A massive week with a run in nuclear technology and uranium and an active options expiry cycle

Portfolio News

In a week where S&P 500 rose 0.86% and Europe dropped 0.16%, my pension portfolio rose 1.31% not including a massive increase is cash from sale proceeds. Positives came from nuclear technology and uranium and gold/silver mining especially in Canada. Drags were lithium stocks on ASX, De Grey Mining (DEG.AX), Japan and in the US falls in Coty (COTY) on earnings, Fiverr (FVRR), solar power and Posco (PKX).

Big movers of the week were Lightbridge (LTBR) (121%), Centrus Energy (LEU) (65.8%), Gevo, Inc (GEVO) (51.9%), Oklo Inc (OKLO) (44.2%), Solis Minerals (SLM.AX) (43.7%), ASP Isotopes (ASPI) (40.3%), NuScale Power (SMR) (38.6%), CleanSpark (CLSK) (34.1%), Honey Badger Silver (TUF.V) (29.4%), GoviEx Uranium (GXU.V) (25%), Kairos Minerals (KAI.AX) (25%), Denison Mines (DNN) (24%), Energy Fuels (UUUU) (23.7%), Stroud Resources (SDR.V) (23.1%), NANO Nuclear Energy (NNE) (22.9%), Anfield Energy (AEC.V) (22.7%), Regis Resources (RRL.AX) (22.7%), Standard Uranium (STND.V) (22.2%), Stuhini Exploration (STU.V) (20.8%), Uranium Energy Corp. (UEC) (19.3%), NexGen Energy (NXE) (17.3%), GoGold Resources (GGD.TO) (16.6%), Uranium Royalty Corp. (UROY) (16%), Global Uranium and Enrichment (GUE.AX) (15.8%), Bank of Queensland (BOQ.AX) (14.5%), Global Atomic Corporation (GLO.TO) (13.8%), Sprott Junior Uranium Miners ETF (URNJ) (13.6%), Silex Systems (SLX.AX) (13.4%), Cameco Corporation (CCJ) (13%), Aura Energy (AEE.AX) (12.9%), Ur-Energy (URG) (12.7%), IsoEnergy (ISO.TO) (12.6%), Bayhorse Silver (BHS.V) (12.5%), Atha Energy (SASK.V) (11.9%), Titan Minerals (TTM.AX) (11.7%), Global X Uranium ETF (URA) (11.5%), Dawson Geophysical Company (DWSN) (11.5%), CanAlaska Uranium (CVV.V) (11.4%), Baselode Energy (FIND.V) (11.1%), Zinc of Ireland (ZMI.AX) (11.1%), Coeur Mining (CDE) (11.1%), American Airlines Group (AAL) (11%), Insignia Financial (IFL.AX) (10.4%), Canopy Growth Corporation (WEED.TO) (10.3%), Sprott Uranium Miners ETF (URNM) (10.3%), Northern Dynasty Minerals (NAK) (10.3%), Hecla Mining (HL) (10.3%), Skyharbour Resources (SYH.V) (10.1%), Mithril Silver and Gold (MTH.AX) (10%)

A big list of 49 stocks moving more than 10% in the week - 2nd largest list since starting doing this. The big themes for the week from the top - nuclear technology (6 stocks - all that are held), alternate energy (1 stock), battery metals (4 stocks), uranium and uranium enrichment (23 stocks), gold/silver mining (9 stocks). There are a few surprises - 2 ASX financial services stocks and an American airline and Bitcoin mining

Market news looks like a market looking for reasons to be nervous - down on a whiff on news, push to a record, slide a bit, close at a record. Was the perfect type of week going into options expiry - not racing away but closing up.

Crypto Drives Ahead

Bitcoin price was not interested in the drifting and moved higher all week ending 7.3% higher with a trough to peak range of 8.5%

Ethereum price did the same all week ending 8.5% higher with a trough to peak range of 9.5%

Litecoin (LTC) raced out the gates with a run of 16% before giving some back.

