The mass adoption of crypto currencies has been a hot topic lately. Many in The Cryptoverse wait with bated breath in anticipation of the prophesized Bitcoin Exchange Traded Fund (ETF) as a milestone in the institutional adoption of Bitcoin (BTC). There has been not inconsiderable talk of a true BTC ETF as marking the “blow off” top to this current bull cycle. But as Aesop cautioned us millennia ago; “be careful for what you wish.”

It appears there is a touch of cognitive dissonance in the crypto community. On one hand we bash and excoriate traditional finance (TradFi) and all the predatory manipulation of the wealthy elite; then on the other hand the crypto community desperately wants the validation of the TradFi industry. The deluge of fiat that would flow into The Cryptoverse with mass institutional adoption would indeed send many to the moon however, long term will crypto lose its soul? In this Faustian bargain the crypto community would be subjected to the corruption, shenanigans, and manipulations all too pervasive in the world of traditional finance.

The one lesson that all revolutionaries inevitably learn is that of co-option. Anything that threatens The Order that cannot be snuffed out will have to be incorporated into the matrix to neutralize the threat. Eventually packaged and sold as a T-shirt. As crypto becomes a destabilizing disruption to the institutions of TradFi they will employ every lever in their power to tame the beast and bend it to their will. The aspects of crypto that enhance and strengthen TradFi will be co-opted, and those sectors that threaten The Order will be either regulated into dust or made illegal by the states at their service.

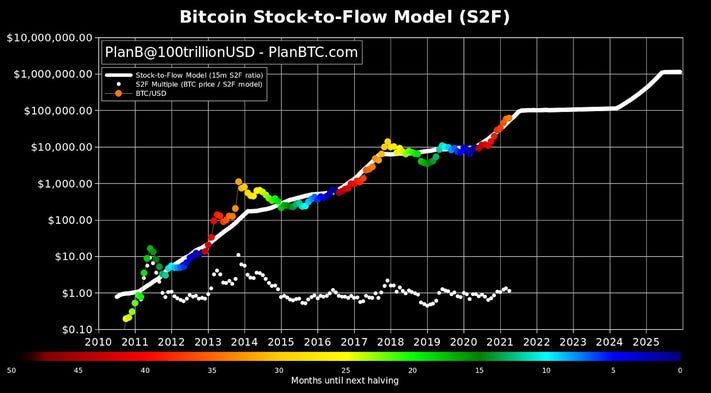

Let’s take a look at the gold market as an example of how crypto can be put under the boot of TradFi. In fact, many now consider Bitcoin to be Gold 2.0, and in some respects, there is a grain of truth to this reality. BTC is treated (currently) as a commodity and the premier store of wealth in The Cryptoverse. These characteristics of Bitcoin are why the fabled stock to flow model has been quite successful so far in predicting BTC price. If it perseveres then BTC will hodl six figure valuations very soon.

The gold market is manipulated, and the price is suppressed by the big institutions in the market. One mechanism that this happens through is “paper” gold and rehypothecation. The former refers to the fact that much of the gold in the market is traded as numbers on “paper” and not in reality. This is possible because unlike Bitcoin the true supply of gold is unknown and fluctuates due to multiple factors. A cursory examination of the expert opinions of how much gold there is in the world are subject to wildly diverging numbers.

Currently there is more paper gold in circulation than physical gold held in bullion reserves. Due to this overabundance of paper gold basic supply and demand dictates a lower price than the current supply should dictate. Additionally, if all bets were called in then some holders of the paper would be without their gold. Could this be the case for Bitcoin as the big players begin to absorb the Cryptoverse into their murky swamp of incestuous connections.

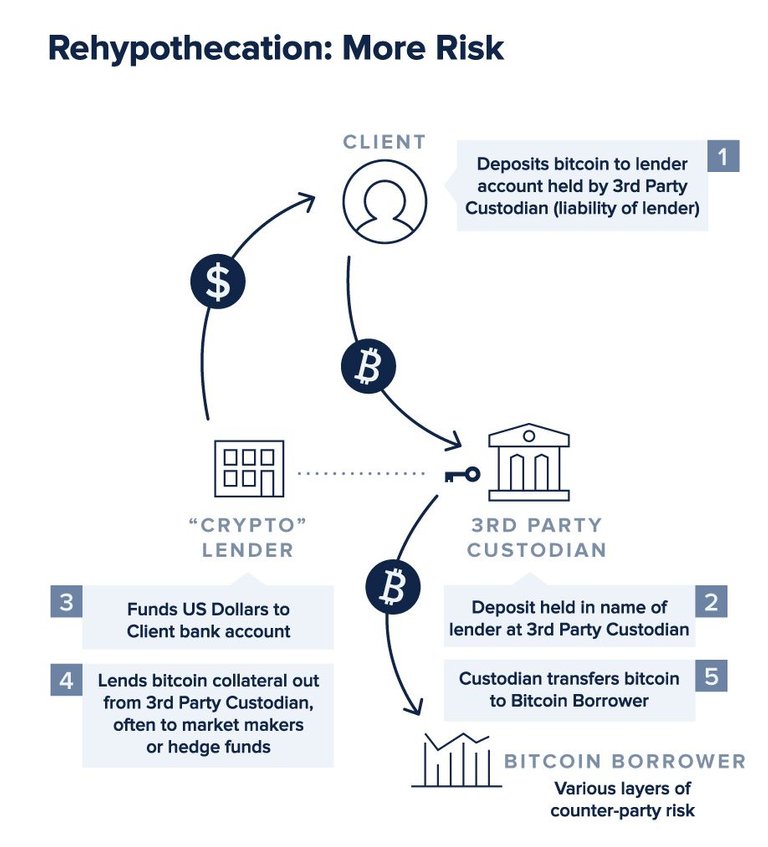

For the purpose of clarity this article will refer to the BTC ETF as a pure exchange traded fund where the fund must be backed by the physical asset and not a futures ETF where the BTC does not have to be custodied. As institutions dabble in Bitcoin custody; as in the case of an ETF; then there is an opportunity for these institutions to loan out their crypto assets as collateral in a process called rehypothecation. This is a common practice that forms a tangled web in TradFi and was one of the causes of the “contagion” in the great financial crisis of 2008.

Rehypothecation is a normal part of TradFi but it is less common in the Crypto market. There are some questions around how centralized exchanges use stable coins, transfer, and loan them to eachother to maintain liquidity in the market. But straight up old school rehypothecation is rarer. As institutions get more involved in the Cryptoverse this could be much more common. Lending and leveraging of crypto assets won't be the purview of your average DeFi Degen any longer.

One glaring issue with rehypothecation and custody is what happens when one of these funds fails. Funds and assets can be locked up for years as the institution is unwound, many investors could get pennies on the dollar if the fund’s positions were over leveraged and rehypothecated. Any crypto that is locked up with a custodian that collapses could be irretrievably lost.

Knowledge is power and it’s best for all that we in the cryptoverse are educated as to these TradFi manipulations. The promise of crypto is that we can become our own banks and escape the world of traditional finance. Always custody your own crypto, not your keys, not your coins!

TIME is the most valuable coin and thank you for spending yours reading my post. I hope you have a wonderful day.

>>> Anarchiss <<<

Posted on my Publish0x blog as well.