Sideways week for markets is a good time to top up holdings in Europe. Also added credit spreads based on research house additions.

Portfolio News

In a week where S&P 500 traded flat and Europe dropped 0.53%, my pension portfolio dropped 0.39%. The drags were Canada (mostly marijuana, some uranium), De Grey Mining (DEG.AX) dropping to the SPP offer range, Europe (only 2 stocks up), half the Japan stocks, and lithium stocks. Doing the lifting were solar power and NuScale Power (SMR).

Big movers of the week were Stroud Resources (SDR.V) (42.1%), Anagenics (AN1.AX) (28.6%), Sagalio Energy (SAN.AX) (25%), NuScale Power Corporation (SMR) (23.3%), Earths Energy (EE1.AX) (18.2%), Sharp Corporation (6753.T) (15.2%), JinkoSolar Holding (JKS) (13.7%), Dawson Geophysical (DWSN) (13.6%), Sunrun (RUN) (12.6%), Castillo Copper (CCZ.AX) (12.5%), Northern Minerals (NTU.AX) (11.8%), Direxion Daily Real Estate Bear 3X Shares (DRV (11.7%), Solis Minerals (SLM.AX) (11.1%)

A short list of only 13 big movers tells you about the week especially when one of them is a short ETF (in US Real Estate). Solar power has 2 stocks. For the rest of the big themes it is one by one - silver mining, nuclear power, copper, rare earths and lithium. Might have to start counting 2 for copper with Solis Minerals adding to copper holdings in Peru. The key move for my pension portfolio was the big jump in NuScale Power (SMR) which takes price well above the aggressive sold put (7) it was holding.

As earnings season draws to a close market turns its attention to inflation readings and FedSpeak - makes for a sideways week even with the big jump in Nvidia (NVDA) earnings.

Crypto booms

Surprise move of the week started with rumours that Ether ETF's would be approved and then the approvals from the SEC

This propelled Ethereum price 28.5% higher and ending the week 26% up.

Bitcoin price pushed higher to creep over $70k but could not hold that ending the week 2.6% higher with a peak to trough range of 7.9%. Guessing the money flow went to Ethereum

AAVE price made two cycles higher after moving averages crossed to go 32% higher.

Aave is an Ethereum-based protocol that offers automated crypto loans. Users can deposit cryptocurrency as collateral and borrow other cryptocurrencies, up to a certain percentage of the collateral value. My holding started when the coin was LEND

Uniswap (UNIBTC) made a higher high with a push up of 43% - not far off my 50% profit target.

Uniswap (UNI) is an Ethereum token that powers Uniswap, an automated liquidity provider that's designed to make it easy to exchange Ethereum (ERC-20) tokens.