Uranium Holdings

There has been a flow of news about the deployment of SMRs to power AI data centres. None of that was really moving the needle until these two announcements hit - concrete deals with names and addresses and timelines. The whole sector exploded (Oct 16)

The SMRs will be the Xe-100 design, a high-temperature gas-cooled reactor developed by X-energy, a global leader in advanced nuclear reactor and fuel technology. Each Xe-100 module can provide 80 megawatts of full-time electricity. Energy Northwest and X-energy have engaged extensively on plans for an Xe-100 facility since 2020.

X-Energy Reactor Company, LLC (“X-energy”), a leader in advanced nuclear reactor and fuel technology, today announced a Series C-1 financing round of approximately $500 million, anchored by Amazon.com, Inc. (“Amazon”). The investment will help meet growing energy demands by funding the completion of X-energy's reactor design and licensing as well as the first phase of its TRISO-X fuel fabrication facility in Oak Ridge, Tennessee.

In Virginia, we’ve signed an agreement with utility company Dominion Energy to explore the development of an SMR project near Dominion’s existing North Anna nuclear power station. This will bring at least 300 megawatts of power to the Virginia region, where Dominion projects that power demands will increase by 85% over the next 15 years.

https://www.aboutamazon.com/news/sustainability/amazon-nuclear-small-modular-reactor-net-carbon-zero

New nuclear clean energy agreement with Kairos Power

To accelerate the clean energy transition across the U.S., we’re signing the world’s first corporate agreement to purchase nuclear energy from multiple small modular reactors (SMR) to be developed by Kairos Power.

Meanwhile down under

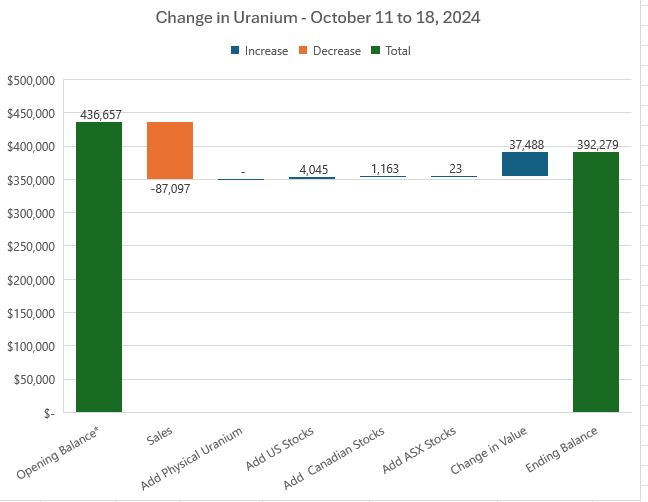

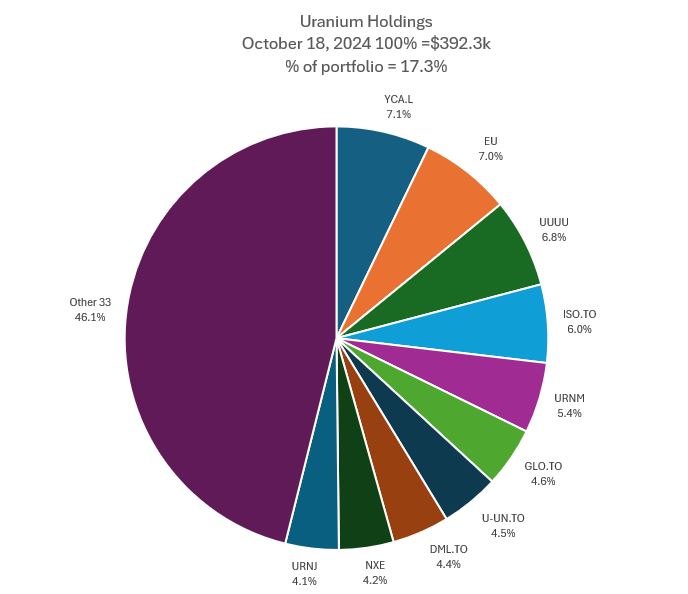

The burst of uranium prices dragged a lot of stocks to assignment with good profits and brings the share of portfolio down a whole 2 percentage points to 17.3%. The overall change in value was 8.6%

