Heard about the news of Paypal creating its own stablecoin recently but after checking out this reddit post it really makes me wonder what the point behind them is. I'll be going through some of the comments and proofs behind their claims while talking a bit about why HBD in contrast is a much better alternative and some thoughts in its future usecases through a possible simple mindset as I'm not a dev or financial mathmetician. :P

The Reddit post claims that Paypal's stablecoin has the ability to freeze its tokens and burn them, the latter is usually not much of concern since you want to remove tokens from supply whenever an exchange occurrs on and off the stabletoken through its issuer. Think of Tether and the way they run things, large institutions or private companies/investors can do deals with Tether to exchange fiat for their stabletoken, this is usually done as onramps for them to get easier access to crypto coins. As far as I know it's to avoid having to deal with taxes where if you're using direct fiat to purchase or sell tokens you'd have to announce each trade rather than just declaring whenever you go in and off usdt in this instance, but there could be other reasons as well.

The freeze tokens is a bit more worrisome, especially for those who entered this space for the value of immutability and "your keys, your coins" as in this regard that's not always the case. While we know that this exists and has occurred lately for the worst case scenario cases such as illegal activities like big hacks/scams and potential other lawfully dangerous activities, the line is quite thin and who knows how it's going to progress over time.

Knowing Paypal and the reputation it had in its past with its own centralized database credit, how many people have had their accounts randomly disabled, funds frozen, not allowed to access them for long periods of time, etc, it's not a surprise that they'd want these options available for their token but it really begs the question of why even create a stable token to begin with. Are they chasing the hype, trying to stay relevant or just matching with other big payment and potential upcoming payment providers and past ones like circle's usdc?

