Markets keep drifting a little lower through the rotation. With some exercise risk sitting in the August expiries, was a week to be a bit more cautious.

Portfolio News

In a week where S&P 500 dropped 0.83% and Europe rose 0.66%, my pension portfolio dropped 0.89%. Uranium and nuclear technology continue to be a drag. The alternate energy surge of recent weeks backs off too and big holding De Gre Mining (DEG.AX) dips 2.9%. Europe was up a little. Japan also falling with a strengthening Yen.

Big movers of the week were SunPower Corporation (SPWR) (23.7%), TechGen Metals (TG1.AX) (21.4%), Blue Star Helium (BNL.AX) (20%), Furukawa Battery Co (6937.T) (18.6%), Sarytogan Graphite (SGA.AX) (15.1%), KMD Brands (KMD.AX) (14.1%), Earths Energy (EE1.AX) (13.3%), ChargePoint Holdings (CHPT) (11.7%), Aura Energy (AEE.AX) (11.5%), Evolution Energy Minerals (EV1.AX) (10.3%)

Another short list of only 10 big movers. One theme making a bit of a showing again is alternate energy and the materials needed (5 stocks). Also a few stocks showing signs of life or are they death throes e.g., Sunpower (SPWR) up 23% on the week but down 13% on Friday? In a week that uranium was down good to see one uranium stock in there - there may be hope for African uranium with Aura Energy in Mauritania.

Rotation continues in US markets. Brighter light emerges at the end of the week with GDP numbers showing economic growth is healthy - soft landing it seems is here

Crypto Bumbles

Bitcoin price softened to start the week and found buyers mid-week ending 2% higher with a trough to peak range of 9.6%

Ethereum price struggled despite the opening of the Spot ETF's in the week ending 3.8% down on the week with a peak to trough range of a 12.7%.

There is always risk starting a new ETF in a week the markets are soft - outflows start as soon as fund holders can exit.

Most altcoins followed the same path - softening with stock markets and bouncing midweek. Most did not gain on the week - Solana (SOL) did up nearly 7%

New Economy (XEM) surfed along the 20 day moving average (on 4 hour chart) and surged after the last toucch with a rise of 26% on the week - two weeks in a row.

Looking at prices relative to Bitcoin suggests there is a rotation happening in crypto too - going to Bitcoin - maybe because of the Donald Trump suggesiton of creating a strategic reserve - best hold the reserve currency - one chart on Fantom (FTMBTC) down 20%

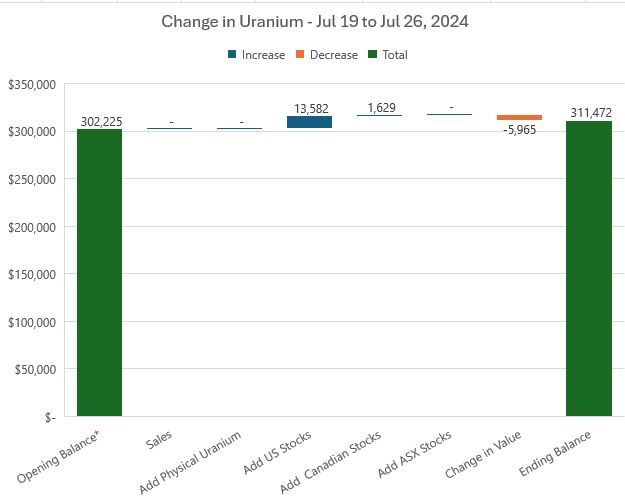

Uranium Holdings

Another down week for uranium but a lot less sever than the week before with only a drop of 1.9% in valuation. Was still adding positions in Niger and got assigned on one stock in US and one ETF.

Notes: Percentage change is calculated from the week before value but does include changes in stocks that are added during the week. The additions that come from stocks assigned are shown net of options premiums for sold puts.

