After World War II rebuilding the world would require a lot of money and cooperation, both of which were made possible by the Breton Woods agreement, but the basic laws of economics operate the same everywhere.

Hello dear friends of leo finance, I hope you are all very well, today I bring you the second part of the summary of the history of Fiat coins, [coins with a representative value, not anchored to a metal or other tangible resource].

After the fall of the Nazis, and the defeat of Imperial Japan, came the real test for the new world economic system devised at Breton Woods, to rebuild Europe and Japan, so that no country could become isolated and radicalized as happened in the 1920s, 30s and 40s. In addition to offering a better alternative to the communist model.

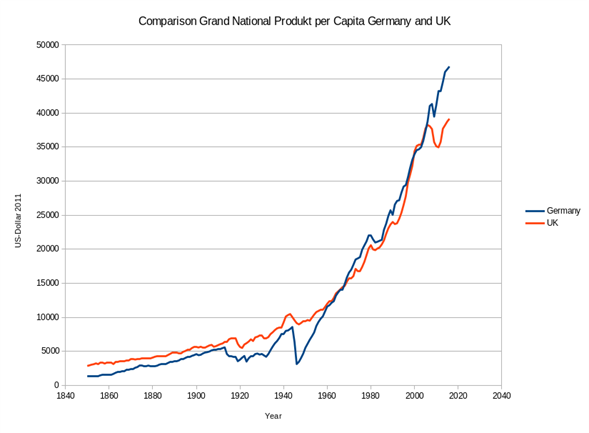

Although between 46 and 47 the new monetary policies were taking effect in Europe, although more slowly than the United States expected, in the nations hardest hit by the war, such as Germany, small pockets of unrest began to appear due to the poor economic situation, this led to the launching of the Marshall Plan by the United States, in an effort to accelerate economic recovery in Western Europe, the United States transferred some 13 billion dollars of the time, more or less some 114 billion dollars, This had a tremendous effect on the reconstruction of Europe, and soon England, France and Germany had strong industrial bases again to provide employment and quality of life for their populations.

It was the golden age of capitalism, and the united states was the undisputed leader of the free world, and despite the cold war that had already begun, with chapters such as the korean war in 1950, the united states was experiencing a bonanza that drove an explosion in the growth of the middle class, World trade without the hindrances of dealing with exchange rates from country to country, and with a reference currency that everyone trusted [dollar] brought prosperity even to nations that were left in total ruin and conquered after the war, such as Japan.

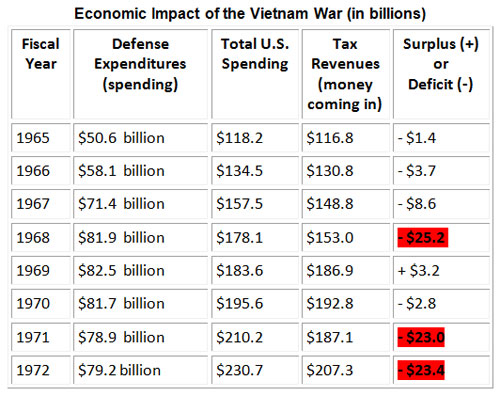

But the success of the Breton Woods plan was also beginning to reveal the shortcomings in it, as nations progressed and large economies emerged, such as Japan's, confidence in the dollar was waning, as it soon became evident that the circulating bonds, loans and paper money in the economy was greater than the gold reserves backing them, by the mid 1960's the US was running on a deficit, which put it in a risky situation, to sum it up, if everyone who had dollars decided to claim their right to convert it into gold, the gold reserves would not be enough, if all the creditors of the United States, or those who had bonds, decided to collect them, there would be no liquidity to pay them all, and with all this, the world economy continued to grow, while the gold on the market was less and less, so that the United States was already in danger of institutions deciding to convert their dollars into gold at a price of 35 dollars an ounce, sell this gold on the world market at much higher prices for dollars, repeat, and enrich themselves by bleeding the US economy...

The indebtedness of the united states can also be attributed to the cold war, conflicts such as those in Korea or Vietnam, launched to contain the advance of communism were prohibitively expensive, but as long as Washington controlled the flow of the currency of choice in the world economy there was nothing to worry about... right?