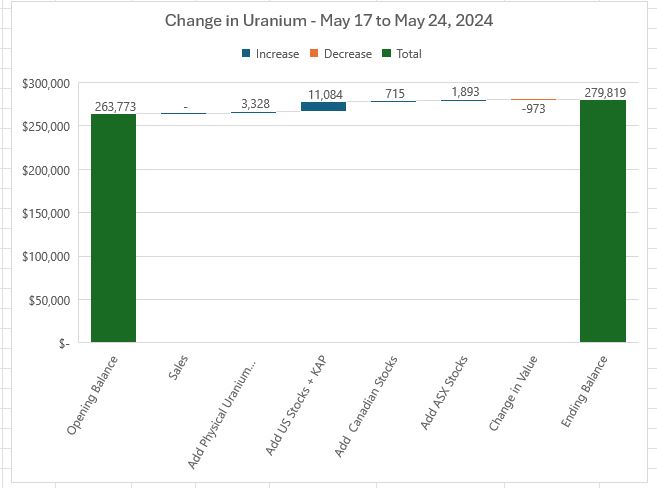

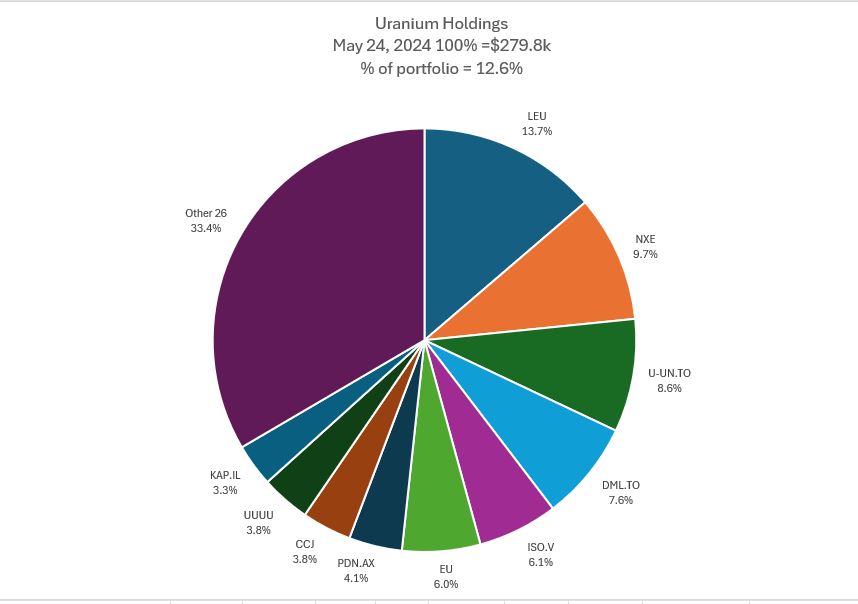

Uranium Holdings

In a bit of a down week, portfolio dropped a tiny 0.36%. Some of the tiny will be from stocks added in the week that went up off the lows after purchase.

A few changes in the mix of holdings with Cameco (CCJ) going up a place and Energy Fuels (UUUU) dropping one. Kazatomprom (KAP.IL) displaces Lotus Resources (LOT.AX) after further additions in the week. The share of Others rises from 30.3% to 33.4% with a few ne adds (now 26 stocks)

One update on options trades open on Uranium Energy Corp (UEC). Price has made its away above the sold put level (7) but seems reticent to breach the bought call level (8). That said it is tracking the blue arrow price scenario and could reach halfway in the 8/11 spread by September expiry. With US operations and inside the 60 day waiver notice from Tenex, there is scope for a strong price move.

Bought

Portfolios have become under-invested in Europe. Worked through the holdings to average down a few entry prices and ran stock screens to pick some new candidates.

Derichebourg SA (DBG.PA): Europe Waste Management. Averaged down entry price as price begins to recover - maybe this is the cycle that will cycle higher.

Société Générale SA (GLE.PA): French Bank. Replaced stock assigned at 3.8% premium to assigned price. Re-ran the Europe Bank comparisons and SocGen remains the laggard. Dividend yield 3.33%. Ex date May 29. Wrote covered call for 0.76% premium with 5.4% price coverage. Add back in pension portfolio was at a larger premium as it was assigned there in April.

JDE Peet's N.V. (JDEP.AS): Packaged Foods. Dividend yield 3.09%. Ex date Jul 8. Wrote covered call for 1% premium with 6.7% price coverage.

Chart is a good example of how the screens work. Price has broken the downtrend and made two higher highs. The previous low is an all time low. 40% profit would be at the level of the left margin (that is someway away from the highest high).

LU-VE S.p.A. (LUVE.MI): Building Products. Not just any building products - heat exchangers and cooling products for data centres. Growth markets. Dividend yield 1.64%

Chart shows price making several cycles on a rising trend. There is 35% range to the previous tops.

Sif Holding N.V. (SIFG.AS): Metal Fabrication. Not just any metal but components for offshore wind farms and other structures. Another growth industry.

Chart is less compelling with price stuck in a parallel channel since the start of 2024. When price breaks, the break tends to be large.

PZ Cussons plc (PZC.L): Household Products. Dividend yield 4.59%. Keen to have some UK stocks in the portfolio.

The chart shows price has been cycling lower with a few attempts to break upwards and failing each time. This has been a long decline down over 80% since the 2016 highs. The support level (green line) goes all the way back to 2003. Cussons is a leading manufacturere of premium soap brands - maybe their business has become outdated. Time will tell.

