A busy options expiry see selling across a range of sectors. Buying is in uranium and alternate energy. Selling was mostly in Europe on assignment

Portfolio News

In a week where S&P 500 rose 1.11% and Europe rose 0.09%, my pension portfolio rose a stronger 1.63%. Heavy lifting was done by De Grey Mining (DEG.AX)) up 8.9%, a few uranium stocks (especially the US listings), nuclear technology stocks (GEV, SMR) (especially the options trades) and Japan stocks with only 3 going down and the new position in Emerging Markets excluding China (EMXC)

Big movers of the week were CoreNickelCo (CNCO.CN) (344%), Mithril Silver and Gold (MTH.AX) (196%), Blue Star Helium (BNL.AX) (33.3%), Austal (ASB.AX) (32.6%), Kairos Minerals (KAI.AX) (30%), Earths Energy (EE1.AX), (28.6%), Anfield Energy (AEC.V) (23.1%), Aeris Resources (AIS.AX) (20.6%), Condor Energy (CND.AX) (16.1%), St Barbara (SBM.AX) (15.7%), Appen (APX.AX) (13.6%), Energy Fuels (UUUU) (12.3%), Aura Energy (AEE.AX) (12%), Tokai Carbon Ltd. (5301.T) (11.8%), Panther Metals (PNT.AX) (11.8%), Sims Metals (SGM.AX) (11.6%), Bayhorse Silver (BHS.V) (11.1%), Atha Energy (SASK.V) (11.1%), Sigma Lithium Corporation (SGML) (10.8%), iShares MSCI Emerging Markets ex China ETF (EMXC) (10.8%), NuScale Power Corporation (SMR) (10.5%), Loop Industries (LOOP) (10.3%), New Hope Corporation (NHC.AX) (10.2%) Cameco Corporation (CCJ) (10.1%)

24 stocks in the big movers list looks like quie a mixed bunch. From the top, the big themes - battery materials (2 stocks), silver/gold mining (4 stocks), alternate energy (1 stock), uranium (5 stocks - including the bellwether - Cameco (CCJ))

Top two are news driven woth CoreNickel announcing financing and Mithril releasing silver mapping results on historic tenements. Been trying to add to CoreNickel holding but my broker does not serve the Pure markets in Canada - sales only. Time to sell.

A week of mixed headlines - a bit of nerves ahead of the Federal Reserve meeting, a mixed reaction with the big rate cut and then a push to record close for the Dow. Tech stocks remain a little nervous. The headlines were chosen - each has two views on the same data.

Crypto Keeps Upward Momentum

Bitcoin price drift from last week was arrested and price then climbed steadily all week ending 9.8% higher with a trough to peak range of 12.5%

Ethereum price was a bit more convincing rising all week ending 16% higher with a trough to peak range of 18.7%

Aave keeps moving with a rise of 29% against USD.

Fantom (FTMBTC) started 3rd cycle higher after reversing with a cycle range of 34%

A bit of a pump and dump on Hive (HIVEBTC) with one spike popping 22% in one 4 hour bar with another spike half as high

IoTeX (IOTXETH) also making 2nd cycle higher with a 22% pop - always good to see a new trade idea staying positive.

Uranium Holdings

Uranium markets lit up on announcement of deal between Microsoft (MSFT) and Constellation Energy (CEG) to reopen Three Mile Island to power AI data centres.

There has been a slew of announcements in recent weeks about restarts, new builds, SMR builds, etc -- catch them all on tweets from John Quakes https://x.com/quakes99

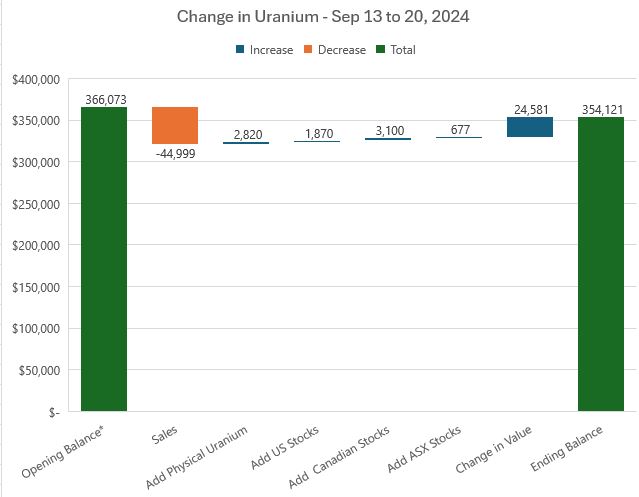

Uranium markets continued to move in the week with a 6.1% increase in valuation of my holdings. This increase would have been a lot more with Centrus (LEU) sold on assignment after it went up 12.9% in the week. A few small additions made during the week.

