Exactly a month and five days ago I gave you an inside peek on what has definitely been my best investment so far. Now don't be fooled, even though I am not part of the core team I am still somewhat involved since the beginning and I am taking the time to tell you all about this project with the information I have at hand, both thanks to doing my own research - something you should always do, this is not financial advice, always DYOR - and also using visual material from the Telegram group and from the Morphswap website.

Disclaimer: I am heavily invested on this project, I actually own a big chunk percentage wise of the circulating supply, but the flipside is that due to personal reasons I won't sell until I am set for life, and when that happens my stack won't make a dent to the market cap and the token price.

Morphswap

The world’s first and only decentralized cross-chain AMM

Centralized exchanges are easy to use and offer an entry gateway for crypto rookies, but when you've been in crypto for a while you realize that using a CEX has a lot of cons like custody - not your keys not your crypto -, security - hackers target CEXes all the time and you depend on the project devs being god tier -, and manipulation - like insider trading, fake volume, and price manipulation.

Decentralized exchanges are a thing since DeFi made a loud entrance a few years ago, and even though there's a lot of FUD around them from the maxis and crypto trads, DEXes are slowly becoming the norm, especially after fucked up events like the one we just saw this week with FTX.

DEXes use bridges to send tokens from one blockchain to another, this allows a user that is holding a token in let's say, the Ethereum blockchain, to hold those same tokens as a wrapped version - or the equivalent on another chain, depends on what token we are talking about - and all you need to do is use a bridge out of the tens if not hundreds of options we have in the crypto space.

The existence of bridges and wrapped tokens has allowed users to not be chained to a specific chain even if they are holding a token that only exists in a specific blockchain, all they need to do is wrap the woken and send it to their wallet address by paying a fee. The fee amount depends on the amount and the native blockchain you are sending the tokens from.

But wait, isn't one of the crypto foundations to get rid of the middle man and to avoid fees and all that banking nonsense?

Well, in a way DeFi provides the scenario where we do pay fees, but we don't pay them to the man but to the people, because the fees are distributed among the users who provide the needed liquidity to allow these trades.

This is where Morphswap comes into play

Morphswap kills the bridge concept entirely.

The way a Liquidity Pool works, very simply and roughly is as follows:

A crypto project establishes some set Liquidity Pools on top of a specific blockchain, using their own protocol and smart contracts they allow users to pool two predetermined assets and allow users to swap these two tokens, thus giving liquidity to their native token or other tokens that are in high demand, offering yield to those who deposit their assets in the Liquidity Pool.

It's all about the users - and a small chunk for the project, but this model definitely takes care of the users in a better way than TradFi and CEXes.

The problem is, these pools are based on only one blockchain, and even though there are projects like Thorchain that allow users to bridge some tokens, the truth is, Morphswap can easily kill Thorchain any moment now, all the project needs is some marketing and promotion to let users the Sushiswap, Uniswap, Thorchain and pretty much any other non-niche bridge (like Polycub and Cub, which imo are safe from the Morphswap expansion due to their Hive niche nature).

