I don't know how to write this article, but I will try my best to share with you my 18-day journey in staking my LP tokens, and how I lost more than 50% of them. Before anything else, let me explain what is a Liquidity Pool in my own understanding.

Liquidity Pools or LP are paired crypto assets, in my case, EBEN-BCH and CATS-BCH, that are pooled together to earn a certain token, which is EBEN. Since I'm not into technical stuff, I highly recommend you to DO YOUR OWN RESEARCH.

18-day journey in LP

So August 30, I added 100K CATS and 0.0269 BCH into the LP. I also swapped 0.011 BCH for 51.9 EBEN. The 51.9 EBEN was added to liquidity and an amount of 0.0109 BCH was also needed to complete the pair. Both LP tokens were staked in the hopes that I could earn more EBEN fast.

100K CATS - 0.0269 BCH

51.9 EBEN - 0.0109 BCH

I had no idea about the risks until Jane mentioned it to me in our TG group. PVM also said he doesn't like providing liquidity. According to him, if APY/APR is high, you could lose.

I was a bit worried but didn't bother to pull them out yet since at the back of my head, I could gain more profit once BCH hits $700. However, francis105d1 also posted his reminder in our TG group that finally made up my mind to do something about it before I regret not pulling out on time.

Unstaking your LP tokens

So yeah, after 18 days, I finally pulled out everything. So the process was simple, in case you want to unstake yours. I'm not saying you have to unstake it now. Just DYOR and ask the experts. Anyway, to unstake your LP tokens, here is the first step:

- Click the '-' sign under the LP token you want to unstake.

After I unstaked my EBEN-BCH, I immediately checked my wallet to see if my assets were back. I was shocked when I couldn't see it. I almost got panic. So I explored the Liquidity page, and there I saw my token. So what's next?

If you want to pull out everything and have no plans to stake them back...

Hit Remove.

Set the percentage bar to max.

Confirm the transaction.

Hit Approve, and then Remove button.

Confirm.

Once the transaction is completed, you will then see your assets in your wallet.

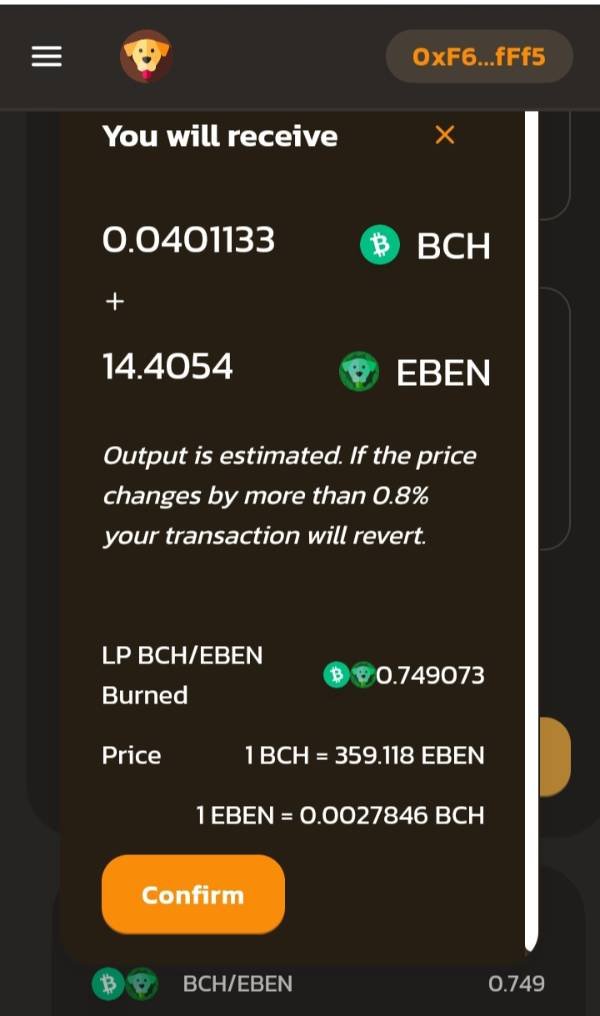

Unfortunately, from the original 51.9 EBEN - 0.0109 BCH, what's left for me is 14.4054 EBEN (plus 4 from the Harvest) and 0.0401133 BCH. This means I lost 37.4946 EBEN and gain 0.0292133 in BCH.

