The stock rotation rolls on. Uranium gets sold off. Europe stocks see more assignments than US - a busy week adjusting

Portfolio News

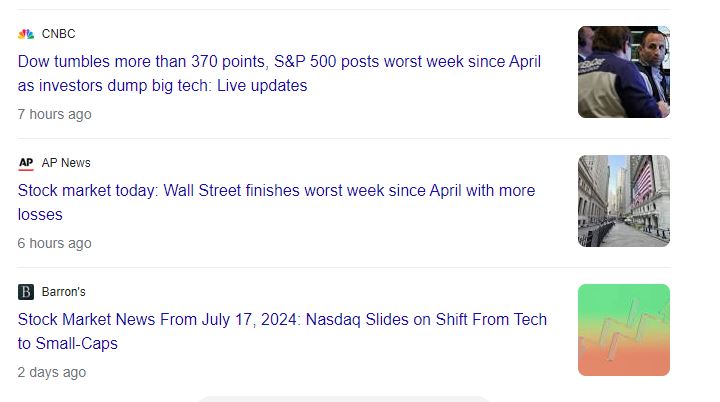

In a week where S&P 500 dropped 1.96% and Europe dropped 2.63%, my pension portfolio dropped a whopping 3.79%.

Biggest drags were Sunpower (SPWR), nuclear technology like NuScale (SMR) and the whole uranium sector. Timing of pullbacks like this in the week of options expiry does reduce the number of stocks going to assignment.

Ugliest fall was Sunpower (SPWR) down 74% on the week - looks like it is heading to bankruptcy or a firesale.

Big movers of the week were Lifeist Wellness (LFST.V) (60.9%), Stroud Resources (SDR.V) (31.2%), Genmin (GEN.AX) (25%), ProShares UltraPro Short QQQ (SQQQ) (12.6%), CleanSpark (CLSK) (12.6%), NeuRizer (NRZ.AX) (12.5%), Terra Uranium (T92.AX) (10.3%), Canopy Growth Corporation (WEED.TO) (10.3%), Lanxess AG (LXS.DE) (10%)

A tough week with only 9 stocks in the big movers list. No surprise to find one of the nine is a short Nasdaq ETF (SQQQ). Surpise on a week that uranium was crushed to find one uranium stock.

Good to see a struggling medicinal cannabis stock on the list - two weeks in a row and one of two marijuana stocks. And Bitcoin mining works in a week when Bitcoin pops - 2nd week in a row.

The rotation from big tech that started last week continued - with Nasdaq and S&P 500 falling on the week but Dow Jones and Russell 2000 rising.

Crypto Rebounds

Bitcoin price pushed higher all week ending 11.6% higher with a trough to peak range of 12.6%

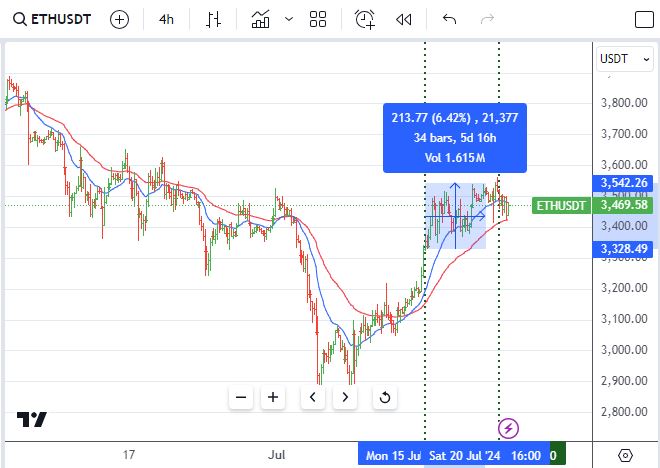

Ethereum price pushed higher too but was more subdued ending 4.6% higher with a trough to peak range of 6.4%. Fully expect to see the price keep moving ahead with the Spot Ethereum ETF starting to trade in the coming week.

