Markets move up all week ending in a busy options expiry. Drew the line under a bunch of sold puts - now for the long hold

Portfolio News

In a week where S&P 500 rose 4% and Europe rose 3.24%, my pension portfolio rose 2.16%. Drags were the marking to market of a few sold puts that were assigned at higher strikes than ruling prices. Pushing the up side was De Grey Mining (DEG.AX) up 7.5%, solid moves across all but 3 Japan stocks and all but 2 European stocks.

Big movers of the week were Mipox Corporation (5381.T) (51.6%), HelloFresh (HFG.DE) (45.6%), Appen Limited (APX.AX) (36%), Orora Limited (ORA.AX) (32.3%), Elixir Energy (EXR.AX) (22.4%), Torex Semiconductor (6616.T) (19.6%), Hercules Metals (BIG.V) (19.6%), Stuhini Exploration (STU.V) (17.2%), Earths Energy (EE1.AX) (13.6%), Marvell Technology (MRVL) (14.5%), Lotus Resources (LOT.AX) (13.6%), Mizuho Financial Group (8411.T) (13.1%), Bayhorse Silver (BHS.V) (12.5%), Skyharbour Resources (SYH.V) (12.15), KMD Brands (KMD.AX) (12%), Coeur Mining, (CDE) (11.8%), Hecla Mining Company (HL) (11.7%), LINTEC Corporation (7966.T) (11.7%), Honda Motor (7267.T) (11.5%), Sims Limited (SGM.AX) (11.5%), Cronos Group (CRON) (11.4%), Canopy Growth Corporation (WEED.TO) (11.4%), Evolution Energy Minerals (EV1.AX) (11.1%), Advanced Micro Devices (AMD) (10.6%), Microequities Asset Management Group (MAM.AX): (10.6%), Sigma Lithium Corporation (SGML) (10.4%), Guzman y Gomez (GYG.AX) (10.3%), Insignia Financial (IFL.AX)

A stronger list of 28 big movers many on the back of earnings (ASX listings and HelloFresh) or on bid news (2 ASX stocks). Big themes are represented in silver mining (5 stocks), alternate energy (3 stocks), uranium (2 stocks), marijuana (2 stocks).

No news around the move in Mipox price other than a move up in all Japanese semiconductor related stocks - driven by the advances from Nvidia. Mipox provides coating technologies used in semiconductor manufacturing (amongst other uses)

Better than expected inflation numbers drove the US markets to 6 consecutive up days - whew!. The worst of carry trade appears to have been unwound or scaled back.

Crypto Recovers

Bitcoin price trade sideways most of the week ending 0.6% lower with a peak to trough range of 9.5%

Ethereum price pushed higher to start and then drifted lower and sideways ending 2.2% higher on the week with a peak to trough range of 9.8%

Nothing sideways about Aave (AAVE) popping 29% from the Sunday lows and still going higher

Helium (HNTBTC) kept the momentum of the last few weeks going with another 30% rise

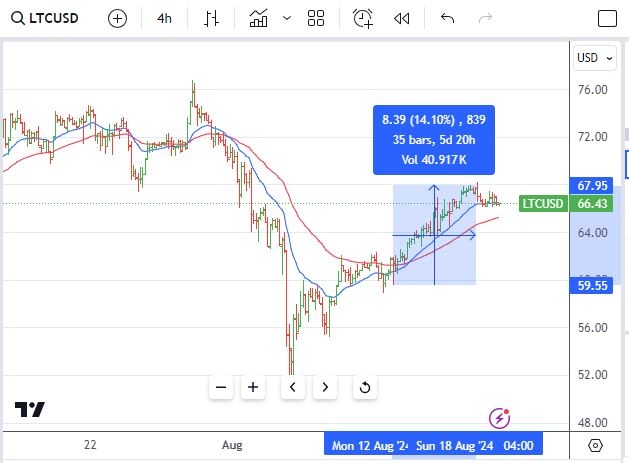

Litecoin (LTC) too with another 14% rise

Thorchain (RUNEETH) made a higher high with the moving averages crossing over higher for a 28% pop - some way below my last entry.