Cronos Group Inc (CRON): Marijuana. Averaged down entry price in managed and pension portfolio.

Dawson Geophysical Company (DWSN): Oil Services. Stock has appeared on big movers list a few times recently - added a small parcel in personal portfolio to average down entry price.

Fiverr International Ltd (FVRR): Internet Services. Replaced stock assigned at 0.3% premium to assigned price. Time to build back from a lower base.

iShares Global Clean Energy ETF (ICLN): Alternate Energy. Replaced stock assigned at 0.9% premium to assigned price. Averages down entry price of holding. Wrote covered call for 1.1% premium with 6.2% price coverage.

Ur-Energy Inc (URG): Uranium. Added a small parcel to managed portfolio with chart showing price in a tight consolidation. Comparative chart with other US producers shows URG (the bars) lagging enCore Energy (EU - yellow line) and Uranium Energy Corp. (UEC - light blue line) by a margin

Ur-Energy call themselves "Proven Low-cost North American Uranium Producer." Flagship project is Lost Creek in Wyoming which is being ramped up with 6 additional mine units (depending on permitting) to add to the 2 already in production. The Shirley Basin project in Wyoming is scheduled to start production in 2026. URG is 10th largest holding in Sprott Junior Uranium Miners ETF (URNJ)

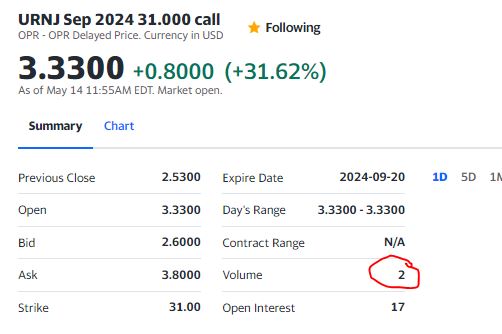

Sprott Junior Uranium Miners ETF (URNJ): Uranium. Took the profits from the winning options trade in the managed portfolio and bought a September expiry 31/34 bull call spread. With a net premium of $1.10 this offers maximum profit potential of 173% if price moves 12% from $30.32 opening price (May 21)

Let's look at the chart which shows the bought call (31) and breakeven as blue rays and the sold call (34) as a red ray with the expiry date the dotted green line on the right margin. Price looks like it is following the green arrow price scenario which suggests trade could reach the maximum a month before the September expiry. My sense is there will be a pull back and another leg up closer to expiry. Hard to predict as this is blue sky trading

Options chains shows this was the trade volume for the day and the broker paid me commission.

Two days later made a July expiry 29/26 risk reversal in the pension portfolio. Bought a 29 strike call option and sold 26 strike put option as a ratio. The effect is to give a breakeven of $30.14 with price coverage of 11.4% from the $28.96 open (May 23). Price was over that breakeven two days prior (May 21)

In Friday trade, in managed portfolio added a parcel of stock. The pullback over the week has given a good base for a run higher. Did cap the potential by writing a covered call for 2.3% premium with 8.2% price coverage. Also added a June expiry 29/28 risk reversal. This is a bit of an experiment to test out short term call options. Totally happy to buy the stock at $28 as this would average down entry price. Breakeven is $29.15 - only 1.7% higher than the last purchase.

iShares MSCI China Small-Cap ETF (ECNS): China Small Cap Index. Averaged down entry price in personal portfolio. Price has broken downtrend and made higher high - aim is to exit the whole position using covered calls just out-the-money. Liquidity of options is low further out.

Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO): Silver. With the large number of silver positions assigned in personal portfolio added a first holding in this ETN that writes covered calls on silver. Price seems to move in step with silver when silver is running.

Chart compares iShares Silver Trust (SLV - the bars) to the ETN (blue line) going back to the cycle low. SLVO price does move up when silver moves up and then lags with the turnovers and then drifts lower. Am thinking what happens is the covered calls are being assigned and not grabbing all the upside on the way up. What I do with my own covered call writing is widen the strikes when the prices are running higher - that reduces the lag.

