Qtum, Tron, EOS and Komodo - once dubbed the "Ethereum Killer" blockchain protocols due to their high transaction throughput and low gas fees may not be the killers they were originally thought to be. According to a recent report by the crypto venture capital firm, Outlier Ventures, Blockchain developers are devoting less time to the once popular "Ethereum Killer" blockchain protocols in favor of other projects.

Per the report newer "multi-chain protocols like Polkadot, Cosmos and Avalanche are seeing a consistent rise in core development and developer contribution." While "Ethereum Killers Qtum, Tron, EOS and Komodo are seeing a decrease in development metrics." According to the GitHub data all the Ethereum Killers saw a 50%+ decline in development throughout 2020 into early 2021. Blockchains that focused on interoperability between protocols or Decentralized Finance (DeFi) saw the largest gains throughout the same timeframe.

Ethereum On Top

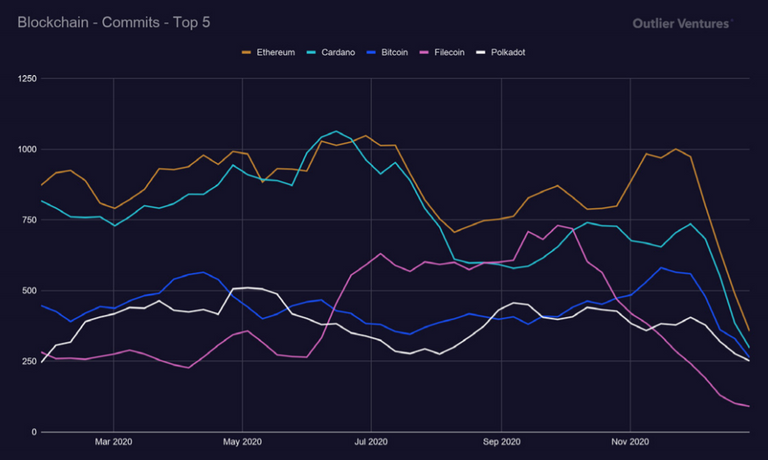

Ethereum (ETH) is still leading the way in total active development with more than double the amount of active developers (220) than Bitcoin (103) and weekly code commits ETH (866) to BTC (441). The second most actively developed blockchain is Cardano with 144 developers and 761 code commits per week. Hyperledger and Filecoin round out the rest of the top five most actively developed blockchains.

The sharp decline you see in the above photo is the decline that happens each year around the Christmas holiday season.

DeFi Protocols

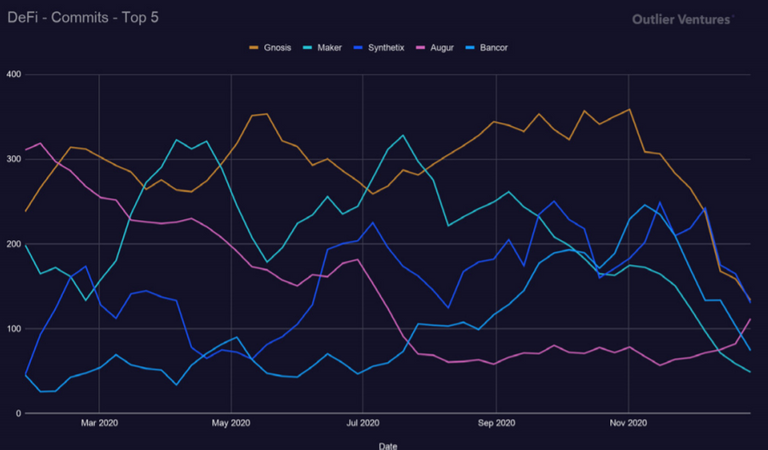

2020 was a true coming out party for DeFi, as the total value locked went from under $700 Million in January of 2020 to $15 Billion in December of 2020. Today there's almost $150 Billion locked according to Defi Llama. An absolutely astronomical increase in terms of popularity and use. This sentiment was shared in Outlier's report as most DeFi protocols saw a steady increase in developer contribution throughout 2020 and into the first quarter of 2021. At the time of their report Maker, Gnosis, Synthetix, Augur and Bancor were the leading DeFi protocols by developer contribution with Maker leading the way but it's numbers were slowly decreasing. Since the release of this article Binance Smart Chain based DeFi protocols have exploded with the increased popularity of PancakeSwap, Venus and BUNNY.

