You may not have noticed or paid attention yet, but there is a transformation taking place around you and it concerns the way the financial system will function in the years to come. Loans, investments, insurance, passive income and more are being rethought and recreated by communities and developers around the world who are dedicated to innovating and providing new ways for people to relate to money.

Freer environments, with more alternatives, where reliance on intermediaries is no longer needed. In the coming years, conventional finance will find a powerful alternative that can return control of money to its holders.

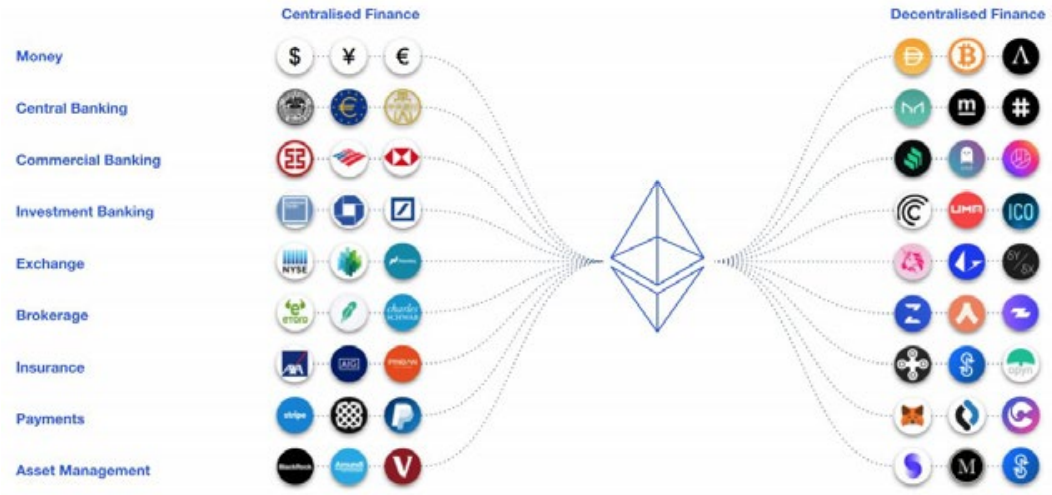

Ethereum's blockchain is the platform where the construction of these experiments is taking place, which in essence has the same function as traditional financial products, which is to bring surplus agents closer to deficit agents, but with much more possibilities and with valuable resources for decentralization and transparency , whose need for trust in intermediaries is removed, giving way to a non-permissioned infrastructure (permission-less), where everyone has access, just connect a wallet, such as Metamask for example.

This revolution is called Decentralized Finance (Open Finance / Decentralized Finance / DeFI) and is enabling the creation of the digital age financial system, which works horizontally and where there will be a multitude of new products and services, where users will have the freedom to choose between the many alternatives that already exist in this ecosystem and the many others that are yet to emerge.

Explaining in a simple way, through decentralized finance, you can do things like loans, transfers, trading, get insurance and more, but in a decentralized way, without having to ask for permission or wait for someone's approval.

Have you ever wondered if your money was smart and could apply to higher interest rates? How about a lossless lottery, where you always get your starting money back? Perhaps you would like to receive your salary daily instead of monthly or else have access to lines of credit with lower rates. Well, for the first time in human history, this is already possible, thanks to open networks linked to cryptography and economic incentives.

In a world where many people don't even have documents, let alone access to bank accounts and financial services, it's hard to imagine how much the impact that decentralized finance will have on the financial market means.

THE PROBLEM OF CONFIDENCE

Although the economy and society are based on trust, it is not perfect, because humans and their institutions fail and these failures can cause systemic risks and generate distortions in many ways.

When confidence assumptions are reduced, systemic risk is reduced and a more productive and healthy environment is created, in which transactions are transparent and the free market is encouraged, operating in a more just and efficient manner.

Changes of this level occur few times in the history of mankind and that is why it is necessary to be attentive to be able to take advantage of the opportunities that are already out there.