Massive changes in the mix of holding with the assignments. New leader is Yellow Cake (YCA.L). Encore Energy (EU) moves up 2 slots to #2. Energy Fuels (UUUU) goes up 3 places. IsoEnergy (ISO.TO) goes up 3 places. Sprott Uranium Miners (URNM) goes up 4 places. Global Atomic (GLO.TO) rockets into the Top 10 in slot 6. Sprott Physical Uranium (U-UN.TO returns into slot 7. Denison Mines (DML.TO rises two places. Fallers after sales are NexGen (NXE) in slot 9 and Sprott Junior Uranium Miners (URNJ) in slot 10. Share of Other falls over 2 percentage points and has 2 fewer stocks - sales made.

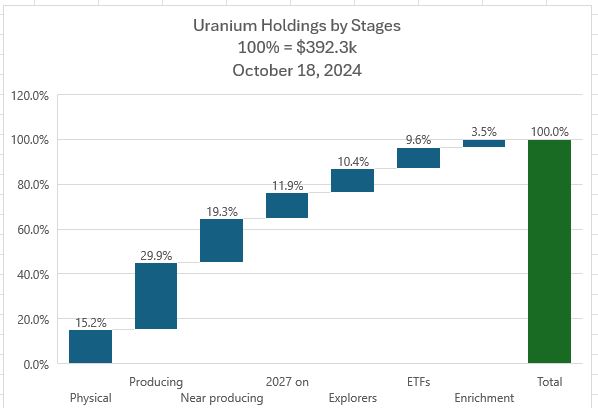

Holdings by stage reflects the assignments and the additions. Share of ETFs drops over 6 percentage points. Share of producing and near producing goes up 4.3 percentage points with additions but mostly in value gorwth - this is where the leverage is. Explorers are also up near 2 points. Enrichment drops with the sale of Centrus (LEU).

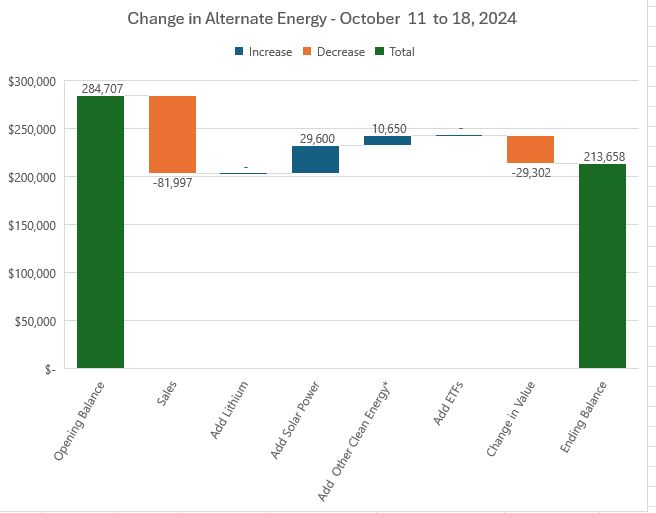

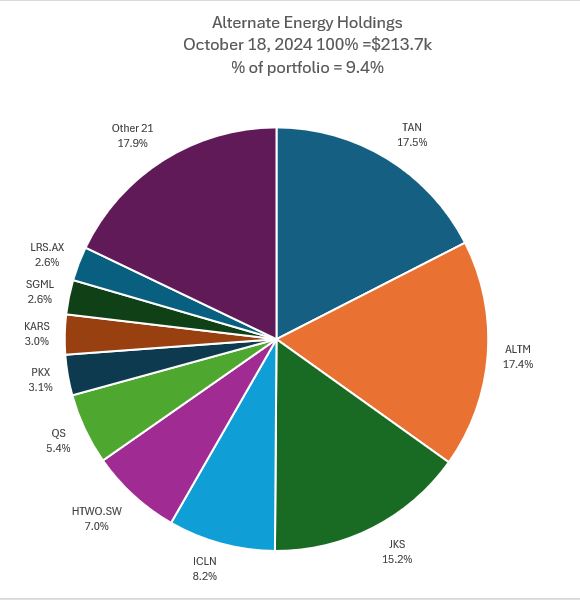

Alternate Energy Holdings

Alternate energy holdings had massive changes with the assignments closing out lithium holdings and adding in solar and battery charging stocks at losses in valuation. Overall decline in value was 10.3% - time did come to take the losses in lithium. The trade strategy is to rebuild using call spread risk reversals. Overall share of portfolio comes down a massive 3 points.