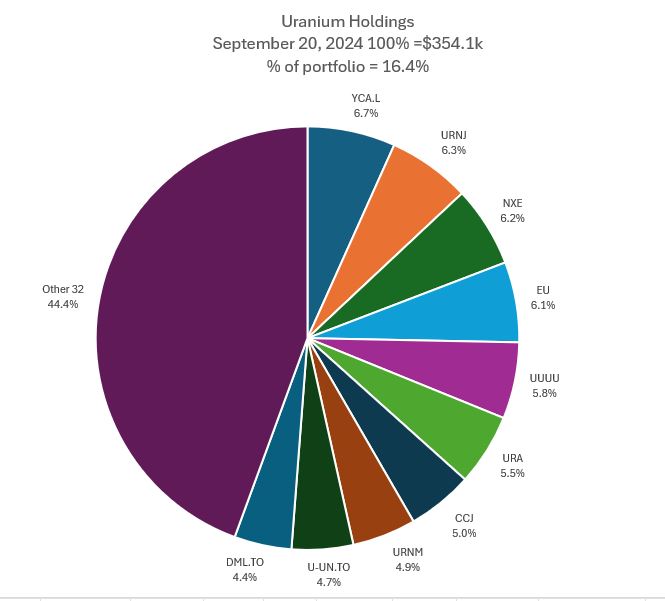

The sale of Centrus (LEU) changed the mix of holdings story a lot with share of portfolio coming down over 1 percentage point despite that rise in value and a new top holding in YellowCake plc (YCA.L). Cameco (CCJ) rises one place to swap with Sprott Uranium Miners (URNM). Rising into the top 10 is Denison Mining (DML.TO). Share of Others stays at 32 stocks with one new stock replacing Centrus (LEU) and share rising just over a half percentage point.

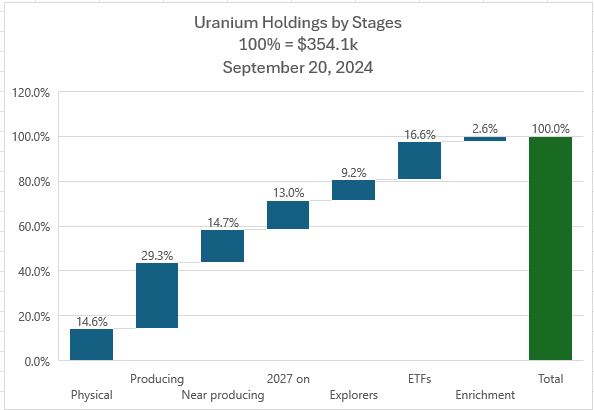

Holdings by stage changes dramatically with the sale of Centrus (LEU). Plan is to add back to the position 100 shares at a time and selling puts at that 45 strike. Share of Physical went up nearly 2 points as chose to categorise CGN Mining (1164.HK) holding that way as it acts more as a trading house rather than a producer (selling Kazakhstan product). Share of Producing went up by over 3 points on the back of increased valuations and one small add. Over 57% of holdings are physical, producing or near producing. This feels like a solid place to be. ETF's did jump over 1.5 points on increased values - they each contribute a slice to the close to producing curve too.

