Uranium and US markets rebound on news and potential for US rate cuts. Quiet week with action only in rare earths and uranium and Japanese semiconductors

Portfolio News

In a week where S&P 500 rose 1.4% and Europe rose 2.8%, my pension portfolio rose 2.07%. Clearly more uranium in my portfolio than in S&P500 but not enough Europe

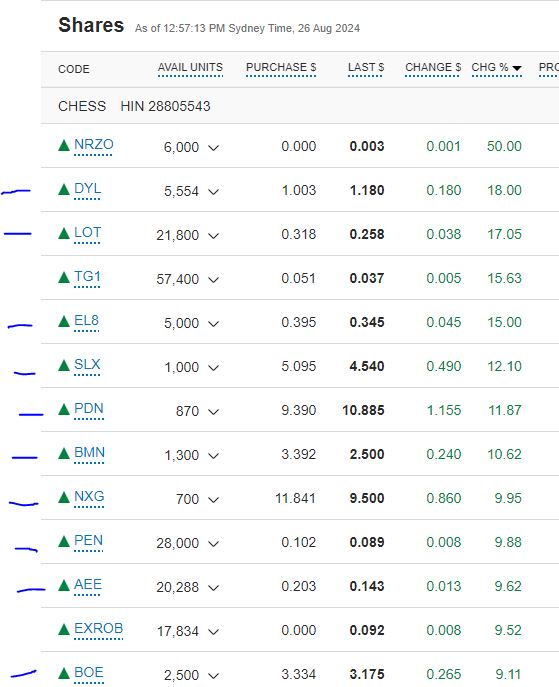

Big movers of the week were Stroud Resources (SDR.V) (66.7%), Elixir Energy (EXR.AX) (50%), Humm Group (HUM.AX) (38.6%), Honey Badger Silver (TUF.V) (33.3%), NeuRizer (NRZ.AX) (33.3%), Stem (STEM) (33.3%), Sun Silver (SS1.AX) (28.6%), Appen (APX.AX) (27.8%), Mithril Resources (MTH.AX) (26.1%), Blue Star Helium (BNL.AX) (25%), St Barbara (SBM.AX) (23.8%), VHM Limited (VHM.AX) (19.1%), NANO Nuclear Energy (NNE) (17.2%), Largo (LGO) (16.9%), American Rare Earths (ARR.AX) (15.7%), Charter Hall Group (CHC.AX) (15.1%), Anagenics (AN1.AX) (14.3%), KMD Brands (KMD.AX) (12.5%), Sharp Corporation (6753.T) (12.4%), Hercules Metals (BIG.V) (11.9%), Healius Limited (HLS.AX) (10.8%), Uranium Energy Corp. (UEC) (10.7%), Standard Uranium (STND.V) (10.5%), IsoEnergy (ISO.TO) (10.4%), TechGen Metals (TG1.AX) (10.3%), Atha Energy (SASK.V) (10.3%), GoviEx Uranium (GXU.V) (10%), Cue Energy Resources (CUE.AX) (10%), Hecla Mining Company (HL) (10%)

Another big week with 29 stocks on the big movers list. Was a week for the long term themes - silver/gold mining (7 stocks - 6 silver), alternate energy (4 stocks), uranium and nuclear technology (6 stocks), rare earths (2 stocks). A few especially on the ASX were results or news driven. Hard to know what was driving Stroud Resources - no news flow but there was a flurry of buying at bigger volume than normal (not huge values - a C$3000 day is big volume). Elixir Energy (EXR.AX) move based on strong gas flows on the Daydream well.

Markets were nervy all week ahead of the Jackson Hole speech from Jerome Powell and the Democratic National Convention. Yields rose again in the early part of the week. When Jerome Powell said there was scope for rate cuts soon, the market hopped higher heading back to those records.

Crypto Builds

Bitcoin price pushed higher all week ignoring US market nerves ending 9.8% higher with a trough to peak range of 12.4%. Price is back between the weekly price bands marked in green.

Ethereum price moved a bit more sideways ending the week 4.8% higher with a trough to peak range of 10.8%

Aave, the lending protocol (AAVE) made another surge with a pop of 38% and giving back about a third of that.