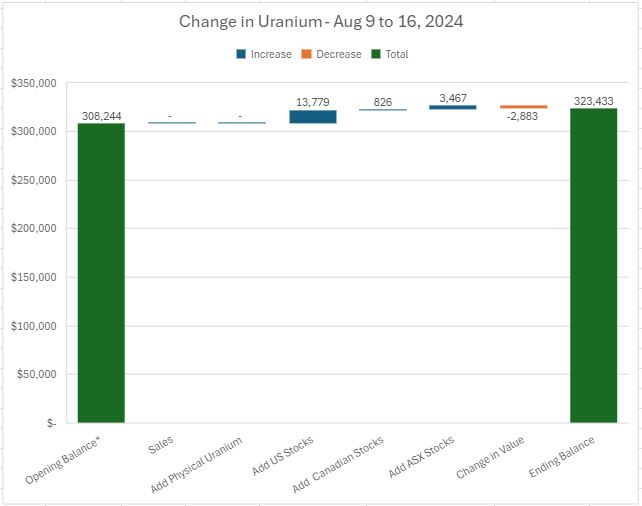

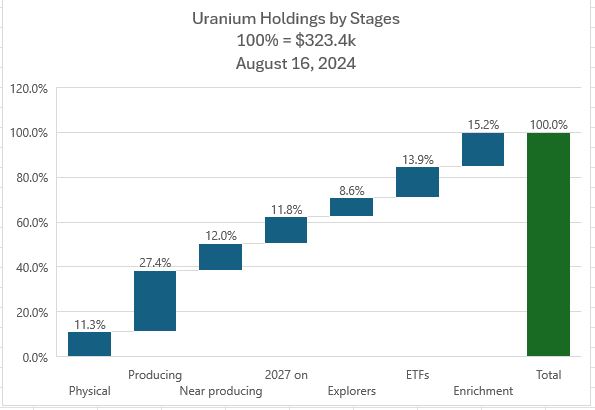

Uranium Holdings

Uranium markets started to shake off the summer slumbers. Seems that the detail of the Kazatomprom operations update points to lower production and a chance that most of the increases will head to Rosatom and not west.

Portfolios saw some changes with two assignments on sold puts and some bottom fishing in ASX stocks and a small add to F3 Uranium (FUU.V) ahead of the spin off of F4. Overall value dropped 0.94% - this is a bit of an anomalous situation as it reflects the marking down of the two stocks assigned at strikes higher than the ruling prices

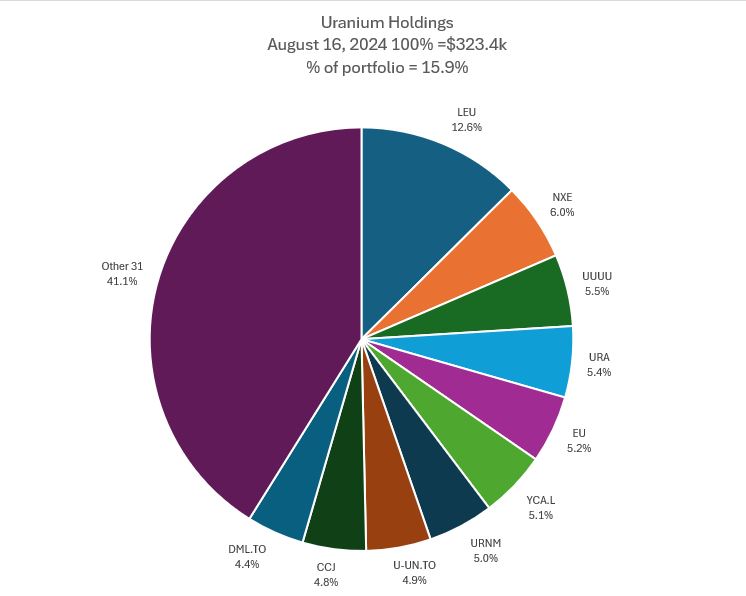

Mix of holdings sees the portfolio share rise to 15.9% which is a bit high. Addition to Sprott Uranium Miners ETF (URNM) brings it to slot 7 pushing IsoEnergy (ISO.TO) out of the top 10. Share of Others rises 1.6 percentage points.

Holdings by stage sees 2 percentage point increase in ETF holdings and 0.3 percentage point increase in Explorers on the back of the adds made in ASX stocks and F3 Uranium (FUU.V). Largest reduction is 0.5 percentage points in Physical. The mix feels right - the challenge is how to trim to get the holding percentage down to 15%.