Reversing the trend from the last two week was Aave (AAVE), the lending protocol dropping 11%

Helium (HNTBTC) found buyers after forming a bottoming formation with a 48% surge

Solana (SOL) followed up the move of the past two weeks too with a dip back to 20 day moving average (on a 4 hour chart) running up 21%

And Ripple (XRP) also built on the momentum with a surge of 21% and giving only one third of that away (also a 4 hour chart)

Uranium Holdings

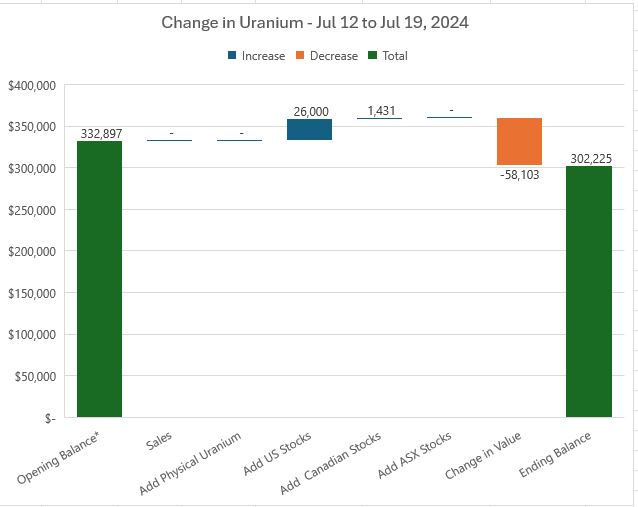

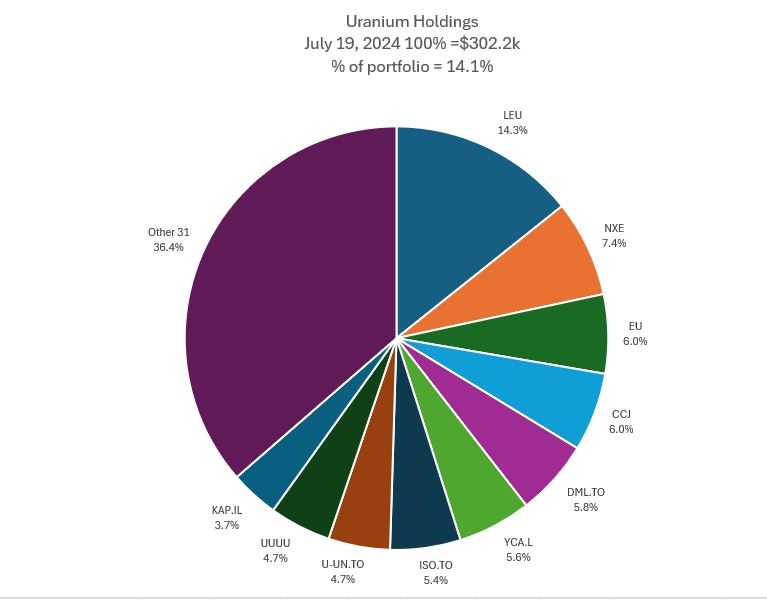

Was a messy week for uranium stocks with a few stocks joining on assignment and a massive 15% drop in values. Am sure waiting for the 2nd half of the year contracting cycle to kick in

Mix of holdings changed with an uptick in share for Centrus (LEU) to 14.3%. NexGen (NXE) rises one place. Encore Energy (EU) and Cameco (CCJ) swap places. Sprott Physicall Uranium Trust (U-UN.TO) drops several places - it had a wrong price set on the spreadsheet. Energy Fuels comes into the top 10 with an add on assignment. Kazatomprom (KAP.L) comes back onthe list as its price recvoered a little from the MET ruling news.

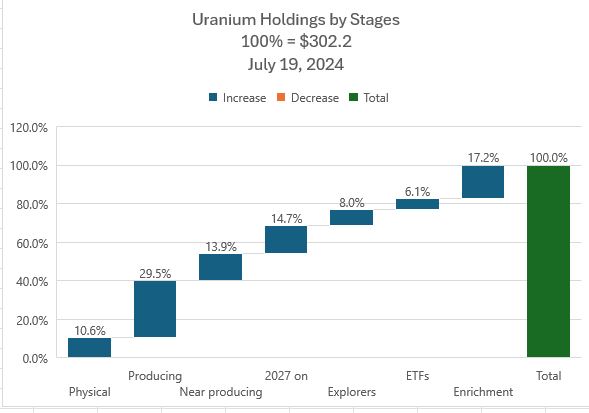

Uranium holdings by stages sees some changes - share of physical drops with the data error, producing goes up a point with addition of Energy Fuels (UUUU), and share of ETF's and Enrichment goes up with the adds there.

