours later for 8.7% profit on the stock leg and the net premium adds to that. In the managed portfolio 135 strike sold put left over from a 155/170/135 call spread risk reversal expired completing a 17.3% profit since April 2024 - not bad for a no cash down trade.

With price closing at $342.66 this feels like one that got away. The chart says just that

Lightbridge Corporation (LTBR): Nuclear Technology. A few trades expiring. With price closing at $4.66, 7/5 risk reversal expired in-the-money on the sold put (5) and 50% loss on the call premium. Was a test idea looking for price momentum to drag price above $7. Also a 7.5/10/5 call spread risk reversal expired. The sold put was kicked down the road to January expiry.

Chart shows price did race past the top of the call spread (10) before falling back and testing the sold put (5)

Energy Fuels Inc (UUUU): Uranium. With price closing at $5.30, 7/8/6 call spread risk reversal expired in-the-money on the sold put (6). The trade itself was cash positive but there is now a stock holding. This assignment is included in the breakeven numbers in the table above.

Chart shows price had only 3 goes at crossing the bought call level (7) and sagged below the sold put level (5) into expiry. With breakeven at $5.30 and $5.56, this does not fee too scary an entry.

NuScale Power Corporation (SMR): Nuclear Technology. With price closing at $19.77, 17.5 strike sold put expired. This is part of a 17.5/22.5/17.5 call spread risk reversal in which the sold puts have been rolled each month to ramp up the potential return.

Chart shows a challenging journey for the first half of the trade with an explosion taking the spread over the top - decided not to close out then as there is too much time value to buy back. Tricky choice now about continuing the funding - stick with 17.5 and risk getting assigned or go lower - say below the higher low on the last cycle

Hedging Trades

Coeur Mining (CDE): Silver Mining. Added to holdings in managed portfolio

Cryptocurrency

Polkadot (DOTETH): Made an entry one bar after buyer bar tested down to the 50 day moving average (red line). Could argue that the level of the prior entry (left hand blue ray) is a support level. Quite happy to enter around these levels as there is 50% headroom to the previous highs.

The Graph (GRTETH). Chart looks similar with pullback and potential of a reversal about the level of the prior entry (left hand blue ray) and making a higher low.

Income Trades

77 covered calls went to expiry across 4 portfolios of which only 4 were assigned - assignment in brackets (UK 8 (1) Europe 11 (1) US 56 (2) Canada 2)

46 naked puts went to expiry with 20 assignments (UK 5 Europe 10 (4) US 31 (16)). This is a higher number of sold puts written as the portfolios were holding strong cash reserves this last month.

Naked puts sold at price happy to hold the stock

- American Airlines Group Inc. (AAL): US Airline. Return 1.21% Coverage 2.5% - not bad for 5 days risk

- Uranium Royalty Corp (UROY): Uranium. Return 2% Coverage 11%

- Denison Mines Corp (DNN): Uranium. Return 1.5% Coverage 1.5% - - not bad for 4 days risk - did get assigned

Naked puts sold on stock likely to be assigned

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 1.9% Coverage 3.2%

ASP Isotopes Inc (ASPI): Nuclear Technology. Meant to roll 6 strike sold put to January to strike 5. Did get the sold put right but not the buy back. Bought a 6 strike call option - not a good day for price to drop from $5.90 open to close at $5.45 - other than the buy back of the 6 strike sold put will be better. Pricey trading error with price closing below sold strike. Did roll the sold put for 175% loss on buy back. 19% cash positive.

Kicked a few sold puts down the road - duplicates from different portfolios

- Lightbridge Corporation (LTBR): Nuclear Technology. 14% loss on buy back. 58% cash positive.

- Lightbridge Corporation (LTBR): Nuclear Technology. 41% profit on buy back. 76% cash positive - rolling out on a call spread risk reversal that will not go in-the-money.

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 60.3% profit on buy back. 60% cash positive - down a strike

- CleanSpark, Inc. (CLSK): Bitcoin Mining. 62.9% profit on buy back. 60% cash positive - one tranche from call spread risk reversal

- Commerzbank AG (CBK.DE): German Bank. 9.4% loss on buy back. 71% cash positive.

- VanEck Gold Miners ETF (GDX): Gold Mining. 31% profit on buy back. 58% cash positive - down a strike

Credit Spreads

Added two new credit spreads

- Agnico Eagle Mines Limited (AEM): Gold Mining. ROI 21.8% Coverage 2.2% - hedging trade in managed portfolio

- GE Vernova Inc. (GEV): Alternate Energy. ROI 23.2% Coverage 7.4% - replacing trade that expired.

Applied Materials (AMAT): US Semiconductors. Assigned early on sold leg. Sold the bought leg for 7.7% loss rather than get exercised out the trade. TheStreetPro has this stock in their buy list and breakeven is only 1.6% above close.

Credit spreads expiring out-the-money - i.e., profitably.

- Robinhood Markets, Inc. (HOOD): Financial Markets. ROI 50.8%

- Elastic N.V. (ESTC): AI Software. ROI 54.1% - TSP idea

- Honeywell International Inc. (HON): US Industrial. ROI 27.2% - embedded uranium enrichment in there.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

December 16-21,2024

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.