Have you ever wondered whether or not you actually own the land that your house rests upon, or the circumstances under which it could be taken from you?

In this article, we'll dive into some modern threats to private property, and how blockchain technology is cultivating communities that could disrupt the ownership of real-estate.

The Old Way

Before the digital age, land titles were written on thick sheets of paper and stored at city hall for reference. Since the advent of computers however, these ownership documents have migrated to electronic databases.

Historically we have looked in the aforementioned places to verify who owns what. In both cases however, the records are under the control of government officials, who could theoretically tamper with them.

Do You Really Own Your Home?

In the case that you have borrowed money from the bank, of course, they will be the true owner of your home until you finish paying off the mortgage. However, even once you have paid it off, the land would be confiscated by the government if you were to stop paying property taxes.

Not only can your home be confiscated from you in the event you are unable to pay your land taxes, it can also be taken under something called "eminent domain" - the compulsory acquisition of private property for public use.

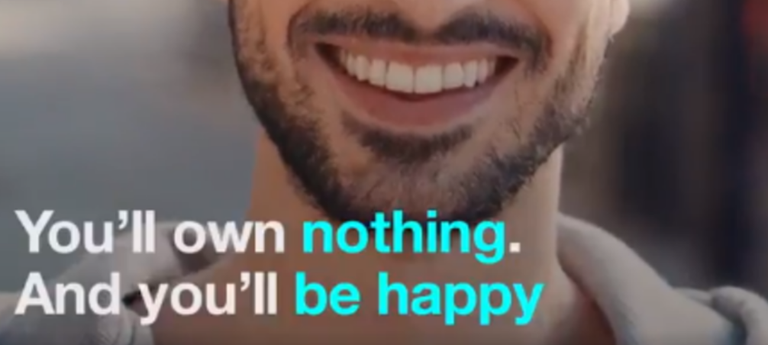

Let's not forget that one of the core tenets behind the WEF's 2030 agenda is that "you will own nothing, and be happy". This may cause you to think about what other creative methods they may use to confiscate land in the coming years.

Bitcoin, Ethereum, and NFTs

Bitcoin was the first blockchain, and has been used primarily for financial transactions. That said, there are plenty of other use-cases for blockchain technology, including transferring physical property peer-to-peer in the form of non-fungible tokens (NFTs).

NFTs are unique digital tokens on a blockchain. They made their debut in Ethereum-based games like Crypto Kitties and Axie Infinity. NFTs originally represented game items like avatars, weapons, or virtual pieces of land, but they can be used for much more.

One of the most interesting applications of NFT technology is the transfer and tracking of real-world assets (RWAs) such as land, houses, and vehicles. Just like Bitcoin, NFTs can be transferred permissionlessly 24/7 by anyone, anywhere in the world.

Structure Of A Land NFT

What kind of data would be contained within a physical land NFT?

- Property's location

- Boundary descriptions

- Zoning information

- Ownership history

The community could collaborate together and make a final decision on what the structure of a real-world land NFT should look like.

Ease Of Transfer

NFTs, whether they represent items in a virtual game or real-estate in the

physical world, can be easily bought and sold on decentralized exchanges (DEXs), without the need for notaries, lawyers, banks, and other middle-men that add friction to our transactions.

Which Blockchain?

This is an interesting question, as we have plenty of blockchains to choose from. Which one would be most adequate for the trading of real-estate NFTs? We already have specialized blockchains (like IoTeX and Peaq) for DePIN projects, but what about for RWAs?

If you've been in the space for a while, you may have noticed that crypto is very tribal, so instead of us all agreeing on a single platform, more than likely we will see different implementations of RWA tech, with each community tokenizing their assets on their own blockchain.

For example, imagine a world where some cities have adopted Bitcoin, and others have adopted Ethereum. The cities which have adopted Bitcoin will tokenize their physical property on a Bitcoin sidechain. On the other hand, the cities which have adopted Ethereum will tokenize their assets on an Ethereum sidechain.

Likewise, the land within other cities will eventually be tokenized on other blockchains that form strong communities and achieve some level of international adoption.

Grassroots vs. Top-down Approach.

There are already major corporations (including Blackrock and IBM) talking about tokenizing real-world assets on the blockchain.

Aside from being partnered with the WEF, the problem with these traditional financial institutions is that they have their heads stuck in the legacy system. They sit comfortably atop the "everything bubble", cannot relate to the plight of younger generations, and do not understand crypto culture.

The more likely scenario in my mind is the sprouting of an organic, grassroots movement. The population will get so fed up with the "great reset" (and the "great taking") that they will simply decide to start registering their own property on the blockchain, and begin trading it amongst themselves.

Community Governance

Another beautiful aspect of modern blockchains is their built-in governance, which allows the community to vote on important issues, while avoiding the possibility of voter fraud.

For example, how do we decide which areas of the city are residential, commercial, and industrial? What do we do with property that has been abandoned or lost by the owner? These are issues that can be voted on transparently by the community.

Imagine if the system were setup in such a way that if the owner of a property didn't perform a transaction for a year (or 5 or 10), his land would automatically be deposited to a community fund, where the token holders would vote on what to do with it.

Enforcement

Unlike Bitcoin, which is just a digital token with zero counter-party risk, physical property actually exists in the real-world. Therefore, there needs to be some enforcement of land rights based on the state of the blockchain.

Ultimately, this will require a mental shift in the population. Similar to how we currently adhere to the paper or digital records held at city hall, eventually we will adjust to respecting community member's property rights as they appear on the blockchain.

Until next time...

As with any new technology, humanity will need some time to adapt to the idea of tracking physical assets on the blockchain. The WEF's push towards "owning nothing and being happy" may accelerate the process.

This technology gives us the opportunity to make land ownership more democratic and transparent. Instead of depending on corruptible government officials to manage our property rights, we can manage them ourselves as a community.

This will likely be a grassroots movement, rather than a decree from existing institutions that are focused on traditional finance and follow the WEF's agenda. As local communities become increasingly sick of the globalist policies imposed upon them, they will likely end up tokenizing their own assets.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Resources

Eminent Domain Image [1]

Investopedia Article On How Blockchain Changes Real Estate [2]

Forbes Article On Real Estate Tokenization [3]

Own Nothing, Be Happy Image [4]

Trading House Image [5]

Grassroots Movement Image [6]

complex topic, not sure if blockchain technology will be great for territory ownership. Sometimes the real owner is the one who has more physical strength

Yes it has been that way for centuries, but I wonder if Bitcoin and crypto will change that paradigm...