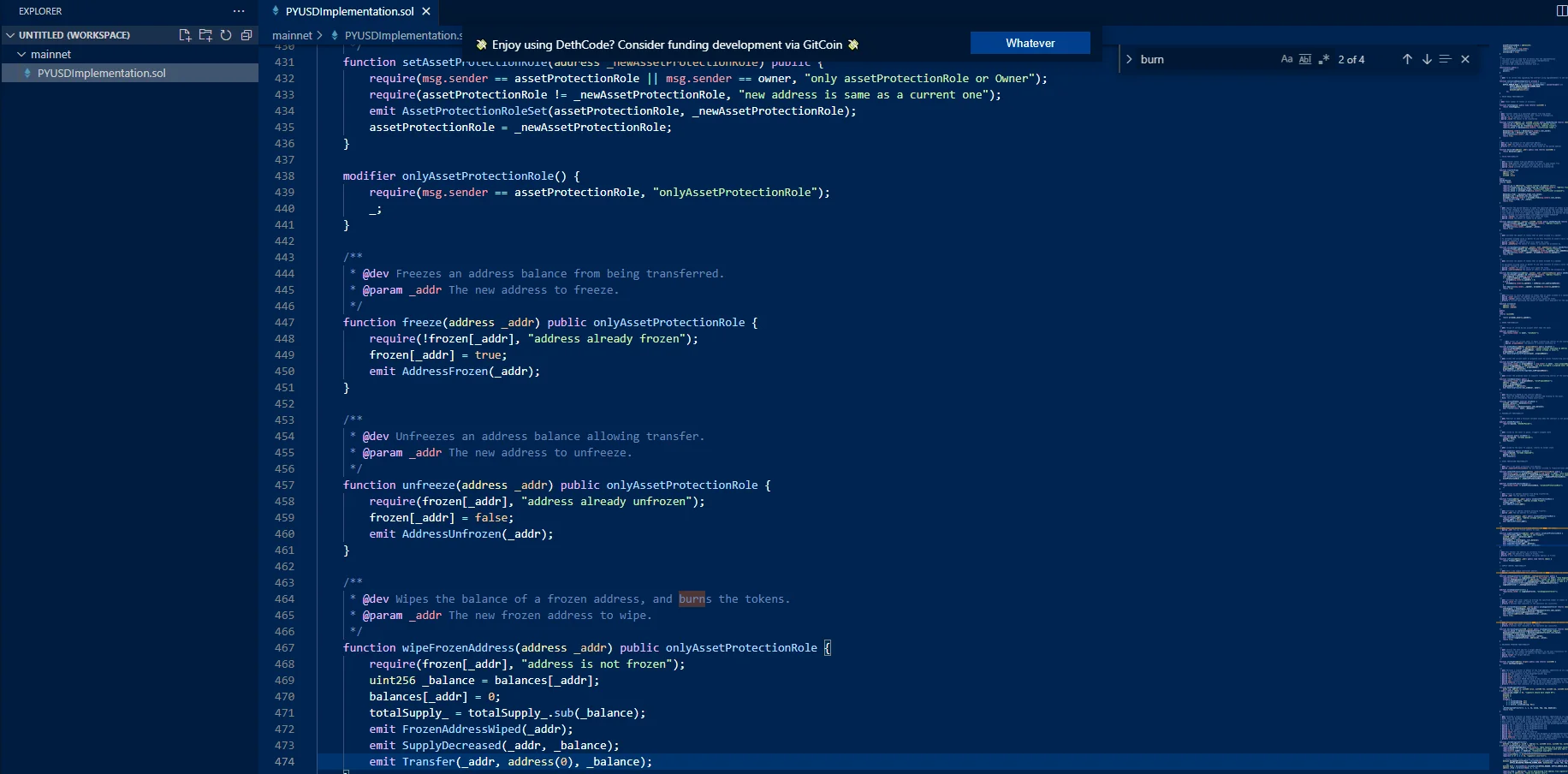

In the Reddit post they also mention that this is something USDC and USDT has been able to do all along as well and there's a banlist of addresses visible on the blockchain with USDT having banned 918 addresses and USDC 174. Here's a screenshot of the contract mentioning the ability to freeze and burn addresses and funds.

It seems to me that the way they're entering this market is with a grain of "okay these solutions already exist" and everyone wanting a piece of that pie but at the same time with a little hint of china's social credit score. Once the masses are more used to using stablecoins rather than centralized credit the governments may get a better understanding and insight as to where these values are ending up. Basically using the blockchain for analytics and historical data to potentially find out more about the customers who end up using on and offramps. You deposit some usd on Coinbase, end up sending USDC to an ETH address you've been using the past 5 years, now its linked to you and they can scan the data of that address to question you what you did with the profits of that NFT you sold in 2020 or how you managed to get these erc-20 tokens, etc. While the sole purpose for this is probably to track those evading taxes it really paints a bad picture into the dystopian nightmare we all fear that our privacy will cease to exist.

It's going to be interesting to follow the cases in which these banlists and frozen assets are used, while close to no one likes that they can do this, pretty much everyone will beg for this options when their tokens get stolen or their keys get hacked. I've witnessed this personally on Hive as well with the often misunderstood social recovery feature we have. Whenever I tell them there's not really anything I can do since they have lost the keys as opposed to someone having stolen/copied them and changed them to access their funds and lock them out of their accounts, they think that you can recover them even if the keys are just gone and plead for me to do something about it.

While HBD isn't immune to being tracked when and if you attempt to off-ramp into fiat to be tracked by governments through exchanges, it does do one thing different and it does it well. Immutability. Hive doesn't have a history of tokens being frozen and burned, while the option exists and was used to protect its values of decentralization and said immutability through risk of governance takeover, we can rest assured that it won't be used for things that other stabletokens may already be using it against. Aside from Dan and Ned hardforking this chain very early on in its age to prevent a hacker having stolen all their Steem, there haven't been any other cases of hardforks to assist someone's stolen tokens or lost keys. While this sucks in many ways and I think many would understand the use of it, it goes against the immutability factor because you give it an inch and suddenly people start wanting a mile. This mile may be something that is a lot closer to these giant stablecoins that we think and given the decision making of the inches is fully centralized it's hard to determine and come to agreement with how it will be used in the future. That's why it's important for Hive to remain decentralized, witnesses proposing ideas that go against this being able to be unvoted from power.