A few news headlines across the portfolios are all positives. Did add to holdings of Uranium Energy Corp (UEC) and Alligator Energy (AGE.AX) in the week.

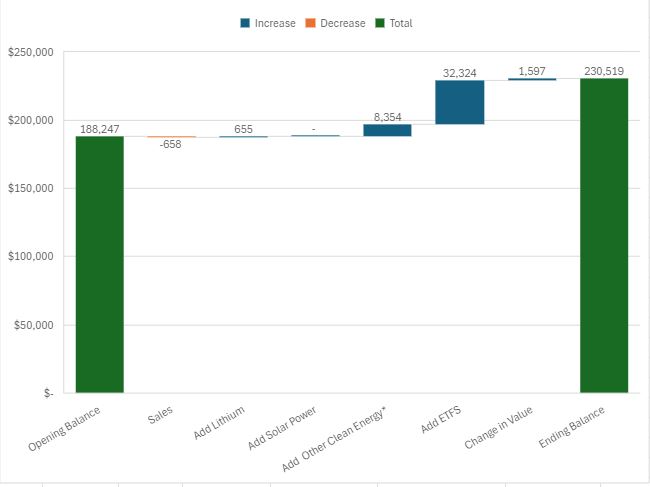

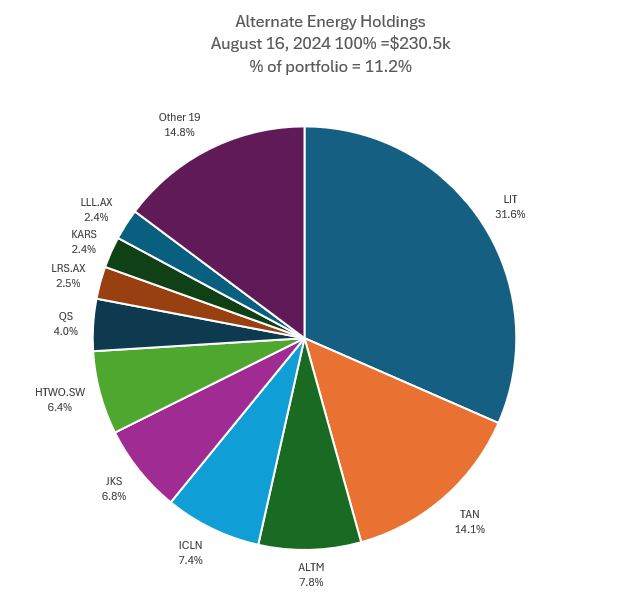

Alternate Energy Holdings

News making move of the week is the takeover of Latin Resources (LRS.AX) by Pilbara Minerals (PLS.AX). Am holding both stocks. Latin Resources is well advanced in development of it Brazil hard rock lithium tenements and has been a stellar performer since my first purchases in 2017 with a few top ups along the way.

One chart to map the two stocks together - chart goes back to January 2020 - longest tranche of stock still held in Latin Resources (the bars) and shows Pilbara Minerals (red line) and Sigma Lithium (SGML - purple line). The huge differential suggests that this acquisition may be a bridge too far for Pilbara Minerals or they overpaid. Sigma Lithium operates a hard rock operation also in the Minas Gerais region - would have been a cheaper target.

A bit more action in the alternate energy holdings also from sold put assignments. Decided to bite the bullet and let the stocks go to assignment rather than kicking the can down the road. Overall portfolio value went up 0.85% which is not bad considering the premium on the two ETFs assigned. The sale and add in lithium stocks was a small switcheroo in Brazil lithium.

ETF adds makes for a big jump in share of portfolios up nearly 2 percentage points to 11.5%. Biggest move in the mix of holdings is two slots up for Invesco Solar ETF (TAN) with the add there. Coming into the list in slot 7 is QuantumScape (QS) with the adds in two portfolios. Dropping out of the top 10 is Pilbara Minerals (PLS.AX) with the market not liking their bid for Latin Resources (LRS.AX) which rose two spots. Share of Others dropped 0.4 percentage points but went up one stock with the addition of Lightning Minerals (L1M.AX)

Bought

Intelligent Investor Australian Equity Growth Fund (IIGF.AX): Australian Index. Dividend reinvestment

Intelligent Investor Australian Equity Income ETF (INIF.AX): Australian Index. Dividend reinvestment

Sprott Uranium Miners ETF (URNM): Uranium. Assigned on weekend early on sold put in personal portfolio. Breakeven at $47.54 is 17% higher than $40.41 open (Aug 12)

F3 Uranium Corp (FUU.V): Uranium. F3 announced the spin off of F4 Uranium for holders at August 14 record date. Added to holding in pension portfolio to scale up the new opportunity - it is a taxable event.