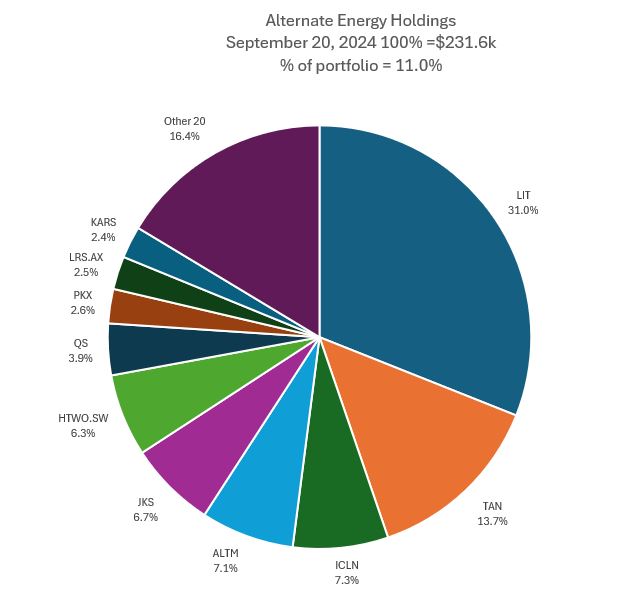

Alternate Energy Holdings

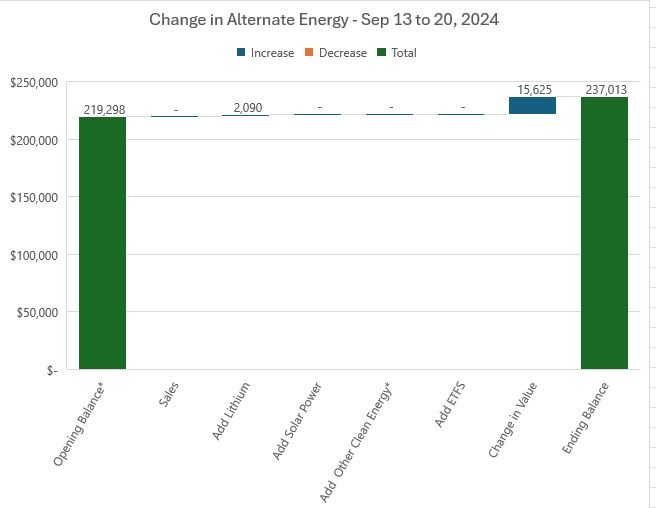

Value of alternate energy holdings increased by 7.1%. Note, the opening balance has been adjusted to add in holding of Posco (PKX) that was missing in one portfolio. The addition is for Posco (PKX) using a multiplier of 15% to discount the steel components of their business. Portfolio share drops a little to 11%

Mix of holdings sees Posco (PKX) coming into the Top 10 into position 7 and pushing Leo Lithium (LLL.AX) out. Leo Lithium remains suspended and it looks like sale proceeds with be paid in January 2025 and possibly July 2025.

Bought

Cauldron Energy Limited (CXU.AX): Uranium. Watched webinar with CEO, Jonathan Fisher discussing the Manyngie South, Western Australia project and pointing to up coming drill results. Added to the small parcel in the personal portfolio.

GE Vernova Inc (GEV): Alternate Energy. With the successful closing of the previous options trade, set up a new January 2025 230/250 bull call spread in the personal portfolio. Spread premium was funded by the profit on the previous trade. With net premium of $8.26, this offers maximum profit potential of 172% for a 9.7% move in price from the $227.88 close (Sep 16). In the managed portfolio set this up as a 230/250/195 call spread risk reversal which makes the trade a free trade with 14.4% coverage to the sold put level (195).

GE Vernova is a spin off of the power assets of GE-Hitachi - if offers a diversified range of alternate energy delivery models.

Quick look at the chart which shows the bought call (230) as a blue ray and the sold call (250) as a red ray and the sold put (195) as a dotted red ray with the expiry date the dotted green line on the right margin. The chart also shows the sold put (135) outstanding from the prior trade- will be happy to buy at that level if price drops that far. The trade feels like a blue sky trade as there is not a lot of history. Have picked a price scenario from the breakout from the first consolidation zone. Am fully expecting a consolidation zone again - how long and how low is hard to tell - so the blue arrow is placed somewhere in the middle.

BlackRock MuniYield Quality Fund III (MYI): US Municipal Bonds. Bought back a small parcel in pension portfolio - with possibility of a 50 basis points cut from the Federal Reserve, price should recover the 1.8% premium paid to buy back. Would be great if this fund had an options market to write covered calls.