Centrus Energy Corp (LEU): Uranium Enrichment. Trying out a different way to trade long positions leaving open the upside. With price opening at $50.15, created a July expiry 55/45 risk reversal. That means buying a 55 strike call option and funding part of that selling a 45 strike put option. With net premium of $1.25 breakeven on the trade is $56.25, 12% away with price coverage on the sold put of 11.4% - not quite symmetrical. Return on the sold put if price stays above $45 is 5.3% for two months exposure.

What I did not do was check existing holdings in the portfolio. One of the bought call contracts was one that was the sold leg of a bull call spread. What that has done is open out one side of that trade for one contract (had two).

The chart shows that old trade with the adjustment for the bought call covering the short call. What the new trade needs is for price to do a blue arrow move - that is what instinct is telling me what is coming based on a surge in demand for enrichment following the Tenex waiver news.

Glencore plc (GLEN.L): Base Metals. Replaced stock assigned at 0.3% discount to assigned price. Wrote covered call for 0.97% premium with 6.2% price coverage.

Lightbridge Corporation (LTBR): Nuclear Technology. Added a small holding to managed portfolio as price had pulled back a bit after spiking - this is a long term punt that is speculative. Wrote covered call for 1.6% premium with 64% price coverage. Will be some move if that 64% is breached.

The Trade Desk (TTD): Digital Media. Added holding to personal portfolio as TheStreetPro (TSP) added to their holdings on the back of Netflix (NFLX) ad announcements. Wrote covered call for 1.9% premium with 4.3% price coverage.

Mithril Resources Limited: (MTH.AX): Silver Mining. Next Investors added this to their portfolio

This is a small cap investment in silver project in the Sierra Madre Gold-Silver Trend in Durango State, Mexico - a region that has delivered ~10% of the silver produced in the world. This is a speculative investment as Mithril have just completed a reconstrction and relisted on ASX this week. They do have a mineral resource estimate

2,416,000 tonnes @ 4.80 g/t gold, 141 g/t silver (6.81g/t AuEq*) for 373,000 oz gold plus 10,953,000 oz silver (Total 529,000 oz AuEq) using a cut-off grade of 2.0 g/t AuEq

NexGen Energy CDI (NXG.AX): Uranium. Uranium stocks sold off first thing on ASX (May 23). Averaged down entry price in personal portfolio - cannot help myself.

Watched the monthly webinar from Uranium Insiders. Got the feeling that this pullback was the time to load up - my investing coach always used to say when conditions are right "make hay".

F3 Uranium Corp (FUU.V): Uranium. Added to holdings in pension portfolio in two tranches two days apart

Yellow Cake plc (YCA.L): Uranium. Added more direct physical uranium to the pension portfolio.

JSC National Atomic Company Kazatomprom (KAP.IL): Uranium. Opened a new position in the pension portfolio. When the ETFs have to buy as their funds grow they are net buyers of all the stocks especially the large holdings.

Uranium Royalty Corp (UROY): Uranium. Found an article with headline "3 Uranium Stocks With 39% Upside or More". Article highlighted stocks which have not propelled ahead as much as others.

Year-to-date, UROY is up about 2.2%, and the shares have popped 19.5% in the last month. However, you can still pick up the shares at a roughly 26.6% discount to 52-week highs.

Added a small parcel to pension portfolio as a holding linked to physical uranium rather than mining or enriching. The other two stocks on the list are already held.

Sunpower (SPWR): Solar Power. Solar stocks got a bid during the week. Went with the flow and added another parcel to the pension portfolio to average down entry price. This is a bit of a contrarian move as the portfolio is currently short a large parcel of in-the-money sold puts. Thinking will be to roll those out in a week or so - will be at a profit. Wrote covered call for 4.65% premium with 78% price coverage.

- the implied volatility on the options is still sky high after the Meme Storm.

Sold

Aegon Ltd (AGN.AS): Dutch/US Insurance. With price opening at 6.23 (May 20), 4.5/6 bull call spread has traded over the sold call. Closed out for a blended profit of 41% since April/September 2023. With the sold puts, this was no cash down trade.