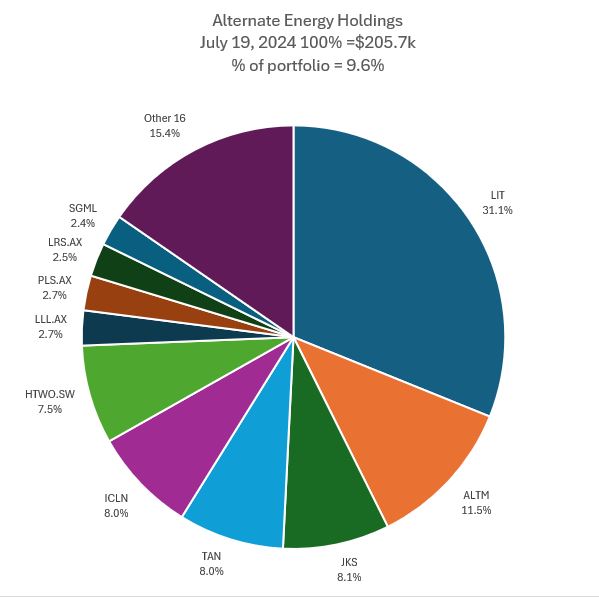

Alternate Energy Holdings

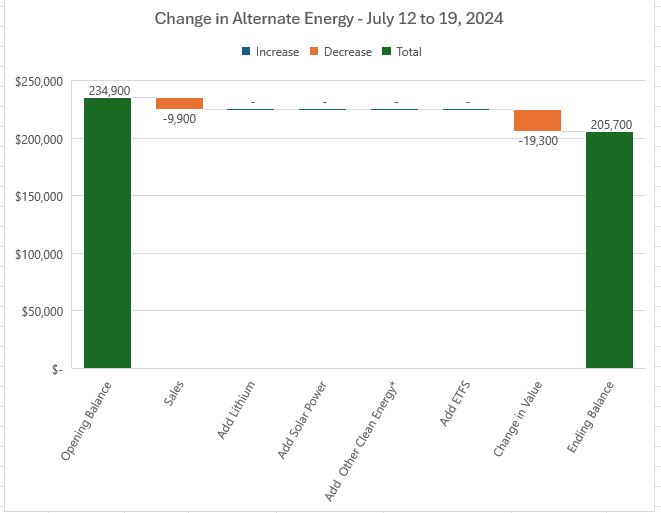

Value of holdings were hit a more modest 8.2% with the majority of that coming from the drop in Sunpower (SPWR) and its share of the Invesco Solar ETF (TAN). Sales were the assignment of Sunrun (RUN).

Mix of holdings sees Sunpower (SPWR) and Sunrun (RUN) drop out of the list. The rise of Leo Lithium (LLL.AX) is an anomaly as it is currently suspended and its price did not change where everything else did. Sigma Lithium (SGML) comes on to the Top 10. Share of Others drops a little over 2 points.

Bought

Aurora Cannabis (ACB.TO): Canadian Marijuana. Averaging down entry price ahead of options expiry. As it happens price sagged below covered call strike.

NuScale Power Corporation (SMR): Nuclear Technology. With price opening at $15.34 (Jul 15), set up a January 2025 expiry 17.5/22.5/13 call spread risk reversal. With net premium of $1.17, the 17.5/22.5 bull call spread offers maximum profit potential of 327% for a 46.7% move in price. The spread was fully funded with an August expiry sold put (13) with 15.3% price protection.

Let's look at the chart which shows the bought call (17.5) as a blue ray and the sold call (22.5) as a red ray and the sold put (13) as a dotted red ray with the expiry date the dotted green lines on the right margin. This can only be viewed as a blue sky trade predicated on the signing of the Advance Act last week and the fact NuScale is the first and only company to have received U.S. Nuclear Regulatory Commission design approval and certification.

The risk in the trade is whether price stays above the sold put level (13) until August expiry (5 weeks away). If it does the call spread is a free trade.