The mix of holdings reflects the changes. Invesco Solar (TAN) takes over slot 1 after Global X Lithium (LIT) was assigned in two portfolios. Addtion to JinkoSolar (JKS) pushes it up one slot to #3. iShares Clean Energy ETF (ICLN) rises one slot to slot 4. All others (5, 6, 7, 8) move up a slot but keep the same ranking. Sigma Lithium (SGML) makes a first entry to slot 9.

Bought

Koonenberry Gold Limited (KNB.AX): Gold Exploration. Read announvement that portfolio holding, Global Uranium and Enrichment Limited (GUE.AX) had sold Enmore gold assets to Koonenberry to form one of the largest NSW gold explorers for stock. At the same time Koonenberry completed a capital raise with a major shareholder extending their holding. A few things running - happy to to be investing in a geographically focused gold explorer when gold prices are rising and to see a uranium holding focus its efforts on the Tallahassee uranium project.

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. The move in nuclear sentiment flowed through to take share price past covered call strike. Bought a replacement parcel at 0.98% premium. Will recover that with one covered call. Did try to write naked puts - could not get hit. Wrote covered call for 0.63% premium with 15.2% price coverage.

enCore Energy Corp (EU): Uranium. Scaled into holding in pension portfolio

NANO Nuclear Energy (NNE): Nuclear Technology. Scaled into holding in pension portfolio on the Amazon news

Oklo Inc (OKLO): Nuclear Technology. Oklo designs and develops fission power plants to provide reliable and commercial-scale energy to customers in the United States. It also provides used nuclear fuel recycling services. New entry on a tweet and Amazon news

Gevo, Inc (GEVO): Specialty Chemicals. With price opening at $2.90 (Oct 17) 2 strike covered calls will go to assignment. Do have a November 2/1.5 risk reversal open which will replace the stock assigned if price stays this way. Price momentum on these types of stocks is positive - added a December expiry 3/2 risk reversal. Used a ratio to fund more of the premium by selling extra puts. With net premium of $0.13 price needs to move 18% to go in-the-money and price coverage is 32.5% on the sold put.

Energy Fuels (UUUU): Uranium. Energy Fuels completed a vanadium run in their mill and are switching over to processing uranium. Price has started to move but not enough for an October expiry 7/8/5 call spread risk reversal to go in-the-money unless something amazing happens in the last day for price to trade from $6.64 close (October 17) to go above $7 or drop below $5. Replicated that trade with a December expiry 7/9/6 call spread risk reversal.

With net premium of $0.44 on the 7/9 call spread, maximum profit potential is 355% for a 36.4% move in price from $6.60 open (Oct 17). Price coverage on the sold put (6) is 9.1% and breakeven will be at $5.98 on this trade alone.

Let's look at the chart which of the new trade shows the bought call (7) as a blue ray and the sold call (9) as a red ray and the sold put (6) as a dotted red ray with the expiry date the dotted green line on the right margin. The old trade will expire out-the-money as the blue arrow price scenario never played out and green arrow price scenario took too long to start up.

For this new trade to reach maximum profit requires more than the green arrow but it could well end in-the-money. Pays to do the chart work before putting on the trade - had chosen a wider spread as wanted to be a bit more open-ended. 8 strike call would have ramped up profit and increased the chances of being exercised. As it is a free trade - not fussed as an entry at $5.98 is just fine as it averages down entry price on stock held. Next day set up 7/8/6 trade in managed portfolio with breakeven dropping to $5.85 - lessons applied after studying the charts.