There is a remarkable similarity in the altcoins agains US Dollar - strong drive from Monday (Aug 19) and then giving some away as the week ended. Of note is the moves started at the front of the week well before Jerome Powell speech.

Sample - Holo up 57% against Ethereum - is a big move

Cardano (ADA) with a 22% pop

Chainlink (LINK) with a 26% pop.

Polygon (MATIC) popping a big 40%

Uranium Holdings

The market has been waiting with trepidation on the Kazatomprom (KAP.IL) results and guidance which came out before market open on Aug 23.

The news was a cut in uranium production guidance for 2025 by 5000 tU, citing uncertainties in sulphuric acid supply - but 2025 production is still expected to be higher than 2024. Got to say the guidance did not surprise me as the information that was flowing around the time of their previous announcement had enough clues what was coming - those acid shortages are real - see TIB719

Kazatomprom indicated their 2024 production was up 6% in first half of 2024 and that they had enough sulphuric acid to raise production for full year by 5.7% - an extra 3.2 mlbs. The market read this as a "flooding the market" signal and sold off all uranium stocks.

https://www.world-nuclear-news.org/Articles/Kazatomprom-lowers-2025-uranium-production-expecta

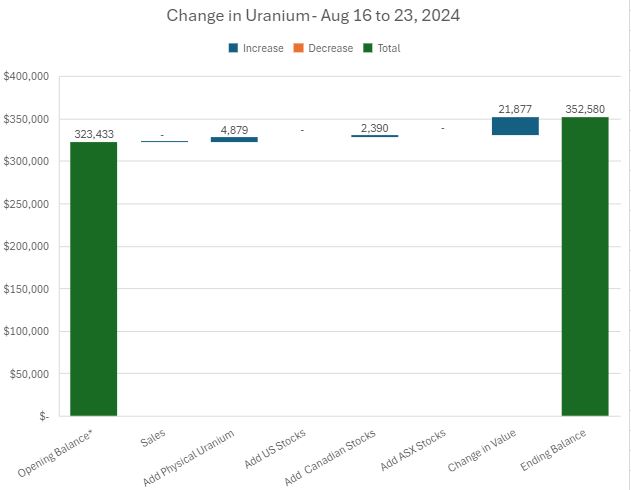

Weekly changes chart looks a whole lot different to the last few weeks with a few additions made to physical uranium holdings and one explorer and overall value going up by 6.76%. Now that is a little under-stated as ASX was closed when the Kazatomprom news came out

ASX stocks jumped on Monday open taking the mid morning increase to 8.8%.

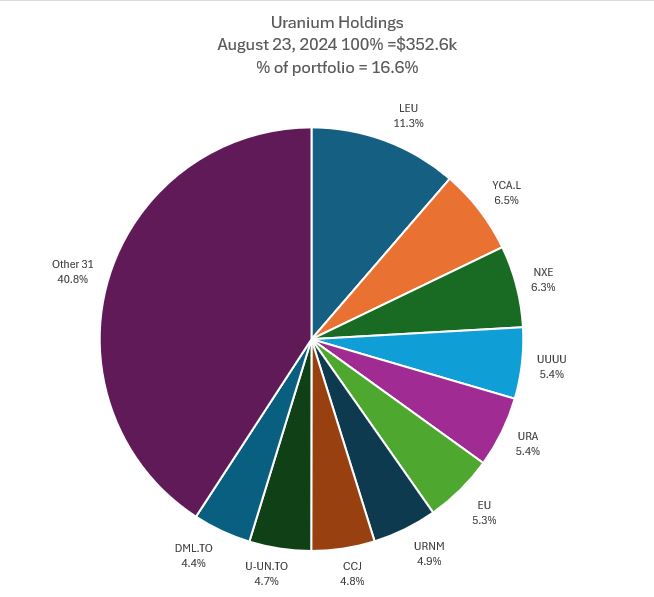

Overall percentage of portfolio holdings went up 0.7 percentage points to 16.6% with uranium growing more than the portfolios. Addition of Yellow Cake plc (YCA.L) moves it up 4 places. Energy Fuels (UUUU) swaps places with Global X Uranium ETF (URA) into slot 4. Cameco (CCJ) swaps places with Sprott Physical Uranium ETN (U-UN.TO). The share of Others drops 0.3 percentage points.

