A quiet week through the holidays with a few changes in uranium and European banks. Also did some breakout trades.

Portfolio News

In a week where S&P 500 rose 1.18% and Europe rose 1.84%, my pension portfolio dropped 0.66%. All of that drop came from transferring cash out to pay pensions and the bean counter. Without that the rise would have been 0.53%. Drags this week - uranium and a few nuclear technology stocks. Examples ASP Isotopes (ASPI) down 33% and Nano Nuclear Energy (NNE) down 17.8%

Big movers of the week were AXP Energy (AXP.AX) (100%), EML Payments (EML.AX) (51.8%), Resource Development Group (RDG.AX) (28.6%), Castillo Copper (CCZ.AX) (20%), Titan Minerals (TTM.AX) (20%), Mayne Pharma Group (MYX.AX) (13.8%), Guzman y Gomez (GYG.AX) (12.7%), Bayhorse Silver (BHS.V) (11.1%), Hercules Metals (BIG.V) (10.9%)

A short list of only 9 stocks in the big movers list of which 7 were on ASX and 2 in Canada. Clearly the US went to sleep for the holidays. Hard to big any themes other than there were two silver exploration companies in there.

A short week with the Thanksgiving holiday interrupting the flow of things but it did not interrupt the flow of record highs on US markets. The headlines point to that flow BUT they also highlight the nerves outside the US. With Trump talking up tariffs, there is good reason to be a little nervous.

Crypto booms

Bitcoin price backed off from the all time highs for a few days and then recovered ending 0.8% lower for the week with a peak to trough range of 8%

Ethereum price tracked a bit sideways before getting the upward moving again ending 8% higher with a trough to peak range of 15%

Ripple (XRP) accelerated the move from the week before with a 92% pop and still going. Good riddance, Gary Gensler

Algorand (ALGO) popped 100%

Waves (WAVES) popped 55%

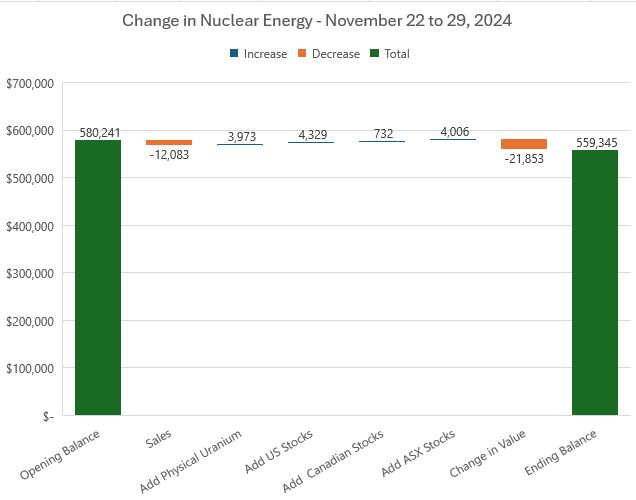

Nuclear Energy Holdings

A few small changes in holdings in the week with sales greater than new additions. Overall value of the portfolio declined by 3.7%

Small change in mix of holdings with Centrus Energy (LEU) and Cameco Corporation (CCJ) changing places. Nano Energy (NNE) drops out the Top 10 replaced by BHP Group (BHP.AX). The overall share of Others drops below 50% with the sale of Denison Mines (DML.TO) Canadian holdings. Share of portfolio drops from 25.6% to 24.8%

Subtle changes in the holdings by stage from the additions and the sales. Physical goes up by half a point - not value driven. producing goes up by half a point - value driven. 2207 on comes down 1.7 points - sale of Denison Canadian listing.

