Gold is making headlines all over the world, having delivered an impressive 34% returns this year, while printing new all time highs on the charts.

Several analysts are raising their targets to $2500, $4000, and so on, while the bears are calling this a top.

Here's a brief disclaimer:

I'm not a certified financial advisor, and even though I've been trading for quite a few years, I urge people reading this, and my other posts to #DYOR (Do your own research) before taking any decisions!

Of course I'm going to help you out if you have some queries/doubts, so feel free to let me know in the comments, or on twitter :)

Before going on to the technicals and charts, let's have a brief overview on what's driving the price up:

- Gold has been a safe haven asset, and has never proved to fail

- Hedge against mounting risks from coronavirus to geopolitical tensions

- The rampant "Printing" of money by central banks all over the world are rising inflation, is indirectly creating demand for gold. (coming in forms of Relief packages, liquidity injections in equities markets, to Quantitative easing)

- Low returns on bonds (with some countries reporting negative returns for the first time in history)

These all factors are affecting the economy, and even though we may or may not like what the banks and governments are doing, they are really not doing it on purpose, or unknowingly.

Putting all the spending into consideration, the US federal budget deficit clocked in at $2.7 trillion for the first time in history.

These factors are causing a drop in the value of currencies. (more on this later)

Coming to geopolitical tensions (which are probably the highest in this century) :

- US-China tensions

- The internet war on Chinese apps

- Trade wars,

- India-China tensions

- Just enter a random country.... Russia, Vietnam, Iran, Iraq, Turkey, Lebanon, Israel, North Korea, Pakistan, European Countries, Almost every country must have some sort of geopolitical issues going on.

(More explanation is beyond the scope of this article today)

Rising geopolitical tensions usually makes investors look out for safe haven assets as a hedge.

TL;DR:

So anyway,back to the original topic:

If you have already checked out the previous analysis on Gold and Silver, a few weeks back, both Gold and Silver broke out as expected :)

Silver did an impressive near 40%+ rally from that time of posting

Feel free to check those older articles out, if interested...

Let's have a look at the Macro trends, to see where we are...

I'd like to bring your attention to the Dollar index charts first:

Chart: DXY, 1W

Link: https://www.tradingview.com/x/Zf9Yg5jp/

Point to note: The reason why I'm positing this chart is because, this chart means the value of USD is going down, which will, indirectly spur interest in safe haven assets like Gold (and Bitcoin is still an experimental asset, but because of it's intrinsic properties, there's nothing that can probably stop Bitcoin from reaching new all time highs, and for reference, you can have a look at the BTC/TRY charts or even XAU/TRY charts, where both the assets broke out together, because of a currency devaluation. There are lots of other currencies which are getting weaker, and this is just an example.

Spot gold prices rose over 1.1% to $2,039.59 an ounce, after earlier reaching a record $2,055.70. U.S. gold future. (at the time of writing)

Over to the Macro trends:

Chart: GC1!/USD, 1 Month

https://www.tradingview.com/x/V4USTnfs/

Let me clearly tell you, if you are reading this.

Consider these as probabilities. They may or may not coincide with future prices.

These are the two scenarios I'm looking at, on Higher timeframes:

Bull case: It blasts through, invalidating any Cup and handle structure on the monthly, printing fresh all time highs

Short term Bear case: The economy recovers, geopolitical tensions ease, dollar index does a fakeout, and gold goes down, consolidates (somewhere between $1600-2000, making another probable rounded bottom, forming the handle of the giant cup it has been forming over almost the last decade, and then breaking out finally

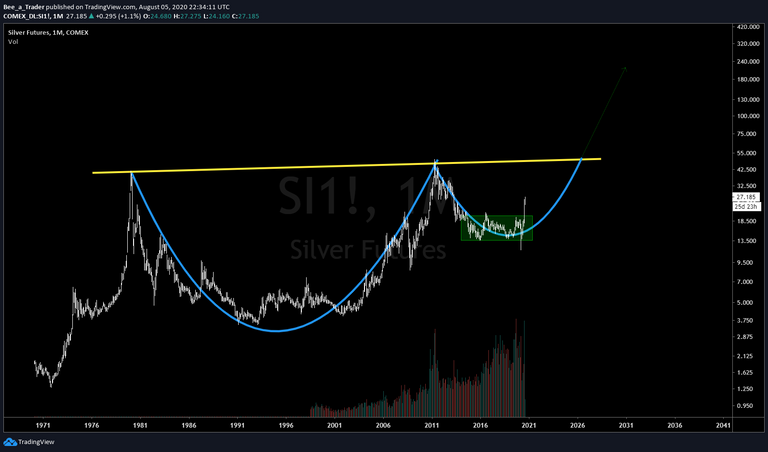

Chart: SI1!/USD, 1M

Link: https://www.tradingview.com/x/X8aBz0Cn/

We are seeing Silver is already forming a similar pattern (Like I posted on gold), but note that the timeframes are different.

We can't really tell which is lagging or which is leading from the charts, and I would say it wouldn't be wise to speculate based on charts alone!

But one thing for sure: Breakout of the previous ATH on Silver will take it through the roof, probably even to Three digits in terms of USD. (It may be too early to tell, but time will tell!)

While looking at metals, we should also never overlook Gold/Silver price ratio.

(Of course, we crypto peeps sometimes look at the Bitcoin/Altcoin Dominance. So, does this sound familiar? )

Chart: Gold/Silver, 1W

Link: https://www.tradingview.com/x/ujAE9QWF/

Point to note: Gold/Silver ratio reached an all time high of around 125, the time when silver was yet to break out, and Gold was already nearing it's previous all time high.

As soon as silver broke out, it rallied much harder, and thus the Gold/Silver ratio started crashing, and even went below the historic multi year support, which was previously a major resistance (And it will become a resistance again if silver keeps on rallying)

I hope this helped!

Are you bullish or bearish on precious metals? Let us know in the comments! :)*

If you liked the article, consider sharing this with your friends and circles, and also spare an upvote for me,so that I get motivated to keep sharing market insights and analysis:)

Want to create an account on Hive to get some money for curation/content creation?

Feel free to get onboard!

Posted Using LeoFinance

This is a great post.

Posted Using LeoFinance

Thanks a lot for stopping by to appreciate the post! :)

Nice charts !BEER

Congratulations @beehivetrader! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Sorry, you don't have enough staked BEER in your account. You need 24 BEER in your virtual fridge to give some of your BEER to others. To view or trade BEER go to hive-engine.com