Well no, many European nations that were already developing without the need for aid saw the Breton Woods agreement as something really unfair, this due to the continuous injection of dollars by the United States to the economy to cover its deficit, without respecting the agreement to the letter, it only cost the United States a few cents to print a 100 dollar bill, in exchange for which a European country had to give the market price of 100 dollars in goods, in 1965 the independent mentality of the French led them to express their desire to leave the agreement, and convert their dollar reserves into gold.

In May 1971 West Germany decided to leave the agreement because it was required to devalue the mark to continue respecting the exchange rate to dollar fixed in the agreement, this led to the devaluation of the dollar by 7.5 percent against the mark, i.e., it showed that the mark was in fact worth more than the agreement allowed.

And from there it all went downhill for the dollar, in the midst of the Vietnam War, the U.S. Federal Reserve's worst nightmare was happening before its eyes, Switzerland demanded the exchange of its dollars for the gold the agreement said they were worth, $50 million, In August of the same year, the U.S. Congress recommended the devaluation of the dollar to prevent the U.S. economy from bleeding to death, that is, to give the countries less gold for their dollars than the amount stipulated in the agreement.

After several negotiations with other countries, and attempts to restructure the Breton Woods agreement, on August 15, 1971, Richard Nixon, president of the United States at that time, trusting the advice of a certain John Connally, decided, before the stupefied eyes of the world, to put the stability of the U.S. economy first, and to completely abandon the Breton Woods agreement, and renounce all the commitments acquired in it.

I believe that many economists around the globe would react like this.

In addition to the freezing of domestic prices and wages in the United States, and 10 percent tariffs on imports [these were a slap in the face of emerging economies that exported to the United States, such as Japan] the Nixon Shock now left everyone with only paper in their hands, no one could exchange them for gold anymore.

But that didn't mean that the dollar lost value, it still had value, the value that people gave it as the best tool for international trade, and the gateway to the world's largest economy, the U.S. economy.

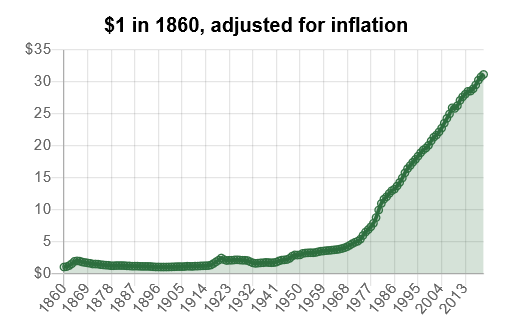

But this also meant that now the United States could print as many dollars as it wanted to pay its debts and stabilize its economy, turning the dollar into what we call a Fiat Currency, a currency that can be created out of thin air and with whatever value the people decide to give it.

The first recorded Fiat currencies were born in the 11th century in China, and although historically they have been a tool that has facilitated trade, in the vast majority of cases they suffer from the evil of inflation, because governments never seem to be able to control their spending, once they have unlimited resources, governments want to give free rein to unlimited growth, power has always been an end, not a means?

And just as it happened to the Chinese in the Middle Ages, it also happened to the United States, for example, this image.

Note that since the implementation of the Bretton Woods policies, the inflation of the dollar increased slightly, but this can be attributed to several consequences, what is obvious is that since Nixon's decision in the early 70's, the dollar has had an inflation of more than 3500%...

But this did not cause the US economy to collapse, as long as the world continued to want dollars, they could print as many as they needed, even using it as a pressure tool, to close access to dollars to a country is to suffocate it in the modern globalized economy.

At this point the Breton Woods agreement was dead, and exchange rates were floating again, speculation in what would one day be called FOREX started, and the dollar was losing value rapidly, some countries, Japan, tried to buy dollars to stabilize it but there was no long term solution, Europeans could not continue living with the uncertainty of the dollar value, they did not know when another Nixon would screw them all, so they started talking about creating their own currency, that would derive years later in the creation of the Euro.

The loss of confidence in the US economy generated a domino effect that led to the financial crash of 1973/74, the worst since the Great Depression, after the energy crisis of the late 70s, strict financial policies aimed at controlling inflation in the US led to another financial crisis in the early 80s. Inflation coupled with soaring oil prices led to another financial crash in the early 1990s. Leaving the Bretton Woods agreement seems to have thrown the world of finance into chaos... but the worst is yet to come.

Recommended Bibliographic Reference

[1] list of recessions in the united states

[2] fiat money

[3] Nixon shock

[5] marshall plan

Congratulations @anyelina93!

You raised your level and are now a Minnow!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!

Your level lowered and you are now a Red Fish!

Check out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!