CanAlaska Uranium Ltd (CVV.V): Uranium. CanAlaska announced drill results with high mineralisation readings pointing to the possibility of a major new field discovery. Added another parcel to pension portfolio to scale in the holding

Premier American Uranium (PUR.V): Uranium. Explorer focused on the consolidation, exploration, and development of uranium projects in the United States. Scaling in.

Uranium Royalty Corp (UROY): Uranium. Scaled in - 9 royalty projects are essentially free holds with uranium inventory and cash holdings accounting for whole of market capitalisation.

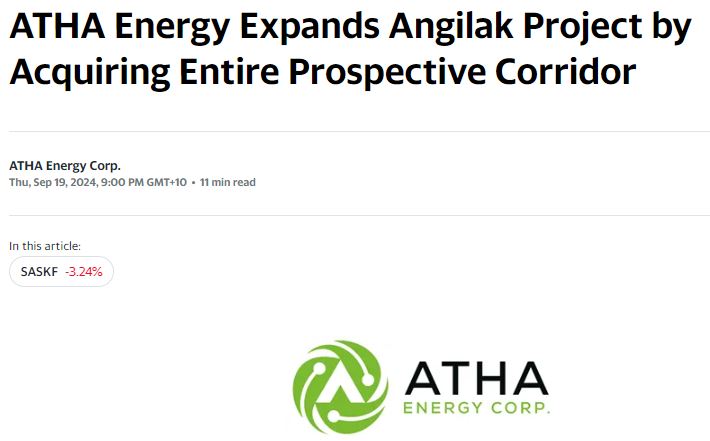

Atha Energy Corp (SASK.V): Uranium. Atha announced drill results for Angilak Project earlier in the month. On the back of that they added to their Angilak tenements.

Price popped and pending orders were not hit - waited for price to pull back a bit from the initial pop and scaled in in two portfolios.

ENGIE SA (ENGI.PA): French Utility. Exposed to an uncovered strike 15.4 sold call since early August. Been making adjustments to claw back premium to mitigate potential losses. With price opening at €15.95 and trading lower one of those adjustments is a strike 16 sold put which is in-the-money. Made the next adjustments by buying stock at €15.46 which will allow delivery on the call at a small loss (0.38% loss). Engie has been a good tool for running income trades (calls and puts) as price does not move that much. Last 12 months has seen 4.8% profit with stock assigned only twice each time for a small loss.

CGN Mining Company (1164.HK): Uranium. Uranium market is heading into a bifurcated state between East and West. CGN Mining is the 4th largest holding in the Sprott Uranium Miners ETF (URNM) and started life as subsidiary of the main Chinese Nuclear Power Company. Its chart looks sick since the June highs where it was out-performing spot.

Next chart adds in the Sprott Uranium Miners ETF (URNM - purple line)) and Global X Uranium ETF (URA - cherry line)and goes back to the spot peak in February 2024. CGN has under-performed by 10 to 20 percentage points.

Do not know what has driven that collpase other than the drop in spot price - some digging required. Just felt it was one way to be on the East side of the divide. CGN holds stakes in Semizbay-U (49% with Kazatomprom), Ortalyk (49% with Kazatomprom) and Fission Uranium (FCU.TO) (11.3%) and operates more as a trading venture selling uranium from the two Kazahkstan operations. In first half of 2024, 90% of the sales were contracted with clients from Europe, 7% of the sales were contracted with clients from Asia and 3% of the sales were contracted with clients from North America. In the recent court hearings on the Paladin Resources (PDN.AX) takeover of Fission Uranium (FCO.TO) CGN indicated they would oppose the deal in the court.

Did push the price comparisons to include Paladin (PDN.AX - purple line) and Fission Uranium (FCU.TO - blue line) and Kazatomrpom (KAP.L - green line). This shows CGN running in line with Fission Uranium (FCU.TO) and lagging Paladin (PDN.AX) by 6 percentage points. Of note is CGN is 20 percentage points behind Kazatomprom, its joint venture partner.