CleanSpark, Inc (CLSK): Bitcoin Mining. Assigned early on sold put - idea was to scale into holding at a lower entry price. Breakeven for this tranche at $15 is an ugly 35% above the $11.08 close (Aug 13). Wrote covered call for 2.5% premium with 44% price coverage.

This is what I wrote in TIB717

CleanSpark has outperformed Bitcoin since the current bull rally started in 2023. Looking back to the cycle high the performance gap is 16 percentage points. Kind of itching to get back to Bitcoin mining as that is where my journey started when Bitcoin was $319

Time to revisit the charts with the time between that post and now not working out as planned - first goes back to the cycle low in late 2022. CleanSpark completely outran Bitcoin and was 150 points percentage higher. The key part of the chart is the different steepness - when Bitcoin jumped 84% in late 2023, CleanSpark jumped 200%. That gets me interested

Now for a comparison chart going back to the start of the current consolidation range, CleanSpark has zigzagged along in a similar fashion but in a tighter and lower range. The big selloff came before the Japan carry trade event where price was level pegging and then dumped nearly 50 percentage points. The middle green vertical line is key - Bitcoin halving. That does change the economics for Bitcoin miners. This may require one more averaging down. Earnings were released in the week - everything looks on track there once you look past the early impairments taken on retiring equipment - that is the business of Bitcoin mining.

St George Mining (SGQ.AX): Rare Earths Mining. Next Investors idea to start a holding in this niobium explorer. 80% of world's niobium comes from a single mine in Brazil and the St George property is a proven discovery next door. There is also potential for other rare earths. Next Investors had offered a placement slot in the capital raise at 2.5 cents a share. I chose not to do that as the minimum bid was larger than I wanted to risk.

When acquisition of the property was announced share price rocketed and then tanked - company requested a trading halt. The price collapse was because of a Hot Copper report about an old tailings dam on the property. Report was false - dam has been rehabilitated. That was enough for me to take a small holding in the personal portfolio. Chart shows the run and dump.

Lightning Minerals (L1M.AX): Lithium. Read newsletter from Next Investors highlighting the announcement of the acquisition of Latin Resources (LRS.AX) by Pilbara Minerals (PLS.AX) and outlining their rationale for investing in a Brazil based lithium explorer - much the same upside and risk that Latin Resources was all those years ago.

Switched out A$1k of Latin Resources stock to acquire a small parcel of Lightning Minerals. Note: My entry to LRS was 5 years before Next Investors - see more below.

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Assigned early on sold put at 1.8% lower price than assignment in July. Breakeven at €15.18 is however 2.4% higher than €14.82 close (Aug 14)

LANXESS AG (LXS.DE): Specialty Chemicals. Assigned early on sold put at 2% higher price than assignment in July (smaller parcel bought). Breakeven at €24.44 is 6.8% higher than €22.89 close (Aug 14). The selloff in the previous week changed the whole dynamic of the sold puts and the mood of the market in Europe.

Uranium market started to find a bottom - scaled into ASX positions in pension portfolio to average down entry prices.

Alligator Energy Limited (AGE.AX): Uranium. Explorer in South Australia and Northern Territory. Good first drill results this week.

DevEx Resources Limited (DEV.AX): Uranium. Explorer in Northern Territory.

Deep Yellow Ltd (DYL.AX): Uranium. Developer in Namibia due to produce from 2026. Mine is fully funded.

Elevate Uranium Ltd (EL8.AX): Uranium. Explorer in Namibia with low depth open cast mine.

Lotus Resources Limited (LOT.AX): Uranium. Developer in Malawi due to restart production in 2025

Silex Systems Limited (SLX.AX): Uranium Enrichment. Australian based enrichment technology supplier.

Aurora Cannabis Inc (ACB.TO): Marijuana. Chart looks like price is bottoming out. Bought another small parcel to start the rebuild.

3D Systems Corporation (DDD): 3D Printing. Assigned on sold put. Breakeven after 12 months of sold puts is $2.98, 22% higher than the $2.44 close (Aug 16).

