Busy week dealing with Meme Stock blowout, topping up uranium and preparing for busy options expiry time - most of the kicking the can down the road worked.

Portfolio News

In a week where S&P 500 rose 1.65% and Europe rose 1.68%, my pension portfolio rose 1.75%. Heavy lifting came from US (Fiverr (FVRR), Advanced Micro Devices (AMD), US Treasuries) , Canada (Marijuana, Uranium and Silver). The surprising drag was De Grey Mining (DEG.AX) in a week when gold was rising - they are in the middle of a capital raising which suppresses price.

Big movers of the week were Sun Silver (SS1.AX) (210%), Castillo Copper (CCZ.AX) (60%), NeuRizer (NRZ.AX) (50%), Sarytogan Graphite (SGA.AX) (47.1%), Vulcan Energy Resources (VUL.AX)(38.3%), Honey Badger Silver (TUF.V) (28.6%), Aeris Resources (AIS.AX) (27.4%), KEIWA Incorporated (4251.T) (26.1%), Dawson Geophysical Company (DWSN) (25.7%), Pantera Minerals (PFE.AX) (25.6%), ChargePoint Holdings (CHPT) (24.8%), SunPower Corporation (SPWR) (23.9%), Panther Metals (PNT.AX) (23.1%), North Pacific Bank (8524.T) (19.8%), Canopy Growth Corporation (WEED.TO) (19.8%), Zinc of Ireland (ZMI.AX) (14.3%), Aurora Cannabis (ACB.TO) (13.1%), Blue Star Helium (BNL.AX) (12.5%), Coeur Mining (CDE) (11.1%), NexGen Energy (NXE) (11%), Commerzbank (CBK.DE) (10.9%), GoGold Resources (GGD.TO) (10.7%0, Resource Development Group (RDG.AX) (10.7%), Energy Fuels (UUUU) (10.4%)

24 stocks in the big movers - in line with previous weeks. Quite a mixed bag of the big themes: Gold/silver mining - 4, base metals - 5 (copper and zinc), alternate energy (lithium 2, geothermal - 1, solar - 1, uranium - 1), marijuana - 2 stocks). The leader chose the perfect week to list when silver price went over $30 for the first time since February 2013 (when it dropped from above $30)

Market was in a nervy mood as earnings season moved to the closing stages and ahead of inflation data - the data was better than expected and Dow hit and held the all time high. Betting that Joe Biden is happy wot this as it improves his chances in the election - still got 5 months to run

Meme Stock Mania

Meme Stock mania returned after an 18 month holiday with one video about GameStop (GME) and AMC Entertainment (AMC).

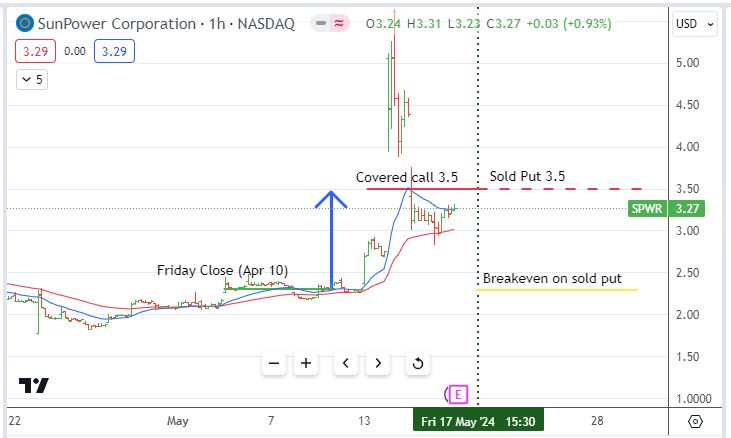

Caught in the frenzy was one of the most-shorted solar power stocks - Sunpower - price doubled (Apr 14) one day after a 20% pop. My pension portfolio has a sizeable holding in Sunpower which is not profitable and had covered calls written at a level that was comfortable even after Monday's 20% pop. The squeeze dragged them in-the-money. One defence open was to sell puts at the likely assigned strike - the return on strike is a staggering 34.57% - could sell options for 50% of the price of the stock as of last Friday ($1.21 vs $2.30 - May 10). Normally these short squeezes sort themseleves out in a few days - bad news is options expiry is this week (May 17) and the calls could be assigned. That will trigger a large capital loss - if price does drop back below the sold call and put (3.5) by June expiry the trade is still alive and no worse off.