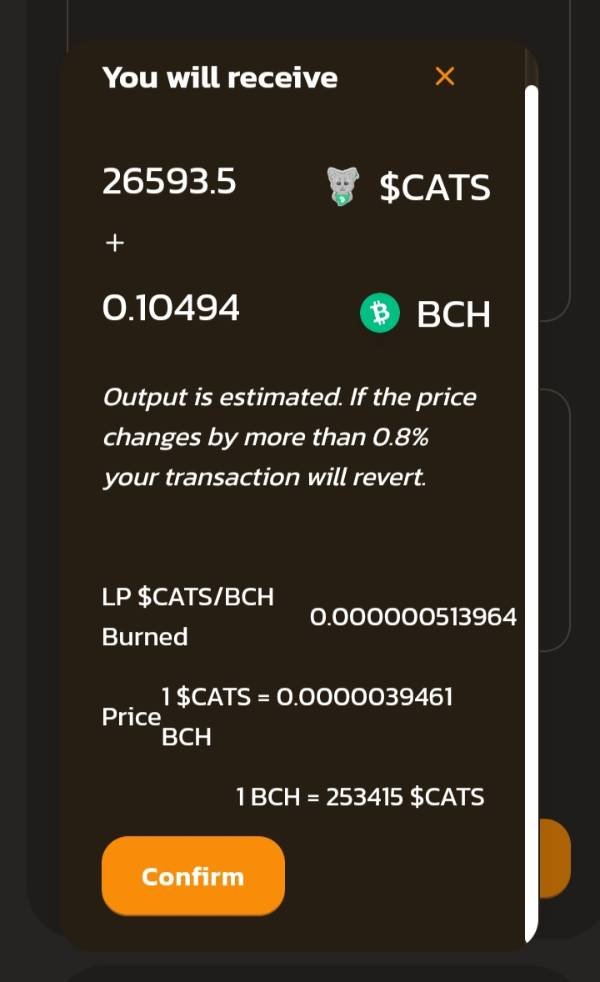

I also pulled out my CATS-BCH. From the initial put-up of 100K CATS - 0.0269 BCH, I now have 0.10494 in BCH but lesser CATS. Out of 100K, I lost 73,406.5 CATS, which means I only got 26593.5 left back to my wallet.

How exactly did I lose my CATS and end up having more BCH?

As I've said earlier, LP requires two assets that need to be pooled together to earn a certain token. The goal is to keep the two assets' value linked with one another and must always remain constant. However, if one asset increases its value, an adjustment has to be made, resulting in lowering the value of another.

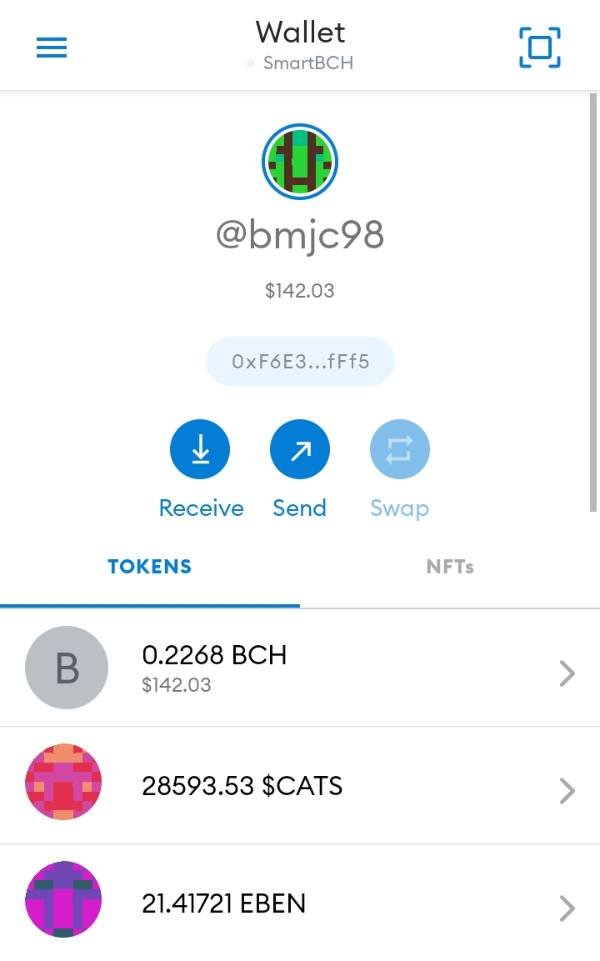

So in my case, I have gained more in BCH but lost more than 50% of my EBEN and CATS. This means the price of BCH is high but the tokens are both low. Despite having more in BCH, I'm still saddened by the loss of my CATS and EBEN. Now, I only have 28593.53 CATS and 21.41721 EBEN left in my wallet.

So where did the risk comes from?

As Francis said, providing liquidity can be very risky. Due to volatility, you may end up experiencing impermanent loss on the value of your pooled assets. You may also end up having more worthless tokens and less of your valuable ones if a rug pull occurs. This is why you must DO YOUR OWN RESEARCH first with the tokens you want to add into a Liquidity Pool to avoid such hassle and loss.

Closing thoughts

Despite this quite unfortunate event for me, I'm happy that my BCH is secured now. Plus, from the initial investment of $47.65, now $142.03 in BCH + $60 that I added in WBCH. Most importantly, I gained something valuable, and that's the lesson I learned from staking in LP.