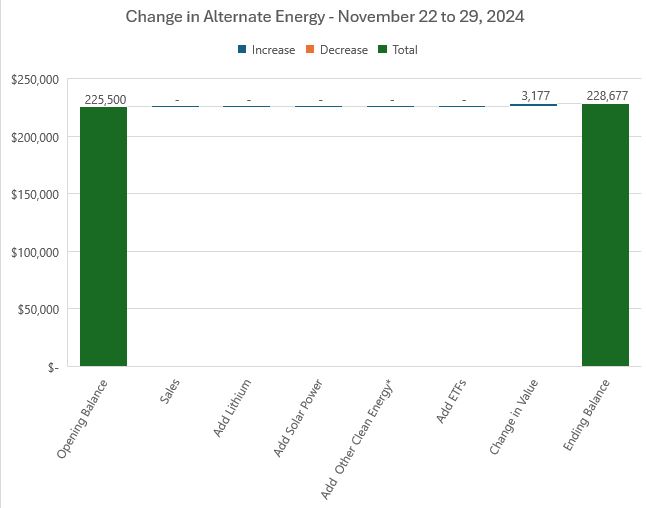

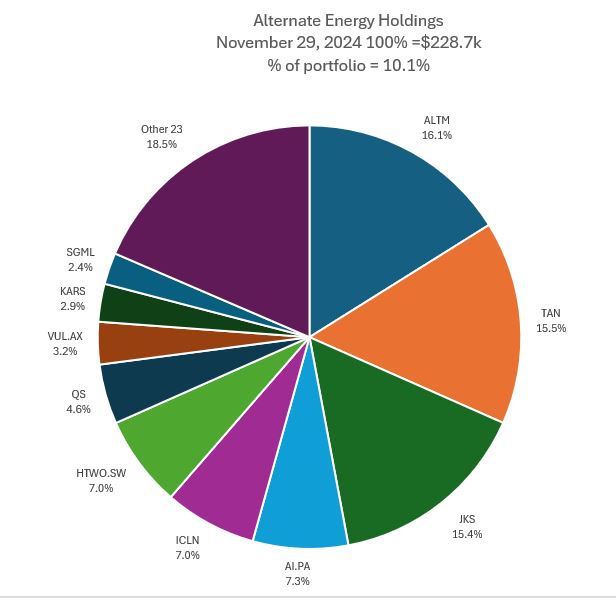

Alternate Energy Holdings

No changes in holdings but portfolio value did rise by 1.4%

Mix of holdings changes with Invesco Solar ETF (TAN) moving up one place to take over slot 1. Arcadium Lithium (ALTM) drops two places to slot 3. Sigma Lithium (SGML) comes into Top 10 displacing Posco (PKX). The most frustrating holding is Arcadium Lithium (ALTM) subject to takeover by Rio Tinto (RIO.AX) with a completion date in mid 2025 - price will not move with that to come so far ahead in time. Overall share of portfolio value creeps up 0.2 points to 10.1%

Bought

Star Minerals Limited (SMS.AX): Uranium. Took up rights offer in personal portfolio at steep discount to market (price then went down there anyway)

Commerzbank AG (CBK.DE): German Bank. Price dipped on news that Unicredit (UCG.MI) made a takeover bid for Banco BPM S.p.A. (BAMI.MI) and would defer any further additions to the Commerzbank stake until after integration is complete. Added a parcel in personl and managed portfolios. Dividend yield 2.28%. Wrote covered call for 1.04% premium with 6.7% price coverage.

Denison Mines Corp (DNN): Uranium. Started the process of switching from Canadian listing to US listing to be able to write covered calls. Put pending order to sell at 52 week high in Canada but bought the US parcels straight away. Idea is to reinvest the profits rather than the whole holdings.

Atha Energy Corp (SASK.V): Uranium. Atha announced encouraging drill results. With positive news on Athabasca basin permitting from Nexgen (NXE) and Denison Mines (DNN) put in a pending order at Friday close (Nov 22). The selloff Monday pulled price back from what I thought would be a bounce up start to the week.

Uranium Royalty Corp (UROY): Uranium. Scaled in in personal and managed portfolio. Uranium Royalty is well leveraged to spot uranium price and has 9 projects which will earn royalties - traction in Athabasca will be a big lever here.

Lotus Resources (LOT.AX): Uranium. Receieved allocation of shares in rights offering in pension and managed portfolios - paid above the closing price of $0.235 per share - the price of being lazy - paid an extra $140 twice over.

Unicredit SPA (UCG.MI): Italian Bank. Pretty clear the market does not like the Banco BPM (BAMI.MI) bid with price dropping 7.5% on the week.

The contrarian investor was happy to grab some of the discount Dividend yield 7.52% - too bad ex date was last week. That will account for some of the drop in price.

Ran stock screens across all markets and added a few stocks - mostly in businesses previously invested in. Focus was on breakout charts

Rentokil Initial plc (RTO.L): Specialty Business Services. Dividend yield 2.20%. Wrote covered call for 1.5% premium with 6% price coverage.

Weekly chart looks like the business seems to have lost its way since the run up from 2016 to 2022 and broken down to the halfway mark to the lows.

The daily chart shows price has made a strong reversal - the worrying part is that reversal has happened below the parallel channel - the risk is that channel becomes a resistance level on the rise higher.

Halliburton Company (HAL): Oil Services. Dividend yield 2.13%

Weekly chart shows price has broken down from the early 2024 highs and reversed on the 2023 lows.

The daily chart shows price is a bit more convincing break of the downtrend and a triple bottom reversal. Profit target of 25% achievable at the recent highs.

