Happy New Year!

For much of 2024, I published a monthly Web3 social media earnings report. It listed the Web3 social media platforms I played around on for that month and how much I earned on those. I stopped publishing that report two or three months ago. Now, it’s New Year’s Day 2025 and I thought I’d start the new year with a report on my earnings for the full year.

I began my Web3 social media journey in 2018 when I discovered Steemit, the precursor to my current favorite platform—Hive (which I’ll discuss in a few paragraphs).

After playing around on a few platforms, which, at the time, were popping up left and right, I wrote a book on the subject. I found a publisher, Business Expert Press, and kicked out ++Cryptosocial: How Cryptocurrencies Are Changing Social Media++. A year later, I revised the book, updated the platform list, added some chapters, and republished the book focusing on the needs of creators. The result was ++Web3 Social: How Creators Are Changing Social Media (And You Can Too!)++.

Over the years, I’ve narrowed my list of preferred platforms. I still play on those and have abandoned most of the rest. Here’s how my publishing efforts panned out in 2024.

2024 Web3 Social Media Earnings

Let’s not dilly-dally. You’ve got your introduction. Now, I’d like to share how I did on each of the platforms I played around on last year and how much I earned during the year on all platforms cumulatively.

gFam (XRP)

++gFam++ was an interesting experiment. I played on this platform for a couple of years and stopped a few months ago. My last real month of earnings was in October 2024. My best month in 2024 was January when I earned 5.994 XRP.

I’ll always sing the praises of gFam for one reason: In my first full year on the platform (2022), I earned $300 in XRP. In 2023, I purchased slightly more than $300 more in XRP. Since then, my XRP holdings have increased to more than $2,000, and I’ve extracted my $300 investment plus some. That’s quite a return.

In 2024, my XRP earnings from gFam were slightly more than $25.

Hive (HIVE/HBD)

After exploring Web3 social media platforms of various types since 2018, ++Hive++ is still my favorite. It’s simple, earns me respectable earnings, and I don’t see it going anywhere.

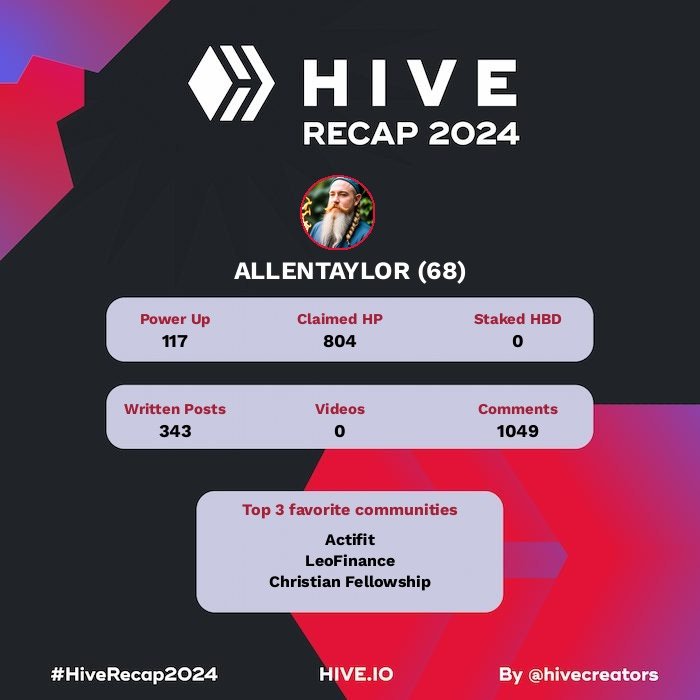

In 2024, I earned 901.118 Hive Power (HP) on the platform, 193.090 Hive-Backed Dollars (HBD), and 164.381 HBD in savings through my HBD Savings Account. These numbers translate into $246.04 USD, $198.02 USD, and $167.39 USD, respectively. I’m confident I could be doing even better.

Why do I say that?

A quick look at my Hive wallet reveals that I have almost $3,000 HP in my account and just under $1,000 HBD in my savings account. Never mind the reason for this split. HBD is a stablecoin and maintains a close connection in value to the USD. HP, on the other hand, fluctuates in value based on market dynamics. Currently, it’s valued at ++approximately 35 cents++. If I took half of my HBD savings and converted it to HP, given that I didn’t change my posting and commenting activity, I would earn more HP. Since my HP earnings were higher in 2024 than my HBD savings earnings, that conversion would earn me higher rewards as long as the value of HP doesn’t plummet. All things remaining the same, my HP earnings would be more.

Of course, I like to maintain a healthy reserve of stablecoin as a hedge against the fluctuating value of volatile assets. That’s just the way I roll.

Bottom line: My earnings on Hive in 2024 were quite significant … $611.47 USD, the lion’s share of my total earnings of $675.29 from all platforms. And I haven’t even discussed the 70+ Layer-2 tokens I hold, a total value of $60.82 USD. Now you see why it’s my favorite platform.