This is the chart ahead of options expiry day - a one hour chart. Key features - at last Friday close (green line) the covered call strike (3.5 red ray) was still 50% away. The sold put premium brings breakeven (the yellow ray) down below the May 10 close. So it looks like it could be a solid trade defence - stock may not be assigned on the covered call and breakven is well below where stock is trading - the challenge is earnings are due on May 17. Going to guess the market is thinking the earnings are OK.

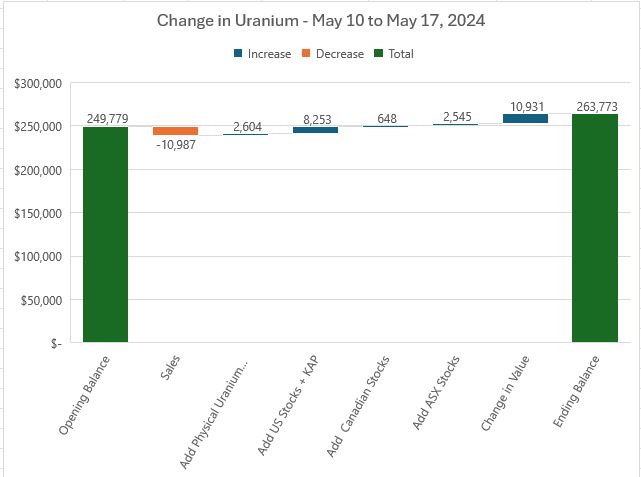

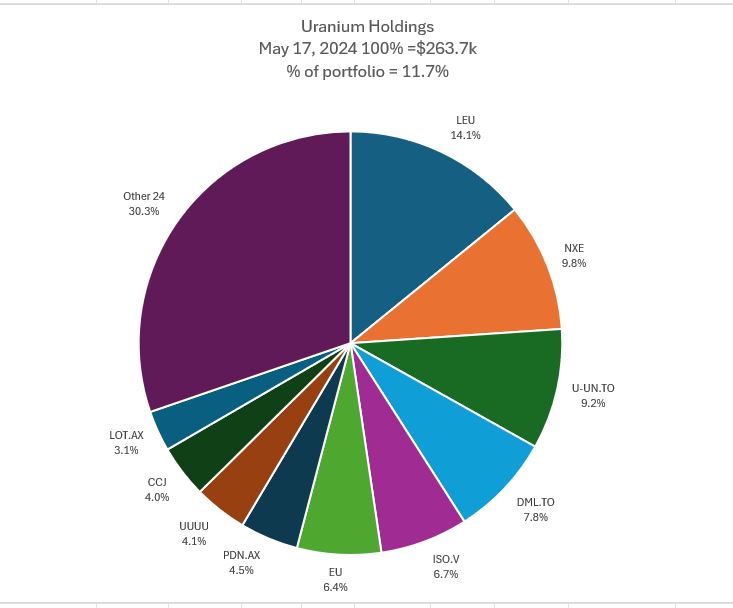

Uranium Holdings

The notable thing about the big movers list above - not a lot of uranium stocks in the list but uranium market did move on the signing of the Russian ban and the force majeure call by Tenex, the largest Russian supplier of enriched uranium.

The move in value of portfolio holdings after accounting for sales and purchases was 4.4%. The market priced in the first wave of the Russian Ban the week before. Key sale was the assignement of one parcel of Cameco (CCJ). Key purchases were in physical uranium and a parcel in Kazatomprom to replace the Cameco parcel and some scaling in on NexGen.

The mix of holdings sees some changes with NexGen (NXE) going up a spot and Cameco (CCJ) going down five spots. Others goes up 2.8 percentage points with the addition of Kazatomprom (KAP.IL)

Worth doing an update on options trades. First up - Gloabl X Uranium ETF (URA) which is a July expiry 29/33/26 call spread risk reversal. Price is tracking along the blue arrow price scenario which shows that the trade will reach the maximum profit potential after a sluggish start with more than a month to expiry. Trade management says to hold until price is firmly above the sold call (33 - red ray). The shape of the parallel channel suggests there is good upside - maybe put on another options trade now.