WhiteHawk Limited (WHK.AX): Cybersecurity. Took up chance to subscribe to private placement for this cybersecurity business. TheStreetPro are invested in the First Trust NASDAQ Cybersecurity ETF (CIBR).

Did the price comparison chart against that and took up the opportunity - the gap between the two is 248 percentage points - close half that makes a substantial profit. Even more if price goes halfway to the 2021 peak.

Sold

Denison Mines Corp (DML.TO): Uranium. Pending order hit in managed portfolio for 68% blended profit since June 2023/February 2024. Pending order hit in personal portfolio for 114% blended profit since June 2023. This now closes out Canadian listing for Denison - replaced partly with US listing.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots

New Buys

Collins Foods Ltd (CKF.AX): Restaurants. Dividend yield 3.28%

2nd time holding the stock. Chart shows price fell over not long after the last exit (red ray) and has broken the downtrend which reversed about the same level as the July 2024 lows. Comfortable 40% profit target before the previous highs.

Top Ups

EML Payments Limited (EML.AX): Payments.

Chart shows price has been tracking sideways and a slight downtrend since the middle of 2023. Business is challenged - it offers reloadable cards, gift cards and cards services for things like buy now pay later - all competitive industries. Plenty of scope to make a 40% profit well below the previous highs.

Hedging Trades

Coeur Mining (CDE): Silver Mining. Added to silver mining holdings in pension portfolio as silver price pulls back a bit.

Income Trades

A quiet week with 12 covered calls written across 3 portfolios (UK 2 Europe 3 US 5 Canada 2)

Naked Puts

Puts sold on stocks happy to hold at lower entry points

- Rolls-Royce Holdings (RR.L): Aerospace/Defense. Return 1.39% Coverage 5.6%

- The Trade Desk (TTD): Digital Media. Return 1.03% Coverage 9.6%

- Centrus Energy Corp (LEU): Uranium Enrichment. Return 3.61% Coverage 26.3%

- ABN AMRO Bank (ABN.AS): Dutch Bank. Return 1.38% Coverage 2.5%

- Denison Mines Corp (DNN): Uranium. Return 1.5% Coverage 20%

- Nokia Oyj (NOK): Network Equipment. Return 1.75% Coverage 5.5%

- Marvell Technology (MRVL): US Semiconductors. Return 3.13% Coverage 9.1%

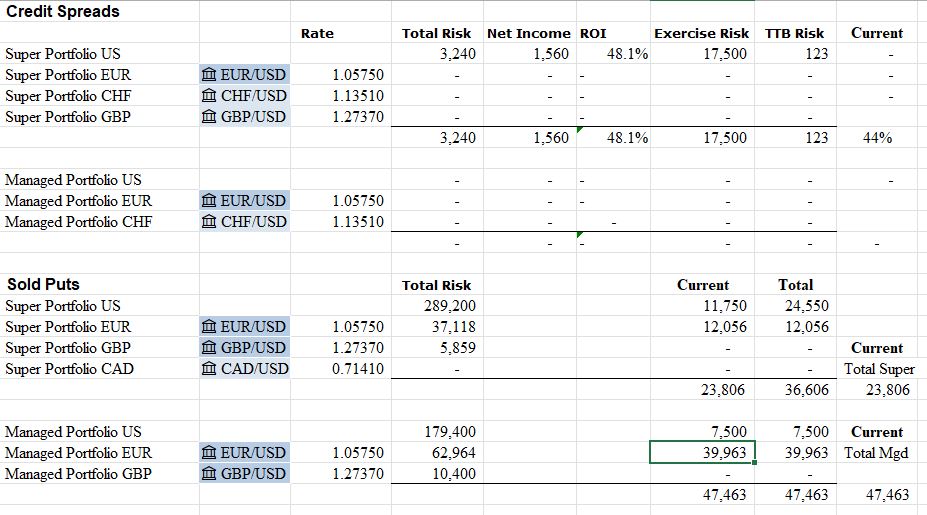

Credit Spreads

No changes in credit spreads. Pfizer (PFE) will trade through the bottom at Dec 6 expiry.

Exercise risks across the portfolios are in control. Looks like there will be some stocks bought in Europe in personal and managed portfolios - mostly in banks.

Currency

Australian Dollar (EURAUD) Sold Euros to fund pension payments and upcoming accounting bills. Sliding Aussie Dollar takes some of the pain away.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

November 25-29,2024

#hive #posh

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

At present the market cycle has changed and we are seeing that the price of everything is going up. If it is in profit, profit should be obtained in all circumstances.

This message tells me it is time to hedge and/or book profits

If five to 10x is done, then I have to say here that profit must be taken.