I would like to bring a very interesting approach brought by the great investor Howard Marks when he discussed aspects of his book The Most Important Things in a lecture, in 2015.

In the lecture in question, the proposal consisted of talking about the book, but, much more than that, showing its investment philosophy and the ideas that supported it and gave rise to it.

In this sense, Marks highlighted four key points, which underpin his investment philosophy. The third of them concerns the fact that, when it comes to investments, it is more interesting to avoid mistakes than to always try to win.

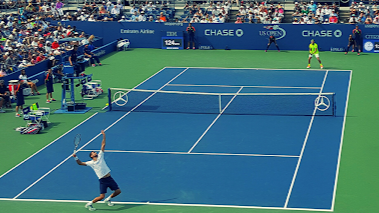

For example, he mentions a book written by Simon Ramo, an executive at a former conglomerate called TRW. The work is about winning tennis matches. In it, Ramo points out that there are two types of winners in this sport.

The first group, made up of players like Nadal and Djokovic, wins because it hits winning moves. This means that your moves are so well placed, so strategic and so fast that your opponents are unable to hit them. On the other hand, if your moves are not potential winners, your opponents are likely to catch up with them and put them out, since there is not so much difficulty involved. In this way, he realizes that the winner of the tennis championship wins by beating other winners.

The second group, made up of amateur players, is unsuccessful in winning winners, but avoiding losing. So, according to Marks, if you are able to hit the ball 20 times, your opponent will eventually only be able to hit it 19 times - and then you will win the point.

So, just as there are two styles for tennis, there are also two strands for investors. In this context, Charles D. Ellis wrote an article - The Loser’s Game (in the game of losers) - in which he highlights that investing is a game of losers, after all they are consistently successful not by winning winners, but by avoiding being losers.

In addition to Ellis' thinking, Marks points out that he agrees with this view, but with a different look. While Ellis believes that investing is a game of losers because the market is efficient and assets are perfectly priced, Marks believes that there are inefficiencies in the market. They are just hard to notice - and you have to be a good investor to consistently get to see them and take advantage of them.

Returning to tennis, the point is that professional players consolidate themselves in the first classification group because they are so well trained and talented that they know that if they arrange their feet in a certain way, they have the perfect angle of the arms and hit the ball with force. correct, it will obey. Thus, the professional athlete is not concerned with the wind, the sun in his eyes or other distractions, after all he is well trained to deal with it.

The fact is that, in matches, they follow something called an unforced error. The reason for doing so is because these mistakes are rare, after all, professionals make very few unforced mistakes. However, we, who are amateurs, make unforced mistakes at all times, so that, in order to stay “alive”, we need to avoid them.

Therefore, to conclude his thinking, Marks ends this topic of the lecture with the following reflection:

The point is, if you want to become an investor, you must decide whether you are good enough to play with the winners or whether you should emphasize avoiding the losers in your approach.

Posted Using LeoFinance Beta

This is a terrific article @bernieflow. Thanks for putting it together.

It is a subject that all need to think about when investing. I hope others see this and take heed. We need more subject matter like this on Leofinance.io.

Most have to avoid the losers because they cannot play the winners game. Few will take the time to become an expert. Hence, they move from one hot strategy to the next. Over time, this ends up not working out because they are always starting over.

Posted Using LeoFinance Beta

Thank you so much for your kind words mister! And exactly if someone invest just because someone is talking about it like DOGE or other shit coins you'll be faded to fail and lose.

Posted Using LeoFinance Beta

Thank you so much for your kind words mister! And exactly if someone invest just because someone is talking about it like DOGE or other shit coins you'll be faded to fail and lose.

Posted Using LeoFinance Beta

Congratulations @bernieflow! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 300 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!