Welcome to the third part of our small Hive Defi guide series. In this episode we're gonna be providing liquidity to the Uniswap platform and by this start earning profit from the trading fees.

If you don't know what's that all about, feel free to check out part 1 (overall DeFi concept for HIVE) and part 2 (sending HIVE to ETH network and DeFi swapping).

Also check out this great video tutorial by @khaleelkazi covering everything we can do with WHIVE right now.

Why should we provide WHIVE liquidity in the first place?

In general, we want to have a broad WHIVE adoption in the DeFi space. It's a token with a lot of usability on the HIVE platform (blogging, voting, gaming, investing), it's backed by our community and it gives a nice APR. The more HIVE we can send to the DeFi space, the less HIVE tokens will be listed on exchanges. We want to get a good exposure for WHIVE and create demand for the token so that the sell pressure on exchanges will decrease and by this, HIVE value will go up.

The other thing is - every trade moves the price and with low liquidity, trades won't be able to make a lot of trading. With big liquidity we will allow big trades, so that the big bois with lots of money can come and make solid profit, even from price difference between platforms.

Currently we're trying to build good liquidity on Uniswap platform but that's just the first goal - if we can get the trading going there, we will be able to increase the interest in HIVE and "colonize" next platforms - currently the final goal is to allow HIVE DeFi lending on websites like aave and compound.

Why people even use DeFi trading?

The thing I probably didn't stress enough in the previous episode is that doing swaps on DeFi platforms, like Uniswap, is not only more secure but also super convenient. With centralized exchanges you need to log in, confirm e-mail, confirm 2fa on your mobile, make a deposit, wait, make a trade, make a second trade, withdraw, confirm e-mail, confirm 2fa on your mobile, wait... not to mention KYC.

On DeFi platforms you just set the amount and click swap, wait like 15 seconds and it's done - the trade is literally happening in your wallet. The more I use it, the more I like it :) Yes, there are ETH fees but with bigger trades it becomes less of a problem (another reason why we need liquidity).

Also, trading on platforms like Uniswap can be quite profitable because of the price differences. If the specific token price goes up on central exchanges, it won't automatically go up on those swap platforms. Someone has to buy them at those "old", lower prices first and if that's you - you're in profit. You can then just send those tokens to the other exchange and sell it for higher price.

What's the profit?

So, by providing liquidity we not only help the HIVE ecosystem, but also earn a passive income. How much? Well currently it's hard to say, as WHIVE has only few days.

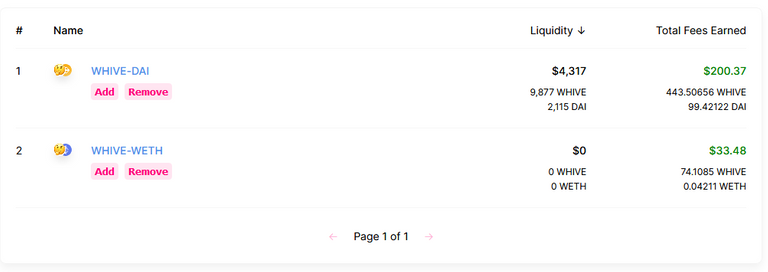

I've provided liquidity for ETH:WHIVE trades (8000 HWIVE and 5 ETH) which earned me $33 in about 2 days (I've withdrawn my funds from there to increase my stake in WHIVE:DAI pair).

I've also created WHIVE:DAI pair (300 WHIVE and 70 DAI) - that's $140 of liquidity and probably the website adds this to profit (because there's no way I would do $200 from initial $140 stake).

You can check my stats here:

https://uniswap.info/account/0xd39B6849d2e1dB20BAb50dd7A4F3e0882c744404

So currently it's hard to say what's the real APR. @jk6276 reports in his last post that he made $0.11 in last 48 hours from his $340 stake. As he points out:

Volume of trades using these pools has been slow so far. They are new and need more funds added to them by Liquidity Providers to gain some traction and usage.

Can't agree more :)

How to provide liquidity

Since we've set everything up already (in the part 2) this one will be easy.

Start by going to https://uniswap.info/token/0x11d147e8d39f59af00e159c4b1fe3a31d58a2c66 to view WHIVE stats - from here you can access any WHIVE service on Uniswap.

