A week of drift for US markets and down for uranium. Makes a good time to take profits in a few targeted areas and cherry pick some ASX uranium.

Portfolio News

In a week where S&P 500 dropped 0.6% and Europe dropped 1.3%, my pension portfolio dropped 2.08%. Drags were CleanSpark (CLSK) down 19.7% on sliding Bitcoin price, a bunch of US and Canadian uranium stocks, and large ticket holdings like Fiverr (FVRR) and Advanced Micro Devices (AMD). Bright spots were ASX uranium stocks (surprisingly), a few stocks in Europe which ended positive

Big movers of the week were AXP Energy (AXP.AX) (100%), New Frontier Minerals (NFM.AX) (72.7%), Loop Industries (LOOP) (40.9%), 3D Systems Corporation (DDD) (36.9%), VHM Limited (VHM.AX) (16.5%), Bannerman Energy (BMN.AX) (11.1%), Bayhorse Silver (BHS.V) (10%)

The fact there are only 7 stocks in the big movers list tells a lot about the week in markets. 3 of the 7 had big news items. New Frontier Minerals (NFM.AX) completed sale of copper interests in Mt Isa, Queensland and focused in on uranium, niobium, and rare earth mineralisation in Harts Range, Northern Territory. Not quite what the investment thesis was at the start - cobalt and copper.

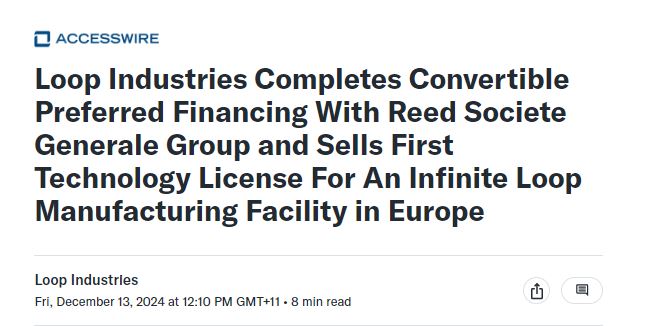

Loop Industries (LOOP) completes convertible preferred financing and sells first technology license for an infinite loop manufacturing facility in Europe

https://finance.yahoo.com/news/loop-industries-completes-convertible-preferred-011000248.html

And 3D Systems (DDD) sells one of its software business arms - been a long road investing in this - might get my investment out.

US markets were in drift mode with a few bright spot days - but the headline writers were onto the longest losing streak from the Dow since 2020. All in the same week that Nasdaq traded over 20,000 for the first time. It is now all eyes on the Federal Reserve meeting this coming week

Crypto Grows

Bitcoin price hesitated around the $100k mark, dropped of a bit and pushed to another all time high ending the week 6.4% higher with a trough to peak range of 12.7%

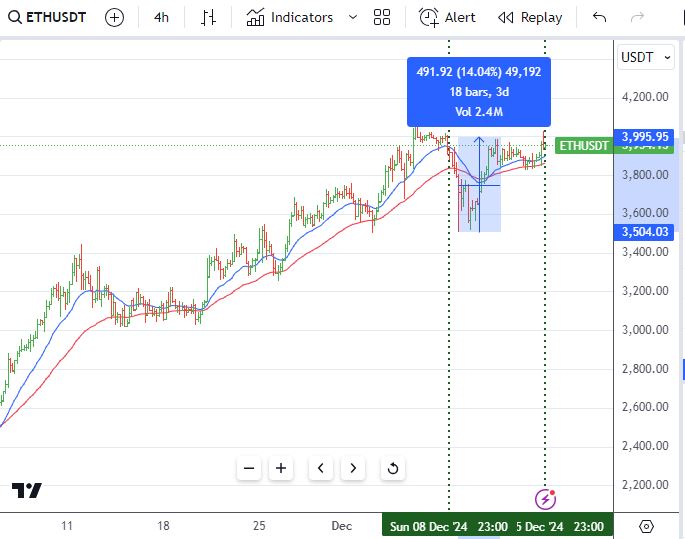

Ethereum price dropped from the outset and made a lower low (on 4 hour chart) before finding buyers ending the week 0.8% higher with a trough to peak range of 14%

Aave (AAVE) continued the momentum of the week before with a bit more vigour with a pop of 76% and giving about one tenth away.

