Although cryptocurrency has the potential to revolutionize our world, let's be honest. Most of us are here to increase our fiat holdings, rather than to build a new economy based on decentralized tech.

We want to 10x, 100x, or maybe 1000x our fiat holdings so that we can work less, buy more things, and increase our status in the legacy system.

These objectives aren't bad, per se. The problem with this perspective, however, is that both fiat currency and the legacy system are on the way out, and may not be with us much longer.

Fiat's Demise

We can argue on the timing of the collapse, but the trend is clear. A combination of exponential debts, de-dollarization, and a push for CBDCs are all guiding traditional fiat currencies towards the graveyard.

No, it won't happen overnight. But as more people start to accept that the legacy banking system is critically ill, confidence is increasingly lost, and the closer we get to this reallity.

The leaders of nations and corporations worldwide are finally starting to acknowledge that the fiat system rests on pillars of sand, and have started warming up to cryptocurrency as a better alternative.

In fact, countries, states, and corporations have started adding Bitcoin to their "strategic reserves" and treasuries, which makes you wonder, will Bitcoin will be the base layer of our new financial system?

Bitcoin's Role

In a world where governments, banks, and people trust each other less and less, Bitcoin has become the "trustless" store of value. Unlike your bank account, stocks, house, or pension fund, Bitcoin cannot be confiscated or redistributed by the government in the event of an financial crisis.

Thanks to Bitcoin's first mover advantage and limited supply, its price continues to increase as more fiat currency is created. However, with limited functionality, and a limit of 7 transactions per second, Bitcoin can't do much other than be "digital gold" and represent a share of the growing fiat pie.

We have to ask ourselves the question, how useful would Bitcoin (and crypto in general) be if the $USD went the way of the Zimbabwean dollar, the Argentinian peso, or the Venezuelan bolivar? In other words, why would people still want these digital tokens if they couldn't be traded for fiat currencies?

In order to survive long-term, a cryptocurrency must have some kind of utility, other than just mere speculation.

Crypto's Use-Cases

Building on Bitcoin's core values of limited supply, permissionless access, and immutability, blockchain architects have implemented additional innovations like decentralized autonomous organizations (DAOs), smart contracts, decentralized exchanges (DEXs), non-fungible tokens (NFTs), and decentralized physical infrastructure networks (DePIN).

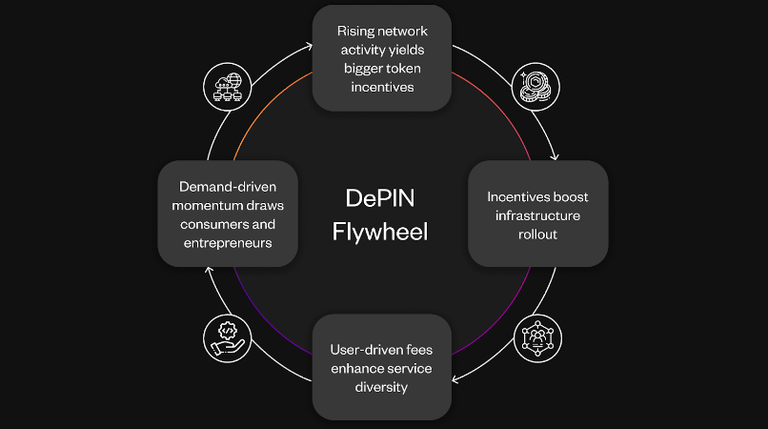

DePINs are one area of crypto that could transcend mere speculation, and actually underpin our future economy. DePINs enable small businesses and individuals to be rewarded directly by the blockchain for rolling out physical infrastructure.

Take Helium, for example. By independently operating a 5G hotspot you earn $HNT tokens, which can then be used to pay for mobile data credits. Or consider decentralized compute network Akash, which awards you $AKT tokens for providing spare compute power to the network.

Imagine a crypto world devoid of fiat, where these DePIN tokens could be traded permissionlessly (using a service like Thorchain or Maya Protocol). Server operators could swap their $AKT tokens with radio operators for $HNT tokens so that both parties could pay their mobile and compute bills.

DePINs are set to disrupt other industries too including digital storage, mapping data, energy distribution, location services, and more. Furthermore, cryptocurrencies have the potential to disrupt social media platforms and data monetization too.

On the Hive blockchain, for example, HIVE tokens are automatically awarded to content creators and curators for their contributions to the network. Aside from speculation, these tokens give you real influence on the network. For example, you can use them to vote for witnesses (validators), approve spending proposals, and influence how rewards are distributed to other community members.

Transparent governance is another major use-case for decentralized tokens. Similar to holding the stock of a public corporation, you can use your crypto tokens to vote on important community decisions.

To wrap this up, imagine if you could use crypto tokens earned via DePIN networks, decentralized social media platforms, and DEXs to purchase real-world assets (RWA) directly from the owner? For example, you could swap your tokens for an NFT on a blockhain that represents physical property, like land or a house.

Until next time...

Most of us still see crypto as a way to capture a greater share of the growing fiat pie. However, taking into account our exponential debts, increasing de-dollarization efforts, and the rapid rate of crypto adoption, it's likely that traditional fiat currency will disappear at some point in the future.

When that finally happens, crypto tokens with real-world utility (such as influence on governance decisions, providing liquidity, access to DePIN networks and data, etc.) will be the most likely to replace fiat as money.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Resources

Thinking Man Image [1]

DePIN Flywheel Image [2]

Real Estate NFTs Image [3]