My investing coach always liked to go out as far in time on LEAPS as he could - maybe 3 years was too far for this one - locked up more capital than was needed to drive the same profit. The chart suggests 18 months would have been enough.

Sprott Junior Uranium Miners ETF (URNJ): Uranium. With price opening at $29.79 and trading higher, June expiry 25/28/21 call spread risk reversal has traded over the top of the call spread. Keen to find a replacement trade, closed out the call side for a 19% profit since February. If the sold put (21) expires worthless overall trade profit is 34% which is more than stock price has moved (27%). While the percentages do not look massive, the trade was a free trade - thought now is to deploy the profits directly on an open call or another call spread.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

New Hope Corporation (NHC.AX): Coal Mining. Dividend yield 7.60%

Chart shows price breaking the downtrend after a consolidation with scope for 25% profit to reach previous highs. Needs more than the blue arrow price scenario to hit the 35% profit target.

Hedging Trades

iShares was CS Gold ETF Hedged CHF (CSGLDC.SW): Gold. Closed out at 52 week high for 51.8% blended profit since July 2013/December 2018. Averaging down worked well. This holding was set up as a hedge portion fo the original managed portfolio using Swiss Francs that were in the account. In the same time the Swiss Franc has appreciated by 21% against the Pound.

Two of the beneficiaries will be paid out in Pounds. Move against the base currency (Euro) was 20%. Hedge exposure in the portfolio is now through gold and silver mining.

GoGold Resources Inc (GGD.TO): Gold Mining. Stock has been on the big movers list a few times in recent weeks. Averaged down entry price in pension portfolio

Cryptocurrency

Chainlink (LNKETH): With price making a one month high and moving averages about to cross over added another parcel. Averages down entry price from last trade made more than a year ago (blue arrow was the level)

Coti (COTIBTC): Price has been consolidating for a few weeks and made a higher high. Added t the holding below the level of the last exit (red ray) but above the last entry.

Income Trades

50 covered calls written across 3 portfolios (Australia 1 UK 2 Europe 8 US 39)

Naked Puts

Wynn Resorts (WYNN): Hotels/Gaming. Return 0.86% Coverage 5%

Barrick Gold (GOLD): Gold Mining. Return 1.35% Coverage 5.8%

VanEck Gold Miners ETF (GDX): Gold Mining. Return 0.85% Coverage 8.7%

Commerzbank AG (CBK.DE): German Bank. Return 1.03% Coverage 6.1%

Deutsche Bank AG (DBK.DE): German Bank. Return 1.08% Coverage 5.4%

Marriott Vacations Worldwide (VAC): Hotels. Return 2.53% Coverage 3%

The Trade Desk (TTD): Digital Media. Return 1.3% Coverage 6.4%

Invesco (IVZ): Asset Management. Return 0.36% Coverage 5.9% - CHENCK

iShares 20+ Year Treasury Bond ETF (TLT): US Treasuries. Return 0.32% Coverage 4.3%

Sprott Junior Uranium Miners ETF (URNJ): Uranium, Return 1.73% Coverage 11.4%

Volkswagen AG (VOW.DE): Europe Automotive. Return 0.63% Coverage 15.8%

Bank of America (BAC): US Bank. Return 13% Coverage 3.3%

QuantumScape (QS): Battery Technology. Return 3% Coverage 12.6%

Credit Spreads

L'Air Liquide (AI.PA): Specialty Chemicals. ROI 18.6% Coverage 2.6%

Added a selection of credit spreads for additions to The Street Pro portfolios

Axon Enterprise (AXON): Defense. ROI 29% Coverage 1.7% - TSP idea - check coverage

Labcorp Holdings (LH): Healthcare. ROI 25.9% Coverage 0.6% - TSP idea

Universal Display Corporation (OLED): Technology. ROI 25% Coverage 2.6% - TSP idea

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 20 - 24, 2024

While reading this, I got lost at some point😅

Looks like you’re very familiar with the market

I love that!

Been doing this for my own portfolios for over 10 years. Each year I add in new stuff and have become quite advanced. What each post is , is a journal of all my trades in a week. Journaling is a very important part of improving investing results. Learn from mistakes - stop doing what is not working - do more of what is working.