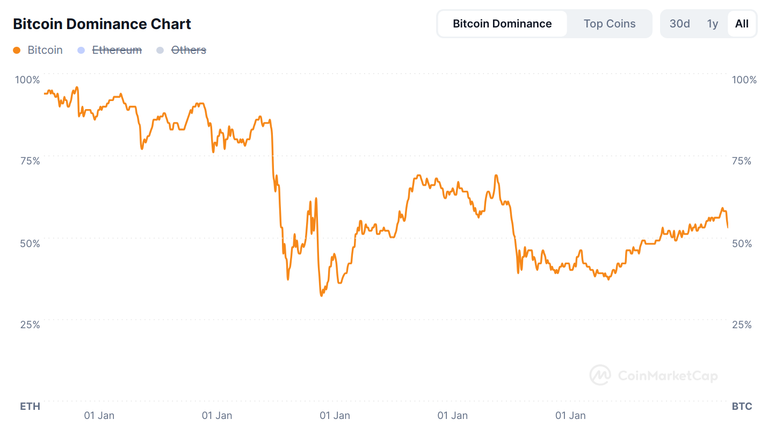

Since 2013, Bitcoin's overall dominance in the crypto market has dropped from 95% to 52%. Throughout that time, a rich and diverse ecosystem of cryptocurrencies has emerged. In this article, we will cover the reasons why both of these trends will continue.

Bitcoin's Strengths

First of all, let me say that I'm not a Bitcoin hater. Like many others, I started my crypto journey with only Bitcoin. If it weren't for Satoshi, permissionless, censorship-resistant, and borderless money with a predictable supply curve would not exist today. 🙏

Also, while I'm not a fan of Bitcoin's decision to artificially limit the blocksize to 1MB, it's true that running a Bitcoin node (not a miner) is something that almost anyone can do, since the blockchain remains relatively small at ~600GB. Bitcoin is also stable, because it prioritizes basic functionality over innovation.

With nations, states, and corporations now rapidly adopting it, Bitcoin is looking more and more like the ultimate winner here. But we have to consider the context in which Bitcoin has reached its current valuation of roughly $100k per coin.

The Everything Bubble

Over the past few decades we have been in an ever-expanding financial bubble. Stocks, bonds, real-estate, gold, and Bitcoin have all been pushed to the stratosphere (in fiat terms) thanks to decades of loose monetary policy.

These circumstances beg the question. When all of the misallocated capital eventually falls back to Earth, and fiat currencies find their true value, how will the global economy be restructured, and how will these assets be repriced as a result?

Bitcoin's original value proposition was peer-to-peer cash. Its price increased as more people used it to trade goods and services. Since the decision was made to keep Bitcoin's block size at 1MB, however, it has transitioned into "digital gold", essentially an unconfiscatable hedge against inflation as fiat continues to be printed.

Since QE infinity started back in 2008, fundamental analysis of stocks has gone out the window. Speculation is the name of the game now, and that applies equally to the crypto markets. Essentially, investors are looking for a place to park all that extra liquidity that has been pumped into the system, but very few are thoroughly evaluating crypto projects, and end up choosing Bitcoin as the default option.

As long as the current fiat paradigm remains in place, Bitcoin will keep these investors ahead of the game. The ultimate question however, is how much value will Bitcoin have when the fiat world faces another crisis, and the central banks cannot (or will not) save the system? Will Bitcoin, CBDCs, or crypto in general, be the replacement?

The Transition To Crypto

All signs are pointing towards failure in traditional government and banking systems, which have traditionally stored our money and kept track of our assets. Will the elite succeed with their "great reset" and the implementation of CBDCs, or will the people ultimately opt for decentralized cryptocurrencies instead? My bet is on the latter.

As confidence in old institutions breaks down (due to things like inflation, taxpayer waste, and de-banking), eventually the population will have more confidence in trustless, censorship-resistant, and decentralized blockchains than the government. That means the coins that power those blockchains will have value.

Of course, tangible assets like real estate and gold will always have value too. That said, as older generations are replaced by younger generations we have to consider that the perceived value of those assets will change over time. We also have to take into account that these real world assets (RWA) will be tracked on a variety of blockchains in the future.

More Factors

Aside from the popping of the Everything Bubble, and the transition of RWA ownership to blockchains, what other reasons will Bitcoin's dominance decline over time?

- Tribal - Humans are tribal by nature. For that reason alone, we will always have a variety of competing cryptocurrencies, similar to how we have a multitude of religious sects worldwide. Each crypto tribe has their die-hard members, who would never abandon their project in favor of Bitcoin.

- Innovation - Let's face it. There's little to no innovation happening on Bitcoin. Meanwhile, other blockchains have implemented things like privacy, smart contracts, DAGs, etc. to improve functionality and the user experience. While these novel blockchains may be unstable now, they will stabilize over time, and become more valuable.

- Bitcoin is for the older generations who can afford it, thanks to QE infinity. The elderly often don't understand crypto culture though, and what makes it valuable. Meanwhile, the younger generations are building on other blockchains, and forming strong communities.

- Instead of purchasing it with fiat, the "no-coiner" masses will likely enter the space by earning crypto via decentralized social media (such as Hive, InLeo, etc), by participating in a DePIN network, or by some other means.

Until next time...

While Bitcoin remains a stable and relatively decentralized store of value, it faces competition from more innovative alternatives that are more appealing to younger generations.

The primary reason Bitcoin continues to reach new all-time highs is because fiat currencies are being printed to infinity. An eventual correction, or "great reset", will require all assets to be repriced in a new monetary system.

If Bitcoin's primary use-case is no longer protecting oneself from the inflation of fiat currencies, then value will transfer from it into more innovative crypto assets that are faster, more user-friendly, and facilitate real-world economic activity.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Resources

Coinmarketcap Bitcoin Dominance Chart [1]

Paradigm Shift Image [2]

Posted Using InLeo Alpha