[Means: Call Spread Risk Reversal. Buy a bull call spread and fund the premium by selling an out-the-money put option below the strikes for the call spread]

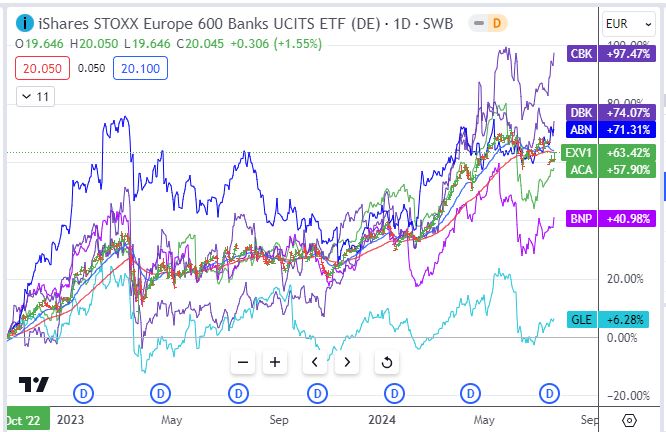

Société Générale SA (GLE.PA): French Bank. Assigned early on sold put in personal portfolio. Dividend yield 3.79%

Quick comparison chart against European banking ETF (the bars) and the banks assigned this last week. SocGen is the clear laggard. Added in two more French Banks to the chart to test if it just a French thing. BNP (BNP.PA - purple line) is 34 points ahead and Credit Agricole (ACA.PA - green line) 51 points ahead. The other banks in the portfolios are all ahead of the ETF.

Lightbridge Corporation (LTBR): Nuclear Technology. Converted the call option trade made last week into a 5/2.5 risk reversal trade by selling an August expiry 2.5 strike put option. This leaves breakeven on the trade at $5.20 - a big move of 24% needed from $4.19 open (Jul 17). Even more after a 10.7% drop on the day. Protection is a long way lower

Later in the week bought more stock on the downswing and rebound in the first hour of trade when price dropped from $31.4 to $2.93. Only got the bottom of the downswing in one of the three trades done.

Anfield Energy Inc (AEC.V): Uranium. Anfied received an affirmative completeness review from the State of Utah’s Department of Environmental Quality (UDEQ) with respect to its Shootaring Mill production restart application.

Share has been in the doldrums - time to add to the holdings as this news will give a kickstart

RTL Group S.A. (RRTL.DE): Broadcasting. Averaging down entry price with price showing some upward momentum. Dividend yield 9.14%

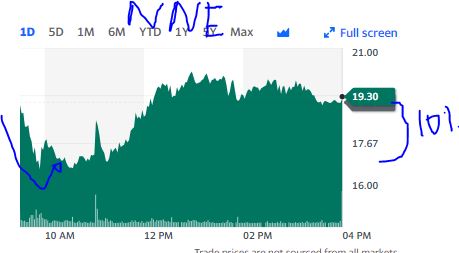

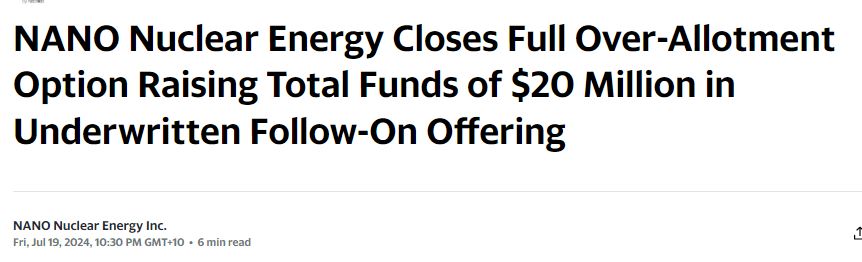

NANO Nuclear Energy (NNE): Nuclear Technology. Bought on the the bottom of the downswing and bounce at the start of trade (Jul 19). Price moved more than 10% up after the entry.

Nano did announce the completion of the IPO over subscription allotments - this does normally move price to the placement level - strange this as this was at $20 above the market ruling on the day.

Centrus Energy Corp (LEU): Uranium Enrichment. Assigned on sold put in personal portfolio. Was part of a call spread risk reversal where the sold put level (50) was hastily chosen and not below previous lows.

Sprott Uranium Miners ETF (URNM): Uranium. Assigned on sold put (50) leg of 54/65/50 call spread risk reversal set up in January 2024.

Chart shows price did test above the bought call (54) level a few times but spent more time oscillating around the sold put (50) level until the week of expiry and then plumbed below. If price stays on the blue arrow price scenario, the remaining 54/65 bull call spread may just end in-the-money but will not hit the maximum.

Sold

A series of assignments on covered calls across 3 of the 4 portfolios.

Alerian MLP ETF (AMLP): US Oil. Assigned early on covered call for 2.5% profit since June 2024 in personal portfolio but only 0.3% profit in managed portfolio.

ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. 0.4% profit since April 2024 in personal portfolio. 3.9% profit in managed portfolio since April 2024. 3.3% blended profit since April/June 2024 in pension portfolio.

Commerzbank AG (CBK.DE): German Bank. 1.4% profit in managed portfolio since June 2024. 2.7% profit in pension portfolio since June 2024

Fresenius SE & Co. (FRE.DE): Aged Healthcare. 3.4% blended profit since July/December 2023. Stock screen idea.

LANXESS AG (LXS.DE): Specialty Chemicals. 15.5% loss since December 2023. 17.5% blended loss in managed portfolio since December 2023/January 2024. 15.8% loss since December 2023 in pension portfolio. Got caught out by results announcement in the week with better results than expected. Stock screen idea. Income trades recovered 47% of the capital loss. Did write naked puts in the week.

Sif Holding N.V. (SIFG.AS): Metal Fabrication. 1.3% profit since May 2024 in managed portfolio. 6.9% blended profit since May 2024 in pension portfolio. Stock screen idea. Income profits higher than capital profit.

Invesco Ltd (IVZ): Asset Management. 3.5% profit since April 2024 in pension portfolio. TheStreetPro options idea adjusted a bit from the start time as roll over dates came along. Income trades contributed a further 159% of profits.

KeyCorp (KEY): US Regional Bank. 14% profit since December 2023 in pension portfolio. Income trades contributed a further 92% of profits. This is the last of the US banks in the portfolios.

Norwegian Cruise Line Holdings (NCLH): Cruising. Breakeven on stock trade in pension portfolio. This trade has become a solid income trade as stock does not move much - overall stock has lost 30% compared to the income trades made - hugely profitable net-net.

QuantumScape Corporation (QS): Battery Technology. 3.9% blended profit since December 2023/March/June 2024 in pension portfolio. Income trades contributed a further 212% of profits.

SunRun Inc (RUN): Solar Power. 11.2% blended loss since July/August/September 2023 in pension portfolio. Sunrun has been a challenging investment with over $10k of capital losses since June 2019 but $10K of income trades in the same time - a little better than breakeven. The problem has arisen with California reducing subsidies for installations.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

Super Retail Group Ltd (SUL.AX): Retail. Return to the portfolio. Dividend yield 5.10%

Chart shows price reversing above the previous lows and making a 2nd cycle higher.

Top Ups

Bapcor Ltd (BAP.AX): Automotive. Bapcor rejected takeover offer from Bain Capital and restructures top management gives a chance to claw back some of the losses by averaging down again. Dividend yield 4.10%

Chart shows the challenge of break up investing. First entry was when the 2022 downtrend was broken and then price went into a channel. 2nd entry at the top of the channel. 3 earnings in a row that disappointed (red E's below) provoked the bid from Bain Capital. Management changes have made the turnaround possible and there is a broker target at those 2023 highs. That is at the 40% profit level and will be better than breakeven for all the trades.

Sold

NRW Holdings Limited (NWH.AX): Mining Services. Closed around 52 week high for 27.3% blended profit since July 2023 - 2nd cycle buying and selling since this portfolio started.

Hedging Trades

A few hedging trades closed - all profitably.

Barrick Gold (GOLD): Gold Mining. 9.4% profit since April 2024 in personal portfolio and 4.7% blended profit since April/June 2024 in managed portfolio.

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. 4.3% blended profit since May/June 2024 in managed portfolio. 16.6% profit since April 2024 in pension portfolio.

Pan American Silver (PAAS): Silver Mining. 8.8% profit since June 2024 in managed portfolio.

Technology Select Sector SPDR Fund (XLK): US Technology. With price closing at $220.87 (Jul 19), 215/210 ratio put spread expired out-the-money. Protection was not needed and locked in 16% profit.

Expiring Options

Centrus Energy Corp (LEU): Uranium Enrichment. With price opening at $44.02 (Jul 19) 45/50/35 call spread risk reversal will expire worthless. Sold the bought call (45) to grab back some premium. Overall trade was 18% profitable.

Chart shows price trading above the bought call level (45) a few times and falling back in the week of options expiry. It did stay comfortably above the sold put level (35) which was always below the recent lows.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Bought call of 29/26 risk reversal expired - a losing trade. The sold put was rolled out to August expiry - time will tell.

