Bitcoin's market value is $1.33 trillion, yeah, sure, let's all be delusional like a 16 year old, it'd help us scale up the hype anyways.

Market Capitalization ≠ Market Value

Certainly, we've had this debate so many times, but it's far too crucial to have solid educational foundations on these things, especially for the sake of newbies coming into the space.

Matter of fact, this is frankly one of many reasons thousands are getting rekt on memecoins. There's a great deal of focused marketing on marketcap movements that lures unsuspecting traders to FOMO in.

Oh wow, $1 million marketcap, must be a gem on a trajectory to $50 million, easy 50x, sure, if you sell first. But son, look at the damn liquidity, the top holder would easily fry this shit and he wouldn't even be able to get out the full “paper value” represented by that token’s marketcap, which is manipulated by the way.

Hard to understand why? Let's look at some numbers below.

Ethereum's Liquidity vs Marketcap

As the second largest asset with significant involvement with DeFi, it's a no brainer to start with it.

Ethereum currently has a market capitalization of $298.44 billion, very impressive but there's a huge problem with it.

It's so crucial to have all market/trading activities happen on-chain, it would create a whole new way to project analysis.

But let's jump over that for now, let's focus back on the numbers first.

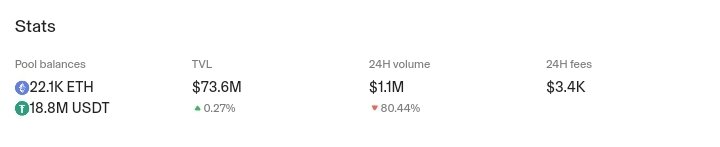

As crazy as this may sound, Ethereum only has $73.6 million as liquidity on Uniswap, on-chain. Roughly 75% of that is ETH in the pool, as noted, only $18.8 million is USDT.

If asked what ETH's on-chain market value on Uniswap is, the right answer would be $18.8 million because that's the readily available liquidity to exit the market.

Of a surety, there are numerous other pools pairing with ETH, which can be considered as liquidity sources too, now this is where we'd get to understand why having all this data on-chain is essential but first, let's look at a different data on Ethereum's liquidity.

This is from livecoinwatch.com(thanks devs).

Shocking that a $298.44 billion asset only has bid liquidity of $409.33 million?

If we add it all to Uniswap’s liquidity, we have $428.1 million, so essentially, the real market value of Ethereum's ETH is 0.144% of its marketcap at this given point.

How does that make you feel about everything you've always known?

Here's the breakdown of what exchanges dominate this liquidity.

Now, I found it weird that the liquidity value difference between ask and bid was so thin, so I decided to see what it looks like with some other asset(Hive) to determine the reliability of the data and here's what Hive's looks like:

There's some exchanges I've never heard of right here.

Clearly, the data varies across different assets, frankly I don't know how to feel about this data of Hive's liquidity, especially considering that the DHF is paying out 8.8% of the available liquidity daily and speaking of "daily payouts," the daily budget is currently larger than the liquidity on centralized exchanges.

Of course not all DHF payouts may he hitting the market but when you consider that they all bring no revenue, it becomes certainly concerning there...

And that friends, is the problem with building economies based on “paper values,” there are simply great ways to acquire debt, one could say it's the ultimate world system of finance, but how long before that system becomes a cause of a catastrophic event?

I mean, people already speculate a crash of the U.S economy which has largely ran on debts through this system, not to mention that traditional assets could be largely more illiquid.

It's important to note that when looking at liquidity data on centralized exchanges, the above includes data from various pairs, meaning that this isn't just flat ETH/USDT or HIVE/USDT liquidity data, but many other pairs like BTC and some other shitcoins.

So the real numbers can be significantly lower if measured against the liquidity of those secondary assets paired.

Now here's where a major problem is too. We can't tell what exactly goes on with these secondary pairs and exchanges, we cannot determine the individual value of paired assets, what their strengths and weaknesses are as much as we can tell for Tether(USDT), so this causes an even larger problem in being able to easily determine the real market liquidity that could accommodate the maximum trade.

The over reliance on marketcaps and centralized exchanges is a major problem for crypto's economy. We need all this data on-chain to be able to easily decipher the true liquidity/market strengths of assets, projects and ecosystems.

Posted Using InLeo Alpha