Chainlink (LINK) dropped quite hard to start hr week and then popped 58% to start a new consolidation zone above the previous highs (also on 4 hour chart)

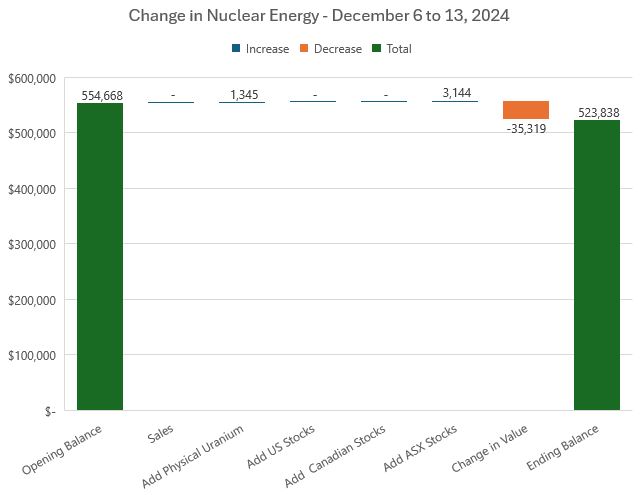

Nuclear Energy Holdings

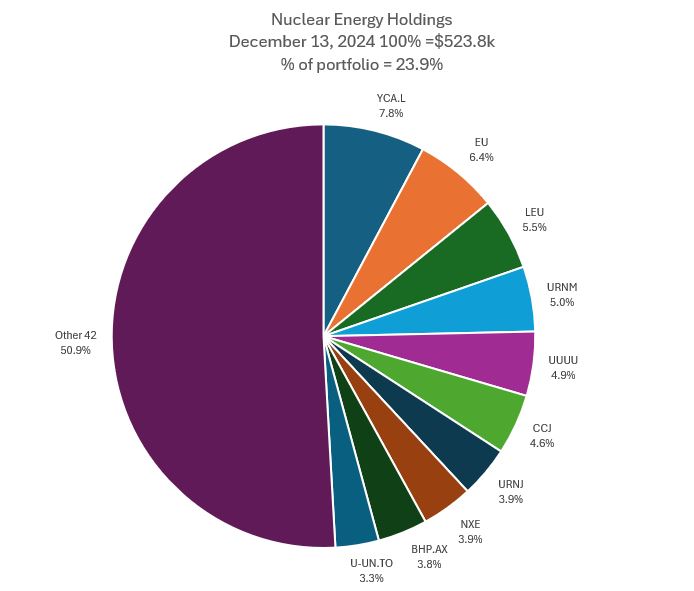

A few additions in the week in physcal uranium and on the ASX stocks. The notable story of the week is 6.4% drop in value - especially driven hard down in nuclear technology stocks.

A few changes in the mix of holdings with Energy Fuels (UUUU) and Sprott Uranium Miners (URNM) swapping places and Sprott Physical Uranium Trust (U-UN.TO) coming into Top 10 displacing IsoEnergy (ISO.TO). Total share of portfolio drops by 0.6 points to 23.9% with uranium dropping harder than portfolios

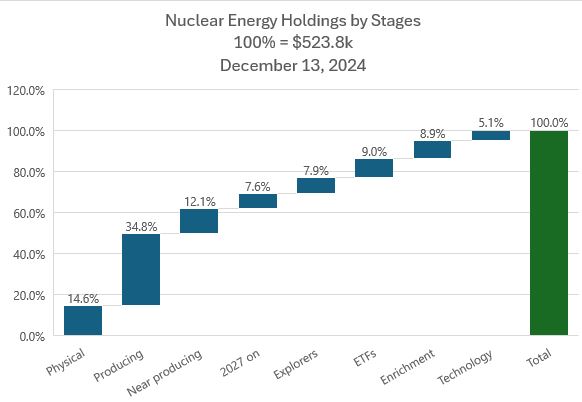

Additions in the week increase the relative share of physical and producing by 0.6 percentage points. Explorers o up by 0.3 percentage points

