During the past few weeks, the traditional market has shown some signs of stress due to the American interest rate curve, in particular the 10-year treasury yield (as the US Treasury bills are called).

These securities showed an increase in their rates and caused some moments of volatility, leading to a drop in stock indexes and gold, assets that do not benefit from the increase in interest rates.

The market appears to be pricing a strong economic recovery that would be accompanied by inflation, when the economy resumes traction. Despite the Fed's claim that interest rates will remain low for a long time, market players seem to doubt this, seeing in the future an increase in interest rates to fight inflation.

But why is the US interest rate so important?

As the main world economy, US debt securities, especially long-term bonds (treasury bonds) are considered the safest securities in the world and used as a risk-free rate benchmark.

Cascade effect

A sudden increase in the interest rate would make the cost of borrowing more expensive, raising the cost of corporate debt as well as US debt, in addition to forcing the reduction in stimulus packages.

economic.

This rate serves as a parameter for contracts of different types of credit, in addition to guiding the rate paid by the government to holders of debt securities.

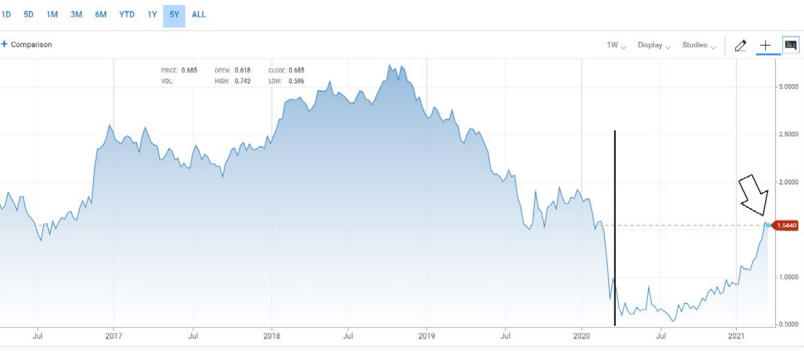

The 10-year interest rate jumped from 0.5%, registered in March 2020, to 1.6% in the last few weeks. This scares the market, which now fears an increase in inflation and starts to bet that there may be an adjustment in interest rate earlier than promised by the Fed in 2023, attracting resources to fixed income, which becomes more attractive.

This movement has cooled in recent days, after the approval of the new stimulus package of US $ 9.3 billion and the possibility of the Fed coming to buy long bonds, should the upward movement in treasuries continue.

Possible impacts

A possible increase in the interest rate would attract capital to US securities that today has no alternative but risky assets such as stocks and would raise the dollar. This would also spur interest rates in emerging countries that would see a dollar drain, depreciating local currencies.

In any case, it is important to monitor the entire development of this scenario and seek to understand the possible impacts on Bitcoin and other assets in the different economic scenarios that may be ahead.

Posted Using LeoFinance Beta