A few days ago I wrote an article about gold and crisis. It is now time to talk about the miners in such situation. Usually they climb much more than gold itself. As gold climb the enterprises producing it explode.

Here I give my top gainers list and the analysis :

- Metalla Royalty - MTA

- Kinross Gold Corp. - K

- K92 Mining Inc. - KNT

- Barrick Gold Corp. - ABX

- Newmont Corp. - NGT (NEM in the US)

In the next article I'll share my favorite watchlist, the special ones I see with massive growth but aren't totally ready yet.

Metalla Royalty - MTA

On the monthly term growth is pretty impressive, but a little too short to analyse in the long term. However the most important is to see how it sticks to its EMA 9 support in the crisis.

On the weekly graph the crisis made it breaks its growth over the parallel channel but it looks like this week has already corrected this little misstep.

But on the daily term we can see it didn't only make amends of the crisis first shot but it even took it's growth again as if the little mistakes were already forgiven. It is for the moment acting as if the last movement was just a fair retest of the angle.

It is now time for a minimum of +120% return !

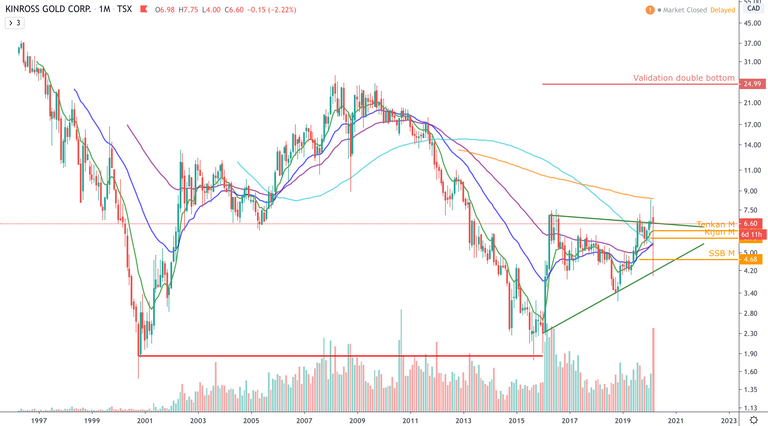

Kinross Gold Corp. - K

On its monthly term the graph has been perfectly preparing its position for crisis time. After building a massive double bottom whose validation level is already more than 200% above actual level (which brings an objective around +4'800% from actual point), it has consolidated its base position now ready to climb up.

On EMAs' side, EMA 26 and 50 (purple and royal blue) are switching positions which is one of the best bullish sign.

The weekly term is now a little confusing and difficult to apprehend. It just validated its bullish flag objective when the crisis striked. I cannot tell from this point how the growth will go from here. However an important point to have in mind is that Kinross announced they had to close their Canadian office because of a Covid-19 positive case. But the stock isn't suffering from this news and is taking its way back to growth as any other mine.

On the daily term we have this bullish flag pending with +300% promised. This is why I truly hope they'll take their growth path following gold.

And indeed it succeeded to climb back into the parallel channel yesterday. This week will be decisive for Kinross but if it maintains its position at the end of the week then it's a go, you should definitely buy !

K92 Mining Inc. - KNT

Without talking too much let's go straight to the point : monthly price fell more than 50% to come back to it's monthly supports. Let's see in the shorter terms what it means.

Now it looks like this little plunge was like hair on soup. But a not so big hair on a perfectly seasoned soup represented by a cup weighting +400% and ready to rock. If the price manages to stay above the resistances drawn by Ichimoku then it's a go too for this one.

But no need to rush and to make investment mistakes because of greed. The buying position will be confirm if the price manages to stick to the parallel channel it just joined again. Let's watch it carefully this week.

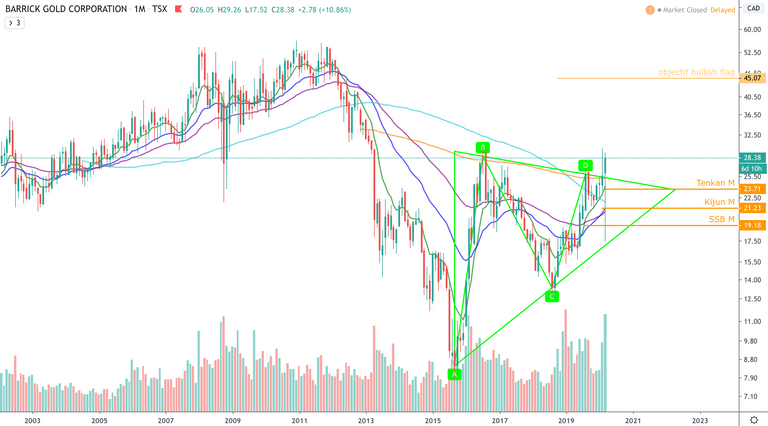

Barrick Gold Corp. - ABX

I've repeated myself enough until now so let's only stick to the point. Beginning of the crisis brought the price -30% down more or less but already bounced back above the triangle formed earlier. Normal growth could have taken the lead already.

The weekly term was lead by the bullish fanion/flag objective. Right after the plunge the price came back above all Ichimoku's resistances (materialised with the orange radius on the side of the graph). We may come back to that objective if the market totally ignores the plunge. But only the next days will tell (just like the cousins above).

On the daily term it is yet too soon to tell where it goes. But if the cup objective is validated then we can assume the market totally ignores the plunge. It would then be the prefect time to invest.

Newmont Corp. - NGT (NEM in the US)

I usually analyse the stocks threw the Canadian market. But Newmont is only listed since April 2019 which doesn't offer a long term view really interesting. The following graph represents the price into the US market.

It shows a very nice performance and the trust of the investors that brought the price back over the little parallel channel taking back the path of the bullish flag whose objective stands above the bigger channel. This movement represents a +170% growth.

On the Canadian market price just came back to its original state and corrected the mess brought by the crisis initiation.

The US market confirms the exact same positions and by this manner help bringing the long term analysis from US to Canadian market.

In other word, the long term objectives are the same and as for the cousins above, if price manages to stay above the double bottom objective line (third red line) then it will be the perfect time to buy.

Conclusion

For all those mines we're already or we're coming in the next to a perfect entry point. It looks like it is a perfect time to invest for long term !

In the next article coming by the end of this week or beginning of the next one, I'll talk about 5 other gold miners that aren't ready yet but will soon (in the next weeks probably) come along with a perfect entry door. Stay updated threw the different channel :

- Telegram channel

- Twitter where are shared my articles, those from my coworkers and other article I find very interesting

You can also join the Crypto/GoldLeoSwitzerland's discord. This project is quite new but if you're interested into precious metals' analysis or DeFi it would be a pleasure to count you among our investors ! For more informations you can read this article : Major moves forward for CryptoSwitzerland and GoldLeoSwitzerland