Given everything going on, it seems less and less tokens and their solutions out there are truly decentralized and immutable. While close to no one outside of this space knows what HBD or even Hive is, I like that it's going to be one of the secure haven against these actions cause even at a low hbd marketcap and low trading volume/liquidity it provides insurance that if you own a Hive account and its keys and trade tokens for HBD, no one is going to be able to take them from you through the protocol. Similar to how content can't be edited by others, how the original text is still stored on chain forever and how no one can take your username/address from you just because they suddenly decide to rename their company to x, the same goes for your tokens and value.

While HBD having liquidity issues is indeed an issue for those wanting to enter the space big-time, it's not something that completely hinders those actions, you just have to be more a bit more slow with it. HBD lacks outside liquidity quite a lot, barely any exchanges offer it as a trading pair and I'm pretty sure none of them offer it against another stabletoken. The thing we can work on in the meantime is usage and utility for it, something we're seeing occurr with merchants and customers in certain parts of the world, more of this will give our stablecoin more stability and more volume which helps that stability. In general while I'm not the biggest fan of the 20% APR, I do believe that offering some APR in the future will be good to not just drive interest towards it but also make it a more favorable asset for merchants and customers to hold after they use parts of it.

Anyway, just some thoughts on the whole situation, I'm not as technically and financially inclined so take my words and thoughts behind this post with a grain of salt and feel free to correct me where I may be wrong.

Thanks for reading.

Posted Using LeoFinance Alpha

It's an aside but I think it's insane we haven't developed a solution for this already. It's absolutely something we can fix.

For example you could designate a list of accounts who can reset your keys with X of Y approval (eg. list 10 accounts and require 8 of them to agree). Then like with HBD savings, Hive Powering down, it takes N days (maybe a full week) for your keys to reset, and if you have the original keys you can cancel the transaction.

There's a really small security trade off, but even if all your trusted peers conspire to steal your coins, you still have days to catch it and stop it, and it would be opt-in in the first place.

We need to break the taboo, keyless recovery is a feature, not a bug. It can be done with a high level of security - one where people can choose the trade off for themselves.

Interesting idea, basically a multisig key reset.

Yeah, but the time-security element is key in reducing the risk of conspiracy against you. For whatever reason we are the only chain that appears to include this really basic but powerful security element.

One of the problems we still see is the difficulty people have in keeping their keys safe. Having a tool that allows recovery would be interesting, although many users might choose not to adopt this feature.

I think that big companies and even banks will provide cryptocurrency custody services precisely so that the most inexperienced users do not have to bear the responsibility of keeping their own keys.

I understand that it goes against the idea of decentralization because now you have a third party involved, but this is already common and breaking the status quo is difficult.

Centralizing decentralized things or decentralizing centralized things have often a word/attitude coming into force that makes everything "arguable": trust

I am building a decentralized Launchpad with a team I know since some time, and when I designed tokenomics I inserted the role of Curators (like witnesses) that are going to evaluate projects to onboard if they deserve funding or not.

BUT, who is going to watch over the Curators? Super-Curators that are to be picked with specific parameters. But to start with, me and other people are going to be part of the Super-Curators team as from the beginning, how can I decide who is a Curator or a Super-Curator or just a scammer?

So we gave a small centralization to start from, to make the small bird flying with the parachute and when the wings are going to be stronger, we are going to remove the parachute, insert the hang glider and enjoy the gliding.

I think big institutions want to create ways for users to keep their funds within the company. Crypto is a path of no return and those who do not follow will lose space. But whether it's safe is hard to say. As a student, I prefer to keep what little I have in separate places, and never in one place.

See what happens in Brazil: companies like Mercado Livre and Nubank offer the user the possibility to buy cryptocurrencies, but they do not offer wallets or keys, so we know that the real ownership of cryptocurrencies is not the user's but the company's, however many people lack of knowledge or looking for facilities ends up choosing to buy anyway.