Chart shows price has dropped below the sold put (26) which is now August expiry (handwritten blue extension). Stock only traded above the bought call (29) for a few days. The September expiry trade does not look like it will win. The sold puts can be pushed along to keep funding it.

Income Trades

68 covered calls went to expiry with 18 assignements across 3 portfolios - a fair amount of overlap especially in Europe (UK 2 Europe 18 (8) US 47 (10) Canada 1)

ChargePoint Holdings (CHPT): Electric Vehicles. With price opening at $2.21 (Jul 15) bought back 2 strike covered calls. Makes for a $200 loss (750%) but prevents a way bigger capital loss. Market sentiment for the battery and charging segment of US market changed in the previous week - keep driving this for now.

Naked Puts

Not too many naked puts open for July expiry with only a handful expiring - the rest went down the road

- Société Générale SA (GLE.PA): French Bank. 29.3% profit on buy back 0.3% cash negative - happy to pay a little to move this

- NexGen Energy (NXE): Uranium. 37.2% profit on buy back 87% cash positive

- Rolls-Royce Holdings (RR.L): Defense/Aerospace. 7.7% profit on buy back 196% cash positive - amazing spike in implied volatility a month out. Even larger ratios in other portfolios and later in the week - rolled all contracts out.

Sold puts on stocks likely to be assigned. Mostly written at strikes lower than the assigned call levels.

- QuantumScape Corporation (QS): Battery Technology. Return 2.6% Coverage 43.7%

- LANXESS AG (LXS.DE): Specialty Chemicals. Return 2.6% Coverage 4.57%. Rolled out in all portfolios.

- Pan American Silver (PAAS): Silver Mining. Return 2.3% Coverage 7%

- 3D Systems Corporation (DDD): 3D Printing. Return 8.75% Coverage 0.2%

- CleanSpark (CLSK): Bitcoin Mining. 6.25% Coverage 14.5% - did not expect this to rise so fast.

- Sunrun (RUN): Solar Power. Return 5.9% Coverage 12%

- Aurora Cannabis (ACB.TO): Marijuana. Return 5.71% Coverage 12.1%

- ABN AMRO Bank (ABN.AS): Dutch Bank. Return 2% Coverage 6%

- Sif Holding N.V. (SIFG.AS): Metal Fabrication. Return 1.17% Coverage 5.8%

- Commerzbank AG (CBK.DE): German Bank. Return 2.3% Coverage 3.3%

- DHL Group (DWPA.DU): Europe Logistics. Return 1.1% Coverage 2.3%

- Fresenius SE (FRE.DE): Aged Healthcare. Return 1.3% Coverage 4.3%

- VanEck Gold Miners ETF (GDX): Gold Mining. Return 1.25% Coverage 7.5%

- Invesco (IVZ): Asset Management. Return 0.87% Coverage 8.6%

- Norwegian Cruise Line Holdings (NCLH): Cruising. Return 2.4% Coverage 9.1%

- Barrick Gold Corporation (GOLD): Gold Mining. Return 1.8% Coverage 5.6%

The plan for the stocks that were assigned for which sold puts were rolled out - will not buy stock until the puts are assigned or expire.

Credit Spreads

Global X Uranium ETF (URA): Uranium. With price opening at $30.33 (Jul 17), converted the 33/28 calendar credit spread to a naked put by closing out the bought put (28) - pretty sure price will not drop that far in 2 days. It did drop 4.4% on the day to $29.10. This trade started out as a trading error - taken a while to adjust it. So far the trade is 35% profitable since the start in February 2024 but there are still August expiry 33 strike naked puts to deal with

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Gate.io offers a solid range of coins many of which have been delisted elsewhere. Have chosen to share the commission rebates. 40% is the rate - split 30% for me and you get to keep 10% for any people you invite. https://mclnks.com/gateio

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

Jul 15-19, 2024

#hive #posh

For the crypto moves, I've been watching some of these coins especially BTC hoping for a climb to happen but it keep making insignificant moves to affect big shakes to other ones

Study the charts I shared closely. Note that Bitcoin went up 12% in the week. That is a little more volatility than normal. Now look at the Helium chart (HNTBTC). It went up 48% against Bitcoin. That is a big shake of around 60% against US Dollar. .

Interesting 👌👌👌

Crypto's movements this week are very interesting man. Bitcoin's surge was expected, but Helium's 48% jump is pretty serious.