F3 Uranium Corp (FUU.V): Uranium. Scaled into holding in managed portfolio. Did say last week, no more uranium additions, but do know there will be a lot of assignments at options expiry - most likely bringing portfolio share down below 15%. F3 seems to be somewhat out of favour.

JinkoSolar Holding Co (JKS): Solar Power. Assigned early on sold put. Breakeven at $25.75 is a massive 26% premium to $20.36 close. Trade set up when share price rocketed over $30 on the China stimulus news - holding now for the long haul. Income trades on the stock have covered way more than the prospective loss from this trade.

Star Bulk Carriers Corp (SBLK): Shipping. With mood improving in commodity markets added to holding in pension portfolio to scale in. Wrote covered call for 1.2% premium with 10.9% price coverage.

Global X Lithium & Battery Tech ETF (LIT): Lithium. With price opening at $43.04, covered calls will go to assignment. Momentum appears to be going higher - scaled into the January 2025 46/52/43 call spread risk reversal entered last week. Net premium on the trade brings breakeven down to $41.12, which is just above the strike calls will be assigned at should this go to assignment. Profit potential on the call spread jumps from 147% to 532% but price now has to move 20.8% (was 14.6%)

Glencore plc (GLEN.L): Base Metals. Assigned on sold put at 0.3% premium to closing price.

ChargePoint Holdings (CHPT): Electric Vehicles. Assigned on sold put at 10.2% premium to closing price. Decided to average down and hold for the long run recovery in 3 portfolios.

ArcelorMittal S.A. (MT.AS): Europe Steel. Assigned on sold put at 2.26% premium to closing price. This sold put was put in place in the event covered call went to assignment. It did not. Next lesson: write the sold put at a lower strike.

DHL Group (DPWA.DU): Europe Logistics. Assigned at exactly the closing price to average down entry price. Of note, one parcel assigned and one expired at same strike and same timestamp.

QuantumScape Corporation (QS): Battery Technology. Assigned on sold put at 4.2% premium to $5.28 close (Oct 18). Happy to hold this category of stock for the long haul - the need for battery power is not going away.

Invesco Solar ETF (TAN): Solar Power. Assigned on sold put at 1.76% premium to closing price. Averaging down. Also holding for the long haul. The climate agenda will keep the growth profile for this category going.

Coty Inc (COTY): US Consumer Products. Assigned on sold put for an ugly 29.7% premium to $7.07 close (Oct 18). TSP exited this trade some time ago at a higher level - was committed with sold puts and covered calls at the time - going to need American women to put on more makeup to get this back. To date income trades have recovered 28% of the current unrealised losses.

Sold

Mithril Silver and Gold (MTH.AX): Gold/Silver Mining. Read last week a tweet suggesting how to participate in share placements that have attaching options. Take up the offer and then sell the stock and hold onto the options. Locks in the profits and frees up capital for other things. The collapse in Elixir Energy (EXR.AX) share price after the end of the Daydream Well 2 testing highlighted the downfall of not doing that. Chart shows that nasty drop.

Closed out a portion of holding for 99.7% blended profit since May/June 2024. Next Investors idea including getting access to the placement. Exercise price on the options is 50% in-the-money and those can be sold on the ASX.

De Grey Mining Limited (DEG.AX): Gold Mining. Sold a small parcel to release funds for next month's pension payment. Locks in 2,365% profit since Novemebr 2016. Invested first time when I saw a post saying the Hema field in the Pilbara was the size of the Witwatersrand - still not opened the mine. Profit on a LIFO basis is a more modest 33% since November 2022/June 2024. Still holding a large tranche.

NuScale Power Corporation (SMR): Nuclear Technology. Assigned on covered call for 162.9% blended profit since March/April/August 2024 in pension portfolio. Risky scaling in, in August also delivered profits.

Centrus Energy Corp (LEU): Uranium Enrichment. With price opening at $84.53 (Oct 18) and trading higher January expiry 65/75/55 call spread risk reversal has traded over the top. Closed out the call spread to bank a net 10% profit in 16 days. Big lesson learned in a big week like this is to keep these types of trades somewhat open ended or widen the spreads. A rise of 62% from trade time was wild beyond belief. This leaves open a 55 strike sold put - a long way down to see that assigned.

