Has Nayib Bukele just accepted a fight he can't win? or has he made the right decisions? and how can this affect all of us?

Hello leofinance friends, I hope you are very well. Today I want to update you on a topic that may prove to have some important repercussions in the world of cryptocurrencies, of course I am referring to El salvador and its adoption of Bitcoin as legal tender in the country, and adding to this the occasional Bitcoin purchases made by the Salvadoran president nayib bukele of Bitcoins with public funds. This has undoubtedly been very controversial, with large and powerful economic groups against, and many young people and entrepreneurs around the world in favor.

But amidst all the controversy, how has the adoption of bitcoin worked out for El Salvador, has it brought benefits, or has it brought more headaches than money, we will find out by taking a look at the numbers.

But first, why wouldn't we, who don't even live in el salvador and don't have bitcoins, care about this whole thing?

When Nayib Bukele decided to make Bitcoin legal tender in his country he put El Salvador in the center of a worldwide controversy, 'Is it a good thing or a bad thing to give a greater integration in the economy of nations to Cryptocurrencies? This debate had been going on for years, as cryptocurrencies gained power as an economic actor, central banks, governments, big investment funds and all those big economic powers were not clear how to react, central banks usually repudiate them, and of course they will since cryptocurrencies take away their control over money, for them it is a struggle for power and survival, governments usually have more complex interpretations, Some see them as an opportunity to avoid regulations or sanctions, something to be monitored and regulated to prevent citizens from doing things with their money that the government does not want, or an economic opportunity which can be exploited with taxes, very few governments see cryptocurrencies as something really useful for the nation, being the government of Nayib Bukele the main one at the moment, but also second line politicians such as the mayors of New York and Miami are great proponents of the benefits of cryptocurrencies.

Some entrepreneurs see cryptocurrencies as the future of money, Elon Musk being the most famous of this group, however, organizations such as investment funds tend to reserve their opinions and wait if an opportunity to profit appears, while the brainy analysts of organizations such as the World Bank or the International Monetary Fund see cryptocurrencies as a risk.

In the middle of all this debate was placed El Salvador, which will now serve as an example of whether cryptocurrencies at the national level are something good or bad, do not be confused friends, in a few years, El Salvador will be cited as the main example of the failure or success of cryptocurrencies, if the economy of El Salvador is depressed and collapses, even if it has nothing to do with the Bitcoin, those who attack cryptocurrencies will attribute it to cryptocurrencies, and those who promote them will attribute any success to cryptocurrencies, that is what the savior is now for many people, the Petri dish where a great economic experiment is performed.

And we all know that the Bitcoin is the Champion of cryptocurrencies, it is the Bitcoin that put them on the map, it is the most valuable, and a fall in the price of it drags down all the others, including ours, that is why the issue is important for us, if the savior experiment fails, it will affect us all.

So, how is El Salvador doing?

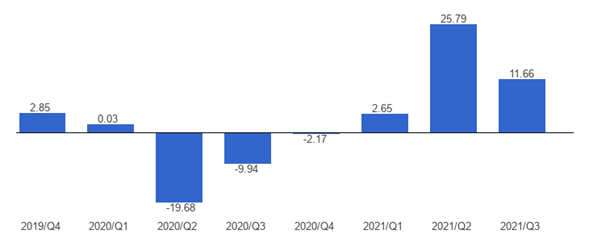

Well, well, President Nayib Bukele recently announced on the social network Twitter that his country's Gross Domestic Product grew by 10.35%. Of course El Salvador was coming from a bad streak and negative numbers in the last two years, this is obviously understandable due to the restrictions of the covid pandemic.

This graph shows the growth in percentage points, divided into quarterly periods.

How much of this can be attributed to bitcoin? Certainly only a part, since the rebound effect of the lifting of restrictions and the activation of the economy have something to do, but something is doing well in El Salvador, since economic growth is appreciable, for example, in the increase in exports recently announced by Bukele, of 13% compared to the same month last year, is part of a trend that has been steady for almost 12 months now.

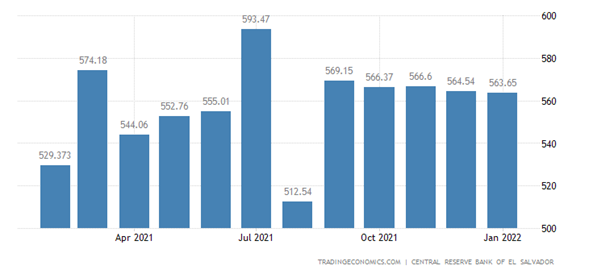

El Salvador's exports calculated in millions of dollars.

Export growth does not necessarily have to be related to Bitcoin adoption, although it is possible that some companies may decide to buy raw materials with Bitcoins. Something that is undoubtedly related to the adoption of Bitcoin is the growth of tourism. That has been more than 30% since the bitcoin law was passed, and many of these tourists come from the United States, 60% to quote official figures, these foreign tourists are good for the Salvadoran economy as they bring foreign currency and more bitcoins to the country, the tourism sector represented between 10 and 12% of the Salvadoran gross domestic product in recent years, the increase in tourism is undoubtedly something very good for the nation.

But El Salvador has problems.