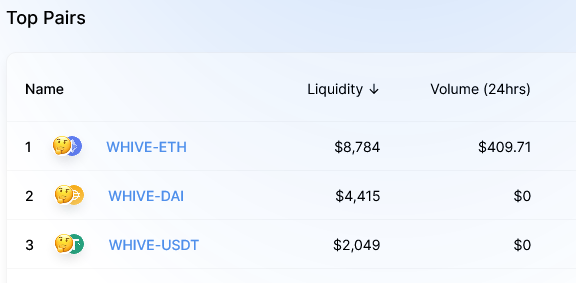

Here are the currently existing pairs:

I'm gonna be adding liquidity to WHIVE:DAI pair but I would suggest WHIVE:ETH for most users as this is the biggest pool and it's more likely to generate fees. Click the selected pair.

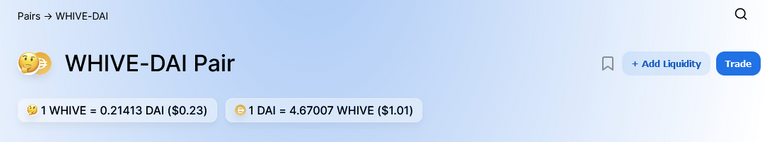

This moves us to selected pair stats page. In the top-right corner we have buttons to directly trade this pair or add liquidity - click it.

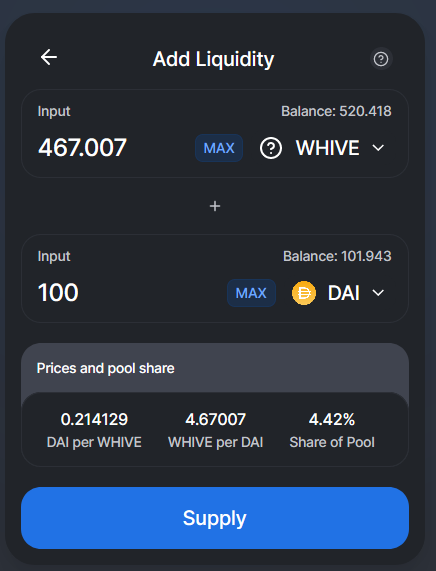

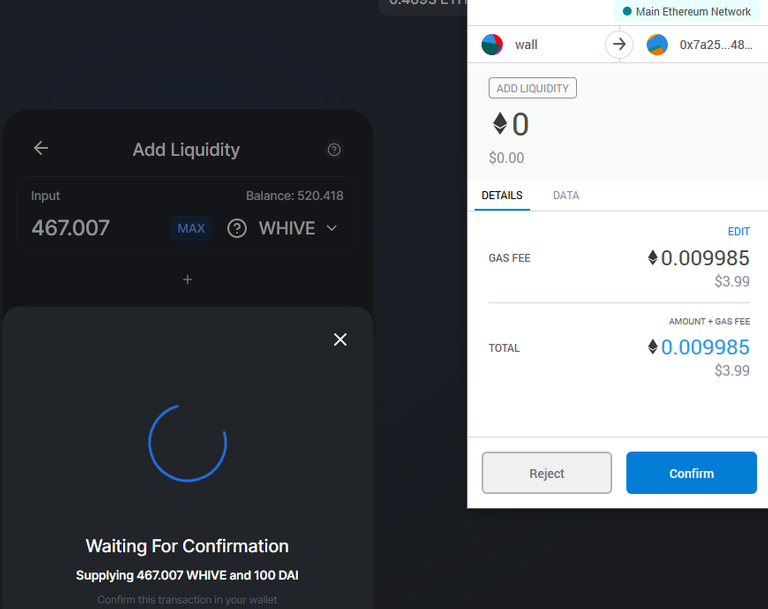

Now, important information - when adding liquidity on Uniswap you need to provide funds for both sides in equal value. In this case I'm adding $100 worth of DAI and $100 worth of WHIVE.

This is also where we need to mention the risks. First, the trading is handled by smart contracts - a software that may have bugs. Those bugs may be exploited to somehow steal your funds or otherwise put you in loss. I don't think it ever happened but it's worth to know.

The other risk comes from big price changes. Let's say I'm providing 500 WHIVE and 100 DAI. If WHIVE price will start to continuously raise and traders will only buy WHIVE from my pool (trading one direction only), in theory my pool will finally get drained from WHIVE and I will have only DAI left - so I will no longer hold WHIVE, which is now much more valuable.