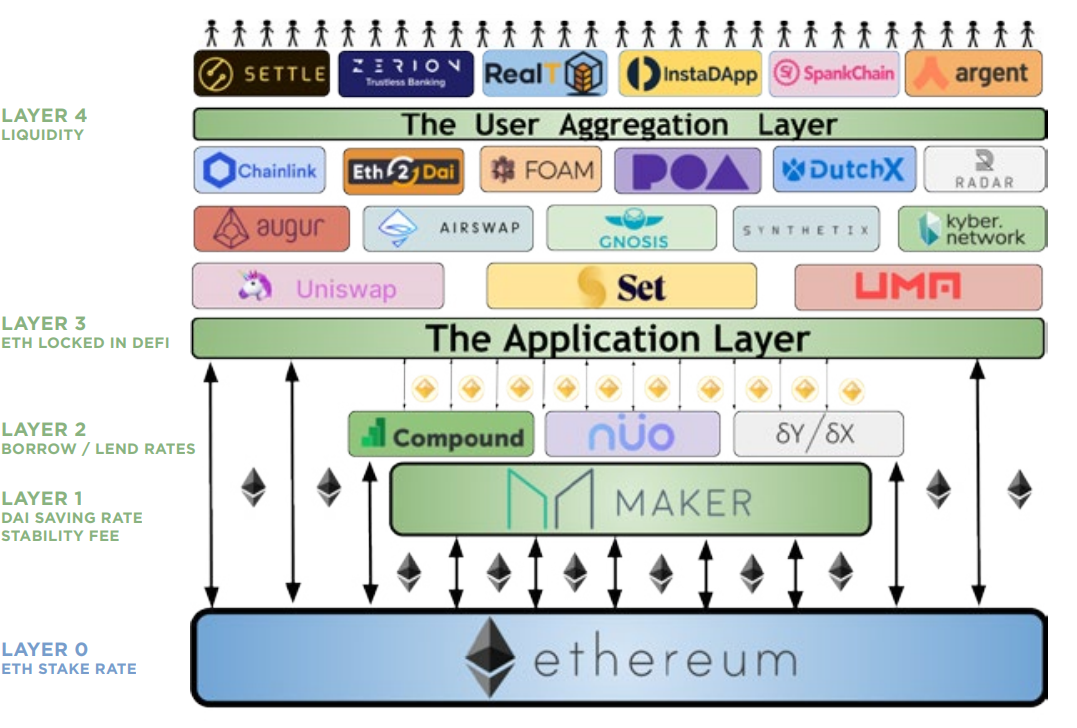

MONEY LEGOS

This name refers to the famous toy that was part of many people's childhood, Lego, with which it is possible to make different combinations by integrating the pieces together.

If you played with legos, you know that the same parts that were a bus can be used to assemble a spaceship. Or the same pieces that used to be a closet can become a home. Finally, each piece can be connected to the next, be separated, finally used in infinite ways.

In DeFi, the Money Legos concept applies as follows:

The projects are designed not only to be used in isolation, but also to be easily integrated and compatible with other products, which can thus benefit from its functionality. This makes it possible for protocols to be organized in various combinations, allowing the creation of an apparently infinite number of decentralized products and services, without the need for trust, open to all and managed by code - even software - to serve a specific purpose.

INSTEAD OF STARTING A ZERO PRODUCT

IT IS POSSIBLE TO BUILD PROJECTS THAT WORK IN CONJUNCTION WITH OTHERS ALREADY EXISTING.

ETHEREUM IS THE LEGO MONEY PLATFORM, WHERE IT IS POSSIBLE TO COMBINE THE PARTS THAT ARE PART OF THE ECOSYSTEM AND BUILD A WORLD OF FINANCIAL APPLICATIONS AND SOLUTIONS.

Example of how an operation works using the Money Lego concept. You can:

- Take out a DAI loan at Compound.

- Divide this Dai into two even values.

- Put half in Oasis and generate 8% interest.

- Put the half in a levered position for ETH on the DeFi Zap.

- Withdraw funds from both at a certain ETH price level.

- Repay the loan and interest to Compound.

- Maintain the remaining balance obtained from the leveraged position (assuming that the price of ETH went up).

MakerDAO is one of the decentralized finance protocols and one of the pieces of money legos. Through Dai, one of the parts of this ecosystem, it is possible to have access to services that would be possible only through a bank or other authorized financial institution.

In developing a personalized smart contract, MakerDAO accepts ETH as collateral for loans at Dai. In doing so, users can withdraw funds borrowed in the form of Dai, without selling Ether, allowing them to maintain exposure to the ETH price while using Dai.

ANOTHER EXAMPLE:

- You can deposit Ether (ETH) in MakerDAO.

- Receive the Dai stablecoin (DAI).

- Lend it on Compound to a borrower credit card and earn the governance token of the network, the COMP.