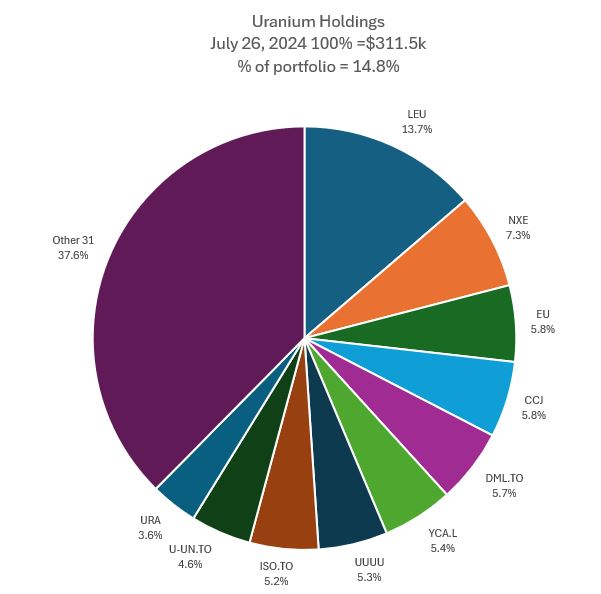

The mix of holdings changed with the additions made - Energy Fuels (UUUU) moves up two places and Global X Uranium ETF (URA) comes into top 10 displacing Kazatomprom (KAP.IL). Overall percentage of portfolio value drops 0.7 percentage points as uranium dropped more than overall portfolio value.

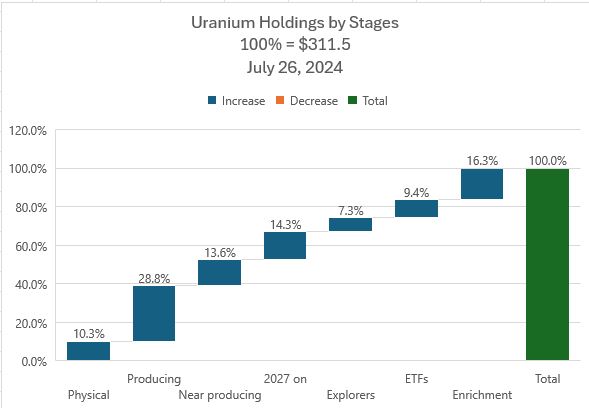

The analysis of holdings by production stage shows drops in relative holdings across all stages apart from ETF's that goes up with the add there. The balance feels right with 60% held in stocks tied to physical, producing, enrichment or close to production. Did the analysis of Top 15 stocks in the ETF added - it is 10.9% physical, 38.8% producing, and 9% from 2027 on. It also holds 14.2% in stocks that manufacture equipment used for nuclear power. So my portfolios are a bit more invested in the producing end but not too far away from the ETF.

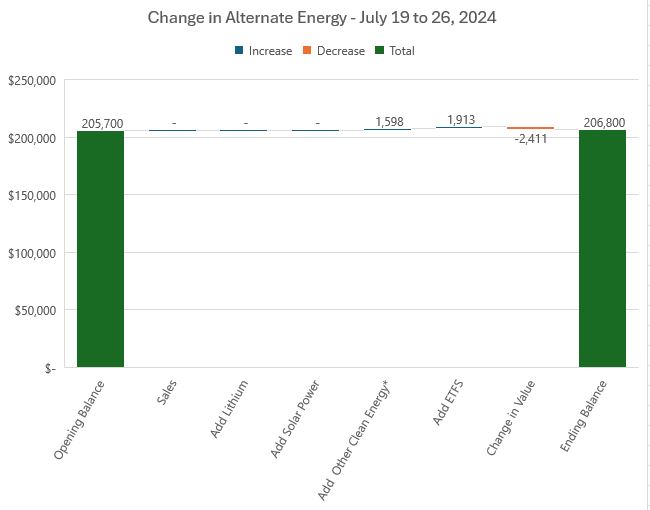

Alternate Energy Holdings

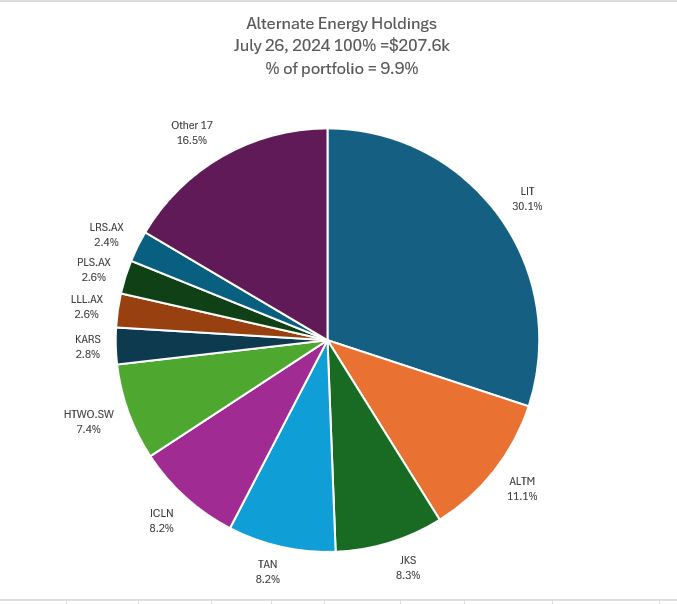

Alternate energy holdings saw a fall in value of 1.2% with two additions. The one in Other Alternate Energy was not included in the prior analysis - the holding in QunatumScape (QS) went out of one portfolio the week before and came back in another this week - added it in as it is active in battery technology.