Sprott Uranium Miners (URNM) is in a different place with a few call spread risk reversals open. Price has moved above the bought call level (54 - blue and turquoise rays). Price is tracking above the blue arrow price scenario. That suggests that the contract expiring in October has a small chance and the ones later are solid chances. The close-in contract looks like it will go to exercise at $54 - happy to let that run as a holding.

Sprott Junior Uranium Miners (URNJ) is fully in-the-money. Have been trying to put in place a replacement but have not been hit on the pending orders. The price scenarios from history suggest there is scope for a $4 wide spread and also in quite a short time - say July expiry. Maybe time to just close out and make a new trade from scratch.

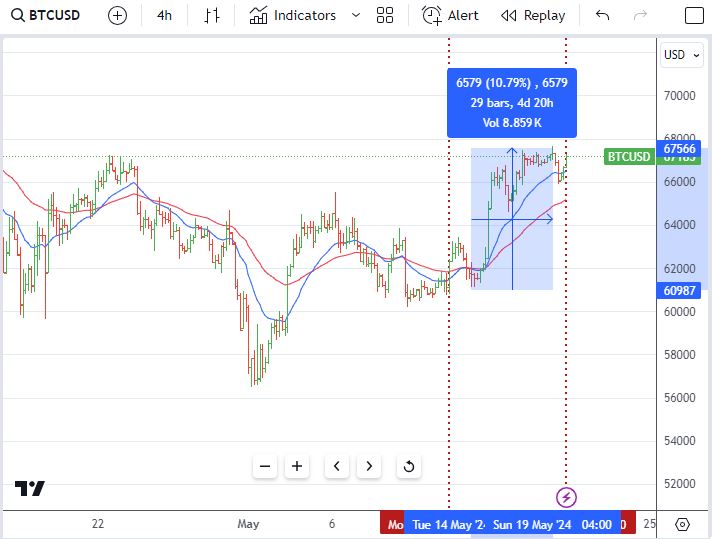

Crypto Steps Up

Bitcoin price hesitated to start the week and then pushed higher ending 6.9% higher with a trough to peak range of 10.8%

Ethereum chart looks much the same but only 4.3% higher on the week with a 9.9% trough to peak range.

Chainlink (LINK) drifted down to a support level and made a 33% reversal confirming the cross over of the moving averages a few weeks back

Solana (SOL) found buyers after tracking sideways for a while and then popping 28%

Fantom (FTMBTC) broke out of the consolidation phase it was in after my last purchase and pushed up 19%

Arweave (ARBTC) continued cycling higher with a 23% range from the last touch of 20 day moving average

Bought

Global Uranium and Enrichment (GUE.AX): Uranium. Averaged down entry price in personal portfolio.

GTI Energy Ltd (GTR.AX): Uranium. Averaged down entry price in personal portfolio.

Denison Mines Corp (DNN): Uranium. Deployed proceeds of sale of Gannett (GCI) in the small managed portfolio - heading to 100% with only one non-uranium stock left (portfolio is small). Chose Denison as it has an options market to write covered calls and it is on the UI list.

Yellow Cake plc (YCA.L): Uranium. Scaled into holding of physical uranium in pension portfolio to get the holding closer to the UI target of 15%

NexGen Energy Ltd (NXE): Uranium. Added US listing to pension portfolio - will sell the Canadian holding bought last week (in error) just above breakeven. Preferred to have bigger holding than seeing price possibly run away before the switch.

Assigned on sold put in pension portfolio - breakeven is $7.65 = 4% discount to close. Price ended at $7.99 and 4 contracts were assigned and 2 expired and broker reporting the same timestamp - close of trade time. Can only guess that someone had an assignemnt instruction in before the close.

TechGen Metals Ltd (TG1.AX): Mining Exploration. Price popped on announcement of a new Western Australian copper/gold resource added to the portfolio. Scaled in holding in personal portfolio. Investing in businesses like this carries high risk - TechGen holds a range of copper interests in the Kimberley. Add to this gold, silver, nickel, lead, and zinc deposits, as well as platinum group elements and lithium. An announcement last week included uranium = a bit like throwing spaghetti at the ceiling to see what sticks

Centrica plc (CNA.L): UK Utility. Scaling in in managed portfolio as price starts gaining momemntum after breaking the downtrend. Chart shows the divergence of MACD, the lower panel has worked through from the last trade made 4 weeks ago - price moving upward. Wrote covered call for 0.87% premium with 4.6% price coverage. Replaces stock assigned later in the week at 2.4% premium to assigned price.