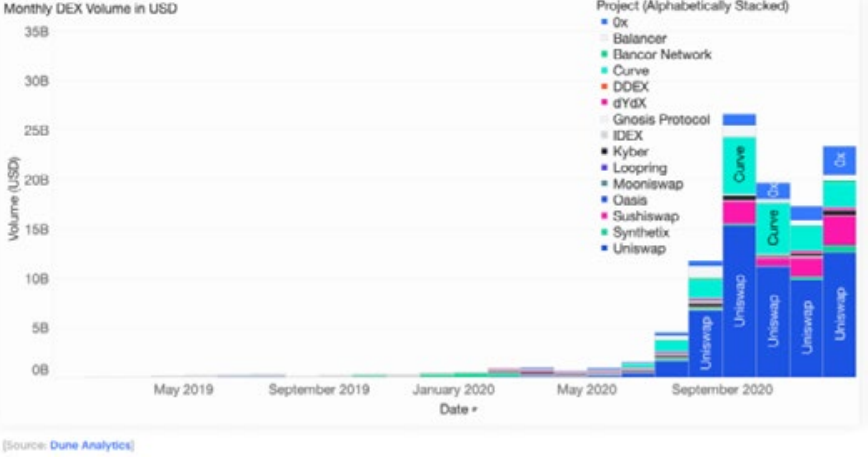

These are just a few examples of how legos work by connecting to each other. Within the decentralized finance ecosystem there are still DEXs, decentralized exchanges that have attracted an increasing volume, the main protocol being Uniswap (UNI). Protocols for portfolio management, such as Balancer (BAL) and platforms for the creation and trading of derivatives of various assets and indices, such as Synthetix (SNX).

In 2020, the volume traded at Dexs broke records. Dexs simplify, reduce bureaucracy and give more privacy when purchasing tokens.

RISKS

As it is a new and experimental environment, it is clear that there are numerous risks. Among them the financial, security, bugs and hacks risk. For this reason, as in any market, it is important to be careful with exposure, protecting capital and managing risks.

There is also no way to avoid friction in relation to regulatory compliance. The financial market is an industry that has existed for many years and will try to resist changes that could alter its structure.

Remember that many of the technologies that exist today have also experienced moments of distrust and resistance.

It is the normal adoption cycle. Innovation is launched, then discredited, they are improved and after some time, if they prove to have value, they gain adoption. Risks tend to decrease as adoption increases and more corrections are implemented.

Sensational example of how similar products from the traditional market can be replicated using the concept of Open Finance through the DeFi protocols.

Fiat currency x Bitcoin and Dai

Exchange NYSE (New York Stock Exhange) x Uniswap

Just as the proliferation of capital markets over the past 100 years has enabled surprising levels of wealth creation, decentralized finance will make capital markets more efficient and accessible to everyone. By making stocks, bonds, real estate, currencies interoperable and programmable on blockchain, capital markets will become more accessible and efficient.

On the Ethescan website, it is possible to explore information from the various decentralized applications, including the DeFi protocols. It is possible to check the number of token holders, audit contracts and much more, proving that this market is really transparent and open to everyone.

As we have seen, there are hundreds of projects, each with its own unique applications and infrastructure, with which to combine its functionalities, giving rise to new financial products.

This is a new way of using money, and we are in the first days of an experiment that tends to attract more and more users who are looking for new alternatives, in addition to those already existing in the traditional financial market.

What happened last week reflects a little of the changes that the financial market will face in the coming years.

A group of investors (individuals) came together to buy GameStop shares after verifying that billionaire hedge funds were trading in the stock, which caused a short squeeze, leading to these funds a billionaire loss never before seen.

CURIOSITY AND CAPITAL PRESERVATION

Anyone who is willing to participate in this new world of decentralized finance and develop the balance between these two characteristics, will be able to discover and advance through something that has the potential to cause a revolution in the financial market and in the way people relate. with the money.

Bitcoin started this big change in the financial market. For the first time in human history, we can choose decentralized financial services, which will give us more freedom and better chances to protect our hard-earned capital.

Every day the arsenal of pieces for the construction of this Money Legos is growing and the community is growing exponentially.

WELCOME TO THE FUTURE!

Posted Using LeoFinance Beta

Amazing post, very well said, the opportunities to use our knowledge and gaming skills is vast.

Posted Using LeoFinance Beta

I'm glado that you like my post

Thanks a lot

Posted Using LeoFinance Beta

Amazing post bro.

Posted Using LeoFinance Beta

I'm glad that you like it

Posted Using LeoFinance Beta

DEFI the best

Posted Using LeoFinance Beta

This...

Exactly!

Posted Using LeoFinance Beta

This is important...

Posted Using LeoFinance Beta

Indeed...

We are truly entering a different age.

Posted Using LeoFinance Beta