Paragraph (MATIC/POL)

In 2024, I migrated the two Substack newsletters I was publishing to ++Paragraph++ and consolidated them. I did this to test the platform and determine whether it was a long-term play for me. It turns out it wasn’t. Never mind the reasons why.

Paragraph allowed me to publish my content as non-fungible tokens (NFTs) and sell them. The last month I earned anything on the platform was May 2024. I left the platform in October 2024.

My total 2024 earnings on Paragraph were 21 MATIC (POL). That translates into $18.37 USD.

Publish0x (ETH/OP)

For several reasons, I like ++Publish0x++. Nevertheless, I decided to leave the platform in October after a presence spanning several years. I earned some Ethereum (ETH) and Optimism (OP).

My ETH earnings on Publish0x in 2024 amounted to 0.003 ETH, a USD equivalent of $8.79. My OP earnings were 2.592, a USD equivalent of $7.02. My total USD earnings on Publish0x last year were $15.82.

Not bad, but not great. Of the four platforms mentioned thus far, it ranks fourth.

Readl (MATIC/POL)

++Readl++ is a platform that allows me to sell e-books as NFTs. I earned on the platform one month last year. My total earnings for the year were $0.51.

Torum (XTM)

I earned about $20 on ++Torum++ in three years. I tried to take those earnings off the platform yesterday and hit a roadblock. If I never get them, I won’t consider a great loss.

Torum is a pretty platform. It has many active members. However, they have completely done away with the ability to earn XTM on the platform. I’m not sure where they’re going to go next. My earnings last year amounted to $3.12.

Presearch (PRE)

++Presearch++ isn’t social media. It’s a search engine. But I still report my earnings anyway.

The search engine allows me to earn PRE by conducting searches for information, something I’m going to do as a writer anyway. The search results are pulled from Google.

I don’t earn much on Presearch, but I continue to use it because I’m almost at the $1,000 PRE threshold, which will open up opportunities for me. I may end up buying some PRE so I can get there faster. In 2024, my earnings were a USD equivalent of $0.46.

Hive Layer 2 and Total 2024 Earnings

Allow me to discuss Hive’s Layer-2 solution, ++Hive-Engine++.

Hive-Engine is a smart contracts platform on the Hive blockchain. Anyone can create a token on the platform, sell it, give it away, use it in addition to the Hive Rewards Pool, and more. Without doing anything extra, I’ve accumulated 71 tokens with a cumulative USD value of $60.826. More than two-thirds of that value is in LEO tokens, which I earn by posting to the Hive blockchain through the ++InLeo community interface++.

Because Hive is decentralized, one can post to the blockchain using various front ends. If one of those goes kaput, your content will remain visible on the blockchain through the other front ends. That’s incredible value!

My favorite front ends for posting are InLeo, Actifit, and ++Ecency++.

As of today, I have 705.349 LEO staked on the Hive blockchain, a value of $41.833. I also have 4442.421 Ecency Points, which aren’t tokens so much as points that I accumulate by using the Ecency dapp (decentralized application) and delegating Hive to the community. I can then use those points to boost my posts to help them earn more HIVE, LEO, and other Layer-2 tokens.

++Actifit++ is an activity counting dapp on the Hive blockchain that allows me to earn AFIT tokens for walking and performing other menial tasks throughout the day. At the end of each day that I earn more than 5,000 AFIT tokens, I post my activity to the blockchain and earn HIVE and other Layer-2 tokens. I currently have more than 11,000 AFIT.

I don’t generally track the accumulated value of my Layer-2 tokens from month to month because the value is so small. The $60+ in value currently held in those tokens is based on three years of activity. Still, it’s nice to know the value is there.

My total earnings for 2024 on all platforms comes to $675.29 USD. That’s not bad income for doing something I would be doing anyway.

Do you want to learn more about Web3 social media? Check out my book ++Web3 Social++ and learn how you can own your account, monetize your content, and protect your intellectual property from Day One.

Posted Using InLeo Alpha

Suprised you did not heard of Grill - https://grillapp.net/17118?ref=12940 on Polkadot!

Now I have. I can add it to my list.

Thanks for this - it's useful to get an idea of how different platforms stack up.

So many of them require an initial investment or ongoing funding to be able to post or vote, which puts me off if I'm then not going to earn anything through it. Hive does it through Resource Credits, and legacy social media does it by selling your details to advertisers, so it feels a bit rough taking a punt on an unknown platform and having to pay to find out if it's going to work. Your post helps save the time and money involved in doing that !

Cool. I'm glad you see the benefit. I agree that pay-to-play schemes have a built in obstacle to overcome. Who wants to "buy in" without any idea of the potential return when there are so many other options?

Thanks for playing with gFam for as long as you did Allen!

You're welcome. Thanks for the invite.