Société Générale SA (GLE.PA): French Bank. Assigned on covered call for 6.7% blended loss in personal portfolio.

Sixt SE (SIX2.DE): Europe Car Rental. Assigned on covered call for 30% blended loss in personal portfolio. 32.5% loss in managed portfolio. 32.5% loss since December 2023 in pension portfolio. Stock screen idea with recession in Germany turning bad for car rental.

Cameco Corporation (CCJ): Uranium. Assigned on covered call for 11.7% blended profit in personal portfolio since March 2024. 5.7% blended profit since June/July 2024 in pension portfolio.

enCore Energy Corp (EU): Uranium. Assigned on covered call for 2.8% profit since March 2024. Partial tranche in personal portfolio.

Lightbridge Corporation (LTBR): Nuclear Technology. Assigned on covered call for 84.5% blended profit since May/July 2024 in personal portfolio. 71.7% blended profit since May/July 2024 in managed portfolio. 87.2% blended profit since April/May/July 2024 in pension portfolio. This is one that got away with price trading back below strike the day before expiry and then racing higher.

The Trade Desk, Inc (TTD): Digital Media. Assigned on covered call for 19.9% profit since May 2024 in personal portfolio. 43.75% profit since April 224 in managed portfolio. TheStreetPro (TSP) idea

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Assigned on covered call for 20.3% profit since September 2024 in personal portfolio. Still have a holding. 2.3% blended loss since Septemnber 2024 in pension portfolio.

NexGen Energy Ltd (NXE): Uranium. Assigned on covered call for 14% blended profit since October 2023/Febraury 2024 in personal portfolio. 9.1% blended profit since Febraury 2024 in managed portfolio.

Global X Lithium ETF (LIT): Lithium. Assigned on covered call for 23.1% blended loss since July/December 2021/February/MayAugust 2024 in managed portfolio. Ouch! Lithium has been a solid case study for markets that get scaled up with too much capacity. In this portfolio, the lifetime negative capital return is 12.7%. Call option trades have recovered 27.3% of that with no losses and put options have recovered a further 9.4% with 2 losing trades. 36.3% blended loss since September 2021/February/September 2022/December 2023 in pension portfolio.

Wynn Resorts (WYNN): Gaming. Assigned on covered call for 0.3% blended profit since June/August 2024 in managed portfolio. Averaging down helped. Wynn Resorts has been a challenging investment idea driven very much by China moods and the impact on Macau gaming revenues. Since first investing in July 2021, stock has been assigned 3 times and overall return on holding stock is negative 2.9%. Call option trades have recovered 268% of that (with one losing call spread includeed) and put option trades have recovered 161% of that. Implied volatility is high which makes it a good stock to work with writing sold puts until assignment and then write covered calls.

3D Systems Corporation (DDD): 3D Printing. Assigned on covered call for 33.7% blended loss since January/April 2024 in managed portfolio. 3D Systems has been a frustrating journey with the technology showing great potential and the business just not executing well. Lifetime negative return is 36.3% and income trades have recovered only 60.2% of that loss.

Uranium Energy Corp (UEC): Uranium. Assigned on covered call for 4.2% profit since July 2024 in small managed portfolio. Covered calls increased overall profit by 3.3 times since August 2023 with this the frst assignment. Strategy for this small portfolio is to invest only in uranium stocks and write covered calls along the way to let the market find exit points. Assigned on covered call for 8.8% profit since September 2024 in pension portfolio.

L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Assigned on covered call for 5.1% profit since June 2024 in pension portfolio. Hydrogen idea (mine).

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Assigned on covered call for 4.6% profit since September 2024 in pension portfolio.

American Airlines Group Inc (AAL): US Airline. Assigned on covered call for 18.4% blended loss sice June 203/May 2024 in pension portfolio. Averaging down helped. Revenge travel idea. Income trades recovered 46% of the capital loss.

Denison Mines Corp (DNN): Uranium. Assigned on covered call for 8% blended profit since February/March 224 in pension portfolio. Remain invested.