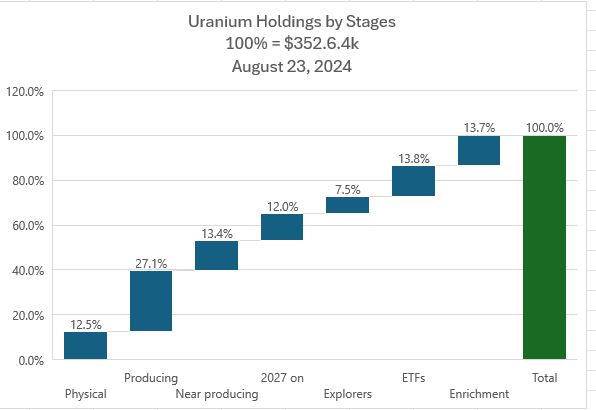

The additions changes the holdings by stage with Physical going up 1.2 percentage points. Near Producing moves up 1.4 percentage points with the addition to Global Atomic (GLO.TO) and value changes. The notable part of the 5 uranium stocks in the big movers list above is only one is a current producer. The rest are explorers.

Alternate Energy Holdings

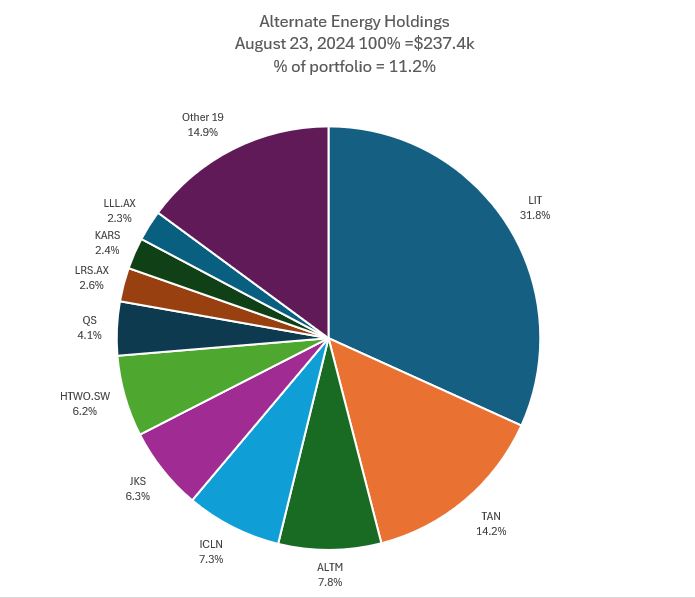

Alternate Energy holdings increased in value by 3% in line with market moves helped by a solid move in Invesco Solar ETF (TAN). There were no changes in portfolio holdings - though the bankruptcy notice was filed for Sunpower (SPWR) US operations. No chart needed for that

Percentage of overall portfolio holdings stayed steady around 11.2%. Small changes in individual percentages but no change in ranking in the Top 10.

Bought

VHM Limited (VHM.AX): Rare Earths/Mineral Sands. Participated in private share placement at 20% discount. As it happens price traded below the offer price in the week of the big selloff. Was not paying attention to buy then. Price has moved up 15.4% (Aug 20) since the SPP closing date (Aug 14)

Global Atomic Corporation (GLO.TO): Uranium. Global released announcement of letter from Niger Govt applauding Global for the progress that they are making. Made for an uptick in price. Added small parcels to managed and pension portfolio at a slightly higher price than the trade done 4 weeks before (Jul 24). In personal portfolio entry was appreciably lower than lsat entry (Apr 26)

Global X Japan Semiconductor ETF (2644.T): Japan Semiconductors. With two semiconductor related stocks on big movers list last week, my eye caught an article last week about the potential for Japanese semiconductor stocks to win riding he AI and Nvidia (NVDA) wave.

Article pointed to this ETF as one way to participate - a good first step easier than trying to guess the winners. Used the proceeds from the sales of the big movers last week to fund the trade.

Yellow Cake plc (YCA.L): Uranium. Kazatomprom guidance got the market moving before US and Canada open and after Australia close. Hopped on the one stock listed in London - it popped 4% on the guidance. Yellow Cake does have options on deliveries from Kazatomprom - have the sense those deliveries can be made. The last delivery was at $65 - compared to current spot around $80.