This analysis was done after the trade - CGN is not on the East side of the trade as it is selling its offtake mostly to the West. Its trading profits tend to follow spot price. My sense at the time of doing the trade and after the post-trade analysis is CGN price will pop when the deal is approved and on any move upwards in spot price.

https://www1.hkexnews.hk/listedco/listconews/sehk/2024/0920/2024092000441.pdf

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Price has stepped well away from the sold put levels - keen to ride the nuclear power potential of small modular reactors - added a small parcel of stock and sold more puts just out-the-money. In the week, Roll Royce announced deals to sell 4 small modular reactors to Czech Republic.

Posco Holdings (PKS): Korean Steel. With a chance that covered call could go to assignment and trigger a capital loss, added a matching parcel of stock below covered call strike (options market is not liquid enough to do the normal sold put routine.) Real interest in Posco is for its lithium and battery plans - counting it as 15% alternate energy for that analysis.

enCore Energy Corp (EU): Uranium. Added to personal portfolio - adding US-based capacity slated to get Alta Measa facility back into production in late 2024.

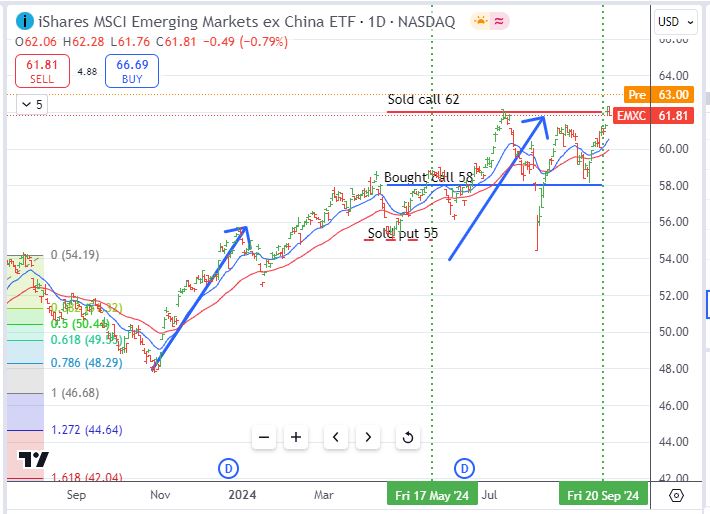

iShares MSCI Emerging Markets ex China ETF (EMXC): Emerging Markets Index. Exercised on bull call spread.

Quick update of the chart shows had a few goes at reaching for the sold call level (62) but could not hold it. It also shows the value of having enough time to run a trade with two spells below the bought call level (58)

Sold

Derichebourg SA (DBG.PA): Europe Waste Management. Reducing margin pressure sale in personal portfolio for 4.5% blended profit since January/April 2024. In the pension portfolio, closed the whole position for a 9.2% blended loss since January/May/June 2023 with only one tranche profitable. Maybe an over-reaction to the margin pressure as stock is recovering and sector is attractive. Did add back a quarter of the holding next day at a slightly lower price (more than trading cost difference)

Commerzbank AG (CBK.DE): German Bank. Assigned on covered call for 4.1% loss in personal portfolio. 5.4% loss since August 2024 in managed portfolio. 6.8% blended loss since August 2024 in pension portfolio The disadvantage of covered call writing when a big corporate action comes along

**Deutsche Bank AG (DBK.DE): German Bank. Assigned on covered call for 2.8% profit in personal portfolio and at breakeven since June 2024 in managed and pension portfolios

Société Générale S.A (GLE.PA): French Bank. Assigned on covered call for 14.9% blended loss since May/August 2024 in pension portfolio.

LANXESS AG (LXS.DE): Specialty Chemicals. Assigned on covered call for breakeven in both personal and managed portfolios since August 2024 and 6.25% profit in pension portfolio since August 2024. All positions started out from sold puts assigned. Stock screen idea. This has been a frustrating investment with markets re-rating stock not long after purchase. Income trades have recovered 55% of the capital losses (in managed portfolio - will be the same in the others)

Société BIC SA (BB.PA): Europe Consumer Products. Assigned on covered call for 1.3% profit since Oct 2023. Income trades have delivered 8 times that profit since then - just under 1% a month.

Fresenius SE & Co. (FRE>DE): German Healthcare. Assigned on covered call for 13.8% blended profit since July/December 2023 in pension portfolio. Stock screen idea.

Corbion N.V. (CRBN.AS): Specialty Chemicals. Assigned on covered call for 10.7% profit since May 2024 in personal portfolio.