Gevo, Inc (GEVO): Specialty Chemicals. Assigned on covered call for 21.2% profit since October 2024 (2 weeks) in pension portfolio.

Jazz Pharmaceuticals (JAZZ): US Pharmaceuticals. Assigned on covered call for breakeven wth some tiny trading costs. Income trades added 8.1% profit on capital invested.

Centrus Corp (LEU): Uranium Enrichment. Assigned on covered call for 13.8% profit since September 2024 in pension portfolio.

Nokia US ADR (NOK): Network Equipment. Assigned on covered call for 3.8% blended loss since April/May/November 2022/September 2023 in pension portfolio. This is a good example of leveraging income trades on a stock that mostlly tracks sideways with income trades (calls and puts) covering that loss 2.1 times.

Global X Uranium ETF (URA): Uranium. Assigned on covered call for 9.1% blended loss since July 2024 in pension portfolio. Can only think the covered calls were written a bit tight.

Uranium Royalty Corp. (UROY): Uranium. Assigned on covered call for 1.9% blended profit since May/June 2024 in pension portfolio. Did make an adjustment last month to buy back some of the covered calls - good move with price moving well ahead. UROY is well leveraged to rising uranium price on its invesntory and through 9 royalty projects.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $500 lots. Scale ins and top ups in $250 lots - increased this week.

New Buys

GR Engineering Services Ltd (GNG.AX): Dividend yield 9.20%. 2nd time for this - price will need to pass recent highs to get to profit target - positive momentum in mining suggests mining services will run.

Cettire Limited (CTT.AX): Luxury Retail. Cettire is showing dramatic growth in its luxury markets with the new opening in China.

Chart shows stock has been beaten down from early 2024 highs, has made a double bottom off support and is now cycling higher. The 40% profit target is half way to the 224 highs. Noted that Cettire is among the 10 most shorted ASX stocks. The China stimulus will be delivering a nasty surprise to the shorts.

Scale Ins

Clearview Wealth Ltd (CVW.AX): Financial Services. Dividend yield 5.82%. Scaled in as price has moved between 5 and 10% from opening. Following the sale of AMP Limited (AMP.AX) - happy to be invested in the sector.

Chart shows price breaking above the 50 day moving average. The choice factor is the 54 percentage points gap between Clearview and AMP

Sold

Myer Holdings (MYR.AX): Retail. Sold at extended target at 52 week high for 42.5% blended profit since September/December 2023/January 2024.

What recession?

AMP Ltd (AMP.AX): Financial Services. Closed above 52 week high target for 34.8% blended profit since June 2023/January/March 2024. Been quite the turnaround story with a 2nd profitable exit.

Charter Hall Group (CHC.AX): Property. Closed above 52 week high target for 45.5% blended profit since April/May/December 2023.

St Barbara Ltd (SBM.AX): Gold Mining. Closed above 52 week high target for 64.8% blended profit since May/October 2023/April 2024. Return includes the return of capital made when St Barbara sold Lenore gold assets.

Hedging Trades

Pan American Silver (PAAS): Silver Mining. Assigned on covered call for 10.4% profit since September 2024 in managed portfolio.

iShares Silver Trust (SLV): Silver. Assigned on covered call for 12.3% profit sicne June 2024 in pension portfolio.

The Technology Select Sector SPDR Fund (XLK): US Technology. With price closing at $230.91 (Oct 18) 220/215 ratio put spread expired 8.4% profitable in pension portfolio. Sold 205 strike puts expired in both managed and personal portfolios brining that series of hedge trades into profit. Love it when hedge trades make profits and were not needed anyway.

Income Trades

76 covered alls went to expiry across 4 portfolios with 40 assignments (UK 3 (2) Europe 13 (6) US 59 (32) Canada 1). The model is to use covered calls to let the market find exit points 5 to 10% above current price.