Final Thoughts

So what does this all mean? It means what you've probably already noticed if you were a user of any of the Ethereum Killer ecosystems, development has gone down markedly and developers have made a shift towards interoperability and DeFi. We've already seen the explosion of blockchains that work towards making it easier to communicate between different chains and we've certainly seen the explosion of DeFi but what I think the true value of a report like this is is that we can really see where the market is heading by taking a look at where developers are spending their time. Generally speaking the more work a project gets the better the result the higher the price of the coin. What I plan to do since reading this report is taking the time to investigate GitHub commits to a project before investing in it and definitely getting out of some of the projects that seem ready to die.

Obviously I'm not a financial advisor though, the above is just my opinion! You can do whatever you want, when I found this report I just thought the methodology and info contained might be helpful to someone else out there. As always thanks for reading and if you enjoyed lightly tap that like button and don't forget to follow. If you didn't like it I'd love to hear why!

Affiliate Links That Keep The Lights On

Ledger Wallet - Get a $25 voucher and Crypto Beginner Guide when you purchase through this link.

CAKE DeFi - Get $30+ of DFI when you deposit $50 and earn 35-150% APY

BlockFi - Get up to $250 when you deposit into any one of their interest accounts. (10% APY for Stablecoins)

Posted Using LeoFinance Beta

I think alternatives like DOT, COSMOS and ADA are here to stay though.

Posted Using LeoFinance Beta

Agreed, and the data supports that above! Interoperability/DeFi and the technology of ADA are on the rise still.

Posted Using LeoFinance Beta

A lot of stuff is here to stay and will get bigger. We need as much bandwidth as we can get when you think about it.

Posted Using LeoFinance Beta

Very true, crypto as a whole is on the rise and only gaining momentum. I have co-workers now, who would never be interested in blockchain before, asking about it. Great thought.

Posted Using LeoFinance Beta

It seems a big mistake to consider that some coin can "kill" Ethereum.

If even some coin (which?) can give a decent competition to ETH, it is still far from actually KILLING Ethereum.

Why these would be not enouth room for both? Why?

Posted Using LeoFinance Beta

Very true! There certainly should be enough room for both. With all the time and money invested in ETH I can't see it ever falling off, especially with Institutional investors starting to step in now as well.

It is really funny how it seemed every few months in 2018/2019 there was some project with high throughput/low gas fees/some technological advancement that was instantly christened an "ETH Killer". I think the coins that come on to "Kill ETH" like you said are just small improvements that in reality just help it develop more, there's certainly a place for all coins.

Posted Using LeoFinance Beta

People are, sadly, stuck in the competition mindset. They do not see how all this keeps helping everything else. The run up in both BTC and ETH is helping the entire industry.

Posted Using LeoFinance Beta

People need to get out of the mindset that these things are like applications they understood in the past. They are more like highways. When one builds a business in a particular location, he or she does not usually up and move it.

As long as the blockchain is running, there will be stuff on it. Ethereum is actually growing by every metric you want to use.

So it is a laugh to think that.

Posted Using LeoFinance Beta

Great way to explain that and think of it! I'm totally using that analogy I appreciate the comment

Posted Using LeoFinance Beta

Your post was promoted by @taskmaster4450le

I completely agree that the development on the chain is very important and ETH is still at the top given the large amounts of funds going in. I don't see the big money avoiding the gas fees since it is relatively small compared to the amount they are investing. I think people will just choose which chain fits them the most and I tend to prefer the lower fee chains.

Posted Using LeoFinance Beta

Great point, yeah the institutional investors have no cares for a $600 fee to migrate Uniswap tokens, while average people like myself will balk at it. I also prefer BSC and the like but still use quite a few things built on ETH.

Posted Using LeoFinance Beta

Congratulations @absolute.unit! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 100 upvotes.

Your next target is to reach 50 comments.

Your next target is to reach 50 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!