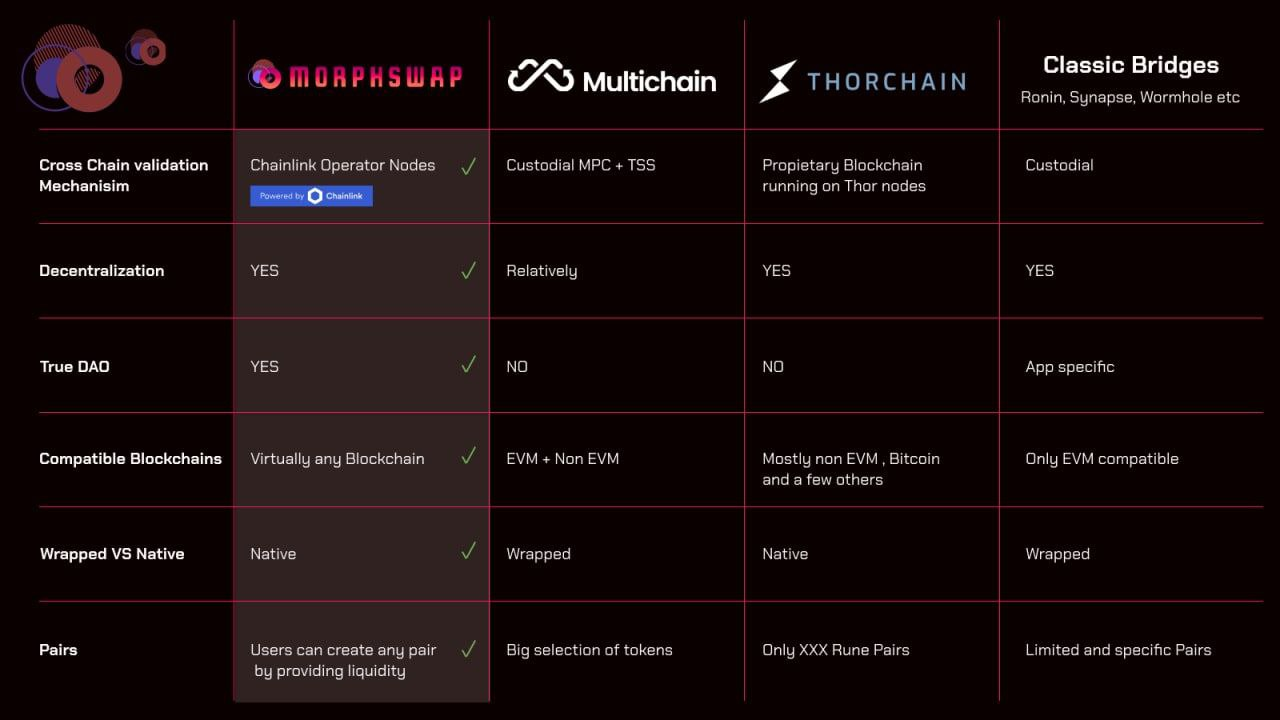

I mean, just look at this image:

One of the most important aspects of a project is the founder. A good founder can take a project to the moon, which is one of the reasons I am a top5 Leo holder, because I trust @khaleelkazi. A great team can bring a project with meh tokenomics towards success, but a great team with tokenomics such as those Morphswap has will definitely bring MS to god tier levels.

The community is kickass and is heavily showing diamond hands during these shaky times, so much to the point where my portfolio is still in the one week green thanks to MS, even after the FTX situation where all the coins are down double digits.

I seriously recommend you DYOR on Morphswap

All I can say is there is a lot going on in the back and the team has a lot planned for these next two months.

And well, you might want to get in early right now that the price is still small enough to allow you to stack a couple hundred thousand tokens.

It might be too late in a month or two when all the whales hear about this project and the token will no longer be so easy to acquire.

To finish this post I'll just drop some pics from the Telegram group and get you somewhat hyped.

In the meantime, go visit [Morphswap.io

|  |

|---|---|

|  |

All aboard the Morphtram, the train to 100M Market Cap is leaving

Posted Using LeoFinance Beta

What's the play here, grab their native token?

Posted Using LeoFinance Beta

Yeah, grab their native MS on polygon or BSC. Also pooling assets from any of the 10 supported chains and mine MS. The utility is big and they are adding the BTC blockchain to their protocol, meaning you'll be able to swap tokens from btc to polygon, bsc, avax, ftm and the other main ones without bridging. No bridges to swap virtually any token in the supported chains = high adoption potential.

The “Pairs” part is interesting”…users can create any pair by providing liquidity. That’s cool stuff. I wonder how the security works

Posted Using LeoFinance Beta

You should join the telegram mate!

Posted Using LeoFinance Beta

morphswap is dope

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the people( @successforall ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

whoa a million dollar wallet isnt enough? sheesh , I need those problems in life :)

Posted Using LeoFinance Beta

Went to check this out, swapping 1 eth from BSC to mainnet ETH would lose you over 200usd, guess that the liquidity is not there?

Posted Using LeoFinance Beta

There is 500k USD in liquidity in total, perhaps the pool you used has not depth, but there are definitely other pools that work wonders. At first I would provide liquidity and maybe buy a bit of the token. If you are looking to help the project grow that's a good way to do it or you can even create your own pool, until the pools have a lot of liquidity it will be hard to swap big amounts.

Posted Using LeoFinance Beta