Centrus Energy Corp (LEU): Uranium Enrichment. Assigned on covered call for 3.9% blended profit since April/May/July 2024 in personal portfolio and 6.6% blended profit since March/April/May 2024 in managed portfolio and 6.3% blended profit in pension portfolio since March/April/May 2024. Frustrating assignment as price passed strike by $0.01 and stayed above sold put strikes by same amount. More frustrating was the one trading error in the pension portfolio which left a bought put open at 45 strike - that expired out-the-money on expiry day and wiped out all the profits for the last 12 months.

Mission Produce, Inc (AVO): Food Products. Assigned on covered call for 14% blended loss in pension portfolio since August/September 2021/March 2022/December 2023. Successive entries were all averaging down but only last one was profitable.

Norwegian Cruise Line Holdings (NCLH): Cruising. Assigned on covered call for 5.6% loss in pension portfolio since August 2024. Income trades did bring breakeven well below the sold price.

Expiring Options

NexGen Energy (NXE): Uranium. With price closing at $6.26 (Sep 20) 7/8 bull call spread expired out-the-money. This trade was constructed as a 7/8/7 call spread risk reversal with the sold puts (strike 7) kicked down the road a few times with one still open for October expiry. The trade idea is for sold put premium to fund the call spread - not worked that way with the sold put rollouts adding 172% to the capital loss on the call spread. Too early to call as the sold puts open can be bought back at a profit.

Update of the chart shows that price followed the required price scenario (right hand blue arrow) for a few weeks and then fell over and traded below the sold put level all the time (hence the rolling needed). Can price get over $7.00? You betcha - a 6 month run in spot like October to March will do that.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. With price closing at $20.27 (Sep 20) 31/34 bull call spread expired out-the-money. Trade was set up as a blue sky trade from profits.

Quick update of the chart shows the blue sky did not happen with price sliding almost from trade time with the drop in spot uranium price. See TIB709 for the rationale

ASX Portfolio

No trades this week

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. With price closing at $29.42, 27.5/25 ratio put spread expired out-the-money. As the ratio only partly funded the bought put premium, trade was 40% loss making. Trade idea is predicated on the potential for major claims about safety of Covid-19 vaccines - seems that Pfizer is staying out of courts for now. Will draw the line under the idea which was profitable overall over the last 24 months

Hedging Trades

Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO): Silver. Silver charts have started moving ahead after a bit of a pullback and gold is touching all time highs. Added another small parcel to this covered call ETN as an income-type hedge. Price tends to lag the iShares Silver Trust (SLV) but yield is 16.86% - makes up for that.

Pan American Silver Corp (PAAS): Silver Mining. Added two trades as a hedge trade. October expiry 20/18 credit spread with ROI of 24.7% and coverage of 2.1%. January 2025 expiry 22/26/19 call spread risk reversal looking for upside a bit further out. Call spread offers maximum profit potential of 281% for a 24.6% move in price with 9% coverage for the sold put which fully funds the call premium.

Quick look at which shows the bought call (22) as a blue ray and the sold call (26) as a red ray and the sold put (19) as a dotted red ray with the expiry date the dotted green line on the right margin. The sold call (26) is below the 2023 highs. The sold put (19) would have been better placed below the previous lows (say 18). As a free trade it looks solid and would be happy to enter with 9% coverage.

The Technology Select Sector SPDR Fund (XLK): US Technology. Wrote last week that two portfolios were holding September expiry 215/207.5 bear put spreads. Ahead of the Federal Reserve announcement sold one of the bought puts for a loss. Held off selling the other contract with a bout of nerves that the Fed decision would be badly received and price could tumble. Got that wrong - market liked the big Fed cut. Overall trade is still open with short puts outstanding for October expiries - looks like a losing trade coming about from the adjustments.

Quick update of the chart which shows the bought put (215) just closed. The time to close out was was when the high of the big down bar was cleared on the reversal. The chart also shows the two reamining sold puts (205 and 210). Given the shape of the move up either of those would be good entry ponts.

Hecla Mining Company (HL): Silver Mining. Assigned in pension portfolio for 16.9% blended profit since August 2024 (two tranches).