The mix of holdings sees the share of portfolios going up 0.3 percentage points to 9.9% and Krane Shares EV ETF (KARS) coming into the top 10 after the additions in spot 7 and pushing Sigma Lithium (SGML) out. The Others group now has 17 stocks from 16 with the addition of QuantumScape (QS).

Leo Lithium (LLL.AX) remains suspended but did release information about the distribution of proceeds of the Mali lithium venture. That is going to knock valuation down dramatically - and is late 20204 and early 2025 only. It does not look like the ASX will allow a return to listing.

Bought

RTL Group S.A. (RRTL.DE): Satellite Broadcasting. Average down entry price in pension portfolio. Stock screen idea from a few months back.

Chart shows that price could not hold the break and then fell below the support (horizontal red line). There is something of a W forming at the next level down - normally one likes to see an upward sloping shoulder for an inverse head and shoulders. This may not hold though the broadcast of Paris Olympics may provide some short term impetus - but a bit wary of earnings coming out Aug 8.

Rolls-Royce Holdings plc (RR.L): Aerospace/Defense. Scaled into holding in pension portfolio - viewing this as an Small Modular Reactor (SMR) investment. Wrote covered call for 1.7% premium with 8.1% price coverage.

The chart looks a bit like it is topping out. As SMR is a small slice of the business, the ups and downs of the jet engine and defense contracts are a price of entry.

Energy Fuels Inc (UUUU): Uranium. Averaged down entry price in managed portfolio.

QuantumScape Corporation (QS): Battery Technology. Added holding to managed profolio after a week where electric vehicles got a bit of a step up. Used this portfolio as it has a bit more margin available than the pension portfolio in which stock was called away the week before. Sold naked put as well with 4.6% return with 12.4% price coverage. Wrote covered call for 3.1% premium with 25.2% price coverage.

Chart is very spikily driven by earnings - the red E's all have price drops after release of earnings. With implied volatility high the income trades make solid returns (but liquidity is not great)

Next chart was not drawn at the time of making the trade - it goes back to the bottom of the big price collapse for QuantumScapa and compares with ChargePoint (CHPT), the EV charging busines and the Krane EV ETF (KARS). Investing in battery technology is better than the vehicles or the charging.

KraneShares Electric Vehicles and Future Mobility Index ETF (KARS): Electric Vehicles. Tesla (TSLA) earnings disappointed the market with a big sell off in extended hours trading (Jul 23). These selloffs tend to be an over-reaction. Added to holdings in this ETF to average down entry price and catch any rebound. Tesla is 3.8% of the ETF and there are 3 other EV makers in their top 10 holdings.

Global Atomic Corporation (GLO.TO): Uranium. Global Atomic announced a private share placement at C$1.35 a share diluting existing shareholders. They are clearly running out of working capital while they line up debt financing for he start of their Niger mine. Price always drops to placement price. It did and hard - bought below that level. Sure do hope they can line up the financing and get moving on developing the mine.

Global X Uranium ETF (URA): Uranium. Assigned early (4 weeks early) on sold put. Breakeven is $29.66 after closing down all the legs for the 33/28 credit spread = a 10% premium to $26.95 close (Jul 25). This is a hold for the long haul. The ETF has more than 50% of its holdings tied to physical price or production.

Sold

ChargePoint Holdings (CHPT): Electric Vehicles. Sold 2.5 strike August expiry call options held as part of a spread trade by mistake. $79.20 loss until fixed. As price does not look like it will pass $2.50 am holding until closer to expiry - may recover the loss at expiry.

iShares Euro Dividend ETF (IDVY.L): Europe Index. Sold in managed portfolio for 15.8% profit since January 2013. This holding was set up when the portfolio was started - invested in regional ETF's for US, Europe and Japan. Not anywhere close to matching inflation over 11 years held.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Lindsay Australia Ltd (LAU.AX): Logisitics. Dividend yield 5.40%

Chart shows price breaking the downtrend and starting to cycle higher. There is 40% headroom to the 2023 highs. Just got to hope that price does not make a repeat of the cycle seen in the second half of 2023.