Sold

Closed out two Japanese semiconductor related stocks that made the big movers list last week. Profile of the two businesses sold does not fit the advancing of AI semicondcutors.

Mipox Corporation (5381.T): Japan Industrials. Product line is abrasives - some are used in semiconductor machine manufacture. 35.5% loss since December 2022.

Torex Semiconductor (6616.T): Japan Semiconductors. Active in analog power IC and the power management. 12% loss since Febraury 2024.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

Dicker Data Ltd (DDR.AX): IT Distribution. Dividend yield 4.30%

Chart shows price standing in the middle between the cycle high and the cycle low and has made two higher lows since reversing in the middle. Trade averages down entry price and gives a chance of exiting better at breakeven if price does make it back to the late 2023/early 2024 highs again.

KMD Brands Ltd (KMD.AX): Retail. Dividend yield 6.90%

Kathmandu has been a frustrating investment. It has strong brands in hiking and outdoor gear. Its business is high margin BUT is prone to bouts of discounting. I know I only buy when there is a sale on. Chart shows price has had two long downtrend runs with small sideways trade in the middle of each. Price has made higher lows since reversing - looking for it to run a little harder. Breakeven at $0.74 is a little lower than the top of the last downtrend (right hand red trend line)

Sold

Emeco Holdings Limited (EHL.AX): Mining Services. 27.7% blended profit since July/December 2023.

Quick chart to show a refresher on the strategy using this trade. Two entries when 20 day moving average (blue line) crosses from under the 50 day moving average (red line) and price makes a one month high. This indicates the downtrend has been broken and price is moving. On the chart there were two such signals (the blue rays are the trades with left hand side the date of the trade). There would have been signals after the 2nd trade - only make a top up trade if a month has passed from the last one. When price is reaching a 52 week high (the right hand side of the blue arrow), I put on a pending sell order to sell at 25% profit (the right hand up arrow shows that). Once a sell order is in place, I ignore any new buy signals (there would have been a few). That stops FOMO trades.

Cryptocurrency

Aave (AAVEETH): Pending order at 40% profit target hit - 173 days held. Note the commentary box from the day after the trade - the sell signal that led to 27% correction the last 4 times. Must have known. Crypto trades are done ad hoc. This chart shows there would have been entry signals lower than the last entry - mid July 2024.

Income Trades

62 covered calls written across 4 portfolios (UK 2 Europe 13 US 47)

Naked Puts

A few sold puts on stocks am interested at buying at lower levels

- Engie SA (ENGI.PA): French Utility. Return 1.6% Coverage 0.3%

- ChargePoint Holdings, Inc. (CHPT): Electric Vehicles. Return 5.3% Coverage 20.7% - last week post suggested naked puts at 1.5 strike better than call spread trades

- Hecla Mining Company (HL): Silver Mining. Return 4% Coverage 2.7%

- Global X Uranium ETF (URA): Uranium. Return 1.7% Coverage 6.3%

- Lightbridge Corporation (LTBR): Nuclear Technology. Return 8% Coverage 1.2%

- Denison Mines Corp (DNN): Uranium. Return 3.3% Coverage 4.7%

- Nokia Oyj (NOK): Network Equipment. Return 1.75% Coverage 2.5%

Puts sold on stocks likely to be assigned

- Coty Inc. (COTY): Consumer Products. Return 2% Coverage 1.5%

Lightbridge Corporation (LTBR): Nuclear Technology. Read a tweet from someone I follow - Dead Money he said. As I look at the chart he is right almost any time invested - but the chart does show solid support at $2.46 (goes back way back in time). Sold puts at that level to get breakeven at 6.5% lower level than that.

Denison Mines Corp (DNN): Uranium. Denison is rated as one of the upcoming success stories yet the charts show it has few friends. Rather than buy stock sold puts at 1.50 strike.

Chart shows that this level has been a resistance level 3 times in the last two years - often makes for a new support level.

No credit spreads in place. Exercise risk in the pension portfolio is a little high given the number of sold puts that ran to assignment last week. Will be some losses taken to recover capital or a whole lot more kicking stuff down the road.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

August 19-23, 2024

#hive #posh