Have you ever stopped to wonder why those paper bills in your wallet are worth something? Isn't it odd that people are willing to give you goods and services in exchange for a flimsy slip of paper? Did you know that those pieces of paper used to represent real value?

Indeed, before the gold standard was dropped 1971, you could actually go to the bank and redeem your paper dollars for some shiny metal. More specifically, one ounce of gold for every $35 dollars.

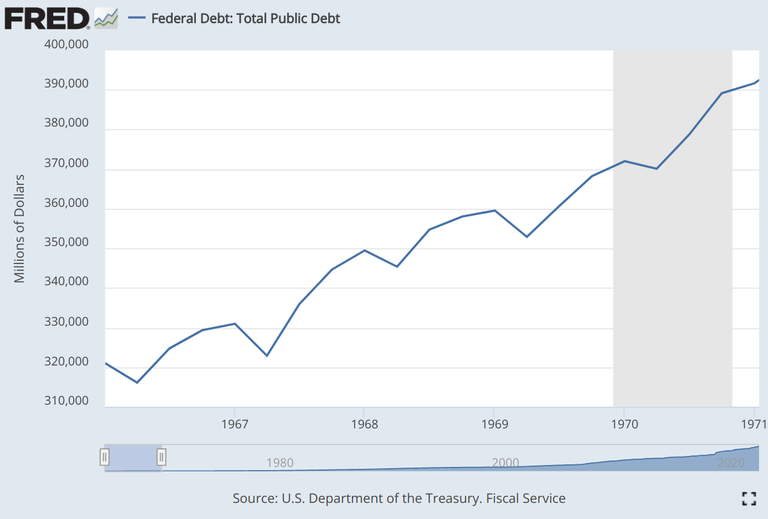

These days, the paper notes in your wallet are not backed by anything, other than the promise of your government to service its debts. And in the case of the US government, its debt has increased from a few hundred million dollars in 1971, to $35 trillion today.

Zooming out further, we can see that the global debt/currency supply has exploded ever since the US government abandoned the gold standard. In fact, total worldwide debt has increased by about $1 trillion in 1971, to $315 trillion dollars today.

Sure, some of that currency fueled production in the real economy. However most of it has been blowing air into the biggest financial bubble in history. Over the past few decades, the value of real estate, stocks, gold and Bitcoin has skyrocketed relative to the dollar.

Why Did America Drop The Gold Standard?

Back in the 1960s, the United States national debt had been expanding (modestly, relative to today) due to increased spending on the Vietnam war, and newly introduced welfare programs such as medicare, medicaid and food stamps.

The gold standard had been restricting the government's ability to spend money on war and welfare, so it was in their best interest to eliminate it. With spending limits lifted, the government could more easily increase its "defense" and welfare expenditures.

Ostensibly to stimulate economic growth, nixing the gold standard actually stole purchasing power from savers, made life increasingly harder for average wage earners, and amplified the Cantillon Effect, which further enriched the ultra wealthy.

Benefits Of The Gold Standard

If the banks wanted to increase the money supply before 1971 they had to acquire more physical gold, a rare physical element that's not easy to obtain.

Therefore, in addition to limiting government spending, one of the benefits of a gold standard is stable (or deflating) prices for the consumer.

It makes sense that if the economy is expanding, but the money supply remains fixed, then the price of goods and services should come down.

For example, if the money supply is capped at $21,000,000, and more automobiles are produced each year, then the cost of the average car should actually decrease, so long as demand remains constant.

Bitcoin-Based Economy

Limited to only 21,000,000 units, Bitcoin is increasingly considered to be this century's digital gold.

In today's world, self-custody Bitcoin can be used to protect your purchasing power from fiat currencies that are being printed to infinity.

The ultimate question is, will Bitcoin become the new reserve currency that underpins future economic activity, like the $USD has done for the past few decades? The answer is nuanced.

Due to its inherent limitation of 7 transactions per second, Bitcoin isn't likely to power the future decentralized digital economy, although it could potentially remain the "digital gold" of the crypto world.

Today there are plenty of other supply-restricted and censorship-resistant cryptocurrencies under development that not only provide enhanced functionality, but the capacity required to underpin future economic activity.

If you learned something new from this article, be sure to check out my other posts on crypto and finance here on the HIVE blockchain. You can also follow me on InLeo for more frequent updates.

Until next time...

Resources

Image Generation Courtesy of Venice AI [1]

United States National Debt Chart [2]

Posted Using InLeo Alpha

Límited supply and high demand —> high price.

Does it mean a crypto whose supply lesser is than BTC (21m) could ever surpass BTC?

Yes, it's possible, regardless of supply. For now, it all comes down to demand.

Unlike Gold and the $USD which have matured over centuries, crypto is still in its nascent stages, so wild fluctuations in the market can occur.

In fact, there was speculation that Ethereum would flip Bitcoin's market cap back in 2017, and Ethereum's supply was more that 4x of Bitcoin.

In the future, the market will settle on which cryptocurrencies remain dominant.