Castillo Copper Limited (CCZ.AX): Copper. With rising copper prices, Castillo announced a focus on exploration permits at Mt Isa in Queensland. They do hold other permits in New South Wales and Zambia in well known copper regions. Averages down entry price in personal portfolio.

Coty Inc (COTY): US Consumer Products. Assigned on sold put. Breakeven after all sold puts is $10.36 = 2.8% below $10.66 close (May 17)

Lightbridge Corporation (LTBR): Nuclear Technology. Chart seems to have bottomed - doubled position size. Have still not been hit on August expiry strike 2.5 sold put - no liquidity.

Studied the chart after the event - price appears to be respecting the upper support (green line) and there are two spots of divergence on MACD - the blue arrows with the 2nd one more convincing than the first. Position size is still small - a bit like an options play.

BHP Group (BHP.AX): Base Metals. added a small holding to match multiplier on options contracts to write covered calls. Averages down entry price a little. Wrote covered call for 0.84% premium with 5.2% price coverage.

Paladin Resources (PDN.AX): Uranium. Replaced stock assigned below and scaled up holding in pension portfolio.

Uranium stocks moved early in Friday (May 17) trade. For example, Sprott Junior Uranium Miners (URNJ) jumped 4.9% in first hour - added in a few laggards that had not jumped as strongly in the managed portfolio

Atha Energy Corp (SASK.V): Uranium. Average down entry price in managed portfolio. Athabasca Basin explorer is a bit out of favour as its tenements are hard to get to. Drilling commences on Angilak Project in June 2024 and Gemini Project in August 2024.

Chart compares Atha Energy (the bars) with Skyharbour Resources (SYH.V - blue line), a similar explorer in the region - close half the 70% percentage points gap (the blue arrow) and price will jump 72%without reaching the previous highs.

Next chart shows that in price terms. Of note is the broker target is $3.00 - more than double that again.

https://finance.yahoo.com/news/atha-energy-provides-2024-exploration-110200124.html

JSC National Atomic Company Kazatomprom (KAP.IL): Uranium. Dividend yield 4.50%. Added this to managed portfolio as its holding in Cameco (CCJ) will be assigned.

Chart shows the clear gap accounting for the sovereign risk of being invested in Kazakhstan. With the volume of trade going into the uranium ETF's, the fund managers will have to keep buying Kazatomprom despite that risk - this will underpin the price.

Rolls-Royce Holdings plc (RR.L): Aerospace. Scaled in holding in managed portfolio - SMR momemntum is building across the world.

Marathon Oil Corporation (MRO): US Oil. Assigned on sold put - breakeven is $26.69 = 1.8% premium to $26.21 close (May 17). Two months of covered calls will cover that. Dividend yield 1.68% - not paying attnetion cost getting the dividend with ex date May 14.

Sold

Paladin Resources (PDN.AX): Uranium. Assigned on covered call for 8.1% profit since April 2024. Good thing got the mulitplier wrong as covered call was written a bit tight - only sold 20 shares

NexGen Energy Ltd (NXE.TO): Uranium. Closed out Canadian listing bought in error last week - recovered trading costs.

Safe Bulkers Inc (SB): Shipping. Assigned early on covered call for 24.4% profit since May 2021 on first tranche. Balance assigned for 21.2% blended profit since May/July/September/October 2021 - got to put this down to Covid-19 recovery trade

Star Bulk Carriers Corp (SBLK): Shipping. Assigned on covered call for 18.7% profit since January 2023

Aberdeen was ETFS Platinum Trust (PPLT): Platinum. With move up in gold and silver prices, platinum is moving too. Took the exits at end of patience for 0.94% blended loss since July 2016/January 2018. Averaging down helped. Advent of electric vehicles is reducing one of the main areas of industrial demand for catalytic converters. Platinum has not worked as a hedge either.

Société Générale SA (GLE.PA): French Bank. Assigned on covered call for 7.8% blended profit in managed portfolio since March/April 2024. Assigned on covered call for 6.2% profit in personal portfolio since April 2024. The bank is still the laggard in Europe banks - will replace it.