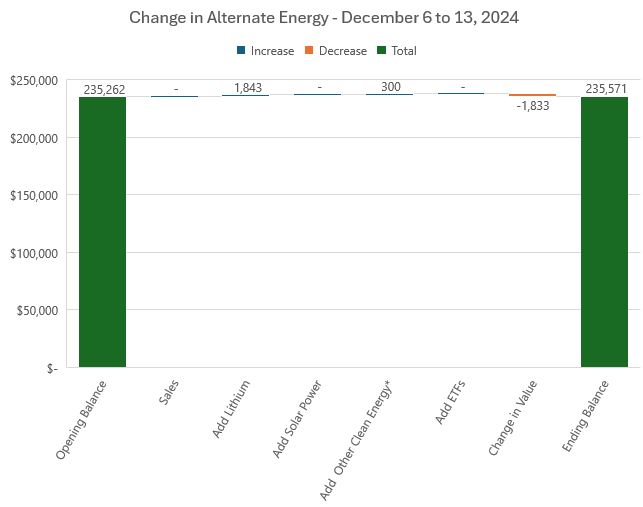

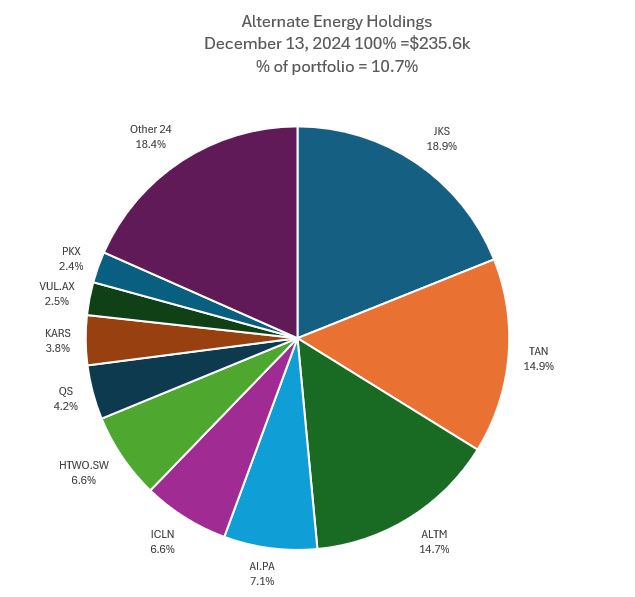

Alternate Energy Holdings

A few additions to alternate energy holdings some via share placements or rights offers. Valuations drop by 0.8% only

Little change in the mix of holdings with a small uptick in portfolio share and iShares Global Clean Energy ETF (ICLN) swapping places with L&G Hydrogen Economy UCITS ETF (HTWO.SW) in the middle of the pack. And Posco (PKX) comes into Top 10 displacing Leo Lithium (LLL.AX). ASX has confirmed that Leo Lithium will not be allowed to relist but there is progress happening with first capital payment from the sale of the Mali lithium mine slated for delivery end of January 2025. Obstacles have also been cleared for Leo Lithium to repay Firefinch (FFX.AX - also suspended) shareholders.

Bought

Yellow Cake plc (YCA.L): Uranium. The uranium ETFs sold off holdings to fund upcoming dividends - that hit prices a bit - perfect time to average down entry price - cannot help myself.

POSCO Holdings Inc (PKX): Korean Steel. Declaration of martial law in South Kore hit stock prices of Korean stocks. The blocking of that ruling by courts and subequent impeachmnt and blocking of that reopens the door to more normal stock moves. Averaged down entry price in personal portfolio.

Westwater Resources (WWR): Graphite Mining. Averaged down entry price in personal portfolio with a small addition - this feels like it needs quit a bit of DCA attention.

Boss Energy Limited (BOE.AX): Uranium. Topped up position size. Boss Energy has been under strong selling pressure with one of the pension funds reducing their holding to below substantial holder size and also facing a short selling campaign. Short squeeze is a distinct possibility.