CleanSpark, Inc (CLSK): Bitcoin Mining. With price opening at $12.09 and trading higher and Bitcoin motoring over $65k, bought back 12 strike covered calls for 0.7% profit (even after trading costs). Good move as price traded to close at $12.86 (Oct 18)

NexGen Energy Ltd (NXE): Uranium. With price opening at $8.15 and trading higher and the whole uranium sector moving, bought back 8 strike covered calls for 66% loss (only $82). Good move as price traded to close at $8.33 (Oct 18) more than covering the extra premium.

Naked Puts

Stocks likely to go to assignment on covered calls

- Uranium Energy Corp. (UEC): Uranium Return 3.34% Coverage 13.7% - average over 2 tranches

- Cameco Corporation (CCJ): Uranium. Return 2.8% Coverage 6.8%

- Cameco Corporation (CCJ): Uranium. Return 2.02% Coverage 13.3%

- Cameco Corporation (CCJ): Uranium. Return 5.22% Coverage 3%

- Denison Mines Corp. (DNN): Uranium. Return 4.0% Coverage 11.5%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 22% Coverage 1.2% - Feels like a dangerous momentum trade but with breakeven at $3.90 well below $4.45 close (Oct 17). As it happens price traded to $8.83 (Oct 21)

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 2.8% Coverage 3.5%

- 3D Systems Corporation (DDD): 3D Printing. Return 8.33% Coverage 2% - added November as expecting October to expire out-the-money

- enCore Energy Corp. (EU): Uranium. Return 5% Coverage 5.8%

- Sixt SE (SIX2.DE): Car Rental. Return 2.49% Coverage 3.6%

Stocks happy to own at lower entry prices

- Oklo Inc. (OKLO): Nuclear Technology. Return 5.5% Coverage 28.2%

- Oklo Inc. (OKLO): Nuclear Technology. Return 15.4% Coverage 2.5%

- Société Générale (GLE.PA): French Bank. Return 2.78% Coverage 2.3% - added November as expecting October to expire out-the-money

- NexGen Energy Ltd. (NXE): Uranium. Return 7.5% Coverage 1.9%

A few kicked down the road

- iShares 7-10 Year Treasury Bond ETF (IEF): US Treasuries. 36.4% profit on buy back. 362% cash positive. Brings breakeven down to $94.91 = tidy discount to $95.83 close (Oct17)

- HelloFresh SE (HFG.DE): Europe Restaurants. 3.2% loss on buy back. 203% cash positive.

Credit Spreads

- Commerzbank AG (CBK.DE): German Bank. 15/4/14.6 fixer upper spread expired returning 77.8%

- Pan American Silver Corp. (PAAS): Silver Mining. 20/18 spread expired returning 27.4%

Exercise risk reduced dramatically with many sold puts expiring out-the-money. Large cash proceeds frm assignement replenished cash holdings.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

October 14-18, 2024

BTC and LTC prices rise, stock market moves higher. Gold price is at an all-time high. Markets are in a good position. You are also in profit. Such a great post is appreciated. There is actually a lot of information here in your post.

Thanks. I write these posts every week (day by day) to journal what I was thinking at the time. What I like is the journal is fully searchable (better on peakd) using my #tib tag and the topic or the ticker. So I can go back to see what I was thinking when I did it first. With over 350 holdings in any one time, there is no way I could remember.

And the real benefit for me is I learn from what worked and what did not work.

Very interesting post. I see that you explore the world of investments in a broad way. I wanted to ask you a question. In your opinion, will the S&P 500 collapse at the end of the year or is it more likely that it will exceed 6000 points?

I do not do price predictions. That said I did write months ago that the market would not collapse before the elections. The powerful hands behind the Democrats will do anything to hold the markets up. Fall over and the Dems have no chance.

The things to do is to check if the conditions for collapse are in place. US consumer is hanging in. Mortgage defaults in US and in most of Europe are in normal bands. Interest rates are coming down in most markets. The Israel retaliation against Iran was very measured and very strategic. No WWIII just yet.

The nagging element is the size if the US debt. It is within the percentage of GDP parameters economists are OK with - but it is high.

As for my portfolio - with the busy options expiry last week, am holding enough cash to ride through 3 years. Only hedges in place are on gold and silver and crypto. Once the election results come in I will hedge the US and Europe portfolios.