If a company like that wants to, they simply add all the assets of the clients. We really need to invest in financial education, especially in emerging countries.

Interesting, I didn't know those functions were built into early Solidity contracts. I am a bit surprised and disappointed, but as you point out I guess you need a nuclear option for hacks other then forking.

Thanks for including the story about the hack and hard fork of Steem, I didn't know about that hack. I still have a fond place in my heart for Steem, so I appreciate learning more about it. Plus the story humanizes Dan larimer a bit, to know that his project got hacked and his Steem was taken.

I wrote a post about this PayPal stablecoin myself, but I focused on the speed and cost of Ethereum transactions as being the oppositie of what you would want for a stablecoin project which would compete with faster , cheaper blockchain stablecoins, especially Hive Backed Dollar. Now you have given me more very solid reasons that this is a centralized security risk to users, in addition to a slow and expensive vehicle.

Cryptocurrency is seeming an endless rabbit hole, and I am constantly learning more about it.

I think it's definitely a play on their part to retain some of the market. The fact that they started allowing users to buy crypto in the first place... I think they are looking for a way to keep those funds on their system. If you have a stablecoin, people are more likely to just keep their gains there than move them out into fiat.

Unfortunately PayPal isn't allowed to use in our country, don't know why!!!!

Yeah another slap in the face of decentralization.

And also a slap to those who put themselves in decentralization 😒 just like us poor peeps!!!!

always had bad experiences with paypal, would not expect them to commit to any privacy features tbh

I don't know if it's still the case but Paypal did had some serious issues with accounts being sold on darkweb. It has hurts the reputation quiet a lot. USDT for me is stable ;) More of a coin to fall back to than BTC for instance.

Such a comprehensive analysis of the recent news about Paypal's stablecoin and its potential implications! It's really eye-opening to consider the complexities and trade-offs behind the creation of stablecoins, especially with insights into freezing and burning tokens. The comparison to HBD as a safer option is interesting. Your explanation of its advantages, such as immutability, makes one think.

Your insights are definitely worth considering! 👍💬

I would never trust Paypal, they closed down my account for making donations to political causes they did not approve of. Going back to 2011/2012 Paypal joined in the debanking of Wikileaks but few at that time protested about this. I agree there appear to few truly decentralised/immutbale crypto coins/tokens out there so let's keep supporting and building out Hive.

They closed mine ages ago as well, all I did was trade some BTC for paypal usd through a website at the time just so I could buy a couple games on Steam, lol.

Gosh, who would have thought I could be interested in the crypto space? How I am learning every day about it and I know very soon I will understand it better. Thanks for sharing.

This would have been very good and even better but PayPal is not allowed in my country and that has been for years without having any reasonalso, I heard that PayPal suspends account without stating reasons. Is that true? If yes, why does that happen?

PayPal seems to want to be trending in finance section every month😂😂

I wonder how far they'll go with their stablecoin....

Ironically it feels like the fact that Hive and HBD is so unknown might actually be a good thing for me since I can hide here with not too much SEC oversight or anything like that.

If only palpal can be allowed in Nigeria 🥺🥺

They've got a stablecoin? Let's see how the idea works out

Thanks for this piece

Common U.S. Coinage will "out-perform" Silver, Gold and all the Cryptocurrencies... My Posts will explain why...

Congratulations @acidyo! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 364000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

I agree, I don’t see any kind of value added by creating their own stablecoin. Sure, if it’s about control then they have it completely but it seems unnecessary when you have mainstream options out there.

It's always good to share thoughts and opinions on these matters, and while you may not consider yourself technically and financially inclined, your insights are valuable. Healthy discussions and different perspectives contribute to the growth and development of the platform.

Thanks for sharing your thoughts, and I appreciate your honesty. Keep exploring and learning, and together, we can continue to make Hive and its ecosystem even better!

Are your comments AI generated as well?

No it's not . I was told I need to decline my payouts for both posts and comments which I did but for some reasons it doesn't..