We all knew it was going to happen. The phenomenal run Iron Finance and Titan were on had to come to an end at some point. And oh boy, what an end it was. Shortly after TITAN reached it's all time high of $64.19 one of the most spectacular dump offs/bank runs in recent memory happened with TITAN dropping to $0 in just a few hours and effectively stalling the Polygon network out for a few blocks.

Before I get too ahead of myself, lets do a quick rundown of just what Iron Finance and TITAN are for those who don't yet know.

Iron.Finance

I was going to try to explain what Iron Finance is but I think this excerpt from Iron Finance's doc page is better than any explanation I can do -

Iron Finance is a multi-chain partially collateralized stablecoin soft pegged to the USD, available on both Binance Smart Chain (BSC) and the Polygon (MATIC) network. The protocol aims to maintain IRON's peg by storing enough collateral in time-locked smart contracts. This collateral is used for redemptions, helping to maintain the peg.

The collateral consists of two tokens. On Polygon, USDC and TITAN, while on the BSC it uses BUSD and STEEL. The USDC or BUSD token is deposited into the protocol when a user mints IRON token, while the TITAN or STEEL token which is used for minting is burned. When the user redeems IRON, the protocol pays back USDC or BUSD and mints the required amount of TITAN or STEEL.

The ratio of USDC or BUSD and TITAN or STEEL used by the minting and redeeming function is determined by the Target Collateral Ratio and by the Effective Collateral Ratio respectively.

Users could also stake their STEEL/TITAN and print USDC or BUSD. This created what was essentially a money printer for STEEL and TITAN holders, with APYs of 50,000%+. Due to the fact that IRON was holding it's peg quite well in the beginning, more and more users were attracted to TITAN. As evidenced by the chart I included above, this created quite the run on TITAN, pushing it all the way to $60.

I jumped in myself around $4 after a tip from a friend but got scared and jumped out at $15. However I do know some people that stayed in, and even bought in more after TITAN's initial dip to $60. For them there would be only pain ahead.

Attack on TITAN

Not long after TITAN hit it's all time high, whales dumped causing some panic. Then a $200,000 transaction was made and people instantly started to sell off their stacks. This caused a massive decrease in the price of TITAN which resulted in IRON losing it's peg. Due to this situation an arbitrage opportunity presented itself. You could now redeem a token worth $0.90 for $1.00 ($0.75 USDC, $0.25 TITAN). Whales started exploiting this arbitrage opportunity at a ridiculous pace. Minting thousands of fresh TITAN tokens and dumping them on the market, further dumping TITAN's price.

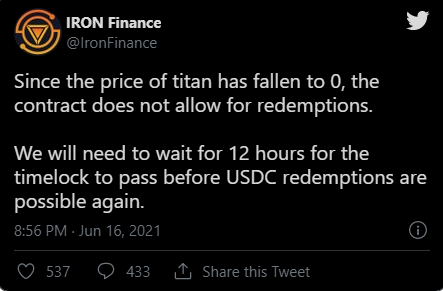

This, coupled with others still panic selling, caused the price of TITAN to drop down further, resulting in IRON losing it's peg even more. A vicious cycle was created causing the price of TITAN to drop all the way down to $0 due to IRON being unable to regain it's peg. Iron.Finance has since warned its users to remove all liquidity while they can and not invest in IRON or TITAN.

Due to the mass printing of TITAN tokens and panic selling on the market the Polygon network saw levels of congestion not seen before. Fee levels were reported as high as 2,000 gwei and there was even a point where congestion was so high that transactions simply would not go through.

Many users lost out on their chance to sell out before losing everything, this certainly was not a good look for MATIC.

Final Thoughts

Another algorithmic stablecoin bites the dust. For a currency known to fail spectacularly, this one certainly takes the cake. Iron Finance and Titan were rising stars on the Polygon Network. Exploding to nearly $2 Billion total value locked and a seemingly "always up" token price; subsequently dumping to $0 over the course of just a few hours. I'd be lying if I said I was surprised Iron failed but I never expected anything like this.

As far as we know Iron was not subject to any sort of exploit or hack, just a case of extreme FUD and a stampede of sellers (post mortem from Iron crew is set for tomorrow). I think I'm most interested to see how people react to MATIC not being able to handle the massive amount of transactions that occurred. What was essentially a failure of the blockchain itself. More than anything though I hope you learned something. No token is ever always up and degen farms like Iron, while a huge possibility for profit, are never a sure thing.

I hope you enjoyed reading as much as I enjoyed putting this together. Don't forget to like/follow if you enjoyed. Happy earnings!

Keep your funds secure with the leading hardware wallet on the market, Ledger, and get a $25 voucher through this link.

And here's a solid Crypto Trading Bot I use - DeltaBadger, 10% off through this link.

Get $10 of BTC when you deposit $100 or more on BlockFi. Also get early access to the NEXO Crypto card through this link.

Posted Using LeoFinance Beta