Centrica plc (CNA.L): UK Utility. Assigned on covered call for 5.6% profit since April 2024.

Glencore plc (GLEN.L): Base Metals. Assigned on covered call for 2.6% blended profit since December 2023/April 2024. Will replace this as there is an odd lot left over and closing price was quite close.

Cameco Corporation (CCJ): Uranium. Assigned on covered call for 6.5% profit since April 2024.

Fiverr International (FVRR): Internet Services. Assigned on covered call for 58.2% blended loss since 2021/2022/May 2023 in managed portfolio. This is a sad story of a fallen angel that boomed during Covid-19 lockdowns and then fell over exacerbated by a few sold puts that did not work.

iShares Global Clean Energy ETF (ICLN): Alternate Energy. Assigned on covered call for 4.2% profit since April 2024 - only wrote covered calls against the last tranches in - some way to get back to profit overall.

Qualcomm (QCOM): US Semiconductors. Assigned on covered call for 10.3% profit since April 2024.

Enel SpA (ENEL.MI): Europe Utility. Assigned on covered call for 10.9% blended loss since February/May/October 2021/March 2024. Enel was the renewables utility that was going to change the landscape of electricity in Europe - did not work out like that

Bank of America Corporation (BAC): US Bank. Assigned on covered call for 1.5% profit since April 2024.

Dutch Bros Inc (BROS): US Restaurants. Assigned on covered call for 2.9% profit since March 2024.

Morgan Stanley (MS): US Bank. Assigned on covered call for 0.9% profit since April 2024. Frustrating exit has price had popped another 8.3% - credit spreads did grab some of that

Britvic plc (BVIC.L): UK Beverages. Closed out at 52 week high in perosnal portfolio for 17% profit. Stock screen idea.

Centene Corporation (CNC): Assigned on covered call for 6.3% blended profit in personal portfolio since October 2023/January 2024.

Sigma Lithium Corporation (SGML): Lithium. Assigned on covered call for 10.4% profit since April 2024.

ASX Portfolio

The segment reports trading in ASX fractional share portfolio. Trade entries are made based on stock screens looking for undervalued stocks (price to book, price earnings, price to sales) that are showing technical signs of breaking a downtrend. Exits are made at 35% profit or 25% if 52 week high is lower than 35% advance. New buys are in $400 lots. Scale ins and top ups in $200 lots

New Buys

OM Holdings Ltd (OMH.AX): Manganese. Popped up on price screens - company is a an investment holding company, engaged in mining, smelting, trading, and marketing manganese ores and ferroalloys worldwide. Normally I skip these with a preference for owning mines directly. Dividend yield 2.88%.

This tweet came across the bows the day before - cyclone sets back the world's 3rd largest producer of manganese - the Genmo Mine owned by South32 on Groote Eylandt in Northern Territory. OM Holdings operates a manganese mine in the Northern Territory too. No supply disruption for them and manganese prices

surged over 35% month on month to US$5.94/dmtu as of

April 26th following force majeure of a key global supplier

Chart shows two price pops - once directly after the cyclone and again when South32 made the announcement about the expected duration of the supply disruptions.

Sold

Link Administration Holdings Limited (LNK.AX): Financial Services. Acquired by Mitsubishi UFJ (8306.T) for 23.2% profit plus 9.3% special dividend. Held since December 2023. Sure pleased my son chose not to take up a position in the business last year - he would struggle with a boss based in Japan.

Expiring Options

iShares MSCI Emerging Markets ex China ETF (EMXC): Emerging Markets Index. With price closing at $58.80 (May 17), sold put leg of 58/62/55 call spread risk reversal expired. The call spread was only partly funded by this sold put. As this is the second trade in a sequence, there is only a small shortfall to be funded. Will write another 55 strike put option with one month to expiry to cover that.

Hedging Trades

Credit Suisse X-Links Silver Shares Covered Call ETN (SLVO): Silver. Holdings in Silver will be assigned across the portfolios. Chose to add to holding of this ETN that writes covered calls on Silver as a replacement. Exisiting holding has just gone in-the-money at capital level - distribution yield 17.78% makes up for the capital moves. Ex date for next dividend is May 21 - good timing.