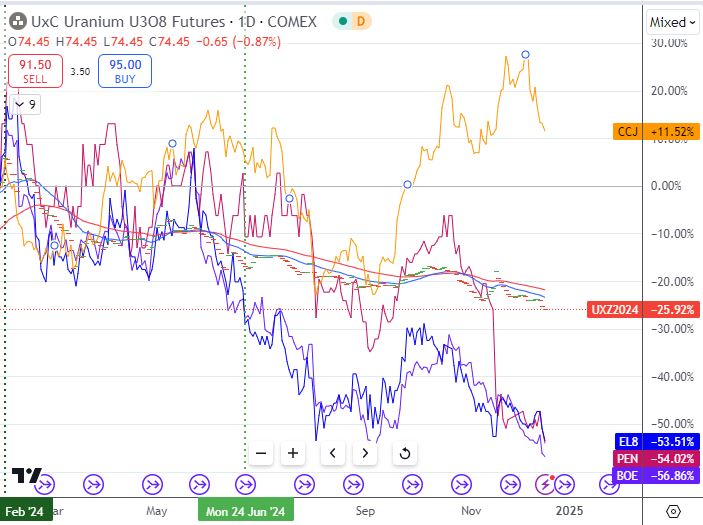

Uranium stocks on the ASX have been under-performing other markets. Seems that investors are preoccuppied with the spot price. Added two more laggards on the back of news. The comparative chart shows Uranium U3O8 futures (the bars) against the 3 stocks bought and goes back to February 2024 - the high point for spot in this cycle. For reference have included Cameco Corporation (CCJ - yellow line). These trades are all about closing the gap to futures price and then to Cameco (CCJ) once spot starts to move.

Elevate Uranium Ltd (EL8.AX): Uranium. High grade uranium tenements at low depth in Namibia. Increased resource estimate was the news.

Peninsula Energy Limited (PEN.AX): Uranium. Reopening Lance project in Wyoming.

A few placements to catch up on reporting - the good news is some of these have options attaching. Many investors sell the stocks and hold on to options until exercise time - might do the same myself. The challenge is believing some of the exercise strikes.

Pantera Minerals Limited (PFE.AX): Lithium.

Lithium Universe Limited (LU7.AX): Lithium. $0.3 strike Jan 2026 - placement price $0.012

AML3D Limited (AL3.AX): 3D Printing.

Sold

Beamtree Holdings (BMT.AX): Health Information Services. Closed at 52 week high for 45% profit since May 2019. Idea from a friend who was working in healthcare information at the time. Out of patience.

American Rare Earths (ARR.AX): Rare Earths. Trimming position size for 1700% profit since February 2020.

Mithril Resources (MTH.AX): Silver Mining. Trimming position size for 125% profit since June 2024. Next Investors idea

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Inghams Group Limited (ING.AX): Food Products. Dividend yield 5.06%

A second time around for this stock in the portfolio - trading is characterised by huge gaps on earnings. The last two were down. The one before was a big gap up - would not be surprised to see a gap up as the seasonality plays out. This time in 2023 was three legs higher. There is a comfortable 52 week high profit around those early 2024 highs

Fortescue Ltd (FMG.AX): Iron Ore. Dividend yield 10.11%. This feels like a long hold needed. This is a China trade as Fortescue is 3rd largest ASX listed iron ore exporter

Chart shows price breaking the downtrend and trading sideways a bit before dropping down to make a higher low - the short term trend is the hope for another cycle higher.

Sold

Regis Resources Ltd (RLL.AX): Gold Mining. Closed at profit target at 52 week high for 47% blended profit since November 2022/April/October 2023/April 2024. Been holding off putting on the sell order as gold kept pushing higher. Needed to raise capital to fund next month's auto-invest.

Chart shows price finally catching up with the SPDR Gold Trust (GLD) since the 2022 low cycle. Chart also shows the challenge of the strategy model. Let hand two entries (the blue rays) were in rising parts of the cycle and held the line for a bit before falling over. The value of averaging down on the same signals is shown with the last entry in the first leg up. There were no new entries after that as the strategy says no entries when price is close to 52 week high.

