Swamp!

Here we go again! Now we are going to farm Banana in the Swamp! I kid you not! No matter how ridiculous this sound, I promise you it is true. In additional to that, Swamp has a bit of a twist, which none of the other farms that I described recently has.

Swampy (SWAMP) is a governance token native to the Swamp.finance ecosystem. Swamp.finance is a yield optimizer hosted on Binance Smart Chain (BSC). Swampy token’s utility is for participation in voting on SwampDAO proposals. As an incentive to deposit their assets in Swamp.finance vaults users are getting a bonus yield in Swampy.

Swamp.finance is a yield optimizer, which enables yield aggregation for holders and users of SWAMP token. To facilitate automation of the yield farming and the process of compounding, Swamp.finance uses vaults. Vaults also enable a more efficient utilization of gas, as well as other automated processes, and use different yield strategies to help users grow their assets through automation. Swamp.finance has an optimal compounding strategy with an efficient pricing model, designed to encourage long-term yield farming and provide appropriate incentives for long-term holders.

In simple terms, this is a option, if you hold other selected LP token. You can put them in the Swamp, and get return in 2 ways.

- You will get Swamp token (currently printing $200 almost!)

- You will also get your staked LP token that you have put in the vault. So the number of LP token you held, will increase.

This tool also auto-claims at an optimized interval and you do not have to do anything. If you are like me, and if you have money in various pool, going to each pool and claiming daily gets old rather quickly. They are all mostly the same anyways. Swamp Finance allows you to automate that and gives you a better return in the process.

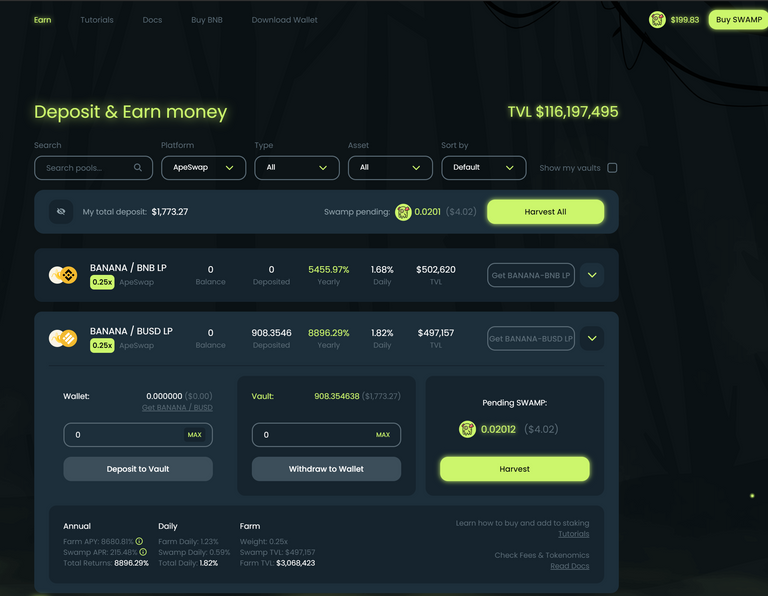

Example from ApeSwap

Recently, I put in some money at the Banana Farm of ApeSwap. Its Banana-BUSD pool currently pays 13.18 Banana tokens/$1000/day. That equates to about 1.07%/day. The same Banana-BUSD LP token, if I put in at the vault at Swamp Finance, I get 1.82%/day. If you say 0.75%/day difference is small, think again. It compounds to 8896%/yr, compared to 4706%/yr, if I just kept in at ApeSwap. So the long term compounding effects are phenomenal, so is the 'set-it and forget-it' feature. Because, if you choose not to, you don't have to log-in to Swamp Finance everyday. You don't have to harvest your tokens.

Chart

Price is through the roof for Swamp. $116M is substantial TVL, so there is little fear of a 'rug-pull'. Price is very volatile though, but for a new project it stands a bit apart with a innovative product, so personally speaking I do not have any problem dealing with the price volatility.

https://goswapp-bsc.web.app/0xc5A49b4CBe004b6FD55B30Ba1dE6AC360FF9765d

The above chart tool is quite good, the usual tradingview affair, I am just fine with that personally.