VanEck Gold Miners ETF (GDX): Gold Mining. With price closing at $36.87 (May 17), exercised on bought leg of a 35/38/32 call spread risk reversal. Breakeven on trade is $34.85 = 5.7% discount. Was the perfect timing though not a maximum profit trade

Quick update of the chart shows price was tracking the price scenario borrowed from the previous run - could have gone one more month to expiry to get to the maximum. Now the trade is open ended.

Coeur Mining, Inc (CDE): Silver Mining. Assigned on covered call for 19.3% profit in managed portfolio since April 2024 and 30% in personal portfolio since April 2024. Call written at a higher strike.

Pan American Silver (PAAS): Silver Mining. Assigned on covered call for 46% profit since March 2024.

iShares Silver Trust (SLV): Silver. Assigned on covered call for 4.6% profit since April 2024. 7.8% profit in personal portfolio since April 2024 - also written at a higher strike.

Cryptocurrency

The Graph (GRTETH). Added a parcel after price made 3rd cycle higher after the reversal - entry is below the previous partial exit. Still have a holding from earlier times

Income Trades

Covered Calls

77 covered calls expired across 3 portfolios with 17 being assigned (in brackets) (Australia 2 (1) UK 3 (2) Europe 11 (2) US 57 (12) Canada 4)

6 new covered calls written across 3 portfolios Australia 1 UK 1 Europe US 4

Cronos Group (CRON): Marijuana. With price opening at $2.89 and trading higher bought back covered call for 166% loss plus trading costs (high). Did not want to trigger the massive capital loss on the risk of assignment.

Fiverr International (FVRR): Internet Services. With price opening at $25.25 bought back covered call for 5% profit but small loss after trading costs. Made a mistake and sold June expiry covered call at same strike - got carried away with the size of the premium. Am banking on price drifting lower again or time value decay getting a lower buy back price.

Naked Puts

After a nervy first few weeks, the naked put performance was solid with 30 expiring and only 2 being assigned (UK 1 Europe 6 US 23 (2)). That is too much exposure but it paid off.

Sold puts on stocks that could go to assignment on covered calls mostly at the same strike but some lower.

- ABN AMRO Bank N.V. (ABN.AS): Dutch Bank. Return 1.88% Coverage 3.3%

- FMC Corporation (FMC): US Food Products. Return 2.52% Coverage 3.9%

- Fiverr International (FVRR): Internet Services. Return 4% Coverage 3.0%

- Nokia Oyj (NOK): Network Equipment. Return 2.57% Coverage 14.6%

- SunPower Corporation (SPWR): Solar Power. Return 34.57% Coverage 43.7%

- ChargePoint Holdings (CHPT): Electric Vehicles. Return 7.3% Coverage 26%

- Société Générale (GLE.PA): French Bank. Return 2.9% Coverage 3.5%

- Sigma Lithium Corporation (SGML): Lithium. Return 4.4% Coverage 45.1%

- Fiverr International (FVRR): Internet Services. Return 1.4% Coverage 11.6%

- Star Bulk Carriers (SBLK): Shipping. Return 3.3% Coverage 3.5%

- Dutch Bros (BROS): US Restaurants. Return 1.2% Coverage 7.9%

- iShares Silver Trust (SLV): Silver. Return 1.2% Coverage 7.2%

Rolled a few sold puts out to June

- Global X Lithium & Battery Tech ETF (LIT): Lithium. 268% Buy back loss 34% cash positive

- Coty Inc. (COTY): US Consumer Products. 33% Buy back profit 116.7% cash positive.

Credit Spreads

4 outstanding credit spreads all exited profitably. In the coming month there will be more credit spread work - less capital at risk than naked puts.

ResourcesCautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers. Crypto tickers come from TradingView

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Investing: Interactive Brokers provides comprehensive global markets coverage with very competitive commissions. Open an account to earn up to USD 1,000 in IBKR stock. https://mclnks.com/ibkr

Crypto Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Kucoin offers a wider range of altcoins than many of the other exchanges. I do like to diversify my holdings in case an exchange gets knocked over. Grab 15% discount on your trades when you open an account on this link https://mclnks.com/kucoin15

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

Aus/NZ Investing Sharesies provides low cost, fractional share investing for Australian and New Zealand residents covering stocks in those countries and US. Start investing with as little as $20 https://mclnks.com/shares

May 13 - 17, 2024

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.

Excellent informative post I appreciate your post dear Sir