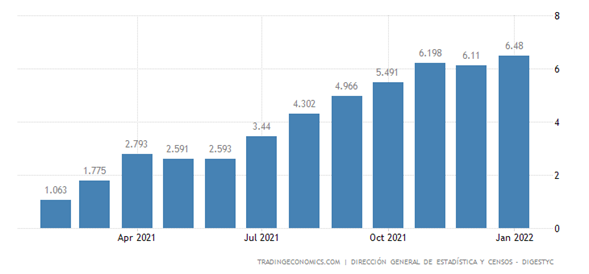

One of them is inflation, which last year closed above 6%.

This is a consequence of the expansionary monetary policy that has fueled the economic growth, this high inflation, the highest in 20 years, https://www.eleconomista.net/actualidad/El-Salvador-cierra-2021-con-la-inflacion-mas-alta-en-20-anos-20220112-0001.html

It is eating up much of the benefits of economic growth, which means that the impact on the general population of economic growth is not 10%, it is actually much less....

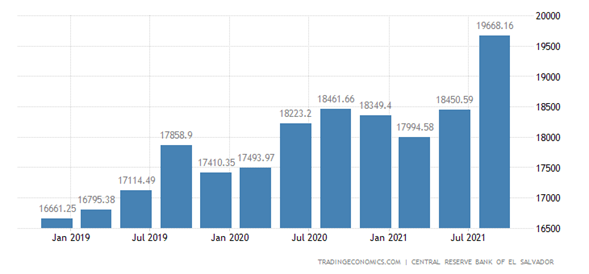

Another problem in El Salvador is the fiscal deficit, El Salvador owes money, lots and lots of money.

Here we can see the growth of El Salvador's external debt in the last few years, calculated in millions of dollars.

And international organizations such as the Fitch agency consider that by the end of 2022 the debt of El Salvador will be 1.7 trillion dollars... of course the ability to pay exists, but paying the debt would mean compromising a large part of the GDP.

Which brings us to the last part, remember I told you that there are sectors of the world economy that are enemies of cryptocurrencies?

Well, the savior is under attack.

I once told you about how the International Monetary Fund harshly criticized the Bitcoin law in El Salvador, and is using the economic aid packages as a source of pressure to coerce the Salvadoran government, and the Salvadoran government has remained unmoved. https://www.dw.com/es/fmi-insta-a-el-salvador-a-eliminar-al-bitcoin-como-moneda/a-60554030

However, recently, the United States Senate has spoken out harshly against the adoption of Bitcoin as legal tender in El Salvador, saying that it opens a window for the laundering of drug trafficking and terrorist assets, and introduced legislation to limit the impact of the adoption of Bitcoin as legal tender in El Salvador on the US economy, https://www.foreign.senate.gov/press/ranking/release/risch-menendez-cassidy-introduce-legislation-to-mitigate-risks-of-el-salvadors-adoption-of-bitcoin.

This in Christian terms translates into cutting commercial relations between El Salvador and the United States, which will undoubtedly put more pressure on the Salvadoran economy.

It is no coincidence that a week before, the Fitch agency, reduced the rating of El Salvador in its ranking from B to CCC, I say it is no coincidence because it is well known that in the US Senate there is inside trading, and many senators and congressmen have relationships with large economic powers which allows them to take advantage of sensitive information to make millionaire business, the fact that the actions of Fitch and the Senate seem to be coordinated can not be a coincidence.

The Fitch downgrade will drive foreign investment away from El Salvador, which is exactly what the country needs to solve its fiscal deficit and have a healthy economic growth that does not depend on inflationary policies.

Nayib Bukele's response to the US senate in my opinion did not help at all, not the part about telling a US senator OK Boomer... that part I loved, but the part about saying 'el salvador is not a US colony, we are not your backyard or front yard, stay out of our internal affairs, don't try to control something you can't control' https://www.euronews.com/next/2022/02/17/bitcoin-vs-boomers-el-salvador-s-president-bukele-tells-us-senators-to-stay-out-of-its-aff

That part could have been handled better, because now it sounds like the authoritarian leftist governments that have appeared in Latin America in recent times, such as those of Venezuela or Argentina, which are characterized by disastrous economic policies, expropriations and very high taxes. This similarity will only further drive away foreign investment.

As true as Bukele's words are, and as anxious as Salvadorans may be to defend the sovereignty of the nation, we all know that a frontal fight against the United States does not end well, I think Bukele should have been more astute and handled the situation with a softer and more conciliatory rhetoric.

All this gives us a mixed picture of what is happening in el salvador currently with bitcoin, although the salvadoran economy is growing, this growth is not as big as government agencies make it look, and they also face several challenges that will undoubtedly manifest themselves more strongly this year, it is also important to emphasize that el salvador does not have to fail or succeed in its experiment with cryptocurrencies, it must only appear to achieve one thing or the other, so that its influence on the price of the same is given ....

And with that friends, I close my article, I just have to ask you, what do you think about the great experiment that is being carried out in El Salvador? do you agree with a more nationalistic and independent line from the United States? or do you think that Bukele needs to balance a little? no doubt we must be aware of the great Salvadoran experiment, as this will undoubtedly have a great influence in the world of cryptocurrencies. I look forward to seeing you in the comments section. Happy evening to all and thanks for reading me.

Recommended Bibliographic Reference

[1] nayibbukele

[2] el Salvador

[3] El Salvador cierra 2021 con la inflación más alta en 20 años 20220112