Comparing Yield between for TOKEN/BUSD Farms

I decided, I will keep track of the tokens I am following using this simple table. I have updated the prices and I have added the project start date to understand the maturity of the farm. Currently Comos is struggling to gain capital from the investors, but at the same time, that is also a high-risk opportunity. I have added to my Comos position at 0.80 cents. I understand that it is highly speculative, but I am willing to take the risk. This is money I can loose.

| Project | CUB | COMOS | BANANA | EGG |

|---|---|---|---|---|

| Current Price | 3.20 | 0.61 | 0.84 | 26.92 |

| Token/$1000/day | 3.53 | 42.01 | 12.85 | 0.41 |

| $Return/$1000/day | 11.29 | 25.62 | 10.79 | 11.03 |

| $TVL | 16.4 M | 1.5 M | 41.2 M | 134 M |

| Project Start Date | Mar 09, 2021 | Mar 28, 2021 | Feb 21, 2021 | Feb 11, 2021 |

Current prices and yield at the time of writing (updated at 09:00 AM CST)

Source: Project Data from Binance Yield Farms Listing

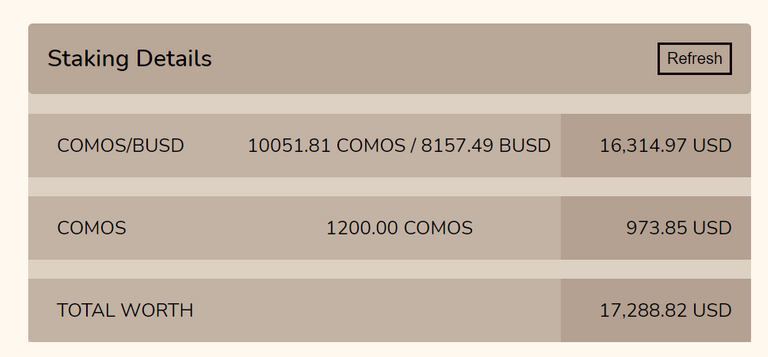

I currently have nearly 10% of the COMOS-BUSD pool, which is giving me excellent return if the project survives. I estimately, I can get my money back in about 30 days time, which is a risk-reward ratio I am willing to take.

TVL 116M, and I'm first time hearing about it :)

Lol! You are getting rusty!! :)

COMOS looks too high risk, too good to be true 😅.

They all are ;)

This is free ?

Has the BSC transaction fees, which are 10s of cents

Nice thanks bro

Dat DragonBall Doe

Okay, that settles it, I need to get some more skin in the game over on the BSC side of things!

Posted Using LeoFinance Beta

Flavor of the month, probably year.

Dada, I still am a bit unsure how they keep adding to the LP. So from apeswap you're supposed to get banana to harvest. But if you stake via swamp, you don't have to harvest. Swamp auto harvests it for you, converts half to BUSD and adds to your LP? I am trying to figure out where the extra LP tokens are coming from.

They don't explain that in detail in their doc, but I am guessing, they just optimize the harvesting precisely with a algo, and perhaps have a deal with Apeswap on fees, part of which they give back to the customer, similar to what Reazul does with Monstermarket. Again, I am guessing. There is no documentation to prove it.

What can I do to learn this trade dada?

Get a metamask wallet.

Search google for Metamask and Binance Smart Chain.

a big fan of swamp. almost all of my LPs are there auto-compounding. I wish we could also auto-compound single token swamp but they don't do that for their own token.

I am just finding out about it. I will build up my position here

Similar apps to Swamp (sorted by emrebeyler™ scoring system)

Thanks! I have about $140K in CUB, but not much in others. As Cub earns money every day, I am testing a few others. I like to control a significant portion of the pool, that way I get a substantial portion of the rewards. I know about beefy... don’t know much about the other two. But I will investigate.

This looks good to me. How can I trade this without having loss?