Earnings filing delays make the market nervous even though the numbers were in line with guidance.

Société Générale SA (GLE.PA): Assigned on sold put. Breakeven after 12 months of sold puts is €24.83, 17.8% higher than the €21.06 close (Aug 16).

Global X Lithium ETF (LIT): Lithium. Assigned on sold put. Breakeven after 12 months of sold puts is $42.44, 16.7% higher than the $36.38 close (Aug 16). Holding for the long haul for climate activitists to come back with spending plans.

QuantumScape Corporation (QS): Battery Technology. Assigned on sold put. Breakeven after one month of income trades is $6.44, 10% lower than the $76.29 close (Aug 16). Ex date for upcoming dividend Aug 19 - get that too.

Wynn Resorts (WYNN): Gaming. Assigned on sold put. Breakeven after 12 months of sold puts is $68.35, 12.7% higher than the $5.72 close (Aug 16).

Deutsche Bank AG (DBK.DE): German Bank. Assigned on sold put. Breakeven after this contract of €14.371 is 2.3% higher than €14.04 close (Aug 16)

Uranium Energy Corp (UEC): Uranium. Assigned on sold put. Breakeven after this contract of $6.10 is 25.8% higher than $4.85 close (Aug 16). Ouch.

Volkswagen A (VOW.DE): Europe Automotive. Assigned on sold put. Breakeven after 8 months of sold puts is €113.36, 11.8% higher than €101.40 close (Aug 16)

LANXESS AG (LXS.DE): Specialty Chemicals. Assigned on sold put. Breakeven after this contract of €23.60 1.1% lower than €23.87

Norwegian Cruise Line Holdings (NCLH): Cruising. Assigned on sold put. Breakeven after 12 months of sold puts is $13.4, 16.7% lower than $16.09 close (Aug 16)

NuScale Power Corporation (SMR): Nuclear Technology. Assigned on sold put. Breakeven after 5 months of sold puts is $8.12, 10.5% higher than $9.08 close (Aug 16)

Invesco Solar ETF (TAN): Solar Power. Assigned on sold put. Breakeven after 12 months of sold puts is $45.33, 11.4% higher than $40.70 close (Aug 16)

Marriott Vacations Worldwide Corporation (VAC): Hotels. Assigned on sold put. Breakeven after 12 months of sold puts is $79.42, 11.5% higher than $71.19 close (Aug 16)

A mixed bags of entries - key lesson is there have been spells when been too aggressive selling naked puts.

Sold

Latin Resources (LRS.AX): Lithium. Sold small parcel to fund purchase of Lightning Minerals (L1M.AX) for 2900% profit since January 2020. The scale of the profit made was substantial - hoping there is similar potential in Lightning Minerals.

Chart goes back to initial trades as far back as May 2017 with each vertical line showing entry weeks. Portfolio currently holds tranches from the last two entries (Jan 2020 and Dec 2022). The implied value of the Pilbara Minerals (PLS.AX) offer is 3233% and 1566% - happy with that.

Aurora Cannabis Inc (ACB.TO): Marijuana. Assigned on covered call for 0.1% blended profit since March/April/July 2024 on a maximum gain basis. FIFO loss would have been ugly which is what the accountant will do. Marijuana has been a difficult investment - industry has been scaled into and massive overcapacity exists while legalization has been slow across the world. Aurora has made progress in more than one geography and price is showing signs of life - hence getting called away.

Global X FTSE Southeast Asia ETF (ASEA): Southeast Asia Index. Closed out at 52 week high for 6.2% blended profit since April/June 2023 - just made inflation. GDP growth trade idea with the end of Covid restrictions.

ENGIE SA (ENGI.PA): French Utility. Assigned on covered call for 1.3% loss since June 2024. Engie has been a solid income trade with profits outweighing this loss by 5 times in the last 12 months.

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Assigned on covered call for 2.8% profit since June 2024 in managed and personal portfolio and 5.6% blended profit in pension portfolio since June/July 2024. Averaging down helped.

PayPal Holdings (PYPL): Payment Services. Assigned on covered call for 25.7% blended loss since May 2021/August 2022/January/September 2023. Early tranches bought before the falling out with eBay drove the losses. Income trades recovered 41% of the capital loss.

HelloFresh SE (HFG.DE): Europe Restaurants. Assigned on covered call for 9.6% profit since July 2024. Part of a tranche bought when price popped onto big movers list.