Top Ups

Endeavour Group Ltd (EDV.AX): Beverages. Dividend yield 4.10%

Chart shows price failed to hold the break of the downtrend and bottomed out at the low of that trend twice - maybe this time the break will hold.

Insignia Financial Ltd (IFL.AX): Financial Services. Dividend yield 7.20%

Chart shows price making a third attempt at breaking the longer downtrend - maybe this time the break will hold from the short term downtrend

Perenti Ltd (PRN.AX): Mining Services. Dividend yield 1.90%

Chart shows price collapsing after the DDH merger and then starting a recovery move and a consolidaiton - maybe this time the break will get price back to the pre-merger highs. Trade does average down entry price.

Star Entertainment Group Ltd (SGR.AX): Gaming.

Do not normally add to stocks bought in close proximity to previous adds but decided to follow this move. Chart shows the short term uptrend drawn at the last purchase. Added to the holding as it seems the newly appointed CEO is already making something of a difference.

APM Human Services International Ltd (APM.AX): Human Resources. Dividend yield 5.40%. Was not paying attention when adding to the holding other than it does average down entry price - there is a private equity offer for the stock at $1.45 just above the price paid for this tranche. The likelihood of a competing offer coming along is low as APM is not permitted to provide due dilligence access.

Hedging Trades

Technology Select Sector SPDR Fund (XLK): US Technology. With price opening at $225.16 (Jul 23) put in place an August expiry 217.5/212.5 ratio put spread. This offers protection for a drop between 3.5% and 5.95%. Bought put is fully funded by the ratio.

[Means: Ratio Spread. Sell more options than one buys with sold premium funding bought premium. ]

Income Trades

Covered Calls

66 covered calls written across 4 portfolios (UK 4 Europe 15 US 46 Canada 1)

3D Systems Corporation (DDD): 3D Printing. Meant to write 12 contracts - did 124 - good news is brokerage paid me commission for the trade which gives leeway for the buyback. Did the buyback a few days later at the same strike and was paid commission on that too - 6.5% profit for being the market maker.

Naked Puts

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. With the assignment of Global X Uranium ETF (URA) bought back sold puts needed to reduce margin exercise risk. Delivers 38.1% profit in 3 weeks. Do remain exposed long to the ETF.

Did add a bunch of sold puts on stocks that were assigned the week before and a few in stocks am happy to scale into at lower prices.

- JDE Peet's N.V. (JDEP.AS): Europe Coffee. Return 1.6% and 1.8% Coverage 2.1%

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Return 2.1% Coverage 5.8%

- Engie SA (ENGI.PA): French Utility. Return 1.4% Coverage 2%

- Sprott Junior Uranium Miners ETF (URNJ): Uranium. Return 4.8% Coverage 0.9%

- Wynn Resorts, Limited (WYNN): Gaming. Return 1.1% Coverage 9%

- Commerzbank AG (CBK.DE): German Bank. Return 1.4% Coverage 4%

- Deutsche Bank AG (DBK.DE): German Bank. Return 1.6% Coverage 2.6%

- Société Générale SA (GLE.PA): French Bank. Return 1.5% Coverage 6.3%

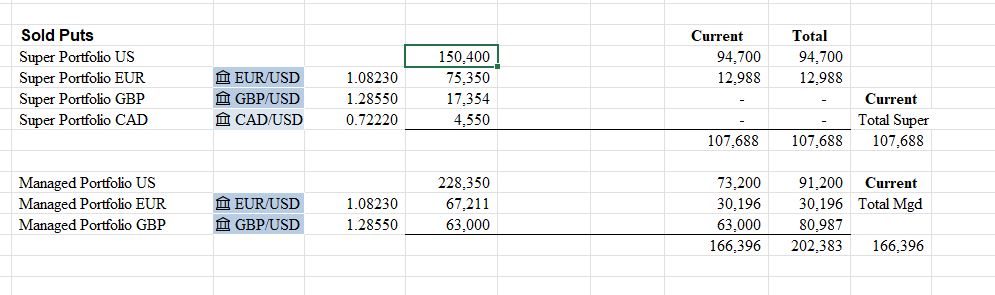

Exercise risk (sold puts only - no credit spreads open) is a bit high in the current month especially in the pension portfolio. Hence buying back TLT sold puts - will kick a few more down the road on up days.

Note: As at July 29.

Currency Trades

US Dollars (AUDUSD): Sold US Dollars to fund Australian pension payment for next month.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

Jul 22-26, 2024

#hive #posh