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. Converted the in-the-money sold put (28) to a 28/26.5 credit spread by buying a 26.5 put with the same expiry. This caps the maximum loss to $1.50 per contract. If price rises above $26.50 at expiry but not as far as $28, the loss is the size of the premium. Did fund part of the bought premium by selling a ratio put further out-the-money.

The error continued a bit earlier than planned with the sold put (28) getting assigned early. With price closing at $25.37 (Dec 12) this caps the loss at $300 and will end as a marginally profitable trade. Overall the short trade has been hugely profitable - too bad about this trading mistake.

Cryptocurrency

Solana (SOLETH). Solana surged at the same time Bitcoin did and then gave it all back relative to Ethereum. Put in a buy order against the trend based on the short term support level forming (the yellow ray). Too bad that it may not hold there with the next support level a little lower between 0.055 and 0.050

Aave (AAVEETH). With the surge in price noted last week, pending order taken out for 50% profit since September 2024. Aave has been a useful trading counter with 3 wins in the last 6 months.

Income Trades

A few covered calls written - only 5 - normal for the week before next expiry (Europe 2 US 3) and with most of the adds for the week not having options markets

Naked Puts

Sold a few naked puts on stock happy to own at lower prices

Denison Mines Corp. (DNN): Uranium. Return 1.25% Coverage 9.5%

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 0.69% Coverage 8.7% - average after scaling in

NexGen Energy Ltd. (NXE): Uranium. Return 2.14% Coverage 3%

Pan American Silver Corp. (PAAS): Silver Mining. Return 1.76% Coverage 10%

Cameco Corporation (CCJ): Uranium. Return 1.78% Coverage 2.6%

Pfizer (PFE): US Pharmaceuticals. Return 0.48% Coverage 3% - did this to fund the recovery trade (see above)

Rolled out a few sold puts that could go to assignment

- DHL Group (DPWA.DU): Europe Logistics. 1.4% profit on buy back. 42% cash positive

- Elevance Health (ELV): US Healthcare. 19% loss on buy back. 60% cash positive

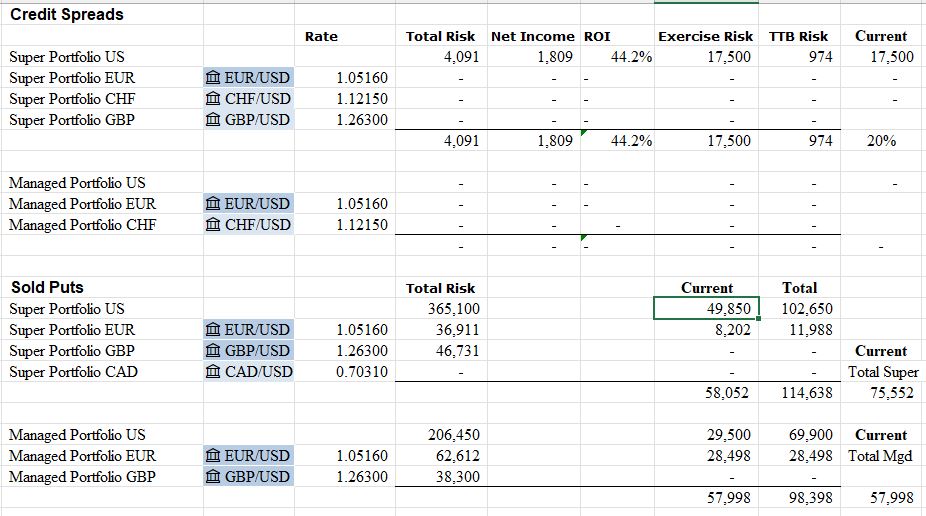

Credit Spreads

No new spreads

Exercise risk is creeping up in pension portfolio but is within margin levels. Could do with an up week next week to nudge a few of these back out-the-money

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

December 9-13,2024

#hive #posh

Just out of curiosity, ever thought about investing in weapons factories shares?