In practice there are system to prevent that - every trade moves the price, the less WHIVE there would be in the pool the more drastically expensive it would get. This should trigger trades in the opposite direction. Also, in theory, the trading fees earned in the long term should cover any losses caused by price swings. Yet, if HIVE would skyrocket to $1 in like one day, I would probably be in loss.

Now, once we've got this covered, let's finally provide the liquidity. Click Supply and confirm.

Again ETH fees strikes back, $4 fee for providing $200 in liquidity. That's why currently you want to make high-value transactions, as the fee stays the same no matter the volume of the transaction.

This is the final step - after the transaction got confirmed, no further actions are required to earn the trading fees.

In conclusion

There's not much WHIVE trading happening currently because of low liquidity. By providing WHIVE in the trading pools, we do not only allow more trading, but we also increase the HIVE exposure in general. More over, we suck HIVE from the current systems and by this lower it's supply - which is good for the price.

Now, it's gonna be interesting to see if WHIVE will get traction on the DeFi trading platforms. I know I will be using it but if we could attract more investors, either because of the price potential or simply thanks to the 10%+ APR, that would be awesome.

For me the final goal would be to get WHIVE listed on DeFi lending platforms - this way I could borrow a lot of HIVE without need to sell my crypto savings or use DAI in the process. On the other side, liquid WHIVE holders could earn a nice, steady APR without need to power-up. This is the kind of service we're heading for and WHIVE lending being only a part of the whole HIVE economy would paint a pretty awesome picture.

In other words:

The big guys will earn the money and the small guys will get screwed.

As usual.

Posted Using LeoFinance

Not really.

The big guys can earn big money, the small guys can earn small money in this case.

You're right, they can but they won't. At least most of them. But hey, what do I know.

But I'm glad I sold my hive at $1 so I don't have that problem.

Nice move, @oldtimer. I also traded my hive with good profit. 👍

I learned my lesson in the first steem bull run.

Posted Using LeoFinance

I'm happy with you, mate!

I got the first STEEM bull run done, so I patiently waited for low prices before buying. Then, thanks to the fork from STEEM, I "magically" more than doubled my staking... now I'm waiting to see what will happen.

Do you like a bit of !BEER ?

View or trade

BEER.Hey @oldtimer, here is a little bit of

BEERfrom @amico for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Best explain

Korci mnie, żeby spróbować

#posh

I'm missing the point. The ETH gas fees kill you entering and exiting. I though getting out of ETH was the better play.

This was just a guide, normally you want to provide much higher amounts in single transaction (so that the fee takes less of your total investment).

Also ETH 2.0 is coming, getting out of ETH wouldn't be smart in my opinion :)

No doubt Vitalik and company are a bunch of smart guys who will figure it out. But will it be too little, too late?

If we increase liquidity, will earnings for liquidity providers decrease?

Posted Using LeoFinance

More liquidity with the same trading volume, sure. But right now there isn't enough liquidity for anyone to trade in the first place.

Go try and set up just 1 ETH swap for wHive and look at the price impact. Its currently showing me 6%. So you can't currently trade even 1 ETH before you begin distorting the price.

So, "too much liquidity" is not currently a worry.

Hard to say - one one hand your share in fees will drop, on the other the trading volume should increase.

That's interesting, I think we need a pool or more of them in Hive which will offer this. I think the usage of bots can help ... I remember in Steem there was a lot of bots, etc...😖

@cardboard Thank you so much for making this in-depth guide!

@cardboard You have to check out https://bit.ly/DeFiTrade as well because that platform allows users to provide liquidity in Balancer liquidity pools AND also lets users generate an extra yield on top in the form of YFV tokens (which skyrocketed today a whopping 260%), vETH and vUSD. *The risks are definitely present in providing liquidity to these pools, so please DYOR and only consider putting in what you can afford to lose.

Maybe if you reach out to the devs of that platform directly, they would be more willing to walk you through the process of getting a wHIVE pool onto their platform and give HIVE access to hundreds of Millions of dollars worth of liquidity.

hey, @cardboard can you please review yearn.finance or yield farming in general. I want to know your opinion about it. I see it somehow related with DeFi and I wander how the price of yearn is growing that fast. I don't know if they have there WHIVE, but they have DAI sore sure.