Cryptocurrency

Aave (AAVEETH): Replaced trade sold previous week with price making a reversal on 20 day moving average (blue line).

Nice to see price come back and test the moving average twice and then pass the last partial exit point.

Income Trades

74 covered calls went to expiry with 18 going to assignment (in brackets) across 4 portfolios (UK 2 Europe 20 (13) US 52 (5). Four new covered calls written for October expiry (Europe 2 US 2)

Naked Puts

NexGen Energy Ltd (NXE): Uranium. Assigned on sold put. Assignment must have happened at same time as was rolling out the sold puts. Was assigned on a sold put that was supposed to be bought back - landed up with a long put with September expiry and got exercised on that.

A fair amount of work on sold puts with most of the rolling down done the week before

Puts sold on stocks likely to be assigned on covered calls These were assigned and sold strike was same as assigned strike

- Norwegian Cruise Line Holdings Ltd. (NCLH): Cruising. Return 1.72% Coverage 11.1%

- Deutsche Bank (DBK.DE): German Bank. Return 0.75% Coverage 0.01%

- Commerzbank AG (CBK.DE): German Bank. Return 1.92% Coverage 8.2%

- Fresenius SE & Co. KGaA (FRE.DE): German Healthcare. Return 1.12% Coverage 4%

- Deutsche Bank AG (DBK.DE): German Bank. Return 2.33% Coverage 2.4%

- Commerzbank AG (CBK.DE): German Bank. Return 1.6% Coverage 3.7%

- Société Générale SA (GLE.PA): French Bank. Return 2.35% Coverage 1.5% This one was not assigned

- L'Air Liquide S.A. (AI.PA): Specialty Chemicals. Return 1.23% Coverage 1.5%

Puts sold on stocks happy to own at lower entry points.

- Cameco Corporation (CCJ): Uranium. Return 1.14% Coverage 16%

-Dutch Bros Inc. (BROS): US Restaurants. Return 1.22% Coverage 10.2%

-Rolls Royce (RR.L): Defense/Aerospace. Return 2.7% Coverage -0.2% (now positive)

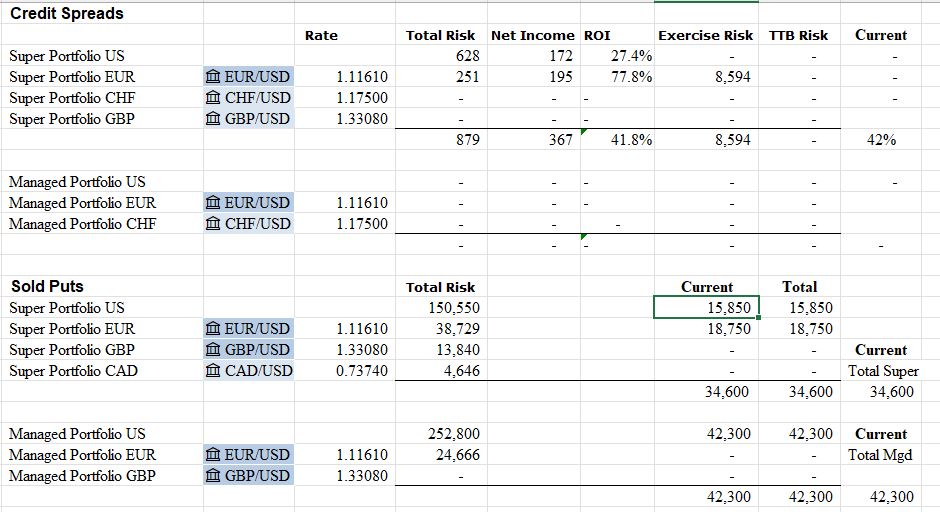

Credit Spreads

Commerzbank AG (CBK.DE): German Bank. Managed to buy an October expiry 14.6 strike put option instead of selling one. Work to do to recover by selling or setting up an assertive credit spread. With price closing at €15.52 (Sep 16) there is plenty scope to do that. Converted to 15.24/14.6 credit spread offering 77.8% ROI with 2.5% coverage. Fully expect this spread to trade in-the-money.

Exercise risk is well reduced with the assignments raising cash balances.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

September 15-20, 2024