JDE Peet's N.V. (JDEP.AS): Europe Food Products. Assigned on covered call for 10.9% loss since May 2024. Stock screen idea. Some work to grab this back.

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Assigned on covered call for 1% loss since May 2024. Income trades have easily covered this loss

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

Top Ups

New Hope Corporation Ltd (NHC.AX): Coal Mining. Dividend yield 6.95%.

Chart shows price making a new high as it trades along the consolidation zone - still waiting for the blue arrow break tot he upside. Trade averages down entry price a little

Sold

No sales

Shorts

Pfizer Inc (PFE): US Pharmaceuticals. With price closing at $28.80, 27/25 ratio put spread expired out-the-money. Doing the trade as a ratio worked well with the sold put (25) premium affording an 8.4% profit on the bough put premium.

The Technology Select Sector SPDR Fund (XLK): US Technology. With price closing at $225.05 (Aug 16), 217.5/212.5 put spread expired out-the-money - cannot assess the profit impact until the ratio part kicked down to 201 strike has been resolved.

Chart shows that price is well away from the new sold put (210) level - next trade adjustment is either to close out the sold put and start again or set up a credit spread with that 210 base.

Hedging Trades

Pan American Silver (PAAS): Assigned early on sold put. Breakeven after 3 months of sold put writing at $20.15 is 0.2% above $20.11 close (Aug 15)

Expiring Options

ChargePoint Holdings (CHPT): Electric Vehicles. With price closing at $1.79 (Aug 16), 2.5/3.5/1.5 call spread risk reversal set up in February 2024 expired out-the-money. With high implied volatility on the sold puts overall trade was 23% profitable on capital invested on the long calls.

Chart shows that price did not once cross the bought call (2.5) level and also only spent a few weeks below the sold put (1.5) level. Maybe the better trade would be to just sell naked puts below the consolidation zone.

Lightbridge Corporation (LTBR): Nuclear Technology. With price closing at $2.58 (Aug 16), 5/7.5/2.5 call spread risk reversal expired out-the-money. Somehow the trade got some mismatches in the contracts - not enough sold calls. Net results was a 14% loss. Will make up the dollar value of that in the next cycle of covered calls on the long position

Income Trades

Covered Calls

Coty Inc (COTY): Consumer Products. TheStreetpro have sold out their holdings into strength. Rather than do that have chosen to hold the stock and write covered calls tightly to grab premium on the way to the exits. Wrote covered call for 2.8% premium with 8.7% price coverage.

Fresenius SE (FRE.DE): German Healthcare. With price opening at €31.74 and trading higher was a chance 32 strike covered call would go to assignment. Bought the sold call back to roll out at a higher strike. Locked in 90% profit on the buyback. As it happens stock closed below strike at €31.95

73 covered calls went to expiry with 9 assigned (in brackets) (UK 7 (3) Europe 16 (3) US 49 (2) Canada 1 (1))

8 new covered calls written for September expiry (Europe 6 US 2)

Naked Puts

Hecla Mining Company (HL): Silver Mining. Return 2.4% Coverage 0.8% - one week to expiry. Quite happy to buy at $5.00 with breakeven at $4.88.

Dutch Bros (BROS): US Restaurants. TSP added this back to their holdings. Rather than buy the stock sold a naked put with 2.77% return and 5.3% coverage.

New sold puts on stock likely to be assigned at assigned strike.

- Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Return 2.5% Coverage 4%

Rolled out

- NuScale Power Corporation (SMR): Nuclear Technology. 238% loss on buyback. 8.5% cash positive.

- Lightbridge Corporation (LTBR): Nuclear Technology. 98% profit on buyback. 215% cash positive.

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. 31% loss on buyback. 35% cash positive.

17 naked puts went to expiry of which 8 were assigned). The selloff in the middle of the cycle did not help. (UK 2 Europe 10 (5) US 4 (3) Canada 1)

Credit Spreads

No credit spreads in place

Exercise risk was pulled back inside margin requirements with the mix of sold puts assigned and the ones kicked down the road in the last 10 days of the cycle.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

August 12-16, 2024

It seems that the market will move more if crypto has pulled back. Great post and lots of information

The days of uncorrelated markets are gone. The crypto ETFs have dragged a lot of big money into crypto. When they get nervy, they sell everything.